More Upside in NSL Sale Prices Expected as Iron Ore Continues Upwards

Published 03-FEB-2017 09:49 A.M.

|

13 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

It’s been some time since we last checked in on NSL Consolidated (ASX: NSL), a commercially savvy minerals miner, that’s travelling at speed towards production status later this year.

We’ve seen a spectrum of commodities stage resurgent rallies in recent months, backed by factors ranging from the trivial to the Trump.

When looking at NSL’s current positioning as the only foreign owned Indian ore miner, there’s room for cheer. NSL is on course to produce at least 200,000 tonnes per annum (TPA) later this year...

...and could reinforce this initial salvo with an additional 200,000 tonnes, as part of an expansion phase being actively deployed.

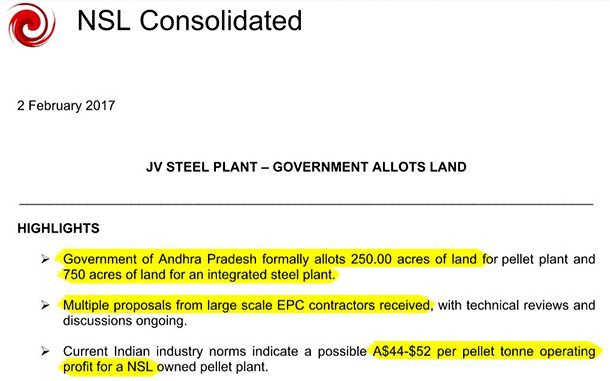

Part of that expansion has been the 250 acres of land for pellet plant and 750 acres of land for an integrated steel plant allotted to NSL by the Andhra Pradesh government through its joint venture with the company.

Based on current Indian mining and pellet industry norms for integrated plants, this indicates a possible AU$44-$52 per pellet tonne operating profit for a NSL owned pellet plant.

This figure is speculative at this stage and anyone considering NSL for their portfolio should seek professional financial advice before making an investment decision.

As well as representing the achievement of another material milestone for NSL in developing the project, it also highlights the importance of continued support from the government of Andhra Pradesh – which will talk more about shortly.

NSL has also been buoyed by process optimisation results at its Phase Two Wet Beneficiation Plant.

Utilising very low grade waste iron ore feed to test the process boundary limits NSL has been able to exceed expectations, with full plant process beneficiating low grade iron ore waste from as low as 14% Fe feed regularly to in excess of 62% Fe and up to 65.3% Fe.

The results of this testing mean there is potential upside to the expected plant production grades and as a result, sales prices.

These results could offer up further commercial opportunities for NSL both in profitability and breadth of customer base.

All in all, when the iron ore price looks like this – it’s going to make companies like NSL get onto an increasingly large share of investors’ radars.

The share price of our chosen small-but-determined ASX steed has really taken significant steps up the valuation ladder over the past year.

Since we last covered NSL in the March 2016 article Cashed Up NSL Now on the Inside Track for Positive Cashflow , we have sat back and watched as its share price has gone up by as much as 525%. Compared to giants such as Fortescue Metals that is significant.

Since the start of 2016, as you can see below – NSL was up by over 700%...

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

But there may be still more upside to come in NSL – just as its expansion plans are starting to kick into gear.

Here at The Next Mining Boom, we think it could be a sign NSL is outpacing rival ASX small caps in getting to production just as the iron ore recovery takes flight.

That means one thing — it could be time to take another close look at this iron ore generator for your small-cap miner portfolio...

NSL Consolidated (ASX: NSL) has been toiling away in Andhra Pradesh — for over 7 years and over that time the State has become the number two State in India for ease of doing business.

In fact Andhra Pradesh has a 15 year business plan that would see an expected 14% growth rate projected to 2029, based on an aggressive infrastructure program including airports, ports, highways and a new Greenfield Capital City.

Andhra Pradesh has a single window process for investments and projects, with a guaranteed 21-day approval timeframe for all state permissions.

Which is one of the reasons NSL has been working so closely with the state and built up such a formidable relationship.

2016 saw NSL transform from a tiny $8.5M capped minnow, to a $90M capped emergent iron ore producer.

We’ve kept tabs on NSL’s progress right for some time, publishing a series of articles since 2015 .In this article, we’ll go through a refresher for those of you just coming to the story.

Hitting the 2017 ground running

NSL is the only foreign owned iron ore miner in India, in what is an extremely large domestic market.

The big news is a deal which could see NSL partner with a billion dollar company to build a steel mill (more on that later).

The most recent news has been just as enthralling, including optimisation results indicating potential upside to metallurgical test work and results conducted for its stage two wet beneficiation plant.

