Thirty solid gold stocks to whet your appetite Part 3: Has gold transitioned from a safe haven to a growth play?

Published 28-JUN-2019 09:42 A.M.

|

15 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

While the gold price has retraced slightly over the last few days, the fact that it has remained above the psychological US$1400 per ounce mark is promising, suggesting that the spike wasn’t a flash in the pan event.

We mentioned in Part 2 that the price of the precious metal will potentially fluctuate as geopolitical developments play out, but there is a school of thought that the break above the long period of consolidation around the US$1200 per ounce to US$1350 per ounce range is a function of pent-up demand.

That said, there is often a knee-jerk reaction to macro events which could throw up some buying opportunities after many stocks have run hard in recent weeks.

You may find some of these in the following 10 stocks, the last in our 30 stock gold sector coverage which we hope has provided some food for thought.

Red 5 Ltd (ASX:RED)

Shares in Red 5 have nearly doubled in the last two months, but this re-rating can’t be solely attributed to the buoyant gold price.

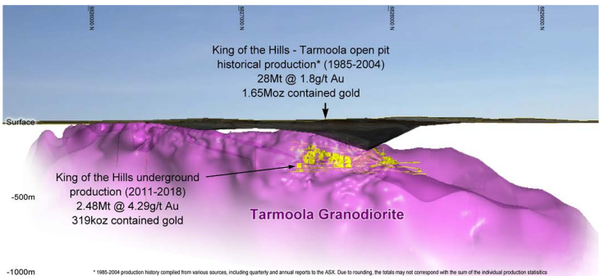

Last week the company upgraded its Mineral Resource Estimate for the King of the Hills Gold Project (KOTH), a development that was promising in its own right, but it also lays the foundation for an impressive prefeasibility study.

KOTH is surrounded by world-class projects in the Leonora region of Western Australia.

The PFS is due to be delivered in the September quarter of 2019, and management expects that it will support the establishment of a standalone mining and processing operation at KOTH.

Importantly, 76% of the updated resource, or 2.35 million ounces, is now in the higher-confidence Indicated category, and therefore is available for conversion to Ore Reserves.

The updated resource also now comprises open pit and underground components, giving a clearer picture of the likely overall parameters of a stand-alone mining and processing operation at KOTH that could include underground and open pit production and satellite deposits.

This PFS will focus initially on the open pit resource, supplemented by the resources currently being evaluated in the course of management’s regional exploration program, including the recently announced resources for the Rainbow and Severn satellite deposits.

Red 5 expects that promising down plunge and along strike diamond drilling results which aren’t reflected in the resource upgrade have the potential to add significant growth in resources.

Consequently, Red 5 is a watch this space stock with drilling results likely to be the most significant share price driver ahead of the completion of the PFS.

Regis Resources Ltd (ASX:RRL)

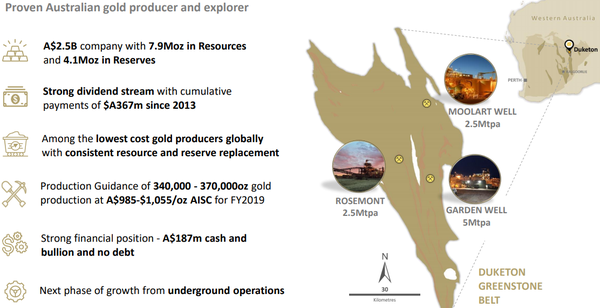

Shares in Regis Resources have soared in recent weeks, increasing 20% from about $4.40 to $5.30.

However, the company is starting to look a little toppy, perhaps reflected in Macquarie’s price target of $5.60 which it set on April 30 after the group delivered its March quarter update.The broker noted at the time that production of approximately 91,000 ounces at AISCs of $1019 per ounce was broadly in line with its estimates.

At that stage, year-to-date costs were tracking below the bottom end of management’s guidance for fiscal 2019.

