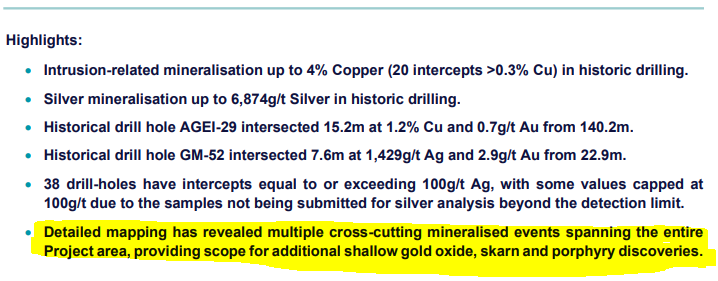

JBY shows up to 4% copper and 6,874g/t silver

James Bay Minerals (ASX: JBY) just gave us a first look at the potential to add copper and silver to its project in Nevada, USA.

JBY’s project already has a 1.2M ounce gold equivalent foreign resource estimate.

Today, the JBY put out assay results from old drillholes which showed copper and silver mineralisation.

20 of the old holes had copper grades >0.3% copper, 38 holes had >100g/t silver.

Pretty strong grades considering most of the old drilling would have been targeting gold mineralisation.

A key takeaway for us from today’s announcement was the commentary on the potential to make “porphyry discoveries”.

The main reason for this is because of where JBY’s project sits…

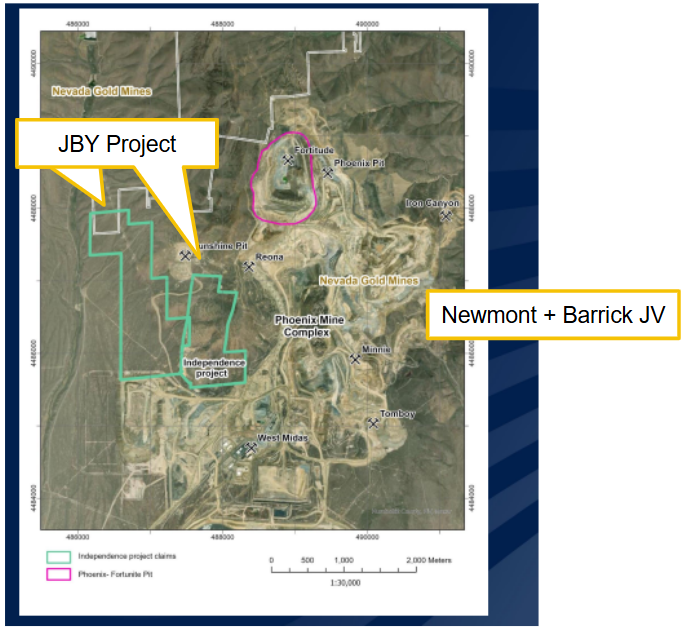

JBY’s project is right next door to the Phoenix Complex - operated in a Joint Venture (JV) between $62BN Barrick and $73BN Newmont.

Across that complex, Newmont and Barrick have a ~3.3m ounce gold, 850m lb copper and 35m ounce silver resource all near surface…

Here is how close the projects operated by Newmont is to JBY’s project:

As mentioned earlier, the reason today’s announcement caught our attention was because of the commentary around the potential to make “porphyry discoveries”.

This hasn't been a big part of the JBY story until now.

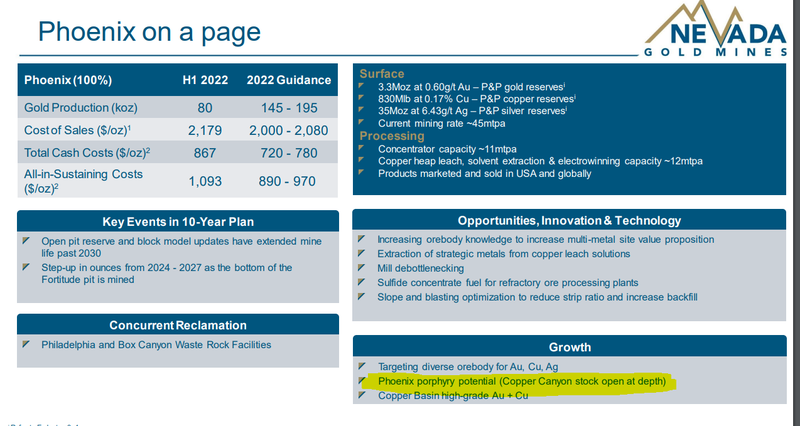

But it's something that neighbours Newcrest and Newmont have talked about in their project presentations and project site visit decks…

Here is a slide from a recent deck for the JV which mentioned “phoenix porphyry potential” for the project.

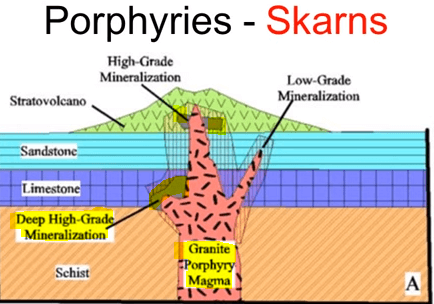

JBY’s resource is a mix of near-surface oxide mineralisation and a higher grade skarn structure.

The skarn mineralisation is important, first because of its high grade nature but also because it could be an indicator of porphyry mineralisation nearby…

Here is what it looks like on a diagram:

A big part of the reason we are Invested in JBY is because of the existing resource and the exploration upside to the project as it stands now.

The porphyry potential just adds a blue sky upside to the project that sits completely outside of our JBY Investment Memo.

