Tesoro continues to ground itself in Chile hot spot

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Plukka Ltd (ASX:PKA) which is to be renamed Tesoro Resources Ltd has released a supplementary prospectus in relation to capital being raised for the acquisition of exploration concessions in Chile.

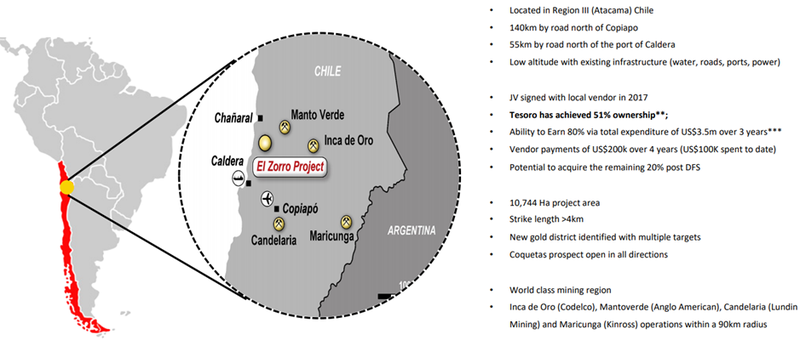

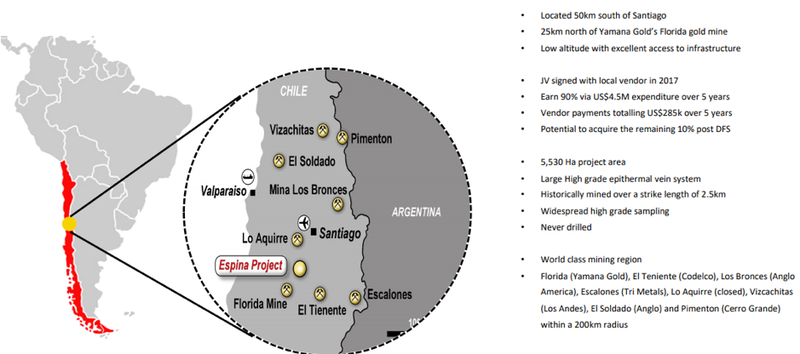

Under the proposed ownership structure, Tesoro will have the opportunity to explore and potentially develop and mine the El Zorro and Espina projects in Chile, with the former emerging as a major newly discovered gold system.

Prior to running the ruler across the group’s impressive new assets, it is important to note the changes outlined in the supplementary prospectus.

The Supplementary Prospectus has been prepared to provide investors with updated information in relation to the status of Tesoro’s mining tenure and to update the indicative timetable of the Offer.

The company has advised that the closing date for the offer has been extended from 5:00pm (WST) on 29 November 2019 until 5:00pm (WST) on Friday, 13 December 2019.

Key dates under the indicative timetable following closure are the issue of consideration shares and shares under the offer (17 December) and the re-quotation of securities which is to occur on 20 December.

Derisking of El Zorro and Espina projects

The other aspect which is extremely important from an operational point of view and arguably represents a significant degree of derisking in relation to the assets being acquired is the dispensing of conditions which previously cast doubt over the possible mining concessions being approved for acquisition.

On this note, the following clause was part of the initial prospectus.

‘’The mining concessions are at various stages of application and grant. More specifically, 16 of the mining concessions for the El Zorro Project and 36 of the mining concessions for Espina are still under application. Whilst as at the date of this Prospectus the Company does not anticipate there to be any issues with the grant of these applications, there can be no assurance that the applications that are currently pending will be granted. Whilst the Company considers the risk to be low, there can also be no assurance that when the relevant concession is granted, it will be granted in its entirety. Some of the concession areas applied for may be excluded.”

This paragraph has now been deleted as all of the concessions which comprise the El Zorro and Espina Projects have been granted and none are at the application stage.

Diamond drilling identifies wide high-grade intercepts

Tesoro Chile has the right to acquire up to 80% of the El Zorro Gold Project, 130 kilometres from Copiapo in Region III (Atacama) of Chile, approximately 850 kilometres north of the Chilean capital, Santiago.

The project is located only 10 kilometres from the coast at low altitude and has easy access to infrastructure and mining support services.

It is fully permitted with drilling set to start on day one.

Tesoro Chile currently owns 51% of El Zorro and is required to pay approximately US$100,000 in project payments by January 2022 as reimbursement for historical costs incurred by Sr Bahamondes and his related companies in development of El Zorro and US$3.5 million in expenditure on the El Zorro project prior to January 2021 in order to earn 80%.

Tesoro has already spent approximately US$1.5 million on exploration of the project.

The project covers an area of approximately 10,500 hectares.

From a geological perspective, gold mineralisation at El Zorro is associated with a suite of felsic to intermediate intrusive rocks (diorites and tonalites) which have been subject to multiple phases of faulting and brittle deformation resulting in the deposition of gold bearing fluids within intrusive rocks.

Tesoro has undertaken considerable exploration work at the project including the drilling of 16 diamond drill holes which have returned a number of wide, high grade gold intercepts.

Tesoro’s work has also identified numerous new gold prospects within a 4 kilometre by 4 kilometre area outside of the previously identified Coquetas prospect which featured multiple high grade results from diamond drilling.

At Coquetas a mineralised zone of more than 650 metres has been defined, with gold mineralisation identified up to 100 metres thick and 300 metres deep, as well as being open in all directions.

All holes encountered gold mineralisation with some of the high-grade returns outlined on the right-hand side.

El Zorro ready to drill

Adding further flavour to the story has been the identification of multiple anomalies at new prospects including Buzzard which featured 26 metres at 1.6 g/t gold including 8 metres at 3.1 g/t gold at surface in outcropping mineralised rock

Coquetas North also delivered promising early stage results, including 16.6 metres at 1.3 g/t gold.

A 10,000 metre drilling program which will target extensions of known high-grade mineralisation at Coquetas, plus infill drilling is planned for 2019/2020. The company is aiming to define a resource during 2020 from Coquetas.

It will also test new drill new targets at Toro Blanco, Drone Hill and Buzzard if warranted from follow up sampling work.

Further, there could be some news in the interim with 1000 outcrop channel samples ready to be assayed with results expected in January.

The end game is to establish a well-defined geological model and a mineral resource estimate which would provide the foundation for an accelerated earn-in process and move the project into development.

Potential to move to full ownership of Espina Gold Project

Tesoro Chile has the right to acquire up to 100% of the Espina Gold Project, 50 kilometres south of Santiago, in the Maipo Valley, Chile.

The Espina project covers an area of approximately 5,530 hectares and as indicated below, it is within a well-known epithermal gold region, 25 kilometres north of Yamana Gold’s operating Florida mine.

Tesoro is targeting epithermal style gold mineralisation which has been identified within the project area along two main structural trends, mapped for over 2km long each.

Considerable exploration work has been undertaken at the project including mapping, systematic soil sampling (over 1,000 soil samples), processing and interpretation of aeromagnetic data.

Tesoro’s work has identified two structural/fault trends which are delineated by strong geochemical anomalism, outcropping epithermal gold bearing veins and associated widespread alteration believed to indicate the presence of a large epithermal mineralising system.

Tesoro’s work has returned rock chip results from outcropping epithermal veins of up to 69.3 g/t gold.

The Infiernillo Trend and the Puertelera Trend have been identified, and these have a strike extent in excess of 2 kilometres each and are coincident with soil anomalies featuring gold, silver and base metals such as zinc and lead.

While Espina isn’t drill-ready, results from assays of 140 outcrop epithermal vein samples and 420 soil samples should be received in January.

The company is planning a maiden drill program at Espina during 2020.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.