Right Place, Right Time: PMY Secures Large Near-Surface Lead-Silver-Zinc Deposit

Published 11-SEP-2018 10:13 A.M.

|

12 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Strategic junior explorer, Pacifico Minerals (ASX:PMY), has recognised an opportunity to secure a position in the lucrative lead space, acquiring a controlling share of Australia’s largest undeveloped near-surface lead-silver-zinc deposit, the Sorby Hills Project.

While it has an exciting portfolio of exploration projects spanning Australia, Colombia, and Mexico, PMY is currently focused on completing the acquisition of a 75% interest in Sorby Hills.

Located in Northern WA’s Kimberley region, 50 kilometres from Kununurra, Sorby Hills is significantly de-risked with an estimated 18-month path to production once additional drilling and an updated study can be completed. The large, flat-shallow Mississippi Valley Type (MVT)-style lead-silver-zinc ore body has extensive JORC 2012 Resources, permits and approvals already in place, and a promising historical pre-feasibility study.

Being a shallow deposit it has potential high operating margins once up and running, especially in an encouraging lead price environment.

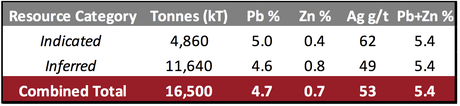

The project has global inferred Resources of 16.5 million tonnes, grading 4.7% lead, 53 grams per tonne silver, and 0.7% zinc, within which 4.9Mt at 5% lead, 62 g/t silver and 0.4% zinc are indicated Resources.

Sorby Hills has drawn favourable comparisons to Galena Mining’s (ASX:G1A) world-class Abra Base Metals Project. Like PMY, Galena has visions to develop its own Western Australian lead-silver-zinc project, Abra, as a high-grade, high-margin mining operation. Like Sorby, the Abra deposit was discovered many decades ago but in today’s pricing environment looks very attractive.

Yet one key advantage that PMY’s Sorby Hills has over Galena is that the Abra Base Metals Project is underground, whereas Sorby Hills is only 20m from surface. Sorby Hills is also further advanced, with a pre-feasibility study completed December 2012.

Galena’s market cap is currently significantly above that of PMY, at around $60 million compared to just $5.4 million for PMY, at a 0.6 cent share price. So there’s good reason to expect PMY’s market cap to play catch up once the acquisition is fully locked away. This is inching closer by the day, especially now that PMY has successfully completed all due diligence.

Of course, PMY still has a great deal of work to do on the project to reach Galena’s level, so investors should seek professional financial advice if considering this stock for their portfolio.

With cash in the bank from a recent capital raising, PMY is all set to complete Sorby Hills’ acquisition, its extension and infill drilling, and development to get to production as soon as possible.

PMY also holds an option to purchase 100% of the Violin Gold-Copper Project in the Guerrero Gold Belt of Mexico with outstanding potential for the discovery of a large gold-copper deposit.

The company has also recently flagged that it is in negotiations with several major miners and developers in Colombia for the potential acquisition or Joint venture of its Copper gold projects in Colombia. In addition, PMY sits on a majority stake in a JV with ASX heavyweight Sandfire Resources (ASX:SFR) with its Borroloola West base metals project in the Northern Territory.

All the latest from,

It’s been a while since we last updated you on PMY with the article, ‘PMY Snaps up New Gold-Copper Project in Mexico’s Famed Guerrero Gold Belt’. Since then, the company has made plenty of strides...

Recognising the opportunities on offer for lead producers, as well as the near-term and long life production potential for the Sorby Hills Project in particular, PMY is close to completing the acquisition. Just a few conditions remain, including regulatory and shareholder approvals.

Early in the year, Pacifico secured an option to purchase a 100% interest in the Violin Project in the country’s Guerrero Gold Belt.

Extensive geological mapping and soil sampling has now been completed at the project’s Coaxtlahuacan prospect. A diamond drilling program to test for major skarn related gold-copper mineralisation is planned for October-November 2018.

In Colombia, several mining and development companies are evaluating PMY’s Urrao and Natagaima copper-gold projects for potential joint venture or outright purchase. Both projects are highly prospective for the discovery of economic copper-gold deposits and PMY is focused on advancing these agreements.

