WHK 3 cent rights issue, we are participating.

Disclosure: S3 Consortium Pty Ltd (The Company) and Associated Entities own 6,828,547 WHK shares at the time of publishing this article. The Company has been engaged by WHK to share our commentary on the progress of our Investment in WHK over time.

Our US based cybersecurity tech Investment, Whitehawk (ASX:WHK) has contracts with various US federal government departments, US defence contractors, Fortune 500 companies and a global social media company...

But due to the sensitive nature of cybersecurity defences, WHK is unable to reveal the exact identities of these customers.

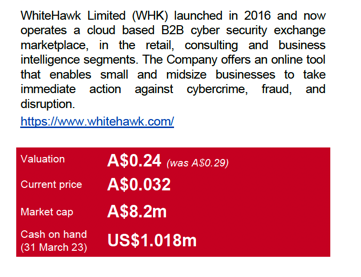

WHK has grown revenue every year since we Invested, pulling in US$3.2M in revenue in calendar year 2022. US$2.4M is recurring yearly revenue.

Despite the consistent revenue growth, WHK is currently trading at a sub-$10M market cap.

We have been Invested in WHK for over four years, seeing it go from 3c in the March 2023 COVID lows, all the way up to 46.5c in the height of the bull market...

... and now back down again to trade at around 3c.

Low sentiment for ‘not quite yet profitable’ tech stocks, combined with WHK’s recent lack of material newsflow or any big new contracts has inflicted significant pain on the company’s share price.

However, according to WHK’s May 2023 presentation, there is over US$12.5M in potential contracts that could be on the table for WHK’s Cyber Risk Radar product alone.

That’s nearly 4x the total revenue WHK generated in CY2022.

And across all its sales channel partnerships and products - WHK said in that same May presentation that its pipeline is worth USD$22M.

We don’t expect them all to convert into revenue, but even if a portion do, it will be materially significant to WHK’s bottom line.

With market expectations currently low, we are hoping that WHK can deliver some deals and pull a Oneview (ASX:ONE) style rebound from its lows.

Zooming out to the broader macro environment, we have seen larger tech stocks that have been beaten up in the last 18 months now on the rebound. Small cap tech stocks copped the brunt of the negative sentiment and many are still trading at near all time lows.

Over the last few months we have been looking for opportunities in the small cap bear market to make new investments, or increase our positions in our current portfolio stocks where the share price has taken a beating but we believe in the company.

In order to shore up its balance sheet in the near term, WHK is currently offering a rights issue to holders at 3.2c per share to raise up to A$1.3M.

This offer is open to all WHK holders including board and management. We intend to participate in this rights issue because we think WHK share price is currently beaten down.

Please be mindful that this is our own Investment strategy, which works for us based on our own risk profile and financial circumstances. This is not for everyone. Always seek professional investment advice before investing in small cap stocks.

The entitlement offer is available to investors who hold WHK shares as of the record date of 28 July (Friday), so any new investors that buy WHK on market today and hold shares to the record date of Friday will be also able to participate in the rights issue.

Now all we need is for WHK to land some of those long awaited material contracts that are in the sales pipeline...

Driving WHK’s sales pipeline conversions will be CEO and Founder, Terry Roberts.

Roberts currently holds around 8.7% of WHK shares which we see as sizeable amount of skin in the game.

Roberts is a former deputy director of US Naval Intelligence and 35-year veteran of the US national security and cyber intelligence community - and a big part of why we Invested in WHK in the first place.

Despite a recent lack of material newsflow from WHK, it's clear now that major cybersecurity incidents are the “new normal” in 2023.

And because WHK’s business is largely shrouded in a certain level of secrecy - it may be hard for the market to get a grip on what constitutes progress, even when macro forces are strong.

WHK’s clients and partners include the U.S. Federal Government and defence force departments as well as industry leading corporations and Fortune 500 companies - including an unnamed “global social media company”.

There are obvious reasons as to why big corporations are reluctant to reveal who their cybersecurity vendors are.

We remain confident that if things at WHK finally click into place - the growth could be as rapid as it is surprising, especially given WHK’s current micro cap valuation.