This type of blue sky upside can be important in the long run - especially when your multi billion dollar neighbours are talking about it.

As Newcrest and Newmont operate the Phoenix complex and mine out the existing resources of the project they will look to add bolt on resources to plug into all of the existing infrastructure they have spent decades (and billions of dollars) building.

So if Newcrest/Newmont go out and prove a big prophyry discovery here, JBY could benefit just from its neurology and the type of results it put out today…

The porphyry potential is all unexpected blue sky upside for JBY, the main reason we are Invested is for the shallower mineralisation.

JBY currently drilling - results could come at any time

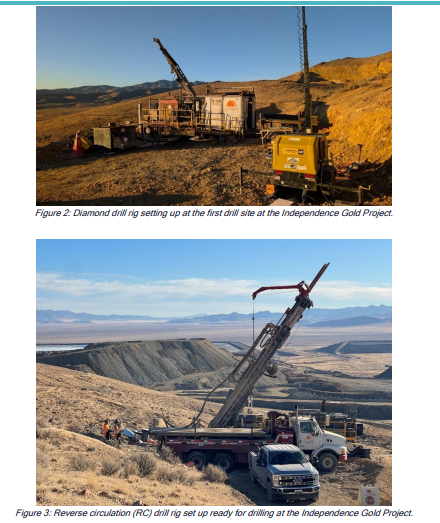

Just last week JBY kicked off its first drill program.

The first thing that stood out to us straight away in that announcement was JBY’s decision to use a mix of RC & Diamond drilling.

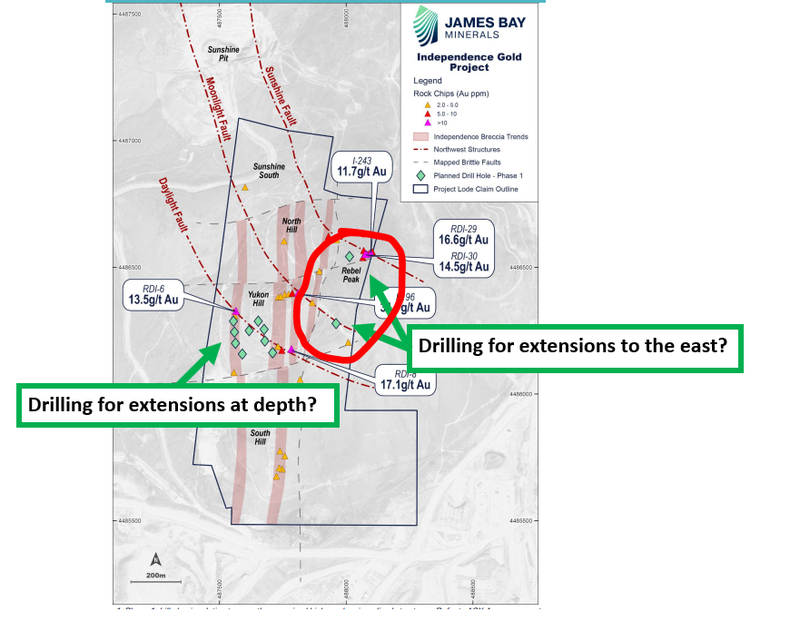

That’s because of where JBY’s existing ~1.22m ounce gold equivalent (foreign) resource sits.

The project’s foreign resource currently sits across most of the western edge of the project area.

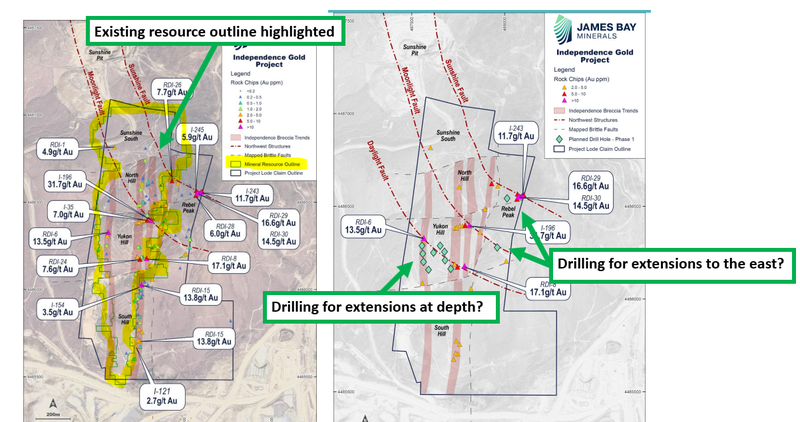

With this drill program, it looks to us like JBY is going for:

- Extensions to the east with the RC rig, outside of the current resource footprint.

AND

- Extensions at depth under the existing resource with deeper diamond holes.

Here is what it looks like on a map:

We like that JBY is choosing to go for high risk high reward extensional holes straight off the bat.

Extensional holes are usually what get the market most interested and (IF they come off) generate the most value from a share price perspective.

Ultimately we are hoping to see JBY hit extensions both at depth and to the east of its foreign resource area which we hope eventually leads into resource upgrades for the project overall.

JBY advancing its project forms the basis for our Big Bet which is as follows:

Our JBY Big Bet:

“JBY re-rates to a +$300M market cap by expanding its large US gold resource and moving into development studies and/or attracting a takeover bid at multiples of our Initial Entry Price”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our JBY Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

What’s next for JBY?

🔄 Drill results from Independence gold project in Nevada, USA.

We are looking forward to the drill results from JBY’s 2,000m drill program.

We are especially interested in seeing what comes from the results to the east of the current resource outline.