Surge in Kairos Minerals may be linked to Breaker Resources capital raising

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

On Wednesday, shares in Kairos Minerals (ASX:KAI) spiked 35% from the previous day’s close of 1.4 cents to close at 1.9 cents prompting a speeding ticket from the ASX on Thursday.

Of course is should be noted that share trading patterns should not be used as the basis for an investment as they may or may not be replicated. Those considering this stock should seek independent financial advice.

Responding to the usual questions, KAI confirmed that it wasn’t aware of any information concerning it that had not been announced to the market which, if known by some, could explain the recent trading in its securities.

It’s not for KAI to speculate on what is happening outside the company, but there is a fair chance that developments at Breaker Resources (ASX: BRB) contributed to the share price surge which occurred under near-record daily trading volumes of more than 13 million.

Fleshing out the possible school of thought behind the rush for KAI, the company’s Roe Hills project is located along strike and immediately to the south of BRB’s emerging Lake Roe gold discovery.

Just prior to the market opening on Wednesday BRB entered into a trading halt, announcing that a capital raising was imminent. The word on the street was that the company had managed to raise circa $10 million at close to par (last closing price 74 cents).

While this hasn’t been confirmed, it was reported by the Australian Financial Review on Thursday morning that BRB had raised $10 million at an issue price of 70 cents per share.

The AFR reported that a mainstream broking house in Paterson Securities assisted in the raising. Putting this in perspective, you have a company with a market capitalisation of less than $100 million raising a sizeable sum at an issue price equating to only 5% discount to its last traded price.

Such a development should provide shareholders in BRB (and KAI) with a significant degree of confidence. Normally small miners have difficulty in raising large amounts of capital, in this case more than 10% of its market capitalisation.

Furthermore, it was done with the support of a major broker and executed at a minimal discount to the company’s last traded price.

Kairos a bordering neighbour rather than an oblique nearology play

This arguably implies confidence in both the company and the project, which in turn translates into a positive view from the investment community regarding the prospectivity of BRB’s territory.

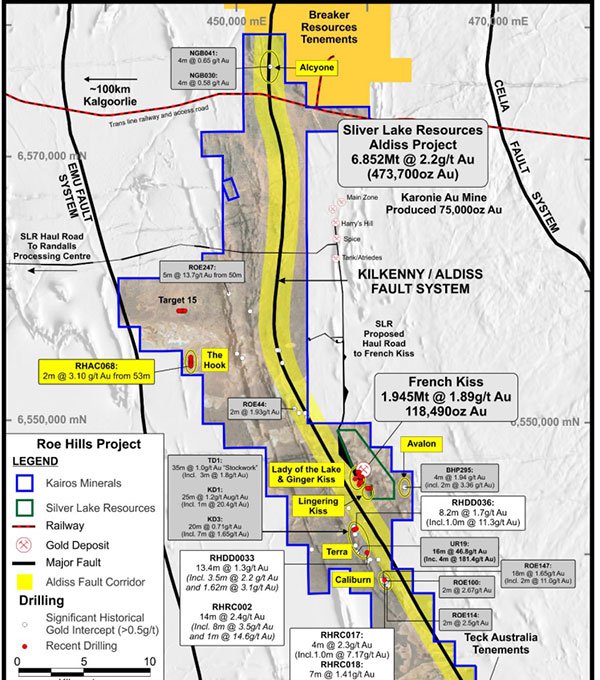

Consequently, if streetwise investors have joined the dots that could well account for the interest in KAI which as the following map demonstrates is not just an abstract nearology play, it is sitting right in Breaker’s backyard, as well as being adjacent to other major projects/deposits, including those being developed by Silver Lake Resources (ASX: SLR).

Kairos flying under the radar

It could also be argued that Kairos was, and still is, trading at a significant discount to fair value. Unfortunately, the last round of promising drilling results which featured hits of up to 5.26 grams per tonne gold at the Lady of the Lake deposit and 29.16% at the Lingering Kiss deposit were released at the same time as the gold price retraced after a strong run in July.

Furthermore, it coincided with a rally in base metals which to some extent saw some gold investors take money off the table and redistribute it into copper and nickel stocks. However, with the gold price recommencing its rally in the last week, perhaps KAI will come under the spotlight.

Certainly, if the reports regarding Breaker Resources’ capital raising are confirmed there could well be further share price support for KAI.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.