Shares in De Grey Mining surge more than 10% following acquisition of Indee Gold

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The market responded positively to De Grey Mining’s (ASX:DEG) announcement on Thursday that it had secured an exclusive and binding 12 month option to evaluate and explore with the right to acquire the highly prospective Indee gold project within 18 months.

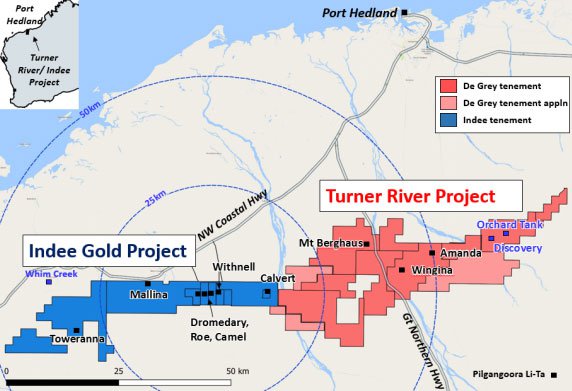

The Indee gold project abuts DEG’s Turner River project located near Port Hedland in Western Australia as can be seen below.

Indee offers proven resource, infrastructure and additional drill targets

The Indee gold project represents a large contiguous landholding covering an area of 414 square metres adjacent to DEG’s Turner River project which covers a further 823 square kilometres.

The project comprises granted mining and exploration licenses with existing defined in situ shallow gold resources, a large advanced near-term exploration target (Mallina), other walk up drill targets and longer term exploration upside.

Importantly, the Indee project has a pre-mining resource statement featuring 10.46 million tonnes grading 1.6 grams per tonne gold for 529,000 ounces as published by the previous owners, Range River Gold, in March 2005.

While this resource was reported to JORC Code 2004 standards and as such is not totally compliant with JORC 2012 standards, it provides a guide as to the mineralisation, the size of the resource and the prospect of further resource definition.

Furthermore, investors should be advised of an upgraded JORC Code 2012 resource by March, a development that could prove to be a share price catalyst.

Of course it is early days in this play and any catalyst is speculative, so investors considering this stock should seek professional financial advice.

It should also be noted that there is 851,000 tonnes of crushed material in surface stockpiles, as well as exposed gold mineralisation in five partially mined shallow open pits. DEG also has access to past mining and exploration information which will assist in determining potential drill targets.

In commenting on the strategic benefits of the Indee agreement, DEG Chief Executive, Simon Lill said, “This acquisition not only consolidates ownership of the regionally significant and highly prospective Mallina shear zone, but dovetails very well with our Turner River project and fast tracks De Grey into development studies”.

Lill highlighted the fact that the potential scale of the combined assets would place the group within reach of a small and select group of ASX listed gold developers.

Second quarter resource drilling at Mallina and the group’s established Mt Berghaus prospects should assist in supporting Lill’s expectations. This will also coincide with the commencement of detailed feasibility studies.

Agreement receives tick of approval from broker

FinFeed discussed this latest development with analyst Michael Beer from Beer&Co. He initiated coverage on the stock in November with a speculative buy recommendation.

At that stage, based on an Australian dollar gold price of approximately $1730 Beer determined that DEG should generate a maiden profit of $10.8 million in fiscal 2019.

While the spot gold price based on a slightly stronger Australian dollar than that projected in Beer’s forecasts is tracking in the vicinity of $1630, the numbers still stack up well.

Based solely on the established Turner River project, Beer estimated production to increase from 27,000 ounces in fiscal 2009 to 83,000 ounces in fiscal 2020, resulting in net profit increasing to $58.3 million.

Commenting on the Indee transaction, Beer said, “This is a great transaction for DEG as the Indee gold project already contains known gold resources and has previously proved through its gold production via heap leach that oxide recoveries are excellent”.

He also believes there is strong exploration potential with the addition of 60 kilometres of the Mallina shear zone.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.