Here are the two big things we are looking for from WHK to unlock this growth:

- Sales catalysts - Previously, WHK has been working with a host of major US organisations to roll out WHK’s products across these companies’ supply chains - if these convert into sales, these contracts could be material to WHK’s revenue numbers this year.

- Regulatory catalysts - US government legislation mandating a new cybersecurity compliance regime that WHK is well positioned to facilitate for contractors. This could enable WHK to progressively lock in a larger and growing portion of its sales pipeline.

We’ve got more on the two WHK potential catalyst types later in this note.

As we noted above, WHK currently trades at 3.1 cents and market cap of ~$8M, and given the recent lack of newsflow and capitulation in the share price, it may not take much to see WHK return to favour with the market (which is why will be participating in the WHK rights issue).

Of course, at the same time, micro cap tech stocks are risky investments, and there is no guarantee WHK will be successful.

Furthering WHK’s ability to deliver on share price catalysts, as we mentioned above, WHK announced a 1 for 6 non-renounceable entitlement offer yesterday seeking to raise ~$1.36M at 3.2 cents.

The WHK sales pipeline is strong

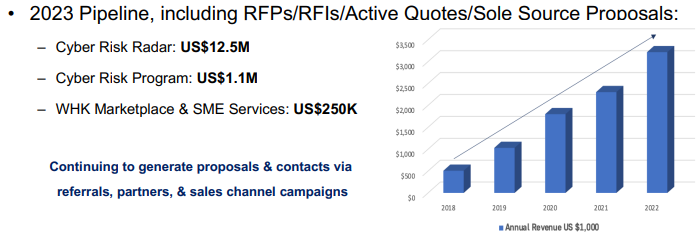

In addition to current contracts, there is a relatively large amount of RFP/RFIs in WHK’s sales pipeline (as of May 2023).

Requests for Proposal (RFPs) and Requests for Information (RFIs) are formal processes for potential customers evaluating WHK’s technology offerings.

(Source)

According to the above slide from WHK’s May 2023 AGM Presentation, there is over US$12.5M in potential contracts that could be on the table for WHK’s Cyber Risk Radar product alone.

That’s nearly 4x the total revenue WHK generated in CY2022.

And across all its sales channel partnerships and products - WHK said in the same May presentation that its pipeline is worth USD$22M.

What we’re really looking for now is for WHK to close at least one, maybe two but hopefully three (or more?) large material contracts in the coming months.

We’ve seen what being patient can achieve when Invested in tech companies that have large sales pipelines before.

Our other tech Investment, Oneview Healthcare achieved a peak return of 767% and re-rated more than 300% between late April and mid-June on the back of having recently signed its biggest ever deal with a $22BN capped US healthcare company.

WHK also works in the US, is chasing big chunky sales contracts and has a very active sales pipeline - just like Oneview Healthcare.

We invested in ONE in 2020, after its share price was well and truly in its “capitulation phase” after a big run following its IPO in 2016 on big expectations, then came right back down after new contracts and revenue growth took too long (which is when we Invested in ONE).

Sound familiar?

WHK’s share price is definitely in the capitulation phase right now (which is why we are participating in the current 3.2c rights issue), and will need to deliver material contracts (like ONE did) to get things moving again.

Of course, it is important to note that our past success with Oneview Healthcare is not an indication that WHK will achieve the same results, many things can go wrong (see our risks section further down).

But there is precedent for patience paying off for us, we just want to see WHK kick some big sales goals now.

And ultimately, we hope these big contract wins from a large sales pipeline help re-rate WHK to a valuation well beyond its current ~$8M market cap.

As for what’s possible on a valuation front, we note one recent analyst research report from MST Access which has a 24c price target:

You can read the full report here.

While that price target of 24c does look interesting, we should be clear that analyst price targets are based on a number of assumptions that may be incorrect. Analysts don't have a crystal ball and no one can accurately predict future share prices. It’s definitely possible WHK does not reach this share price. WHK is a high risk cybersecurity micro cap stock. Never invest on a price target alone, and always do your own research.

Having said that, the MST Access report draws attention to two key aspects of WHK’s business that we’ve already alluded to:

- A strong sales pipeline

- Regulatory change to drive sales

The report also highlights WHK’s Australian business launch which could draw more sales in the wake of the Medibank and Latitude Financial data breaches.

