ROC signs deal with major retail bank for paid trial of its Artificial Intelligence tech across 19 branches

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 6,575,000 ROC Shares and Company’s staff own 125,000 shares at the time of publishing this article. The Company has been engaged by ROC to share our commentary on the progress of our Investment in ROC over time. This information is general in nature about a speculative investment and does not constitute personal advice. It does not consider your objectives, financial situation, or needs.

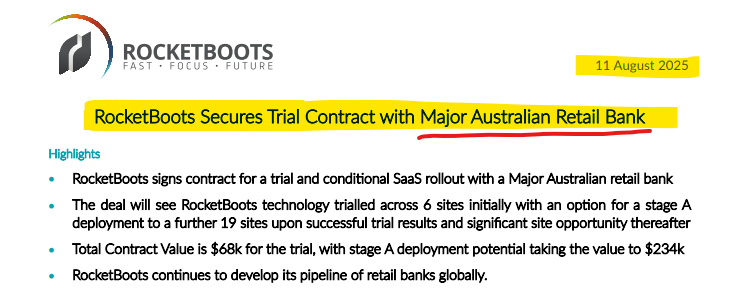

Our small cap AI tech Investment Rocketboots (ASX:ROC) just signed a paid trial with an unnamed “Major Australian Retail Bank”.

(a small AI tech company signing on a major brand is not an easy thing to do)

ROC has developed “Vision Artificial Intelligence” technology for giant companies to analyse and respond to in-store customer behaviours.

(basically this means using AI on live in-store camera footage to analyse customer behaviors, allowing the company to improve operations)

Even prior to today’s new contract win, ROC was currently in use by TWO major, household name companies - Suncorp in the banking sector and Bunnings in retail shopping.

(Both Suncorp and Bunnings renewed and expanded their usage of ROC’s AI tech over many years, proving that the product works and is useful).

This morning a third Australian household name has signed up for a paid trial with ROC - an unnamed “major Australian retail bank”:

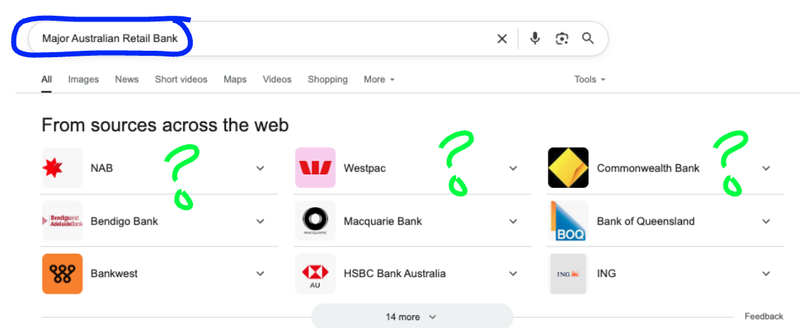

Here is our customary basic Google search when a company is not allowed to name a major new client:

Today’s contract news is for an initial trial across 6 sites for $68,000 in revenue to ROC, and assuming this goes well, will move to 19 sites for a total contract value of $234,000.

(with more potentially to be rolled out if things go well)

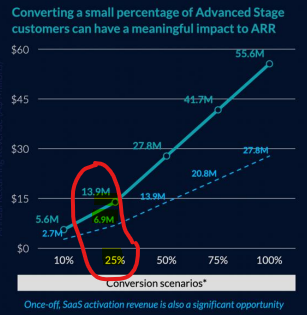

We estimate that ~$20.5M capped ROC has ~$65M potential revenue in their “advanced stage sales pipeline” (based on the June quarterly report, with some assumptions from us shown below).

(ROC reported $746k in cash received in FY25, so even converting just 10% of our estimated $65M potential revenue in their ADVANCED stage pipeline would be a 8.7x increase on ROC’s last reported cash received number)

Note the key word here is ‘potential’ - ROC will still need to convert its sales pipeline into actual revenue, and it may not be successful in doing this. Just because a potential contract is in the pipeline does not mean it will convert to a signed contract.

We like that ROC started developing its AI (artificial intelligence) way before AI became the hottest investment theme in recent memory.

Companies developing genuine AI with over a decade of development efforts AND internal knowledge on how to apply AI to solve a specific and real world problem are not that common on the ASX...

And in our view are the best positioned to leverage and apply the rapid recent advances in AI technology and tools to their specific sector of expertise.