Low-cost production has been a feature of the group’s multi-mine operations in Western Australia over a lengthy period.

The other standout feature has been the regular payment of dividends, setting it aside from most players in the mining sector.

Regis is in a strong position to continue dividend payments as it finished the March quarter debt free with cash and bullion of $187 million.

The company’s assets position is as a long life producer with 7.9 million ounces in resources and 4.1 million ounces in reserves.

Management expects that the next phase of growth for the group will come from underground operations.

Regis also has a promising development project in New South Wales.

Management anticipates that the McPhillamys Project can be developed into a 200,000 ounce per annum open pit gold mine.

Regis has also shown an appetite for acquisitions in the past with its astute management team at times transitioning poorly executed projects into cash cows.

However, it is unlikely that management would be considering such a strategy at the moment with many companies trading at a premium to fair value.

Regis presents as one of the best ‘buy and hold’ companies in the sector due to its consistent dividend payments and share price performance, with the latter increasing five-fold over the last four years.

Resolute Mining Ltd (ASX:RSG)

The most significant recent news for Resolute Mining is its listing on the London Stock Exchange (LSE) where it commenced trading on 20 June.

It could be argued that the company has long been under-appreciated and undervalued, but given the group’s key assets are located in Africa, an area better understood by Northern Hemisphere investors it wouldn’t be surprising to see some substantial share price support start to emerge.

Furthermore, access to capital in European markets could also be beneficial.

However, the company is cashed up, and it is difficult to see the group having a need to raise capital through equity or debt in the near term.

Resolute has cash, bullion and investments of $86 million, and the company has established a unique strategy of paying dividends in cash and bullion.

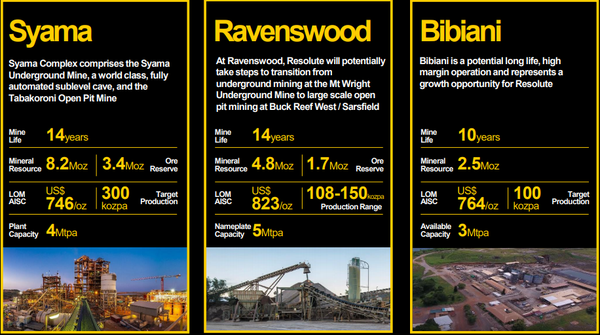

In a snapshot, Resolute is a long life, low-cost, large-scale producer and developer with management’s sights set on transitioning from production guidance of 300,000 ounces in fiscal 2019 to 500,000 ounces per annum in the near future.

With resources of 16.8 million ounces from the group’s existing assets, it isn’t difficult to see Resolute achieve its goal.

Low costs are a feature of the company’s operations with Syama, its main producing mine, targeting long-term production of 300,000 ounces per annum at life of mine AISCs of US$746 per ounce.

Macquarie ran the ruler across the company in May, reaffirming its outperform recommendation and share price target of $1.60 per share.

This implies share price upside of 30% to the company’s current price.

Saracen Mineral Holdings Ltd - ASX:SAR

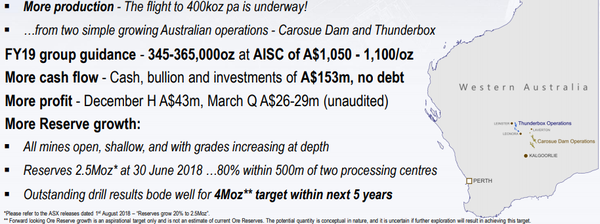

Saracen looks set to be one of the highest growth larger gold companies in Australia over the next two years, driven by a substantial increase in production from its Western Australian Thunderbox and Carosue Dam projects.

If Macquarie is on the mark, the latter will be the real growth engine over the next three years with production increasing from just over 200,000 ounces per annum to approximately 290,000 ounces per annum.

Production from Thunderbox is expected to peak in fiscal 2020, while continuing to contribute at a rate of approximately 150,000 ounces per annum out to 2022, albeit at significantly higher costs in 2021/22.

