USA lithium - MAN’s well sampling has begun

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 3,150,000 MAN shares at the time of publishing this article. The Company has been engaged by MAN to share our commentary on the progress of our Investment in MAN over time.

Small cap ASX investors are in love with hard rock WA lithium assets right now.

Companies with only rock chip and soil samples have market caps higher than $20-30M without any drilling done on them.

Meanwhile anything lithium that is NOT hard rock is being overlooked by the market.

Lithium extraction from brines is the other way to get lithium, and it looks like the lithium brine stocks are trading at a discount to their hard rock cousins.

While there are some question marks around the process of extracting lithium from brines (what's called Direct Lithium Extraction), hundreds of millions of dollars are being invested into DLE, including by none other than Exxon Mobil.

That's right - traditional oil and gas behemoth Exxon Mobil has “plans to become a leading producer of lithium” - according to a press release a few weeks ago.

They even have a brand name for the product: “Mobil Lithium”.

Exxon Mobil has decades of experience in operating oil and gas wells, and thousands of geologists and technical specialists in producing oil - now it's turning its attention to extracting lithium.

That’s part of why we are Invested in US lithium brine explorer Mandrake Resources (ASX:MAN).

MAN has a market cap of $24M, with $15.5M cash in the bank - equating to a $8.5M Enterprise Value.

MAN holds ~93,755 acres (~379km^2) of ground in Utah, USA, which is highly prospective for lithium.

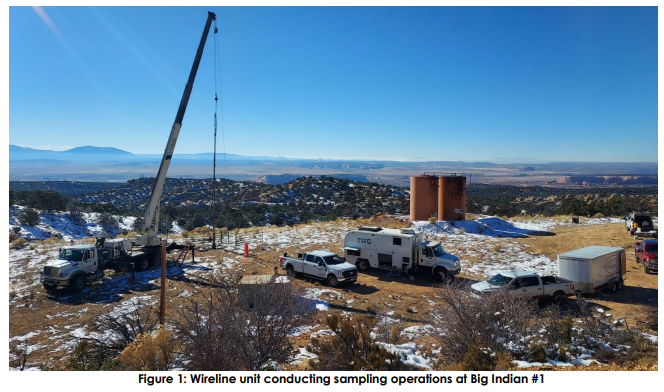

It's got a series of historic oil and gas wells on its property, that it is able to quickly sample for lithium and get a preliminary indication of just how much lithium is in the brines underground.

Yesterday MAN started a six well sampling program where it is testing its old oil and gas wells for lithium mineralisation.

MAN is actually following a similar approach to Exxon Mobil which just kicked off its first drill program a few weeks back after purchasing its projects for ~US$100M 6 months ago.

Exxon’s plan is to take lithium brine assets, apply Direct Lithium Extraction (DLE) technologies, and produce battery-grade lithium products.

MAN’s approach is almost identical to the one Exxon is following...

MAN spent most of 2023 pegging ground and increasing the size of its project - now the company holds 93,755 acres (~379km^2).

Then MAN signed well access agreements with the owners of nearby old oil & gas wells - now the company has access to the wells at ~1/10th of the cost it would take to drill the wells from scratch.

Now it's all about sampling and flow testing the wells to see if a commercial discovery can be declared - and just how big the lithium discovery could be.

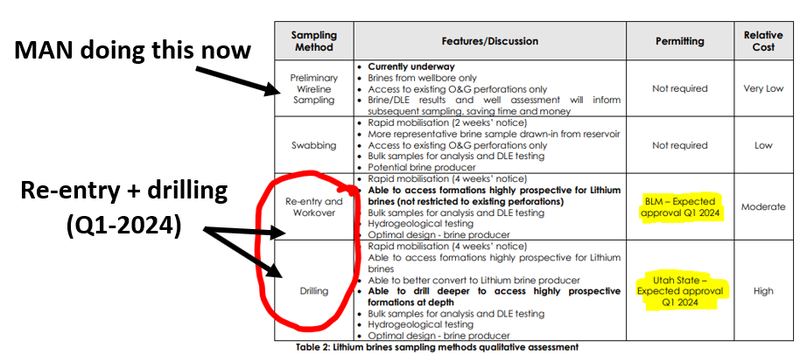

MAN’s plan is to follow up the sampling program by re-entering wells OR drilling new wells in Q1 2024.

What are MAN’s lithium targets?