Noting the peer comparison section on cybersecurity companies - by one ratio called price to sales, WHK trades at around one fifth of what the average ratio is across a universe of cybersecurity companies.

Again, this is off a small current revenue number, and as a micro cap stock, WHK really just needs those big sales contracts to come in.

Building momentum, we then hope WHK’s valuation approaches the average ratio and subsequently re-rates.

So despite a tough couple years, we still have high hopes for WHK and remain Invested over the long-term to hopefully eventually see WHK achieve our Big Bet:

“WHK becomes a $500M technology company by securing new contracts and partnerships as legislation and public pressure force governments and companies to invest in cybersecurity”.

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our WHK Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

More on the two WHK catalysts we’re looking for

Sales catalyst

The first type of potential catalyst for WHK is a sales catalyst and we outlined one potential source of this in our last WHK note.

For example the 31 December 2022 quarterly noted a “renewed Cyber Risk Radar contract with Global Social Media Platform Company for 12 months, with engagement for expansion to additional business units.”

There are really only a few global social media companies out there.

That’s one source for a sales catalyst.

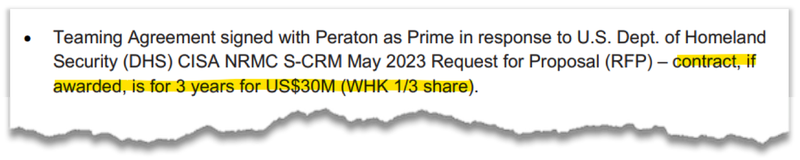

Other sources could include US defence organisations - for example this kind of contract which WHK’s 31 March quarterly said was in the pipeline:

(Source)

Assuming an even split of US$10M across all 3 years, and a one third WHK share that would come to US$3.3M a year to WHK’s revenue coffers.

That would effectively equal its entire CY2022 revenue in one go.

The Peraton mentioned in that contract above from the WHK sales pipeline is a private company that brings in US$7BN revenue per year.

Peraton was formed when Perspecta, Northrop Grumman's federal IT division, Harris Corp’s government IT services division, and Hewlett Packard Enterprise Services’ were rolled into one.

Peraton is essentially a massive US government IT services contractor - and WHK has an existing sales partnership with Peraton.

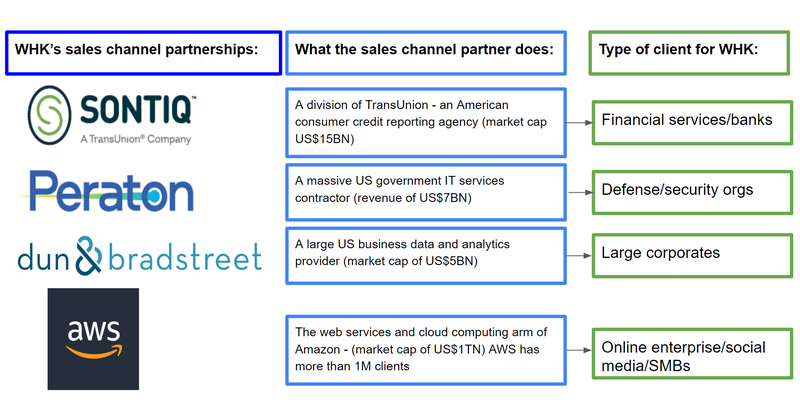

This is complemented by partnerships with Dun & Bradstreet, Amazon Web Services (AWS) Corporate, and Sontiq - all major corporations in their own right with similarly extensive and large client pools.

Given that WHK works at the top end of the US corporate and government pyramid - our hope is that these sales channel partners can push out WHK’s products.

Here’s how we see WHK’s now diversified sales channel partnerships working:

Regulatory catalyst

WHK’s push to get greater market penetration could be further aided by a regulatory catalyst.

In our last note on WHK, we flagged that the US government was aiming to implement a new set of regulations for cybersecurity compliance across its Defence Industrial Base (DIB).

The DIB consists of more than 100,000 companies and subcontractors who perform under contract to the Department of Defense - making up ~3-4% of US GDP.

