SS1 is now the biggest silver resource on the ASX. Silver price moving too?

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 3,810,000 SS1 shares at the time of publishing this article. The Company has been engaged by SS1 to share our commentary on the progress of our Investment in SS1 over time.

Sun Silver (ASX:SS1) now has the biggest primary silver resource on the ASX.

And the silver price is back near decade highs above US $30 per ounce...

... after touching above $32 a couple of months ago.

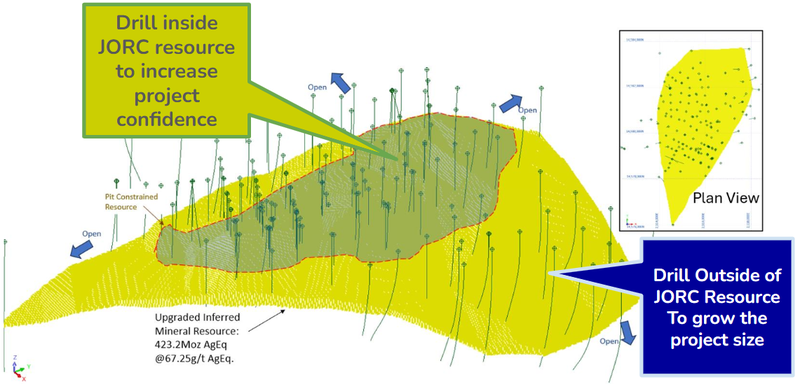

Our 2024 Pick Of The Year SS1 just announced a remodelled 423 million ounce silver equivalent JORC resource at its project in Nevada, USA.

A higher silver price makes deeper sections of SS1’s silver resource economical to extract.

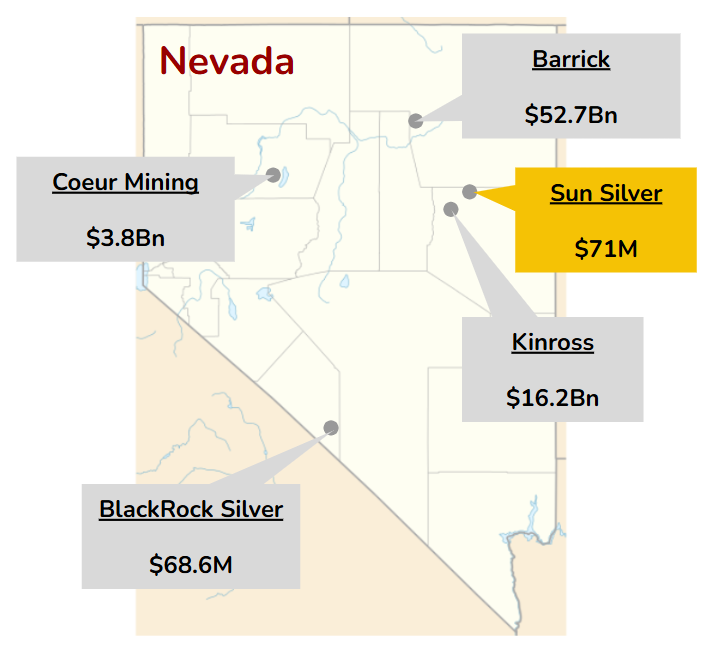

SS1 is currently capped at A$71M (US$48M).

We are Invested in SS1 because:

- We think silver is at the start of a bull run (we’ll explain why in this article).

- SS1 acquired their big, advanced silver project for cheap while silver was unloved.

- ~200 historical drill holes initially gave a 292Moz pit-constrained silver equivalent JORC resource - which increased by 45% today to 423Moz.

- SS1 now has the biggest primary silver asset on the ASX (previously it was Silver Mines). SS1 has taken the mantle as of today. We think SS1 could start to have a Silver ETF “lookalike” premium placed on the stock (more on this further down).

- SS1’s resource is open in all directions.

- SS1 is drilling right now to further expand the resource - more drill results should be out in the coming weeks.

