Tesla inks Nickel deal with BHP - AOU Drilling for Nickel near BHP smelter

Published 23-JUL-2021 15:11 P.M.

|

3 minute read

It is official, BHP has signed a deal to supply nickel to Tesla ... and that could be great news for our nearby nickel exploration investment Auroch Minerals (ASX: AOU).

We invested in AOU at 20c back in March because it has a number of nickel projects within trucking distance to BHP’s nickel smelter.

Including the former nickel mine that once supplied BHP’s mill

Two weeks ago AOU announced it has uncovered a very high priority drill target that it intends to drill test immediately. We also think the long awaited Nepean Deeps drilling programme is due to start any day now.

BHP has already stated it will also be looking for third party supply to meet its nickel demand.

Nickel packs more energy into batteries and allows producers to reduce the use of cobalt, which is more expensive and has a less transparent supply chain.

However, out of all the battery metals, nickel is causing the most headaches for Tesla to scale up its battery production.

The BHP deal goes a long way to fixing Tesla’s problem at a time when nickel demand is set to increase exponentially on the back of demand for EV batteries.

BHP chief commercial officer Vandita Pant who said "Demand for nickel in batteries is estimated to grow by over 500 per cent over the next decade, in large part to support the world’s rising demand for electric vehicles."

BHP will provide Tesla with nickel from its Nickel West operation in Western Australia in a bid to make the battery supply chain more sustainable.

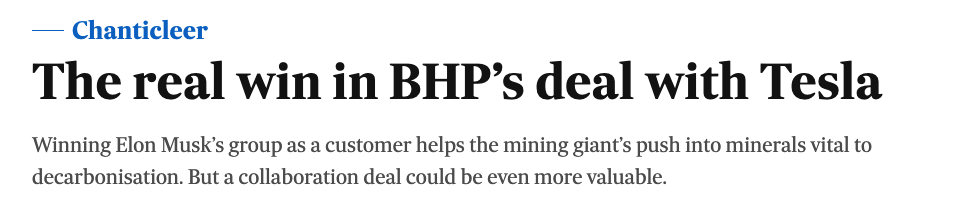

This major move has had significant media coverage:

In Western Australia, BHP is busy increasing its nickel ore reserves, acquiring projects, and is seeking to restart its Kambalda nickel mill with ore fed from third parties...

AOU owns 80% of a historical high grade nickel mine that used to supply BHP but was shut down after the nickel price plummeted a few decades ago.

AOU is now hoping to discover a giant nickel body underneath the historical nickel mine’s original ore body.

The nickel mine stopped producing back in 1987 when the nickel price dropped to below US$4,000/tonne - this is not the case now.

Nickel is currently trading at around US$18,500 per tonne, almost doubling since March 2020.

AOU is currently drilling AROUND the historical mine and the next phase is to drill UNDER it, which is the exciting part for us...

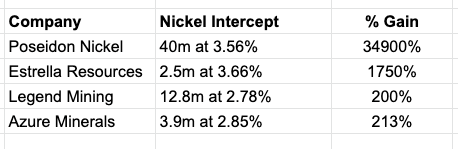

Investors love high grade nickel intercepts - we have invested in the hope that AOU hits the next one.

ASX investors have had a long history of reacting positively to thick, high grade nickel intercepts:

Recently, AOU announced it has uncovered a very high priority drill target.

This decision to instantly drill this new target was based on the target’s size, strength and location.

This drilling will lead into the Nepean Deeps drill programme, which is scheduled to begin very soon - this is a major catalyst for AOU.

Here is why we like AOU:

- WA nickel will be highly sought after now that BHP and Tesla have agreed to work together.

- Nickel is going to play a key part in EV batteries for the coming decades - we are bullish on the long term nickel price.

- AOU is aiming to unlock a much larger nickel resource below/along strike to an old nickel mine. This has happened before in WA – Western Areas is the case study here, and shareholders were hugely rewarded.

- AOU continues to deliver impressive drill results, confirming thick, high grade nickel at shallow depths at its historical nickel mine.

- AOU has a number of options that exercise at 10c that have been converting into shares over recent months. This is good in that it brings funds into the company without having to tap the broader market, however it is worth noting that this can also soften upward momentum in the share price.

- End of Financial year tax loss selling pressure has been lifted

- AOU is aiming to build over 100kt of nickel resources, and has multiple nickel exploration projects - we like the scale of the company’s goal.

What to expect next

- Drilling of new high priority target: RC drilling started? We are not sure but assume we would have seen an announcement... expecting any day now

- Assay and DHEM results from regional RC drilling campaign: Coming weeks

- Nepean Deeps drill programme: Scheduled to begin later this month.

- Results for the recent RC programme: Results from the Leinster Nickel Project are likely imminent.

Quarterly report: We will also see the AOU quarterly report in a few days so we will get an idea of their cash balance.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.