Furthermore, PMY along with the billion dollar capped Sandfire Resources (ASX:SFR) continues to advance the Borroloola West project in the NT, which covers an outstanding package of ground north-west of the world’s largest producing zinc-lead mine — the McArthur River Mine — with high potential for the discovery of world class base metal deposits.

In South Australia, where exploration is planned to begin shortly, PMY has been recently granted licences for ground prospective that’ for cobalt and other ‘battery metals’ including copper, cobalt and manganese.

This geographical and commodity type diversification helps insulate PMY, and its shareholders, against price fluctuations in any one particular market and provides management with flexibility to adapt its focus in response to market conditions.

The low down on Sorby Hills

To capitalise on the positive outlook for lead, PMY is soon to complete the (75%) acquisition of the Sorby Hills Project in WA. Once complete, PMY will operate the project under a JV arrangement with China’s largest lead smelting and silver producer (25% contributing), Henan Yugang.

On completion of the transaction, PMY will pay $1 million in cash, plus $500,000 of PMY shares (15-day VWAP prior to completion), and issue 10 million options exercisable at $0.02. Then six months post completion, PMY will pay an additional $2.5 million cash, while the vendor will also retain the agreed 1% Net Smelter Royalty.

The Sorby Hills lead-silver-zinc deposits were discovered by a French oil company in 1971 while looking for oil. Since then there has been extensive work completed which PMY to draw from.

The project has a JORC 2012 Indicated and Inferred Global Resource Estimate at 2.5% lead or zinc cut of:

A pre-feasibility study was completed by the previous owner, KBL, back in 2012, and now PMY has a clear pathway to upgrade the Resource with infill and expansion drilling planned. This is supported by the project having an environmental permit and mining titles in place for stage one development and operation.

Once the acquisition is locked away, PMY will re-evaluate the economics of Sorby Hills, including a review of the modifying factors and assumptions made by KBL back in 2012, with the aim of working towards a new reserve estimate.

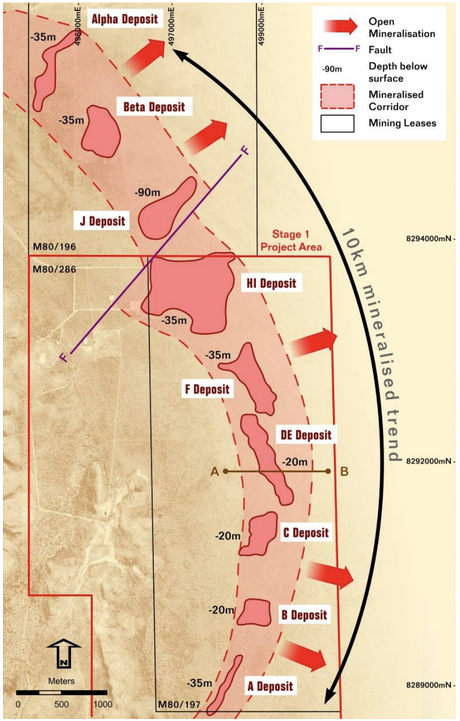

The Sorby Hills lead-silver-zinc deposit has many features typical of Mississippi Valley Type (MVT) deposits. The clearly defined mineralisation occurs within nine currently identified discreet carbonate hosted pods. These pods form a linear north-south belt extending over a mineralised trend of more than ten kilometres.

These mineralised pods average 7-10m in thickness, are generally less than one kilometre long and 100 to 500m wide. There is some structural control to the mineralisation, with higher grade zones associated with faulting. The deposits also appear to subparallel the two main fault trends.

Here you can see the full length of the mineralised trend and individual pods:

All up, since 1971, the project has seen a total 1128 surface drill holes for a total of 110,941.7m of drilling.

Metallurgical test work undertaken indicates that standard flotation circuitry will achieve high quality concentrates of 55% - 69% lead. Excellent lead and silver recoveries of 91% and 87% respectively, are achievable with a conventional crushing, grinding and flotation circuit.