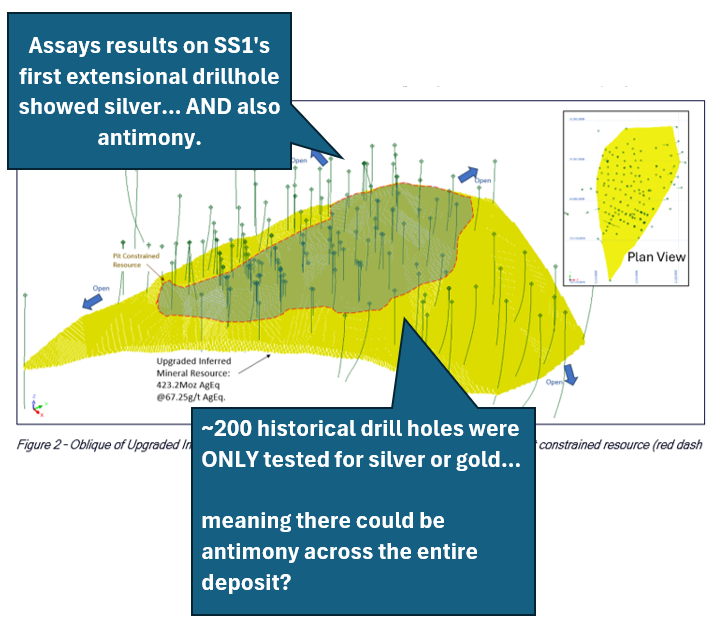

- Last week SS1’s first new extensional drillhole was also tested for and revealed a critical metal called antimony...

- The ~200 historical drillholes were NOT tested for antimony... so SS1 might ALSO have an antimony resource if the historical holes are all retested for antimony.

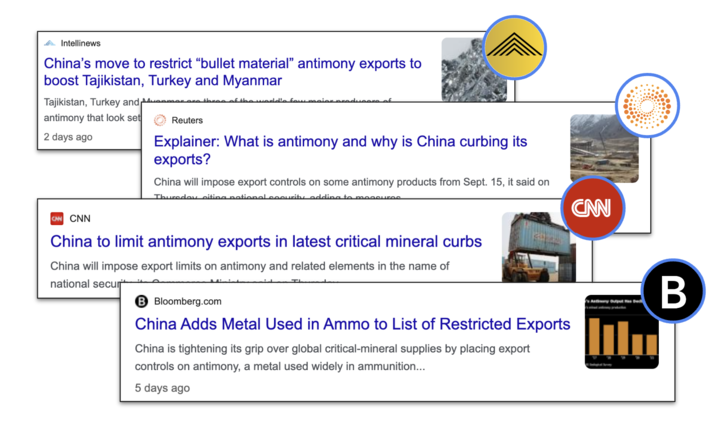

(Antimony is a metalloid used in military applications and weapons. The US has ZERO domestic supply and last week the world’s largest antimony supplier, China, announced antimony export restrictions)

We think adding antimony to SS1’s already giant silver resource would be a great addition to the SS1 value proposition, especially if domestic antimony supply becomes a US defence priority, given that SS1’s project is located in the USA.

So antimony is suddenly the topic of the moment AND the silver price has renewed its strong run from the first half of the year.

Investing in small cap resources stocks is a lot about getting the timing right, specifically the macro themes working in your favour.

We called SS1 our 2024 Small Cap Pick of the Year because we hope it can get its timing right like our best ever Investment Vulcan Energy Resources did during 2020 and 2021.

VUL’s share price went to a high of ~$16 per share, 80x from our Initial Entry Price of 20c, now trading at around $4.

VUL picked up its lithium project for cheap while lithium was HATED in 2019, right before the great 2020-2022 lithium bull market.

SS1 picked up its giant, advanced silver project for cheap while silver was hated, and since then silver has been having a strong sustained run upwards.

(and it might even add an antimony resource to its silver project)

SS1 now the biggest primary silver resource on the ASX

SS1’s silver project has ~200 historical drill holes.

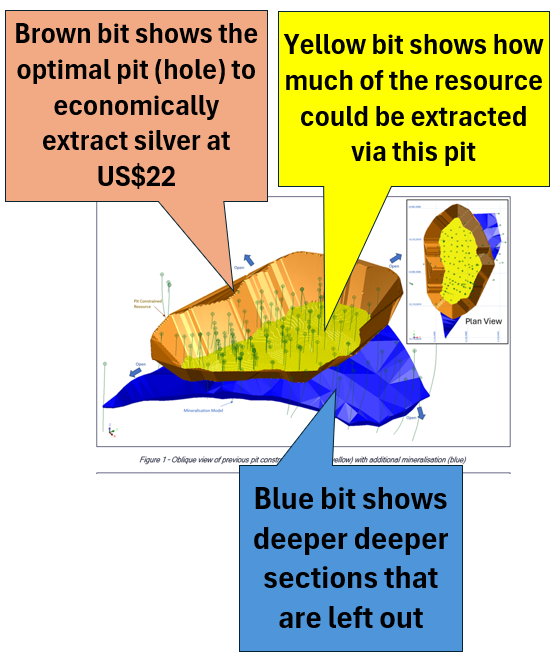

The project had a JORC resource that was constrained by what the previous owners calculated was economical to mine using a silver price of ~US$22 per ounce.