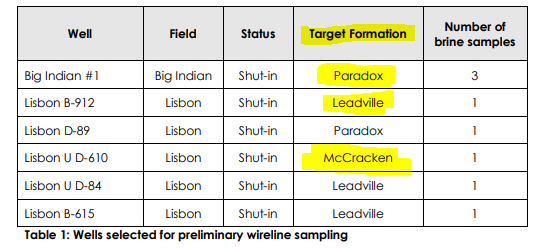

MAN is sampling six different wells and targeting three different reservoir formations:

The goal for this program is to collect samples and see if the three reservoirs have lithium brines in them.

After that MAN will look to test the samples across different Direct Lithium Extraction (DLE) technologies.

In yesterday’s announcement MAN highlighted that agreements were already in place with two DLE providers who have asked for large brine samples to run tests on.

IF everything goes to plan, MAN’s goal is to define a large lithium JORC resource and then partner with a DLE tech provider whose technology is suitable to MAN’s brines.

$24M capped MAN following the lead of $186M capped Anson

MAN’s strategy is the same as its regional peer, the ASX listed Anson Resources, followed over the last ~6 years.

During that period Anson’s market cap went from ~$1.8M to a peak of ~$490M. Anson is currently capped at $186M.

Anson holds ~167km^2 of ground in Utah USA, in the same basin as MAN, and is more advanced than where MAN is right now.

To get to its current valuation, Anson followed a relatively straightforward strategy:

- Started staking more and more ground, increasing the size of its project.

- Re-sampled old oil and gas wells for lithium - and defined a maiden JORC resource estimate.

- Announced a Direct Lithium Extraction (DLE) partnership

- Published a Definitive Feasibility Study (DFS).

MAN is looking to run through that exact same process:

- Staking more and more ground ✅ - MAN’s project sits on 93,755 acres (~379km^2). Anson’s project sits on 167km^2 of ground, so MAN’s project area is actually bigger.

- Re-sampling old oil and gas wells for lithium 🔄 - MAN just kicked off a six well sampling program yesterday.

- Direct Lithium Extraction (DLE) partnership 🔲 - MAN will be using the samples from this round of sampling to see which type of DLE tech its project is most amenable to. That should mean MAN can start talking to potential DLE tech partners.

- Definitive Feasibility Study (DFS) 🔲 - MAN is still a while away from a DFS right now. The first step toward getting to this stage will be for MAN to put out an exploration target and a maiden JORC resource estimate for its project.

By the end of this sampling program, MAN COULD make a lot of progress across three of the four major catalysts that took Anson to its peak market cap of ~$490M.

Right now, Anson is capped at $186M and MAN is capped at $24M.

Of note is MAN’s healthy balance sheet - it had $15.5M in cash at the end of last quarter - which puts it in a relatively strong position compared to other small cap companies in the market.

IF MAN delivers material news, it isn't in a position where it needs to raise capital AND any investors who want exposure to the company’s projects need to buy shares on market.

It's a position many small caps could only dream of right now especially given how hard it is to raise capital these days.

The pathway to a maiden JORC resource: Anson vs MAN

Anson first put out its maiden resource estimate back in 2019.

The company managed to do this by re-entering only 4 wells.

Remember, MAN is running wireline logging across six wells and is expecting permitting to come in for re-entry/drill programs in Q1 2024.

(Source)

At the moment MAN is at the final stages of work before a maiden JORC resource can be announced.

With the current round of work, MAN is aiming for an exploration target and eventually a maiden JORC resource estimate in Q1 2024.

After that, MAN’s plan is to run re-entry/workover programs so it can put together the maiden resource estimate.

For some context - Anson’s maiden resource had a JORC lithium carbonate resource of ~118kt - now its resource sits at ~1mt of lithium carbonates.

We are hoping that by getting to a maiden JORC resource MAN can start to give the market something to compare its project to.

We are hoping the JORC resource is the first catalyst to bridge the valuation gaps between MAN and its US lithium brine peer.

Critical minerals & US lithium macro thematic heating up?

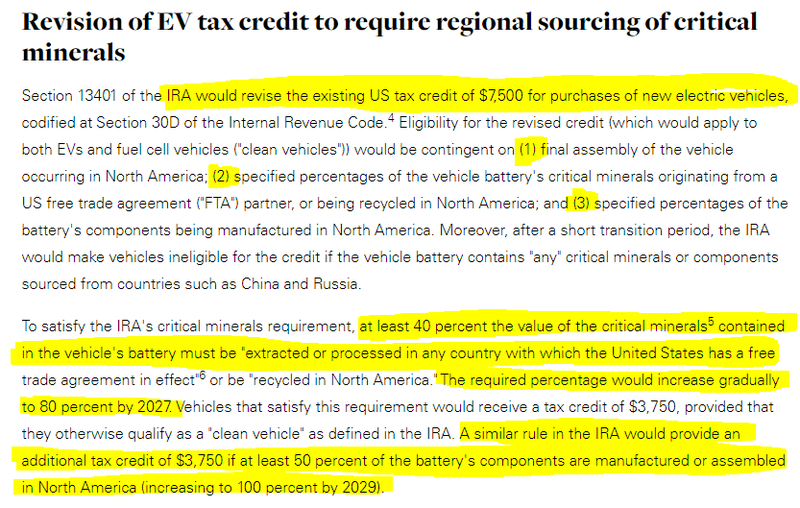

We think US and “friendshoring” of lithium supply is one of the hottest macro thematics in the market right now.