As we noted above, ROC already works with Bunnings in retail shopping and Suncorp in banking - and today it adds another major Australian retail bank to its client list (via a paid trial that could expand to a bigger contract).

There are roughly 3,360 bank branches in Australia across all banks giving ROC an addressable market in this sector of ~$12M in Annual Recurring Revenue (at an estimated value of $3,500 per site).

Around the world however there are around 400,000 bank branches.

Meaning that if ROC can prove its product in Australia (and we think this contract today moves towards that) then it could gain more traction in the larger global market.

In addition to the banking sector, ROC also sells its AI vision software into retail shopping stores to analyse and respond to shopper behaviour.

ROC’s tech helps reduce “shrinkage” (a fancy shopping industry word for lost income due to people stealing stuff or forgetting to scan items at self checkouts).

ROC’s tech also has many more applications for its software around security and workflow optimisations.

ROC’s “advanced stage pipeline” almost doubled in a quarter...

We Invested in ROC in March after it had already spent years developing and marketing its AI tech.

(way before AI became cool)

We think it is now at the point where it can materially start to scale up its revenue.

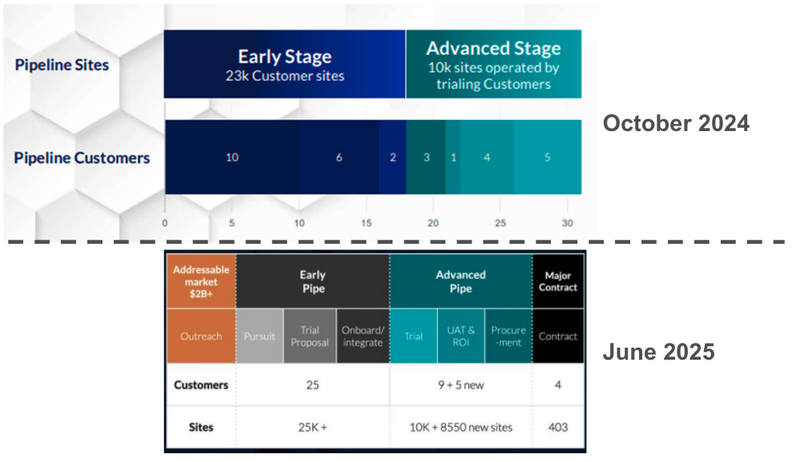

At the time of our initiation on ROC, we estimated that the company had ~$35M in potential revenues in its “advanced stage sales pipeline”.

Following the June quarterly report, we estimate that the sales pipeline is now even bigger at ~$65M.

The basic assumption for our very rough potential revenue calcs is that ROC charges customers $3,500 per year per site for its technology (source, ROC investor deck slide 10).

With the new potential deals and now ~18,550 sites in the “Advanced Stage Pipeline”, our rough, basic calcs show that could translate to ~$65M in potential license revenue, ignoring bulk purchase discounts and set up fees.

That’s an almost doubling of ROC’s potential target revenue base...

Remember that ROC converting its pipeline to sales is not a guarantee to occur, lots of things can and do go wrong in scaling up a technology company.

(again, ROC reported $746k in cash received in FY25, so even converting just 10% of our estimated $65M potential revenue in their ADVANCED stage pipeline would be a 8.7x increase on ROC’s last reported cash received number)

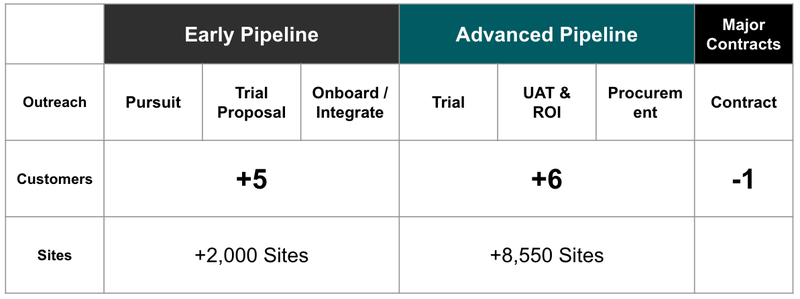

We did some quick maths, here is our rough calcs on how ROC’s sales pipeline improved over from what was reported in October 2024 compared to June 2025:

That’s ~5 additional potential customers and 2,000 additional potential sites in the early pipeline.

And 6 potential customers have moved into the advanced pipeline stage with ~8,550 additional sites.