As the silver price increases, more and more of SS1’s deposit could become economic to mine.

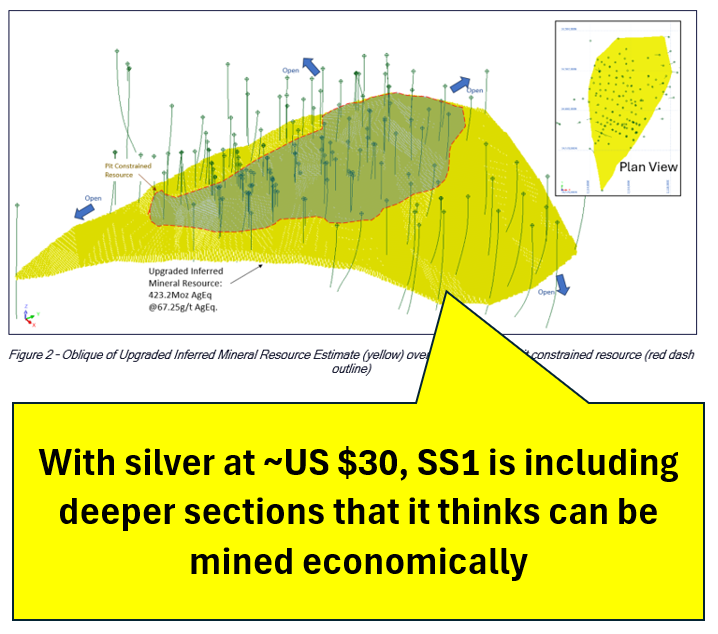

With the silver price holding at ~US$30 per ounce, SS1 has removed the old constraint modelled by the previous owners during a silver bear market and included parts of the deeper sections.

Here is how SS1’s resource looked before today’s announcement:

And here is how it looks after today’s announcement:

SS1 is also drilling right now to FURTHER expand its resource.

SS1 now has the largest primary silver resource on ASX.

A company called Silver Mines used to have the biggest silver resource, and used to be capped at $300M plus.

(Remember SS1 is currently capped at $71M)

Silver Mines Ltd’s resource is located in NSW, Australia, and was effectively a de facto “silver ETF” on the ASX - where the value of Silver Mine’s resource would theoretically increase with every increase in the silver price.

That was until two weeks ago, when Silver Mines ran into some permitting hurdles and the company’s share price came off by ~40%.

So, as of today, SS1 now has the biggest silver resource on the ASX, AND it does not have permitting issues hanging over it.

SS1’s project is in the mining friendly state of Nevada, USA - where there are over 50 operating silver/gold mines and the largest primary silver mine in the US.

So SS1’s project has size and scale, and we think is in the right jurisdiction for getting a mine up and running.

In summary, here are the three key perks of being the BIGGEST primary silver resource on the ASX:

- Institutional investors like it BIG - Institutional investors looking for exposure to silver generally want a resource with size and scale. This will favour SS1.

- BIG leverage to the silver price - Because of how big SS1’s silver resource is, the higher the silver price, the higher the look-through value of the project for the company.

- Silver “ETF Lookalike” premium - Now that SS1 is the BIGGEST silver resource on the ASX, investors looking for silver exposure may choose to buy SS1 instead of (or as well as) physical silver. This places a premium on the stock.

Our view is that if the silver price rallies, then investors will see SS1 as the most levered to higher prices and capital will flow into the stock.

The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

We think silver is going to keep running because of rapidly increasing industrial demand from solar panels, as well as its traditional use as an inflation hedge/store of value in an uncertain world.

At the same time, a silver price run is not a guarantee.

Commodity prices are notoriously fickle and hard to predict - always invest with caution and consult a professional financial advisor before choosing to invest.