A key reason is the incentives layered into the US government's A$520BN Inflation Reduction Act (IRA).

The IRA dictates that for carmakers to be eligible for tax incentives, the lithium in EV batteries needs to be produced/processed inside the USA or in countries that have free trade agreements with the US (like Australia).

As a result we think the IRA could create bifurcated pricing for critical raw materials like lithium.

Bifurcation means projects producing/processing critical minerals in “friendly” countries will be sold at far higher prices than minerals processed/produced elsewhere.

AND in turn higher demand for projects in those countries....

We wrote about the implications of bifurcated markets in a previous weekend email here: Critical Materials - Long term macro thematics are still very strong

We have already started to see the first order impacts this has had on the majors of the industry.

SQM, Albemarle, Mineral Resources and Gina Rinehart are all battling it out for WA’s best lithium projects - think the ~$6BN Liontown battle and ~$1.6BN Azure Minerals battle.

And in the US, a bit closer to MAN’s lithium project, as we covered above, Exxon Mobil entered the industry with its US$100M purchase in Arkansas.

We think things are just starting to heat up and that projects with size/scale potential will attract the most interest from majors.

We also think projects inside the US could do just as well, if not better, in the long run, given the scale of US industry and demand

MAN’s project is fairly early in its lifecycle, but we think the company is doing all the groundwork at the right time in the cycle and has a low enough market cap that IF things go right there is still upside from its current valuation.

Of course there is always a chance that MAN is unable to find commercial quantities of extractable lithium at its project, and so we think the current valuation is likely a representation of that inherent risk.

The three major catalysts we think could re-rate MAN:

- Sampling results - MAN has seen grades of ~340mg/li in wells ~6km away from its ground. Anson’s resource has an average grade of ~127mg/li. If the sampling program returns grades higher than these across multiple reservoir intervals, the market may start to take an interest in MAN’s project.

- Maiden JORC resource - A maiden JORC resource estimate will give the market something to compare MAN’s project size/scale potential to other US lithium brine peers. Anson has a resource of ~1mt lithium carbonate equivalent and is capped at $186M.

- Direct Lithium Extraction (DLE) partnership - This was a major catalyst for Anson and was a key reason that led to its market cap reaching ~$490M in mid 2022. This was also the peak of the last bull market. Even so, Anson is currently capped at a fairly impressive $186M. After the sampling program is done, the $24M capped MAN can start sending samples to potential DLE partners for testing.

Ultimately, we are hoping the three catalysts culminate into our Big Bet for MAN which is as follows:

Our MAN “Big Bet

“MAN returns 1,000%+ by making a lithium discovery significant enough to move into development studies, or attract a takeover offer.”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved, and it will require a significant amount of luck. There is no guarantee that it will ever come true. Some of these risks we list in our MAN Investment Memo.

What does MAN do next?

Sampling results from re-entered wells 🔄

MAN is currently wireline logging (sampling) six wells targeting three different reservoir formations.

The main things we will be looking for from this program will be similar to the results we are used to seeing from oil & gas sampling programs.

Things like gross/net pay intervals and technical reservoir data.

Ideally, we will get some idea of the type of grades in the reservoirs and all of the above.

What are the risks?

The two key risks we see for MAN in the short term are “Exploration risk” and “Processing risk”.

Exploration risk is relevant because there is always a chance the company finds uneconomic quantities of lithium in the wells it re-enters.

Processing risk is also a factor because, even if MAN does find a decent amount of lithium, there is no guarantee that any of that lithium can be extracted and processed at rates that make MAN’s project commercially viable.

To see all of the key risks to our MAN Investment Thesis, check out our MAN Investment Memo.

Our MAN Investment Memo

In our MAN Investment Memo, you can find:

- MAN’’s macro thematic

- Why we Invested in MAN

- Our MAN “Big Bet” - what we think the upside Investment case for MAN is

- The key objectives we want to see MAN achieve

- The key risks to our Investment thesis

- Our Investment Plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.