“Early-stage pipeline” are prospects trialing or evaluating the product, while “Advanced-stage pipeline” are prospects closer to signing, with deal terms and rollout plans largely agreed.

Of course, like all investors, what we really want to see is ROC convert more of its sales ‘pipeline’ into actual sales (meaning more yearly recurring revenue for ROC).

If ROC was able to convert ~25% of these deals into signed, paying customers it would materially increase ROC’s existing revenues.

...and (we’d expect) re-rate the ROC share price.

(ROC is currently capped at ~$20.5M)

Of course, converting all those ‘potential’ sales is no guarantee, and we saw last quarter that ROC were only able to bring in $5k of revenue for the quarter (quiet quarters can happen when sales cycles are long, like in ROC’s case). This is a high risk early stage tech stock.

We like tech stocks because of that “hockey stick” style growth potential - and we are Invested in ROC with the hope that with one (or more) large signed deal in the near term, ROC can achieve something like this:

The above potential growth looks great but success can take longer (sometimes much longer) than expected... or never actually eventuate.

We first Invested in ROC in March, today’s news is the first update we have had on a new contract since then.

Now we watch to see if ROC can deliver more conversions to sales over coming months.

You can check out our full initiation note on ROC here, in that note we run through:

- What ROC does and why we like it’s tech

- The 8 key reasons why we are Investing in ROC

- What ROC sells and who it sells it to...

- What our Big Bet is for ROC and a full breakdown of how we think it can achieve it

- Our detailed ROC Investment Memo

8 key reasons why we are Invested in ROC

Below is a reminder of the 8 key reasons why we like ROC from our 31 March initiation note.

We have added a few updates under a few of the reasons based on any new information from today’s announcement and ROC’s recent quarterly.

- ROC already has long term, paying enterprise customers including Bunnings and Suncorp.

Both Bunnings (large DIY goods retailer owned by Wesfarmers) and Suncorp (a bank owned by ANZ) are paying customers of ROC.

They have been customers since before ROC’s December 2021 IPO and continue to renew and expand their licence contracts 7+ years later.

This is strong evidence that ROC can sell its product to enterprise customers, and that those customers find long term value out of the service. - Over ~$35M in potential annual recurring sales from “advanced stage deal pipeline”

According to ROC’s most recent quarterly report, ROC had 10 customers in its “Advanced Pipeline”.

These customers represent over 10,000 sites in total.

At $3,500 per site per year, by our rough, basic calcs this represents over $35M in potential annual recurring revenue if ROC is able to convert into sales.

(using a basic $3,500 per site per year times number of sites calc, ignoring bulk discounts and setup fees)

Even if just 10% of that “advanced stage” pipeline is converted, it would be 3.5x ROC’s current revenues.

UPDATE:

Following the June quarterly report, ROC’s “advanced stage deal pipeline” almost doubled in one quarter.

As mentioned earlier ROC added another ~8,550 potential sites to this pipeline and our back of the napkin calcs show that could be worth ~$65M in potential annual recurring revenue.

Again - there is no guarantee these deals turn into revenues for ROC. - One large deal could multiply ROC’s current revenue

If ROC is able to sell to a large multinational contract it could have its product in thousands of stores through just one deal.

At a price point of $3,500 per store, one deal could be in the millions of dollars in recurring free cash flow.

These deals take a very long time to secure (as do most enterprise software deals).

ROC has shown that its enterprise customers tend to be incredibly “sticky” (stay on for a long time) - Partnership with Europe’s largest Point of Sale company: Gebit Solutions

Gebit Solutions sells self checkouts to supermarkets and retailers.

Gebit is the point of sale system for some of the largest supermarket retailers in Europe and Gebit will now support an “out of the box integration” with ROC’s software.

High-synergy partners like Gebit help improve ROC’s reputation to enter the conversation with big retailers, despite ROC being a smaller player in the space. - Original founding team still in place, with a new experienced tech chairman at the helm

The original team that developed ROC’s technology in the early 2010s are still running the company (including the CEO and CTO).

This is a positive sign for tech startups when a long term founding team has been working on the product for 10+ years.

Now however, ROC has a new chairman with experience in both private equity and tech enterprise sales.

ROC’s new chairman Roy McKelvie is also the chairman of an education technology company called Pathify that he helped to scale and raise US$25M at a A$180M valuation.