Why we think the silver price could go even higher

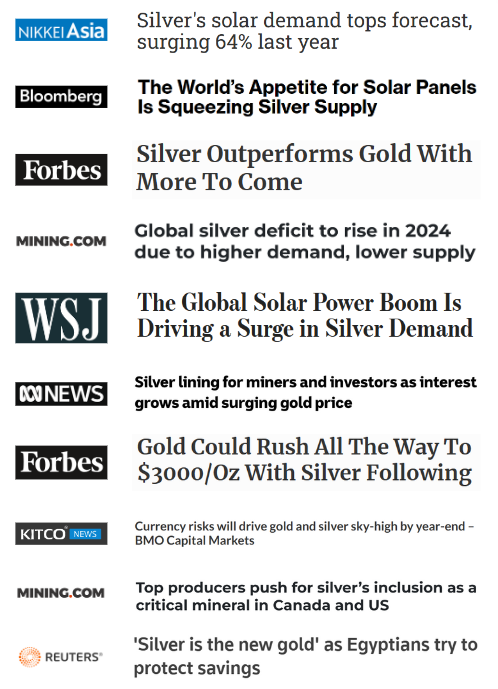

Silver is in the headlines now:

But, for a long time we believed the price of silver was trading unsustainably low.

We have been Investing in commodities companies for decades now and one way to gauge IF a commodity is likely to rally hard is to try and plot what is called “incentive prices” against the chart for that particular commodity.

Incentive prices refer to the price for a commodity where companies see it as worthwhile to either explore for OR develop advanced assets.

I.e if the cost to produce a commodity is say, $10, then the incentive price would need to be way above that number for it to be worth building a huge mine and taking on all the risks associated with that.

And for explorers, the incentive price is usually even higher - where the price needs to be high enough to make it worthwhile spending money on high risk/high reward exploration.

When it comes to silver, we think the market traded well below incentive pricing for far too long.

That period of low prices resulted in mines being shut down or new mines not being built AND a complete lack of exploration looking for new discoveries.

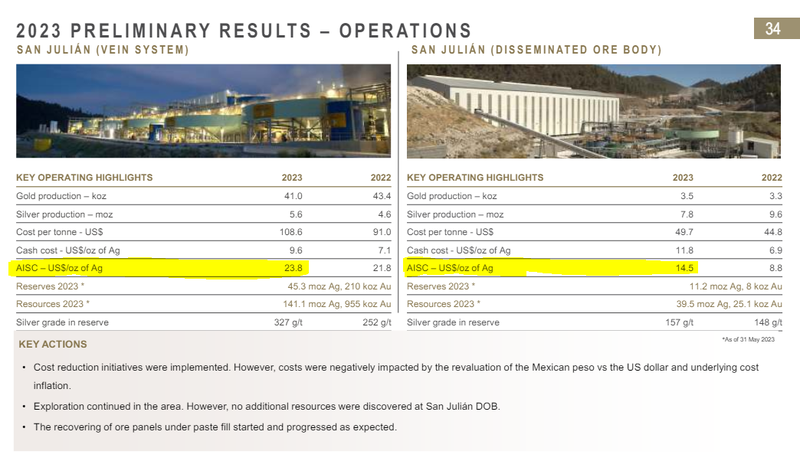

Fresnillo plc is the world’s biggest silver producer.

Below is a slide taken from the Fresnillo 2023 results presentation which shows the All in sustaining cost (AISC) for two of its silver mines.

One is at US$21 per ounce and the other at US$14.5 per ounce.

(they must be a lot happier with silver at ~US$30 per ounce)

Naturally, their assets are in the lowest cost quartile for silver producers.

So, US$14.50 to US$21 is as good as it gets when it comes to the cost of mining silver.

( Source )

Now looking at the silver price...

The above numbers show us roughly how much it costs to mine silver.

The next thing to think about is how much a miner can sell its silver for.

For over a decade the silver price traded between ~US$13 per ounce and ~US$22 per ounce.

Those prices were nowhere near high enough to justify bringing new silver mines online, and they were especially not high enough to incentivise new exploration.

The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Taking into consideration the time it takes to bring new projects online, the forward outlook for silver supply is relatively grim.

New mines can take up to ~17 years to come online following a discovery. Obviously projects at a more advanced stage in terms of development can come online quicker.

All in all, we think the silver market currently finds itself in a position where there is no new supply coming online and demand could be about to go exponential...

Exponential silver demand growth projected to 2050

By 2050 - 50% of silver demand is expected to come from the solar panel manufacturing market. This is a relatively recent development in the silver market.