Further to previous wet plant commissioning updates released by NSL. Utilising very low grade waste iron ore feed to test the process boundary limits, NSL has been able to exceed expectations , with full plant process beneficiating low grade iron ore waste from as low as 14% Fe feed regularly to in excess of 62% Fe and up to 65.3% Fe.

The results of this testing mean there is potential upside to the expected plant production grades and as a result, sales prices leading to further commercial opportunities and a potential extension of its customer base.

NSL has ramped up operability of the crushing and screening plant and will commence to feed ROM material grading between 25-35% Fe into the plant in the coming week.

Further to this, NSL expects sales of the wet beneficiation plant product produced to commence in February, with multiple customer discussions at the final stages.

Given the positive optimisation results and imminent sales, NSL has commenced the process of employing shift supervisors, plant operators, mobilising stockyard fleet with goal of ramping up of throughput and production to a 24-hour operation to meet expected production and financial targets in the coming months.

This news plays nicely into NSL’s hands following the announcement that Andhra Pradesh has formally allotted 250 acres of land for a pellet plant and 750 acres of land for an integrated steel plant in Orvakal Industrial hub, Kurnool District.

Given NSL’s ambitions to expand operations, this presents a further milestone for the company and could be quite profitable based on current Indian mining and pellet industry norms for integrated plants. In fact, the deal indicates a possible AU$44-$52 per pellet tonne operating profit for a NSL owned pellet plant.

NSL will now continue to progress the pellet plant pre-feasibility in line with its Indian iron ore beneficiation strategy.

NSL is sticking to its word — and gradually bringing its iron ore production aspirations into reality. It’s all happening in a country that’s busting a gut to compete on the industrial world stage.

Let’s take a run-through of NSL’s positioning, to see if small-cap investors have a chance of siphoning further returns

Here is a map of NSL’s current operations in India — where NSL hopes to launch a four-phase production spree beginning as soon as this month.

That’s right folks, after months of heavy lifting, NSL is now on the cusp of production. Initially the expected production capacity is 200,000 tonnes per annum, although this is expected to quickly double to up to 400,000 TPA on the back of project developments being hatched at NSL’s HQ.

NSL has built the phase one plant, which has production capacity of 680,000 TPA throughout – with total output aimed at about 200,000 TPA.

The company brings in ore at grades of 20-35%, with a resulting 50-55% grade iron ore after processing – which can then be sold off to steelmakers in the region.

This plant is already producing, and offtake deals with major industrial customers are penned.

And the revenue is starting to come in.

Here is an approximate timeline of NSL’s development:

NSL is entering its ‘sweet-spot’ with a clearly defined production pathway ahead that will see it expand production over the coming years to reach 2,500,000 TPA by 2019.

Given the information available so far, NSL is on track to generate ROM feed grade ranges of 25-35% Fe and produce high grade premium price product, of 58-62% Fe.

If the high-grade nature of NSL’s Indian iron ore project is a great help, then the macroeconomic factors that affect iron ore are an absolute godsend — take a look at how iron ore prices have performed over the course of 2016:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

The iron ore price fell to a decade low of $US38 a tonne in late 2015, then rebounded by 80% in 2016.

Renewed iron ore demand from China helped lift prices to around US$65 per tonne, breaking out of the $US40-60 a tonne range set over the past few years.

Current Indian industry norms indicate a possible AU$44-$52 per pellet tonne operating profit for a NSL-owned pellet plant.

Some market watchers are calling it a “swing for the sixties” — and just like in the 1960s, it would seem the going is good.

Of course, as you can see above, commodity prices do fluctuate and caution should be applied to any investment decision here and not be based on spot prices alone. Seek professional financial advice before choosing to invest.

NSL’s Project Economics looking perky

According to NSL’s feasibility studies, the Phase 2 plant will produce iron ore at a cash cost of $22 per tonne. Meanwhile, iron ore prices are in the mid-US$60’s per tonne.

Here is a snapshot of NSL’s feasibility:

It’s also already bagged offtake deals with two major Indian players in JSW Steel and BMM Ispat – meaning all NSL needs to do is get the plant on site and producing.

NSL continues to make good progress towards taking its Phase Two wet beneficiation project into production.

NSL recently successfully completed the assembly stage of the plant, and then significantly progressed the commissioning of the plant. A milestone was achieved with the energising of the grid power transmission line for the delivery of 33kV power to the site so that the site is now fully functioning on mains power.

With the electrical commissioning of the plant complete, it is fully operational and ready to commence production now.

Let’s have a look at progress snaps taken a few weeks back:

With the economic advantages NSL’s plans bring to one of India’s poorest regions, Andhra Pradesh, the local communities can’t wait to start mining.

These local communities, with whom NSL will be working closely for at least the life of NSL’s first mine, or around 10 years, are fully on-board with iron ore development. Take a look at the snaps from NSL’s debut “energisation” which got its iron ore production plans firmly underway.