Roy invested $200,000 personally into ROC last year at 8.5 cents and a further $90,000 in the current placement. - Genuine AI and deep knowledge of how to apply AI to a specific problem

ROC’s AI and machine learning technology has been developed since 2010.

(well before AI became a big Investment theme)

Companies developing genuine AI with over a decade of development efforts AND internal knowledge on how to apply AI to solve a specific and real world problem are rare on the ASX...

And in our view are the best positioned to leverage and apply the rapid recent advances in AI technology and tools to their specific sector of expertise. - Vision capture technology valued in the US$250M-$500M range

In late 2022 a company called Trigo raised US$100M off the back of its grocery vision software.

In 2023 one of the largest companies in this space Everseen raised US$70M to advance a very similar technology.

Those large raises are evidence of the size of the opportunity in this space that investors are seeing.

If ROC is able to deliver more sales and capture market share, it could grow to the size of these larger competitors in the space. - ROC has a good capital structure with strong ownership represented in board and management

Following today’s capital raise news and its completion, ROC will have 154 million shares on issue.

The major shareholders are the original vendors of the technology and have proven to be sticky since the IPO.

The board and senior management represent ~44% of the shares on issue prior to this recent capital raise, which means they are very aligned to shareholders interests.

UPDATE:

Immediately following the March $3M capital raise at 8c, ROC attracted cornerstone backing from a major tech fund, Bombora Investment Management.

Bombora came into ROC with a $1M investment on the same terms as the $3M raise, and Bombora’s co-founder David Willington joined ROC’s board.

The Bombora Special Investments Growth Fund is now a substantial holder of ROC with 7.30% of shares. (source)

Bombora has had a previous win with ROC’s chairman - we covered Bombora’s investment in our last ROC note here: ROC to bank another $1M, secures new strategic investor, and board member.

We hope ROC will be another one.

Ultimately, we are hoping that a combination of the above reasons helps it achieve our Big Bet which is as follows:

What is our Big Bet for ROC?

“ROC re-rates to a $200M market cap by securing multiple large recurring contracts with retail clients and scaling up its business”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our ROC Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

What’s next for ROC?

🔄Sales updates

We want to see ROC close deals, with updates that include the number of sites that ROC’s tech will be deployed to and contract dollar values.

We’ve outlined the types of deals that ROC is in the process of closing in our ROC Investment Memo:

New Sales: Retail/Supermarket

✅ New customer 1

🔲 New customer 2

🔲 New customer 3

New Sales: Consumer Banks

🔲 New customer 1

🔲 New customer 2

🔲 New customer 3

Existing customer re-signs or expands:

🔲 Contract re-sign with Bunnings

🔲 Contract re-sign with Suncorp

What are the risks?

We’re most focussed on sales/delay risk and market risk right now. On the sales and delay risk front it’s quite straightforward - ROC needs to sign contracts and bring in cash:

Sales and Delay Risk

ROC could lose key clients or not seal as many deals, hurting their revenue and share price.

Large organisations like the one’s ROC works with don’t tend to adopt new technology very often and the sales cycle can be long. This feature of ROC’s customer base can cause delays in sales that drag out over a long time,

Macro factors in the market including a recession can cause a reduction in spending on new technology, affecting ROC’s ability to make sales.

Source: 31 March 2025 ROC Investment Memo

We list more risks to our ROC Investment in our ROC Investment Memo here.

Other risks

ROC operates in a rapidly evolving AI vision market. Larger, better-funded competitors could emerge and challenge ROC’s position or put pressure on pricing.

The technology depends on in-store video and behavioural analytics. Changes in privacy regulations or public attitudes could increase compliance costs or limit deployment opportunities.

Currently, ROC’s revenue comes from a small number of key clients. Losing any one of these could have a significant financial impact.

Scaling from initial trials to broader rollouts will test ROC’s operational capabilities. Delays, integration challenges, or customer service issues could slow growth.

As a growth-stage business, ROC may require additional capital to fund its expansion plans. The availability and terms of future funding will depend on market conditions and investor sentiment.

Investors should consider these risks carefully and seek professional advice tailored to their personal circumstances before investing.

Our ROC Investment Memo

In our ROC Investment Memo, you can find the following:

- What does ROC do?

- The macro theme for ROC

- Our ROC Big Bet

- What we want to see ROC achieve

- Why we are Invested in ROC

- The key risks to our Investment Thesis

- Our Investment Plan

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.