Exploration plans

Once the acquisition is complete, PMY will kick off an aggressive exploration program to test the significant upside potential that’s been identified within the project area, including a possible increase to the Resource base.

PMY will also undertake a scoping study to re-evaluate the project economics that could lead directly to a Bankable Feasibility Study (BFS) and a new ore reserve estimate.

To get to that point, the company is now reviewing the modifying factors and assumptions made by KBL Mining in its 2012 pre-feasibility study.

To this point, PMY remains a speculative stock and investors should take a cautious approach to any investment decision made with regard to this stock.

Planning is also underway for the next phase of drilling at the project — a proposed 100+ hole RC and diamond drilling program (6000m) — which will seek to significantly increase confidence in the Resource within or near the current pit outlines; test drill interpreted faults, to better understand their relationship to suspected higher grade lead occurrence; and increase the zinc Mineral Resource estimate, particularly in some northern pods where previous exploration by others has identified excellent potential.

The video below provides a summary of the Sorby Hills project. Note that at the time the video was produced the project was still owned by KBL.

A strategic focus on lead

The decision to acquire Sorby Hills with the view to progress towards production comes at a promising time as far as the lead supply-demand equation goes.

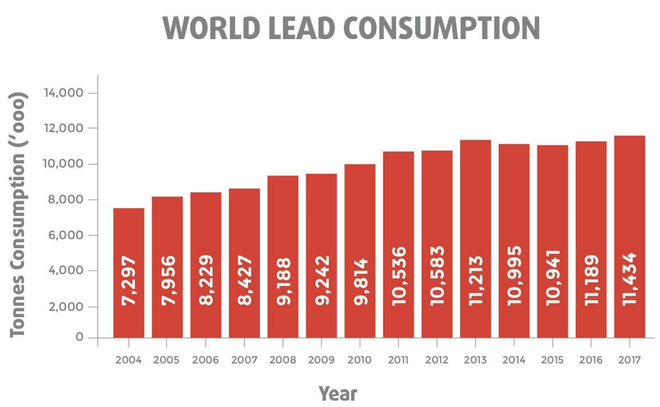

Rising lead consumption is largely being driven by growing demand for lead-acid batteries, which make up around 80% of lead use. These batteries are used in vehicles and continue to see rising demand despite simultaneous rising demand for lithium-ion batteries. They are also used in computers and emergency systems, with growth supported by higher uptake of consumer electronics in developing countries.

This rise in consumption occurs simultaneously with a long-term decline in LME stockpiles and rising US-dollar prices. Increasing demand and reducing supply has produced an average spot lead price of US$0.97/lb over the last 10 years.

Prices have pulled back a little since their highs in recent months, yet the outlook for lead remains very strong.

Violin Project

Since securing an option to purchase a 100% interest in the Violin Project, located in the Guerrero Gold Belt of Mexico, earlier this year PMY has made some exciting progress.

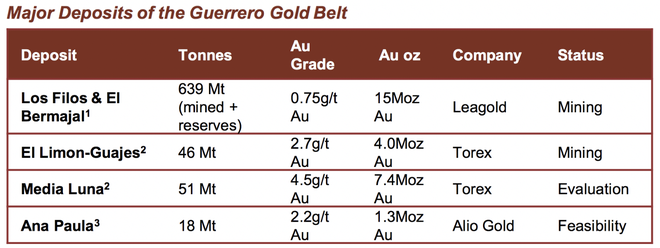

The Guerrero Gold Belt is home to several pre-existing multi-million-ounce gold mines and developing projects of this style of mineralisation, as below.

Take particular notice of Los Filos and El Bermejal open pit mines, owned by $560 million-capped Leagold Mining Corp (TSE:LMC), which are some of Latin America’s largest gold mines. Like these, the Violin Project area offers outstanding potential for a large and significant gold-copper deposit.