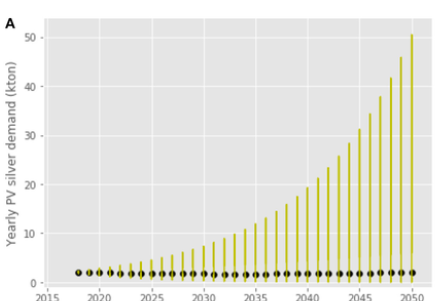

The chart below shows how demand for silver is expected to rise by over 250% by 2050 due to solar alone:

( Source )

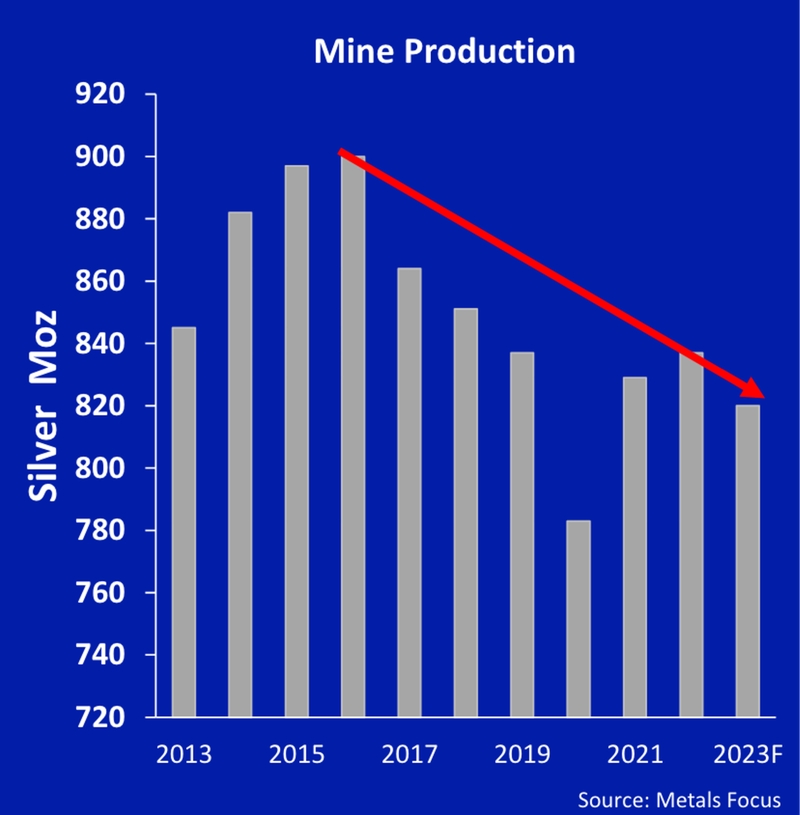

Demand is growing, BUT global silver production is declining...

Globally, silver production declined by 0.7% in 2023. ( Source )

Decreasing production isn't just a “2023 thing” either.

Global silver production has been trending lower since 2016... ( Source )

( Source )

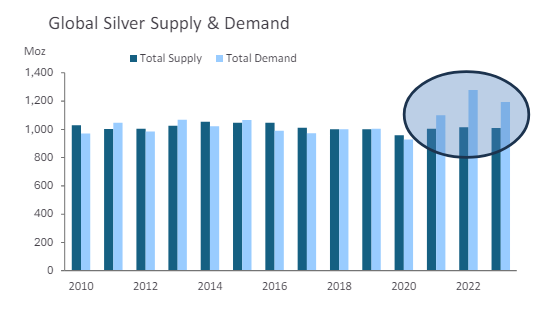

Production falls have led to deficits for 3 years straight...

While the last three years have seen a significant large supply deficit emerge. ( Source )

( Source )

We think the silver price is running largely as a result of the supply/demand imbalances the market is starting to price into the silver market.

Our view is that over the next 5-10 years, the silver price will need to go a lot higher then where it is today, to incentivise new exploration and new mine supply.

For the lithium market to incentivise new supply to come online, prices rallied over 10x in 2021...

The silver market is a lot more mature than lithium - but even if we got a 2-3x move in the silver price, we think it will bode extremely well for SS1.

