Our Cobalt Portfolio

| Stocks |

Date of Initial Coverage

|

Initial Entry Price

|

Highest Point |

Performance from Initial Entry

|

|---|---|---|---|---|

| KNI | 1629813600 25-Aug-2021 | $0.200 | 425% | -3% |

| Stocks |

Date of Initial Coverage

|

Initial Entry Price

|

Highest Point |

Performance from Initial Entry

|

|---|---|---|---|---|

| KNI | 1629813600 25-Aug-2021 | $0.200 | 425% | -3% |

Macro Outlook Cobalt - 2023

We think ethically sourced cobalt from friendly jurisdictions must urgently be discovered and brought online, or eventually cobalt could be at risk of being phased out of battery chemistries.

This is where we see the big opportunity in cobalt.

Cobalt is an essential part of the EV supply chain and the majority (~70%) of it is sourced from the Democratic Republic of Congo (DRC), where unethical mining practices prevent ESG conscious battery and technology companies from purchasing the raw material.

Discover the 5 Battery Materials Stocks we’ve Invested in for 2023

In 2021 the world’s second largest producer of cobalt was Russia.

Before cobalt can be used in batteries or technology, it needs to be processed. China controls 65% of the processing of cobalt.

These geopolitical and ethical elements are colliding with surging demand for batteries from consumer electronics and electric vehicles.

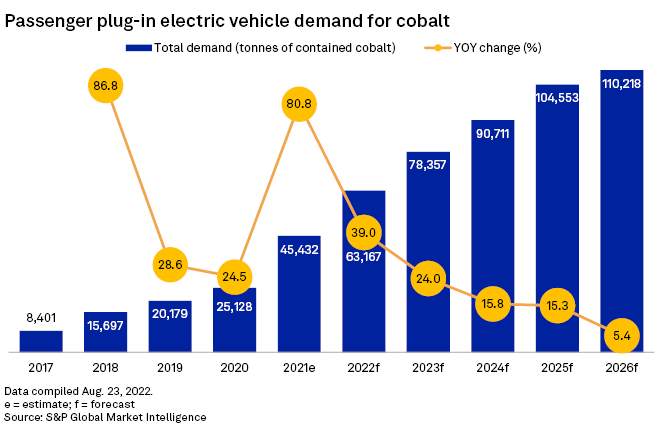

Cobalt demand from EVs was expected to reach 63K tonnes in 2022, increasing ~75% to 110K tonnes by 2026 - and EVs likely now make up more than consumer electronics in the cobalt demand “pie”.

As a result, we think there will be two forces at play in the outlook for 2023:

- A push to strip out cobalt from EV battery chemistries

- And at the same time, a push to source cobalt from lower risk jurisdictions

As cobalt plays an essential role in higher performance NCM (Nickel, Cobalt, Manganese) batteries - we expect 2023 to see capital flows towards cobalt projects in politically friendly locations that can support ethical supply of this critical raw material.

Cobalt prices could take a hit as battery chemistry preferences change and EV manufacturers clean up their supply chain which could create short term pressure for cobalt stocks - but the longer term picture for cobalt demand remains largely intact - especially for cobalt projects coming from friendly countries.

What the analysts say

In the short term, the demand/supply imbalance for cobalt in 2022 might not be repeated early in 2023.

One Chinese cobalt producer source quoted by Fastmarkets, said: “Overall sentiment for the cobalt market in 2023 is very weak, and cobalt demand in 2023 is expected to remain low, in our opinion…Many cobalt producers feel that spot purchases will largely fulfill the weak demand, and negotiations of long-term contracts haven’t begun yet. We are not going to sign long-term contracts…”

Darton Commodities' Andries Gerbens says:

"[Automakers] and EV cell manufacturers are moving to higher nickel [and] lower cobalt chemistries…This has been driven by both cost considerations and concerns regarding unethical mining practices."

“Despite the prevailing transition to lower cobalt cathode chemistries and the growing share of non-cobalt chemistries, the cobalt bearing [nickel-cobalt-manganese] chemistry will remain the dominant chemistry in the foreseeable future…Furthermore, the sheer absolute growth in EV sales will mean that EV-related cobalt demand will continue to accelerate in the years to come.”

As a result the projected year on year growth for cobalt is expected to wane through to 2026 (but remain positive):

Greg Miller, a senior analyst at Benchmark Mineral Intelligence, says: ”In many ways, the shift towards lower volumes of cobalt on a per-cell basis may in fact be a positive for the cobalt industry, reducing the pressure on the supply side of the industry to keep pace with the levels of unprecedented demand growth.”

Over the long term though - NCM batteries can continue to thrive, particularly if the geopolitical side of the cobalt equation can be addressed:

Cameron Hughes, analyst at Benchmark Mineral Intelligence says: “Although LFP production in China has outpaced NCM/NCA production recently, the chemistries’ global market shares are not forecast to change dramatically in the coming years.”

Discover the 5 Battery Materials Stocks we’ve Invested in for 2023

What about the bear case?

We see three primary potential threats to the outlook for cobalt in 2023:

- Rising substitution of cobalt (switch to different battery chemistries)

- Renewed demand destruction - cobalt price gets too high, hurts demand (maybe later in year, increasing substitution)

- DRC oversupply of the market - with the Tenke Fungurume cobalt-copper mine (TFM) exports potentially coming back online (this mine was expected to produce 17,500-20,500 tonnes of cobalt in 2022 and that would equally roughly 10% of the market)

Susan Zou, senior analyst at Norwegian consultancy Rystad Energy says: “After the cobalt metal price surged over 90% in early May 2022 from early June 2021 mainly at the back of logistics disruptions of the cobalt feedstock, the price plunged by nearly 40% in recent three months, before it slightly rebounded in late August amid pent-up inquiries over the summer…

However, despite the positive outlook of batteries used in electric vehicles, the overall market rhetoric of cobalt remains weak in near-to-medium term given sluggish consumption of lithium cobalt oxide (LCO) batteries for consumer electronics amid global macroeconomic headwinds.”

We think this means cobalt is at a critical inflection point - where Western EV makers will be forced to aggressively pursue domestic and friendly cobalt sources or scrap their plans to quickly increase EV market penetration (this is the specific area we are Investing in for the cobalt thematic).

Our Commentary on Cobalt

5 Battery Materials Stocks for 2023

Weekender

Apr 22, 2023

|Next Investors

|10 min

In this article we shine a light on five NON-LITHIUM companies we are holding in the battery materials space.

5 Battery Materials Stocks for 2023

Next Investors

|Apr 22, 2023