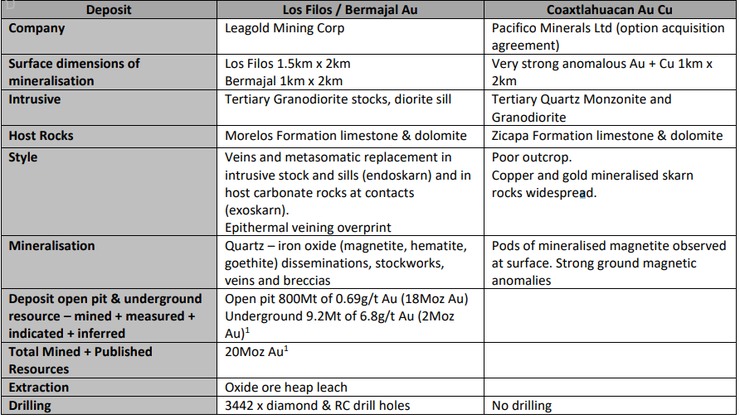

The Coaxtlahuacan Gold-Copper prospect is the most advanced prospect within the Violin Project, and has demonstrated strong similarities to the Los Filos/ Bermaja style and scale of deposit.

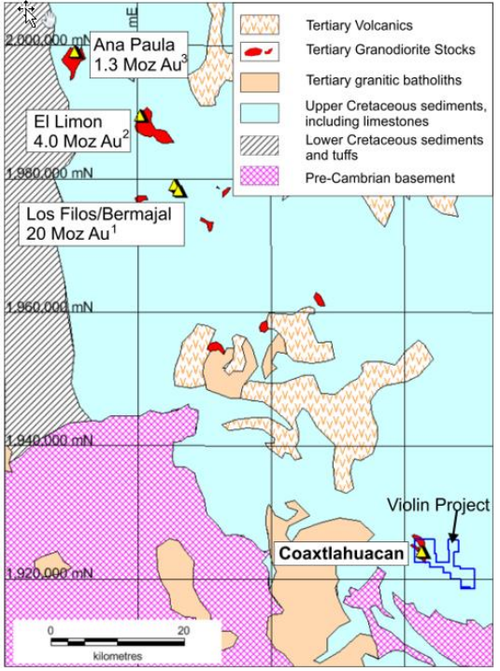

And here is the Violin Project, with the Coaxtlahuacan prospect, in relation to Los Filos/ Bernajal.

Geological mapping and soil sampling has now been completed at the Coaxtlahuacan prospect. Results has shown the gold anomalies now extend over an overall zone of 2km x 1km containing greater than 100ppb gold.

Further soil sample results are awaited, which cover a north western and an eastern extension of the existing gold in soil anomaly. A ground magnetic survey with a continuous reading ground magnetometer was recently commissioned and so there is plenty of news flow expected.

A diamond drilling program to test for major skarn related gold-copper mineralisation is planned for October-November 2018.

The Violin Project was discussed extensively in our last update in March, which you can review here.

Funding sorted

PMY completed a share placement in late August, raising $1.28 million to fund the acquisition of the Sorby Hills lead-silver-zinc project and undertake an accelerated exploration program, as well as for general working capital purposes.

Remember, however, that this is an early stage play and investors should seek professional financial advice if considering his stock for their portfolio.

PMY issued 213,333,333 shares at $0.006 per share to institutional and sophisticated investors.

It is also undertaking a Non-Renounceable Entitlement Offer to raise an additional $2.84 million. Subject to shareholder approval, eligible participants will also be entitled to receive free attaching options on a 1 for 2 basis, exercisable at $0.015 each on or before 21 November 2020. Highly regarded, PAC Partners and Discovery Capital are acting as Joint lead managers and in consultation with the company, may allocate any Shortfall Securities.

A Final Word

Potential near term catalysts are the upcoming completion of the Sorby Hills project, which is something that could certainly grab investors’ attention. Immediately after completion PMY plan to complete an extension and infill drilling program at Sorby which has potential to provide highly attractive news flow.

Grabbing even a fraction of the investor interest that Galena Mining has attracted via its Abra base metals project could be highly rewarding with PMY certainly flying under the radar at less than $0.1 cent per share today.

Other potential catalysts on the horizon include the upcoming diamond drilling program at the Violin Project, as well as potential acquisition or JV of PMY’s Urrao and Natagaima Copper Gold projects in Colombia.

Exciting times ahead for this busy Junior undertaking a transition to developer.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.