Saracen is already an impressive fiscal 2019 story with management having increased production guidance from 345,000 ounces to 365,000 ounces.

Macquarie is of the view that the company can crack the 400,000 ounce mark in fiscal 2020.

However, the company’s share price has increased by nearly 50% in the last two months, hitting an all-time high of $3.97 this week.

This represents a significant premium to Macquarie’s target price of $3.30, and particularly the consensus target of $2.89.

It is worth noting that Macquarie’s price target looks well supported by the company’s earnings metrics, and it wouldn’t be surprising to see the consensus target increase substantially.

Providing the company delivers a robust fiscal 2019 result and upbeat 2020 guidance, there is also the potential for Macquarie to upwardly revise its price target.

With Saracen trading on a PE multiple of 11.6 relative to Macquarie’s fiscal 2020 earnings projections, the company doesn’t look as overpriced as price targets would have you believe.

St Barbara Ltd (ASX:SBM)

Shares in St Barbara plummeted from $4.50 to $3.19 on March 22, 2019 after management provided a mix of disappointing news regarding the results from a feasibility study and a decline in production guidance for fiscal 2019.

This news prompted Macquarie to lower its price target by 35% from $5.20 to $3.40.

However, the news kept getting worse at St Barbara, and an update by Macquarie on May 31 saw the broker downgrade its recommendation to underperform and cut its price target to $2.50 per share.

The company is currently trading at a premium to Macquarie’s target, but this appears to be courtesy of the buoyant gold price rather than any company specific factors.

Consequently, St Barbara appears to be a stock worth steering clear of, particularly given a number of variables in relation to the company’s operational outlook.

Silver Lake Resources (ASX:SLR)

While Silver Lake Resources’ rampaging share price has no doubt benefited from the kick in the gold price, it appears that most of the gains that have occurred over recent weeks can be attributed to exploration success.

The company’s shares have roughly doubled in 2019, but they have grown another leg in June, increasing 50% from approximately 80 cents to hit a six-year high of $1.30.

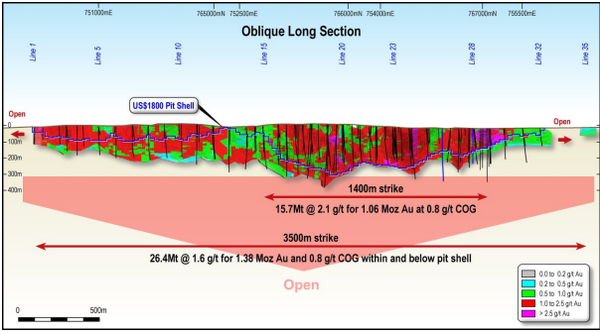

Silver Lake’s cornerstone asset is the Mount Monger gold mine situated in the prolific Eastern Goldfields District of Western Australia.

Production from Mount Monger was 158,000 ounces in 2018, but it appears that another chapter is ready to be written, as extremely high-grade mineralisation continues to be unveiled at the group’s Deflector Gold-Copper Project in the Murchison region of Western Australia.

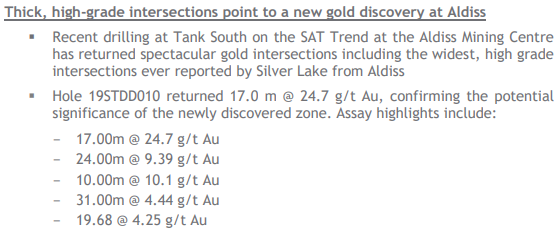

It was mid-June when the first promising drilling results came through, and these related to the group’s Tank South newly discovered zone at the Aldiss Mining Centre, part of the Mount Monger operation.

The gold intersections were the widest and highest grade ever reported by the company at Aldiss, and included 17 metres at 24.7 g/t gold and 24 metres at 9.4 g/t gold.