These 100,000 companies frequently handle sensitive data and to combat cybersecurity threats, and the US is rolling out something called Cybersecurity Maturity Model Certification 2.0 (CMMC).

This is a new way of ensuring that DIB companies and subcontractors are compliant with the latest in cybersecurity methods.

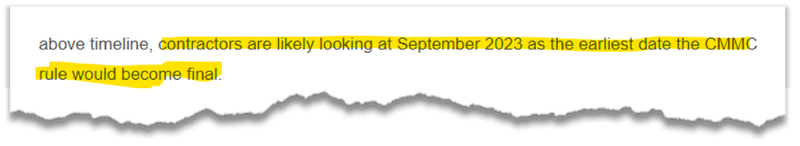

From what we can tell, the new rules are scheduled to come into effect in September 2023:

(Source)

With a complete implementation of the new rules targeted for late 2025.

The upshot for WHK is this: there could be a large wave of defence industrial base contractors which would all of sudden, need to find a cybersecurity compliance product that has been vetted through the appropriate channels.

In particular, we think WHK’s Cyber Security Radar and Scorecard products fit the bill.

Given WHK’s deep connections across major defence organisations and CEO Terry Roberts’ significant previous experience in the field, we think WHK is well positioned to sell products to DIB contractors and subcontractors with their CMMC 2.0 compliance.

We’ll be watching to see what happens with CMMC 2.0 in the coming two quarters and keeping an eye on how this affects WHK’s sales pipeline and conversions.

We also note that we have been waiting for these new regulations to come into force for many years (it was one of the original reasons we Invested) and it could still take a while with a US election coming up next year.

More on the WHK rights issue

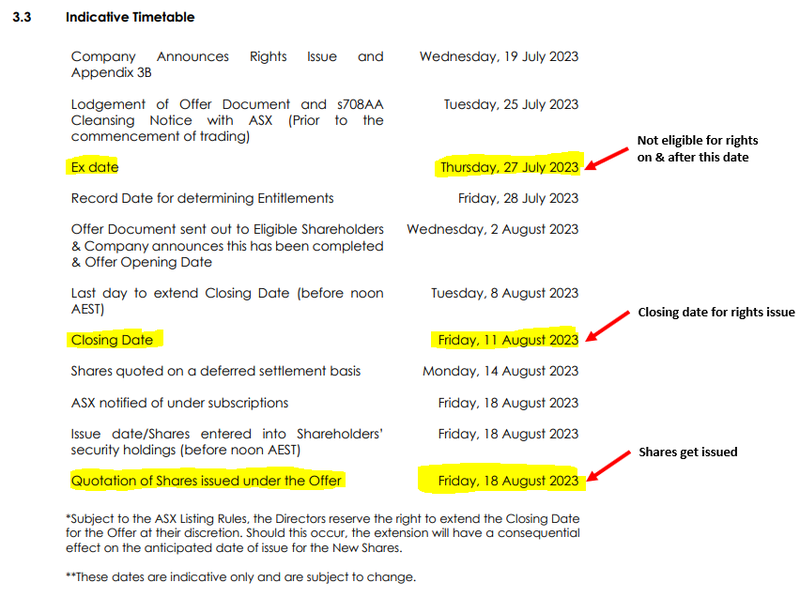

As we noted earlier, the rights issue ex-date is tomorrow (27 July).

Given the 2 day settlement timing on the ASX, this means that the last day for investors to buy WHK on market and also be eligible to apply for the 3.2c rights issue is today, 26 July.

If holding shares on the record date of Friday 28th July, anyone who owns six WHK shares will be eligible to subscribe for one new WHK share at 3.2c.

Typically, during rights issues we see company share prices trade sideways at about the same price as the rights issue.

Capital structure update

WHK is still a relatively early stage company and so revenues can come in at random, unpredictable points in time.

Last calendar year the company had two positive cash flow quarters but in the March quarter this year the company again produced a negative cash flow quarter - this is largely due to the “lumpy” nature of WHK’s large contracts and revenue recognition.

