We think 2023 will be the year for companies with projects that are ‘shovel ready’ - meaning resource definition and economic studies are complete and they are ready to start building a mine… if they can get financing.

In early to middle stages of a commodities supercycle, commodity prices are high and the market needs mines built ASAP, so we think significant amounts of capital will start finding its way to later stage projects.

We think that security of supply issues coupled with decades of underinvestment will create a sense of urgency from both the investment community and governments leading to a wave of capital flowing into projects that are closest to being put into production.

We have also seen large global funds pull money out of big US tech companies during the tech crash of 2022 - these funds will be looking for a new sector to achieve the internal rates of return on their capital they previously enjoyed in big tech.

Financing the building of mines during a commodity cycle can deliver those returns.

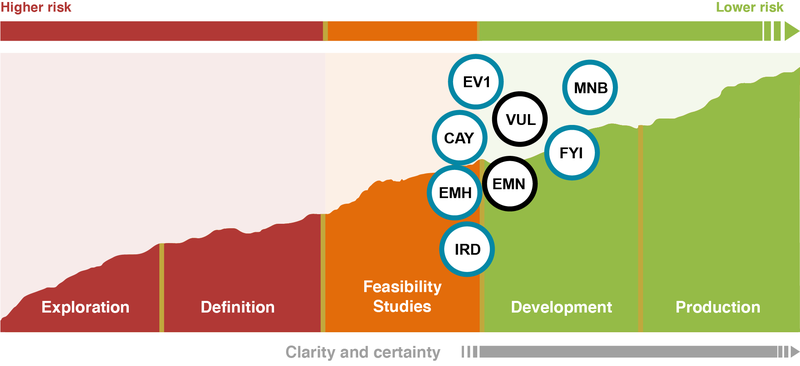

Below shows the companies in our portfolio that have projects that are at the feasibility/development stage (as of January 2023) and looking for financing to build their project:

What the analysts say

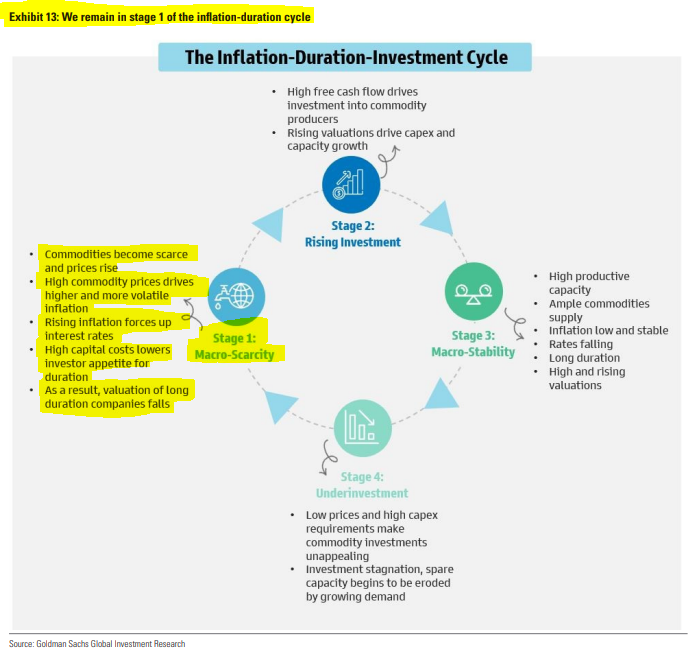

Goldman Sachs holds a similar view to us.

In its latest 2023 commodities outlook Goldman touches on the issue with the following comments:

Decades of underinvestment to cause supply issues.

Goldman expects commodity markets “to be shaped by underinvestment in 2023”.

They also continue with a comment on the fundamentals of the commodity markets saying that “from a fundamental perspective, the setup for most commodities next year is more bullish than it has been at any point since we first highlighted the supercycle in October 2020”.

While the common perception across markets is that increasing interest rates is bearish for commodities, Goldman think that it will just make the underinvestment and subsequent supply issues worse with the following comment:

“Across commodity markets, the rapid rise in the cost of capital lowers the incentive to hold either physical inventories or paper risk, distorting price discovery as financial markets react faster than the real economy, creating markets that are simply unprepared for sequential growth in 2023”.

No supply response in sight

Goldman adds to the comments on the cost of capital saying that increasing interest rates to reduce commodity prices are merely a short term bandaid fix.

Goldman thinks that draining market liquidity “is not a long-term fundamental solution” and that “without sufficient capex to create spare supply capacity, commodities will remain stuck in a state of long run shortages, with higher and more volatile prices”.

The following image from Goldman’s report summarises where the Investment Bank thinks we are in the commodities market:

Read the full Goldman Sachs report here.

What about the bear case?

The bear case is relatively straightforward.

We think that a global slowdown in economic growth will lead to a demand shock for commodities taking individual commodity prices lower.

Lower commodity prices will also mean lower share prices for explorers/developers and producers.

A combination of lower commodity prices and a depressed share price will mean companies switch into ‘survival mode’ and start to preserve cash leading to reduced CAPEX.

This, along with increased interest rates, will make capital very hard to come by and companies will choose to hold off any Final Investment Decisions (FID).

Some projects may even be deemed un-economic due to the much lower commodity prices.

In this scenario the long-term supply/demand outlook is unchanged and once the economy has recovered we expect to see commodity supply shortages persist.

As a result we see this scenario as a buying opportunity - but one that will involve a lot of patience until markets recover.