Sought after health tech, buying into Blue Chips … and 2 macro events that could shape the world

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The accelerated uptake of technology and online activities, including healthcare services, has created a step-change in the way people conduct their daily lives.

Healthcare, in particular, has undergone vast change.

The "Smart Hospital Market Global Forecast by Artificial Intelligence (Offering, Technology, and Applications), Components, Connectivity, Applications, Region, Company Analysis" suggests that by 2026, the Smart Hospital Market will be worth US$79.57 billion.

Smart hospitals are able to maintain better social distancing due to use of technology. Doctors can get real-time data of patients without visiting them at their beds. Smart hospitals are also able to tell the number of beds available on real-time basis compared to the hospitals which were not using technologies.

Outside of the hospital system, telehealth is now a function of the “new normal”.

A Whitepaper titled The Evidence Base for Telehealth: Reassurance in the Face of Rapid Expansion During the COVID-19 Pandemic suggests “clinical outcomes with telehealth are as good as - or better than - usual care with added benefits of improved intermediate outcomes and patient satisfaction”.

COVID-19 accelerated the uptake of telehealth and highlighted considerable advantages:

- Reduction of patient and clinician exposure to infection through physical distancing.

- Efficient use of clinicians and staff time, giving more time to patients with chronic conditions.

- Better access to care.

- Reduces the number of patient visits and hospital admissions.

The uptake of health apps has also facilitated better patient/doctor outcomes.

All of this movement is reflected in the $23 billion poured into global venture funding in October alone.

Interestingly, a great deal of funding has gone into health care services.

Which has led several companies to move down the IPO path.

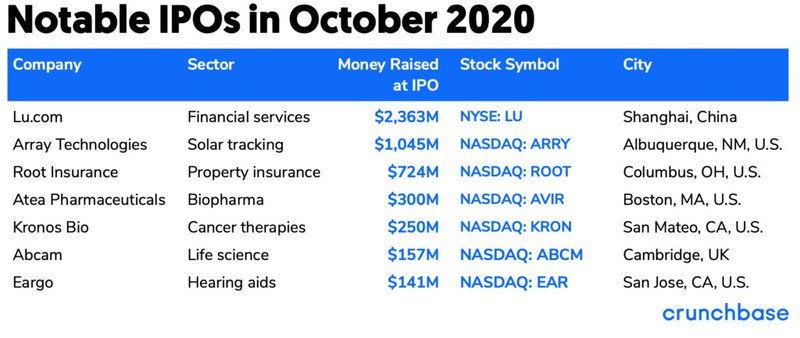

Looking at the NASDAQ in particular, four of the top 7 IPOs were in healthcare.

The interest paves the way for other stocks to consider a US listing. Including ASX stocks.

Certainly, the uptake of health tech services in Australia mirrors the global trend.

Services such as those offered by the $156M capped MyFiziq (ASX:MYQ), which is in the process of getting all its ducks in order for a NASDAQ listing.

MYQ’s NASDAQ listing moves closer to reality by the day.

The company recently completed a substantially oversubscribed $5 million capital raising, putting it in the most robust financial position it has been in for a number of years.

Its financial position was also enhanced by inflows from its US NASDAQ initiative funding, Government R&D reimbursements, a license payment from BCT and partner revenues, which totalled a further $1,504,977 of inflows to the company.

Completion of a $5 million placement to sophisticated and institutional investors will further MYQ’s NASDAQ cause in the virtual healthcare space.

MYQ recently appointed NYSE stalwart Ladenburg Thalmann & Co. Inc. to facilitate the NASDAQ listing which would open up a huge market segment to this health tech provider, and a much bigger capital market in the US compared to the ASX.

The activity in this market is significant, highlighted by Teledoc merging with Livongo Health in an $18.5BN deal that will create a leader in consumer-centred virtual health care.

Virtual health care is the way of the future and investors would be wise to watch this space.

Macro events move markets

This week Joe Biden became President elect.

That event, along with the announcement that a COVID vaccine has been 90% effective in stage 3 trials, set the markets off on a nice run at the beginning of the week.

Those two events in particular, highlight the immense impact of major social events on global stock markets.

Biden’s win sent ripples through the Australian stock market, with stocks such as Vulcan Energy (ASX:VUL) - one of the best performing stocks of 2020, Euro Manganese (ASX:EMN), WhiteHawk (ASX: WHK) and Alexium International (ASX: AJX) all seeing the effects of a policy step-change that will bring green energy front and centre of international politics.

Read: Our Top 4 ASX Stocks to Benefit from a Biden Presidency

International stocks to watch

According to eToro analyst Adam Vettese, investors should be watching the following international stocks.

The Walt Disney Co (NYSE: DIS)

Theme park and entertainment giant Disney has been one firm buoyed by Pfizer’s 90% effective vaccine trial results, which potentially open up a route to a return to normal operations. The firm has faced disruptions both to its parks and to its movie/television production and distribution efforts. Disney stock gained 10.2%, ahead of its latest quarterly earnings results on Thursday.

Cisco (NASDAQ: CSCO)

Networking and telecoms tech firm Cisco also enjoyed a vaccine-induced rally, with its shares up 7.6% during the week. Year-to-date, the firm’s share price is down 18%; with staff working from home, companies have not been spending on the kind of in-office networking technology that makes up a chunk of Cisco’s business. Key to the company’s quarterly earnings report was management updating investors on progress made to move the firm away from some of its legacy business lines and towards software and services. Currently, Wall Street analysts are split between a buy and hold rating on the stock.

Pinduoduo Inc. (NASDAQ: PDD)

Chinese e-commerce platform Pinduoduo, which has a Nasdaq listing and a market cap north of $100BN, has added close to 200% to its share price in 2020 on the back of mass shift to online shopping driven by the COVID-19 pandemic.

The best and worst performing sectors this week

It was a bullish week, but not all sectors fared well. The best performers were Energy up over 14 per cent, Communication Services and Industrials, both up over 7 per cent and Financials up over 5 per cent. The worst performers include Utilities and Consumer Staples, slightly in the red, followed by Information Technology and Materials, both just in the green.

Looking at the ASX/S&P500 top 100 shares, some of the worst performers this year really picked up this week. The best performers include Unibail-Rodamco-Westfield up over 39 per cent, Virgin Money up over 35 per cent, Oil Search up 26 per cent and Santos up over 20 per cent. The worst performers include Northern Star Resources down over 14 per cent, Evolution Mining down over 9 per cent and Domino’ Pizza down over 7 per cent.

So what do we expect in the market moving forward?

According to Wealth Within’s Dale Gillham, “The positive news of a COVID-19 vaccine this week has seen world markets rise strongly with the Australian market rising over 3 per cent so far and looking strong. In the eight trading days since the US Presidential election, the market has risen over 7 per cent in a very strong move to confirm it has broken out of the sideways move it has been in since June. Given this, I expect the market will continue to move up into Christmas and continue into the first quarter of 2021. That said, don’t be surprised if we experience some short term weakness next week.

“The sectors I like for 2021 are Energy, Materials and Financials with many stocks in these sectors starting to look good. Given the volatility in the market of late, I recommend that anyone looking to invest do their research and only buy quality blue chip stocks rather than focusing on what might seem cheap.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.