While these are early stage results, they suggest the discovery of a wider, higher grade zone of mineralisation than previously identified by limited historical drilling.

Further positive news emerged yesterday at Silver Lake’s Deflector Project where diamond drilling intersected high grade gold and copper mineralisation over a 300 metre zone between the southern limits of the Deflector mine and the 2014 intercept at Deflector South West (3.1 metres at 9.9 g/t gold and 7.5% copper).

Underground drilling extended high grade gold-copper mineralisation beyond the previous southern most limits of the Deflector mine workings.

High-grade Deflector style intersections revealed bonanza grades of 0.3 metres at 239 g/t gold and 0.8 metres at 60.5 g/t gold as well as a wider intersection of 5.1 metres grading 9.7 g/t gold.

On the corporate front, Silver Lake completed its merger with Doray Minerals in April, combining complementary operations and establishing a multi-asset, mid-tier gold producer - a win/win for both companies.

Saturn Metals Ltd (ASX:STN)

Saturn Metals has had a stellar run since early April with its shares increasing from 15 cents to 34 cents, the highest level it has traded at since listing on the ASX in March 2018.

Support for the company has come in droves over the last three weeks, mainly on the back of promising drill results from the Apollo Hill Project near Leonora in Western Australia.

The intersections returned further highlight the potential to increase the scale and quality of Apollo Hill’s current Mineral Resource of 20.7 million tonnes grading 1.0g/t Au for 685,000 ounces of gold.

Saturn is in the process of preparing another resource upgrade and anticipates completing this in coming months.

Moving forward, reverse circulation drilling has recommenced at Apollo Hill to further test recently defined higher grade hanging wall lodes in the north of the deposit.

Drilling is following up on a number of high grade intersections including 10 metres at 5.8 g/t gold from 46 metres, including 5 metres at 11 g/t gold.

The delineation of near surface high grade gold often gets the market excited given the potential to establish a low-cost operation, but it is early days at Apollo Hill.

The group’s shares have started to retrace following the recent euphoria, and it would appear that the next likely catalyst is the resource upgrade.

Tietto Minerals Ltd (ASX:TIE)

It was in late May that West African gold explorer, Tietto Minerals reported broad high grade gold intersections at the company’s AG deposit (Abujar-Gludehi) within its Abujar Gold Project in Côte d’Ivoire, West Africa.

These included two relatively narrow bonanza intersections of in excess of 100 g/t gold, backed up by thicker intersections such as 6 metres at 4.8 g/t gold.

This data built on other strong results in March at the AG deposit, including further bonanza grade hits.

Management noted at that stage that mineralisation remained open in all directions and that the latest intercept was 100 metres north along strike of the existing inferred mineral resource of 10.4 million tonnes at 2.1 g/t gold for 703,000 ounces.

It was during this drilling campaign that Tietto really came under the microscope with its share price more than doubling to a 12 month high of 22 cents, broadly in line with where the company traded shortly after listing on the ASX in January 2018.

Another catalyst was a 146% upgrade in the AG mineral resource in April, bringing it to 30.6 million tonnes at 1.4 g/t gold for 1.7 million ounces.

Tietto is also working the Abujar-Pischon-Golikro (APG) deposit within five kilometres of the AG deposit.

Gold mineralisation has been intersected over a four kilometre strike with reports of mineralisation down to 150 metres below surface.

The current mineral resource is 11.2 million tonnes at 1 g/t gold for 350,000 ounces.

Management is targeting a second resource upgrade towards the end of 2019, and this along with drilling results could provide further share price momentum.

West African Resources (ASX:WAF)

West African Resources has been a growth by production story with the company and its management team making the group one of the best-credentialled operations in Africa, and more specifically the Burkina Faso region which can be challenging.

West African announced the results of its updated Feasibility Study for the Sanbrado Gold Project in Burkina Faso in May 2019.