As you can see, NSL was welcomed with open arms.

The nature of NSL’s operations makes them open-ended and with plenty of room for growth and expansion.

NSL has secured access to the second largest mining lease in the region with a 77-acre tenement package holding significant quantities of iron ore amenable to NSL’s beneficiation process. The entire operation is also located less than 10kms from the wet beneficiation plant and stockyard.

From Phase 1 to Phase 2

As a ballpark figure, if both of NSL’s plants are up and running at maximum capacity then NSL can expect to generate free cash flow around $10.9M per year.

We should note that’s a ballpark figure only and it relies on full production and offtake from both plants and makes assumption that domestic steel prices remaining exactly the same – which is fairly unlikely.

But the great thing about the offtake deals is that they remain non-binding, meaning NSL is free to explore the market for a better deal.

For the time being, progress is going gangbusters:

NSL is working hand-in-hand with Indian authorities and snaffling up premium operational space as well as strong connections in a country still in the early stages of reaching its massive industrialisation potential.

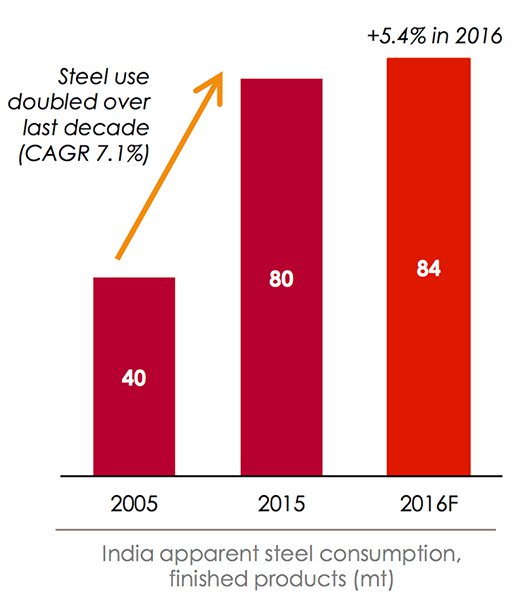

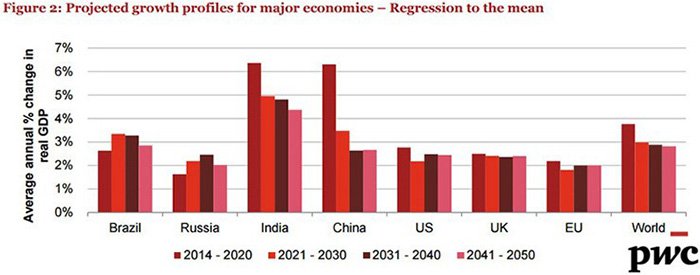

All things considered, we think now could be time to look to both India’s and China’s long-term growth prospects and to seriously consider building some exposure to the rampant growth occurring in these fast growing nations.

According to the largest accounting company in the world, PwC, India and China will win the lion’s share of global growth between now and 2050. This means plenty of investment opportunities relating to raw materials, manufactured goods, food, medicine and pretty much everything else that comes with larger incomes and mushrooming spending habits.

Reassessing iron ore and NSL as a small-cap soon-to-be producer

Iron ore prices have begun their recovery after years of yo-yoing to the beat of Asian industrialisation. Prices have been on the rise in 2016 and are now at levels not seen for several years.

Concurrently, NSL is building India’s first commercial iron ore mining operation to supply its ambitious modernisation drive spurred on by India’s progressive leader, Narendra Modi.

NSL is an eager-beaver digging its way to an iron ore war chest in lockstep with an uptrend in iron ore prices.

That’s the kind of investment opportunity we look for at The Next Mining Boom — small-cap rising stars that have the wherewithal to navigate their way through the choppy waters of mining project development to emerge successfully.

However, like all small mining companies, there are still hurdles to jump so caution is always recommended if considering an investment in NSL.

NSL has been toiling away in India for over 7 years. It has seen ups and downs, twists and turns, lefts and rights, but importantly, NSL now has clear road ahead to advance its Indian iron ore game plan all the way to the finish.

Imminent Indian production is already being earmarked for expansion to the heady tune of 2,500,000 TPA by 2019.

Meanwhile, a Chinese MoU deal is waiting in the wings, subject to a pre-feasibility report that is expected in coming months.

NSL is now on the verge of opening India’s first foreign-owned iron ore mine, recording its first iron ore revenues and establishing a clear production path with first-mover advantage attached.

All this in a country with over a billion people and an industrial demand ramp-up rivalled only by China.

With such an investment outlook underpinning small-capped NSL, we only have one thing to say:

Happy days.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.