Wait there’s antimony? Drilling may reveal SS1’s potential “hot” commodity upside

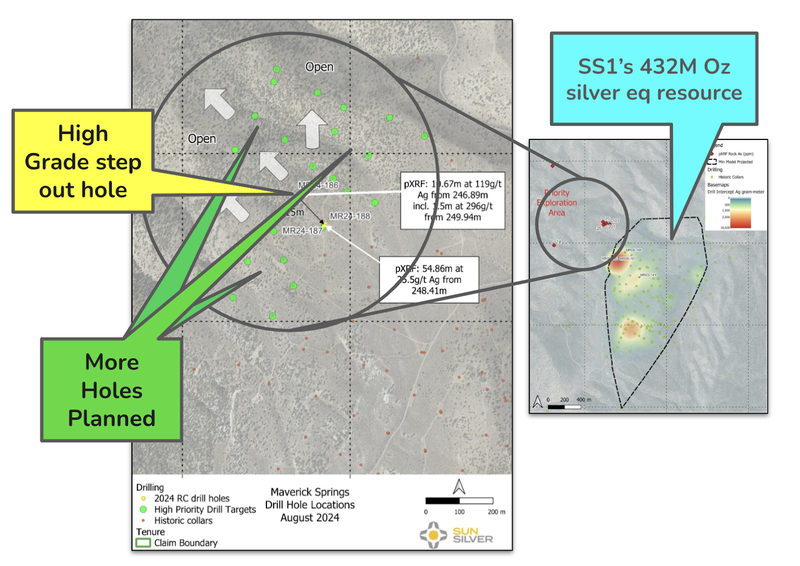

Aside from removing the constraint on its resource, SS1 is drilling outside of its resource area right now.

The 7,500m drill program is primarily to grow the size and upgrade the classification of its now 423M oz silver equivalent JORC resource in Nevada, USA.

The goal is to FURTHER increase the size and classification of this already world class silver resource.

SS1’s first batch of assays were released a few days ago. SS1 drilled 115m away from the existing resource boundary and hit a grade of 296 g/t.

So far, so good, on another extension to the resource...

BUT... this drill hole was also tested for and revealed a metal called antimony.

Antimony is usually found with silver and gold deposits and has become increasingly strategic because of its use in military equipment.

A week or so ago the world's biggest producer (China) announced “export controls” on antimony...

Applying geopolitical pressure by restricting battery metals or energy supply is one thing, but messing with military supply chains is next level.

We suspect a new, giant antimony resource located within US borders would be very well received.

At the moment, we don't know if the antimony is spread across SS1’s entire deposit but we think IF it does, then it could add a strategic importance factor to SS1’s project.

SS1’s value proposition would naturally get a lot stronger, especially if domestic antimony supply becomes a US defence priority, given that SS1’s project is located in the USA.

We are Invested in SS1 for its silver asset but a defined antimony resource would be a really good unexpected surprise to our Investment Thesis.

It could also speed up the timelines for SS1 achieving our Big Bet...

Ultimately, we think it will be the size and scale of SS1’s project that means SS1 is able to achieve our Big Bet which is as follows

Our SS1 Big Bet

“SS1 re-rates to a +$300M market cap by expanding its large US silver resource and moving into development studies and/or attracting a takeover bid at multiples of our Initial Entry Price”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our SS1 Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

SS1 now a de-facto ETF for silver?

As we mentioned above, SS1 is now in a unique position on the ASX.

It is the leading company in a popular commodity - silver.

The more demand for silver, the better it is for SS1.

To understand why, here’s a short history lesson on Silver Mines Ltd.

For the most part, Silver Mines was the de facto ETF Lookalike for silver.

Back in 2018, when the silver price was at decade lows (~US$13/ounce), the Silver Mines share price was ~3c.

Post-COVID, the silver and gold prices rallied.

While there were plenty of gold companies to invest in on the ASX to gain exposure to gold, there weren’t that many options when it came to silver.

Therefore, Silver Mines became the natural home for capital looking for silver exposure.

In 2021, Silver Mines’ shares hit almost 40c (market cap of ~$400M).

The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

So in summary, we think that a lot of this buying stemmed from Silver Mines’ position as the biggest resource in the sector where direct exposure can be hard to find on the ASX.

Now SS1 has taken the mantle and we think it could start to have a Silver ETF “lookalike” premium placed on the stock.

Also, there is a big risk hanging over Silver Mines, which we mentioned earlier.

Just two weeks ago the courts in New South Wales voided the company’s environmental permit for the Bowdens Mine based on issues relating to a 13km transmission line that was omitted from the original project plan.

SS1’s project on the other hand sits in Nevada, USA - the biggest silver producing state in the US.

It's also surrounded by some of the world’s biggest silver producers:

For these reasons, we think SS1 is in a strong position to take over the top spot as a silver exposure on the ASX (and hopefully we start seeing capital move into the stock as a result).