The study envisages an initial 10-year mine life, including 6.5 years of underground mining, with Probable Reserves to 1.7 million ounces (21.6 million tonnes at 2.4 g/t gold).

The project will have average annual production over the first five years of mine life of 217,000 ounces gold and a 14-month post-tax pay back on US$186 million pre-production capital costs.

Project economics are robust, with AISC’s of less than US$600 per ounce over the first five years and US$650 per ounce over the life of mine.

Year one gold production is anticipated to be over 300,000 ounces from underground and open pit ores, at AISCs of less than US$500 per ounce.

The project is fully funded with construction underway and first gold pour scheduled in the September quarter of 2020.

Being a well-managed company with the financial capacity to bring a large scale project into production at a relatively early stage, there is little wonder why analysts at Macquarie are bullish on West African Resources.

The broker is forecasting revenues of $200 million in 2020, increasing to approximately $500 million in 2021 as Sanbrado ramps up to full production.

Also forecast is a net profit of $130.8 million in fiscal 2021, equating to earnings per share of 14.9 cents.

With the company currently trading at 32.5 cents this implies a PE multiple of 2.2, indicating that the group not only is financially robust, but it has an outstanding earnings outlook which is yet to be factored into the share price.

Macquarie has a price target of 50 cents on the stock, implying a PE multiple of 3.3, still a significant discount given the company’s growth profile.

As the boxes are ticked on the way to the first gold pour one would expect the share price to better reflect forward earnings expectations.

Westgold Resources Ltd (ASX:WGX)

Bell Potter resource analyst, Peter Arden, ran the ruler across Westgold Resources in April after the company released its March quarter production results which featured quarter-on-quarter growth of 12%.

However, arguably of more importance was the significant decline in costs which came in at $1269 per ounce, implying margins of about $750 per ounce based on the current gold price.

Westgold’s shares have run strongly since early March after the company announced that it had topped up its hedging at $1863 per ounce.

While the Australian dollar gold price is now sitting about $150 per ounce above that mark, it is a useful safety net that provides earnings predictability.

Furthermore, it is management’s policy to hedge up to 50% of its gold sales in the short term, indicating that a significant proportion of production can still be sold at record spot prices.

In fact, the company went on to increase its hedging position in June with a view to ensuring a solid margin over costs.

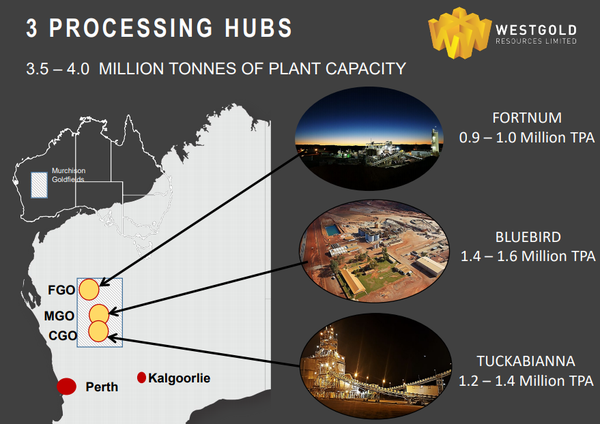

Westgold benefits from having multiple gold operations predominantly in the Murchison region of Western Australia.

The company is also refurbishing the Big Bell operation which should be at full-tilt by the end of 2019.

Westgold’s production is currently running at an annual rate of about 250,000 ounces with relatively high AISCs of $1500 per ounce.

However, Bell Potter expects the company to increase annual production to 350,000 ounces over the next few years while driving down AISCs to around $1360 per ounce.

Looking beyond 2019, Arden is forecasting a net profit of $60 million, representing adjusted earnings per share of 15 cents.

He has a buy recommendation on the stock with a price target of $1.95, implying a PE multiple of 13.

This is broadly in line with where the company is currently trading, and perhaps it is at a level where there will be some consolidation prior to consistently delivering on cost improvements and bringing new projects into production.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.