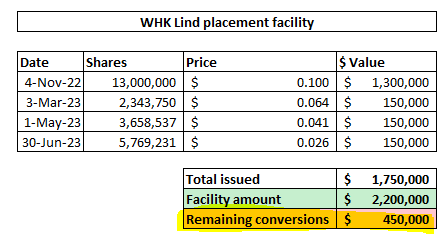

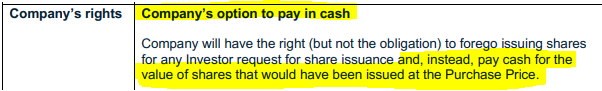

Late last year, WHK signed a funding deal with New York based Lind Partners for a total of $3M.

The arrangement saw WHK receive an initial $2M with the option of securing a further $1M.

The Lind funding deal is slightly different to the typical “cash for shares” deals we are used to seeing (i.e. placements) - instead the deal sees WHK receive the cash upfront from Lind, and then Lind slowly converts the cash amount into WHK shares over a 12-24 month period.

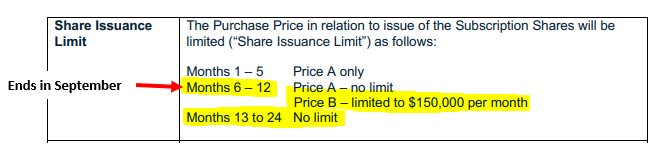

At the moment, Lind are able to convert ~$150k per month into shares at 90% of a chosen five day volume weighted average price (VWAP).

After September 2023, the facility can allow share conversions with no monthly limits.

So far, Lind has converted ~$1.75M of the facility into shares with a remaining ~$450k.

We also note (that if both parties agree), a further $1M can be provided to WHK by Lind, which may mean more conversions in the future.

What does the funding facility mean for WHK’s share price?

Typically, with deals like this, the financier looks to sell some of the shares converted on market.

We have seen Lind sell down some of its position based on the two ASX notices (20 Jan 2023, 23 March 2023).

In the short term, we expect the conversions to lead to more selling pressure on the market which may mean WHK’s share price trades sideways.

For example, the latest conversion was on the 30th of June 2023 at 2.6c per share. We think as long as the share price stays above that level then Lind may look to sell down some of their holding.

We do note though, that WHK has the option to pay for the remaining amounts in cash.

IF WHK can deliver material news, a re-rate in its share price to the upside and lock away a capital raise at a higher share price, generate positive cashflows OR get a lump sum upfront payment from a contract, then the company could just pay out the remainder of the Lind deal.

Ultimately, we want to see WHK deliver news and make that happen.

What’s next for WHK?

As we mentioned before, WHK’s business is somewhat opaque because it works in sensitive areas and industries.

So in the absence of material deals - the company must rely on quarterly reports to articulate progress.

We note WHK achieved two cash flow positive quarters in CY2022, but its latest 31 March quarterly showed just US$25K in receipts.

So while WHK noted that it had US$446K in receivables which are sales due to be recognised shortly, ideally we need to see an operating cashflow positive quarter in the upcoming 4C which is due before the end of this month.

🔲 30 June operating cashflow positive quarterly report

That’s step one.

Beyond that we want to see at least 3x large material deals come in this year across its sales pipeline:

🔲 Material sales contract #1

🔲 Material sales contract #2

🔲 Material sales contract #3

If all of these contracts come in, we expect WHK to substantially grow revenues this year and build a solid financial foundation for the company’s future growth.

Risks

In the short term the two key risks to our WHK Investment Thesis are “Sales risk” and “Funding risk”.

Sales risk because we have been waiting a long time for these big material deals to come in.

There is the possibility that WHK isn't able to close the deals it needs to in order to achieve its revenue targets - we think this has been a key reason why WHK’s share price has come down over the last 12 months.

As an addition to these risks - funding risk is an ever present part of the small cap market. See the section on WHK’s funding agreement with Lind above for further information.

Our WHK Investment Memo

Along with the key risks, our WHK Investment Memo provides a short, high-level summary of our reasons for Investing.

The Investment Memo details:

- Key objectives we want to see WHK achieve

- Why we Invested in WHK

- What are the key risks to our Investment thesis are

- Our Investment plan

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.