With the silver price looking to breakout into new multi-decade highs, we think the market will again start to look for silver exposure...

AND just like we saw in 2021, we hope that the biggest capital flows move into the company with the most leverage to silver prices - the one with the biggest resource - SS1.

The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Scope to grow the SS1 silver resource even further

SS1’s project is already very big, but it has the potential to get even bigger.

SS1 is at the early stages of a 7,500m drilling program for its silver project in Nevada.

SS1 is testing an undrilled area of the project to see if the high-grade section of the project extends to the North-West:

Last month SS1 updated the market with some xPRF results from the first “step-out” hole of the program in this area.

This was the hole where it identified high grade silver XRF reading for a grade of up to 296 g/t.

The samples were sent to the lab about 3 weeks ago so assay results for the first hole are expected any week now.

SS1 also identified some antimony in the holes, and we wrote a deep dive as to what that could mean here: SS1 announced antimony potential... weeks before antimony became “cool”.

Over the next few months we expect more drilling results to be announced from this program.

There are two main goals with the current drill program:

- Upgrade the size of its JORC resource (through exploration drilling)

- Upgrade its resource classification (through definition or infill drilling)

As Investors in early stage resource companies we are most excited by the exploration drilling.

Any high-grade assay results from holes outside of SS1’s existing resource are “blue sky” upside for the company, and potentially a catalyst by themselves (particularly if there are any big, BIG hits).

Once the drilling program is complete, SS1 will review all of the drilling and publish an upgraded JORC resource.

The bigger the size, the better the result for SS1.

In addition to growing the size of the resource, SS1 will be able to improve the classification of its resource - reducing the development risk for larger funds, banks and major miners in the area.

At the moment, SS1’s resource is 100% in the inferred category - which is the lowest confidence interval and where there is still some level of uncertainty around a resource estimate.

So with SS1 moving that resource into higher confidence categories and potentially increasing the size, could start to bring more institutional/corporate interest into the company.

Summary - Why we like SS1’s project

The below list is a summary of the reasons we first Invested in SS1, along with some new [updates] since then. You can find our SS1 initiation article here.

[Updated] Largest silver resource on the ASX

SS1 now has the largest silver resource on the ASX with a ~432M ounce silver equivalent JORC resource.

Potential to increase an already large JORC resource

Only ~20% of SS1’s project has been explored to date. With its first round of drilling, SS1 will be looking for extensions to its current JORC resource and potential nearby targets.

Silver price is hitting decade highs

Silver demand is fast outstripping supply. The silver price is re-testing an 11 year high at the time of writing. We think the long term macro tailwinds for silver are incredibly strong and should help SS1 as it looks to take its resource into development.

Project acquired and IPO priced while silver was “unloved”

SS1 acquired its silver project while silver was boring and trading sideways. The company IPO market cap at just a $25M market cap which was set before silver's current price run.

SS1’s tight, clean capital structure supports share price re-rates

~55M of the ~125M shares on issue are escrowed for at least ~12 months. The top 20 hold ~65%. Most importantly there are no options on issue, meaning there is no extra “weight” being carried when the share price is responding to news. Current shareholders can NOT use a strategy to sell head stock while retaining upside via an option.

The US solar industry will need a lot more silver

Silver is a key material used in solar panels. Silver demand from solar energy is forecast to “go exponential”. In the next six years, the US government is aiming for more than 6x current solar capacity. And to satisfy solar energy targets for 2050, the world would need to dig up nearly EVERY single known ounce of silver EVER found in current reserves (98%).

US push to “onshore” solar industry away from China

SS1 has a giant supply of silver for solar panels on US soil (Nevada).The US has just applied a 50% tariff to solar cells that are imported from China into the US, up from 25% previously. We expect this to provide additional economic incentives and support to domestic US solar manufacturers while also creating further demand for domestically sourced silver and silver paste both of which SS1 is pursuing production of.

SS1 is based in a mining county in the top silver producing state in the US

The area of Nevada that SS1 is working in is called Elko County. There are major gold and silver mines scattered throughout this area of Nevada and Elko County is very familiar with the mining industry. $45BN Barrick and $14BN Kinross both own projects in the region.

Downstream value add: “Silver paste” production (for solar) could improve economics

Silver paste is made from silver and improves the efficiency of solar panels. Currently most of the world’s solar manufacturing capacity (including silver paste production) is heavily concentrated in China. If SS1 is able to produce silver paste in the US this could improve the overall economics of its project.

