Tando’s vanadium resource upgrade marks near term production opportunity

Published 16-APR-2019 13:17 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

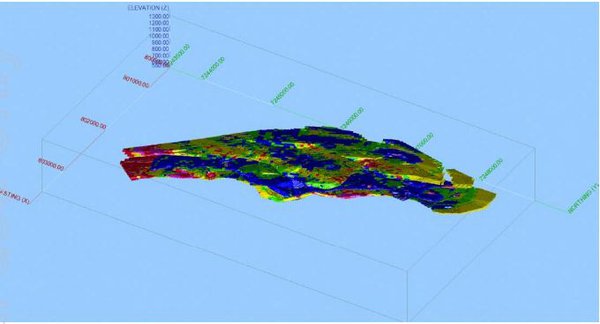

Tando Resources (ASX:TNO) has released a mineral resource update that could fast track its near-term production aims at its SPD Vanadium project in South Africa. The Resource is now the largest +1% V2O5 resource in the world.

The company announced a highly significant JORC Mineral Resource update today, which along with successful metallurgical test work, could pave the way for a Scoping Study to be completed.

“The Scoping Study, which will be completed in coming weeks, will focus on the economic and technical merits of establishing a near-term production operation based on the high-grade surface Resource,” said Tando Managing Director Bill Oliver.

Oliver says it is significant because the new high-grade shallow Resource underpins the potential for a low-cost, near-term production operation at SPD.

“This has immense potential to be a low-cost operation due to the combination of the high-grade material, its shallow nature and the highly attractive metallurgical characteristics.”

Impressive numbers

The numbers for this Resource upgrade are impressive, hence the company’s buoyant demeanor this morning.

The new JORC Mineral Resource estimate for the high-grade component at SPD stands at 169Mt at 1.07$ V2O5 in the Indicated & Inferred categories. It is the largest resource above 1% V2O5 in the world based on published resources.

Importantly, this includes 97Mt at 1.05% V2O5 within 100m of surface and also includes 68Mt at 1.05% V2O5 in the Indicated category.

The previous high-grade surface Resource was 80Mt at 1.07%, all of which was in the Inferred category. The Global JORC Mineral Resource at SPD is now 612Mt at 0.78% V2O5 , compared with the previous estimate of 588Mt at 0.78% V2O5 5, and includes 231Mt at 0.78% V2O5 in the Indicated category.

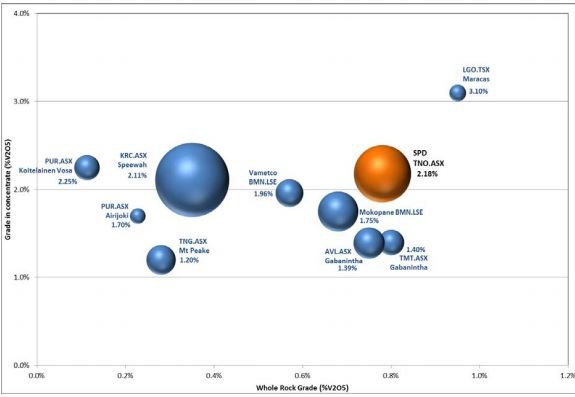

Tando will now seek to generate a +2% V2O5 concentrate from the high grade portions of the Mineral Resource via simple beneficiation.

The SPD Vanadium Project

Situated in South Africa in a similar geological setting to Rhovan (Glencore), Vametco (Bushveld Minerals) and Mapochs mining operations, Tando’s SPD Vanadium Project has the potential to be a globally significant play based on its tonnage and grade concentrate.

As stated, it is now the largest +1% V2O5 in the world.

Given its step forward towards near term production, Tando is now looking to capitalise on the current goodwill surrounding vanadium.

Currently approximately 85% of the world’s vanadium is produced in China, Russia and South Africa, so Tando is in a good position to achieve its aims, particularly based on today’s numbers.

The vanadium market

Vanadium is used in strengthening steel via various alloys and consumption is on the rise following the implementation of stricter standards on the strength of steel to be used in construction (specifically rebar).

Strong demand is forecast to continue, along with supply and substitution constraints, pointing to a positive vanadium outlook.

The price for >98% Vanadium Pentoxide (V2O5 ) has remained between US$15 - US$17/lb for most of 2019, with recent price fluctuations a result of low volumes of trade. This represents a sustained increase in price from US$3.50/lb at the start of 2017.

The rise in price is set to continue as the push to renewable energy solutions increases in momentum.

Vanadium redox flow batteries (VRFB) for large scale energy storage provides additional longer term demand for vanadium. Tando has stated that according to research conducted by Lazard (NYSE.LAZ), VRFB’s already have a levelised cost of storage that is less than Li-ion battery storage by 26% to 32% on a comparative basis.

Tando’s commanding Resource upgrade, not only puts it one step closer to production, but may also help it tap into this market sooner rather than later.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.