WRM plans 2018 exploration for its Red Mountain VMA zinc project

Published 18-DEC-2017 12:56 P.M.

|

5 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

White Rock Minerals (ASX:WRM) today announced its planned exploration activities for the 2018 field season at its 100 per cent owned Red Mountain VMS zinc project located 100 kilometres south of Fairbanks in Alaska.

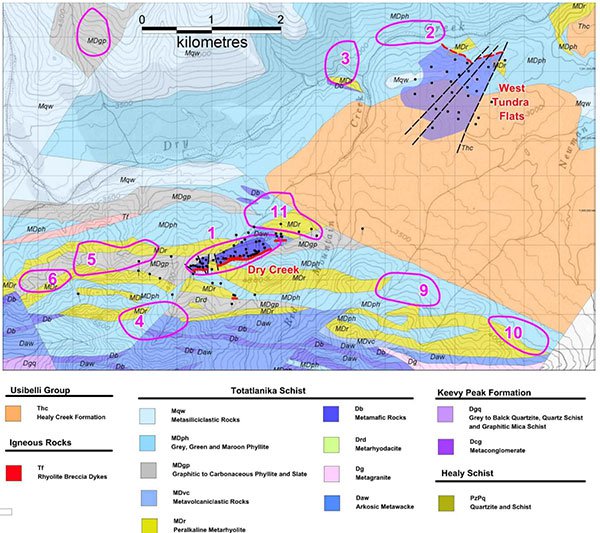

Red Mountain is a globally significant VMS project with two already identified deposits — Dry Creek and West Tundra Flats. It contains polymetallic VMS mineralisation rich in zinc, silver and lead, with potential for significant gold and copper. Mineralisation occurs from surface, and is open along strike and down-dip.

The company sees significant discovery potential in the project given the lack of modern day exploration at Red Mountain. This is further enhanced by the very nature of VMS clustering in camps, and the potentially large areas over which these can occur.

Mapped below is the location of the Dry Creek and West Tundra Flats VMS deposits (purple shape of mineralisation projected to surface) with drill hole traces and priority EM conductors on DGGS geology map.

Source: White Rock Minerals

The targeted 3000 metre diamond drilling programme is planned for the new year, aimed at in-fill and expansion of the current globally significant maiden Resource of 16.7 million tonnes at 8.9 per cent zinc equivalent, including a high-grade component of 9.1 million tonnes at 12.9 per cent zinc equivalent.

At the same time, it’s worth noting that this is an early stage play and investors should seek professional financial advice if considering this company for their portfolio.

WRM also intends to conduct a 3000 metre follow-up diamond drilling programme on the best of the more than 30 already identified exploration targets.

A diamond core rig will drill throughout the 2018 summer season, from May through to October. Drill holes will test for thickened intervals within the two known deposits (5-10 holes), numerous extension targets defined by geochemical and geophysical vectors (5-10 holes), as well as a number of the new targets as ground surveys early in the field season firm-up target locations for drill testing (15-30 holes).

WRM also has plans for a comprehensive 1800 line kilometre of high-powered airborne electromagnetic (EM) geophysics to identify conductivity anomalies associated with massive sulphide mineralisation to depths of 500 metres. This data will augment the existing shallow EM that has identified 30 conductivity anomalies and importantly assist in prioritising those with depth extent and potential to be associated with a large VMS orebody (>10Mt).

WRM will also conduct on-ground orientation ground geophysics in May-June to determine the best ground geophysics methods (EM, IP-resistivity, CSAMT, magnetics, gravity) to identify anomalies associated with mineralisation. Regional application of the best geophysics and geochemistry exploration tools will be determined from the on-ground orientation work.

There are also plans for a dedicated field reconnaissance crew to map and sample all 30 near surface conductivity anomalies. Surface sampling would include systematic rock chip traverse sampling to characterise the geochemical alteration halo for each prospect area, as well as a focus on detailed sampling of any massive sulphide horizons identified.

Prospective areas prioritised from the airborne EM and surface geochemical halo mapping would then undergo more detailed mapping, ground geophysics and geochemical sampling (rock chip and soils) prior to drill testing of the top five to ten targets.

WRM Managing Director and CEO Matt Gill said, “Since acquiring the Red Mountain zinc – silver – lead – gold VMS project in early 2016, we have worked to assess the prospectivity of the area using the publicly available geophysics and geochemistry data. We subsequently expanded our strategic footprint 10-fold, and have also released a maiden Mineral Resource that immediately placed the Red Mountain Project in the top quartile of undeveloped high-grade VMS (zinc, silver, gold) deposits globally.

“Importantly, the two deposits identified within the Company’s extensive land holding immediately placed the Red Mountain zinc project as one of the highest grade and more significant deposits of any zinc company listed on the ASX and an important VMS asset within a global context. Now it is time to get on the ground. As announced on 13th December, we have secured one potential funding solution to allow us to commence this work. This is an exciting time for White Rock.”

The funding solution that Gill refers to is a $7.2 million Equity Placement Facility with Kentgrove Capital Growth Fund.

An important part of the 2018 exploration programme highlighted by WRM is the plan to assess the potential for precious metal zones proximal to the massive sulphide mineralisation. Gold mineralisation is usually found at the top of VMS base metal deposits or adjacent in the overlying sediments. Gold bearing host rocks are commonly not enriched in base metals and consequently often missed during early exploration sampling. This provides an opportunity for potential further discoveries at Red Mountain.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.