US Government to support domestic solar industry and help bring strategic projects online

SS1’s project may be seen as having strategic value to US onshoring of solar panel manufacturing. We think SS1 could benefit from US government tax incentives included in the Inflation Reduction Act, tariffs on Chinese solar panels and potential government grants for strategic projects and manufacturing initiatives.

JORC resource includes ~1.37M ounces of gold

The gold price is also at record highs. Included inside SS1’s 292m ounce silver equivalent JORC resource is a ~1.37m ounce gold resource. We think this gold has appeal as an inflation hedge/precious metal, which could pair nicely with the rapidly growing industrial use of silver from solar panels.

[New] SS1’s project may have some antimony

SS1 just recently announced antimony mineralisation while drilling for silver and there is potential for SS1 to define an antimony resource of its own.

Antimony is used in military applications and weapons, the US has ZERO domestic supply and just recently the largest antimony supplier, China, announced an antimony export restriction.

We think adding antimony to SS1’s already giant silver resource would be a great addition to the SS1 value proposition and could open up funding pathways that wouldn't have otherwise been available to the company.

Another antimony project in the US received US$1.8BN in funding & antimony is listed as a critical raw material by the US government.

What could go wrong?

Well every speculative mining investment carries risk. SS1 is no different.

Here are some of the more obvious risks that we can see at the moment (of course there’s always risks no one can imagine).

Silver price goes down

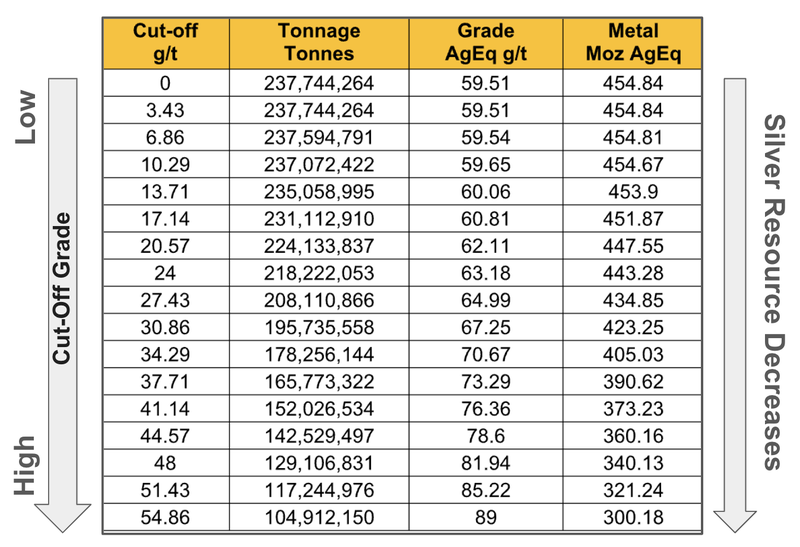

The resource update today uses a cut-off grade of 30.86g/t of silver.

This is the cut-off grade that SS1 determined is reasonable at the current price of silver.

Silver is sitting around US$30/t.

If the price of silver drops, then higher cut-off grades will likely need to be used for any economic model over the project.

Therefore, this mineral resource update from SS1 could shrink if the price of silver shrinks and a higher cut-off grade is used to build the resource model.

This chart here shows how this works in practice:

Learn more: Cut-off grades explained

Commodity price risk

The performance of commodity stocks are often closely linked to the value of the underlying commodities they are seeking to extract. Should silver and gold prices fall, this could hurt the SS1 share price.

Source: “What could go wrong?” - SS1 Investment Memo 18 May 2024

SS1 might not find more economic amounts of silver

In the short term another risk we see for SS1 is “exploration risk”.

SS1 is currently running an infill and extensional drill program.

There is no guarantee that the drilling delivers extensions OR confirmation of the existing mineralisation.

Exploration risk

There is no guarantee that SS1’s upcoming drill programs in Nevada are successful and SS1 may fail to find economic silver-gold deposits.

Source: “What could go wrong?” - SS1 Investment Memo 18 May 2024

Our SS1 Investment Memo

For a full rundown of our investment thesis, read our SS1 Investment Memo, where we share:

- What SS1 does

- The macro theme for SS1

- Our SS1 Big Bet

- What we want to see SS1 achieve

- Why we are Invested in SS1

- The key risks to our Investment Thesis

- Our Investment Plan

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.