Raiden readies to drill at Stara Planina

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

This product is classified as ‘very high risk’ in nature due to its location and geopolitical situation of the region. Finfeed advises that extra caution should be taken when deciding whether to engage in this product, however if you are not sure whether it is suitable for you we suggest you seek independent financial advice.

Raiden Resources Limited (ASX:RDN) has today updated the market on its latest exploration activities at the Aldinac and Gradiste targets within the Stara Planina Project within the Tethyan belt in Serbia.

The Stara Planina Project is subject to an earn in agreement whereby Raiden has the ability to acquire 100% interest in the project.

Preliminary results from the Induced Polarisation (IP) survey have been received from the Aldinac anomaly which is located on the eastern side of the Stara Planina Project.

These latest results indicate the anomaly extends over an approximate strike of one kilometre and remains open to the north-west. The IP anomaly is correlated with high copper and gold values defined in the historical soil survey undertaken by Reservoir Capital in 2011.

RDN is encouraged by the fact that the previous explorer, Reservoir Capital, reported rock sampling results that included eight samples in the 2 - 12.25 g/t gold range and six samples in the 1 - 2 g/t gold range. These results indicate that high grade mineralisation is present within the system.

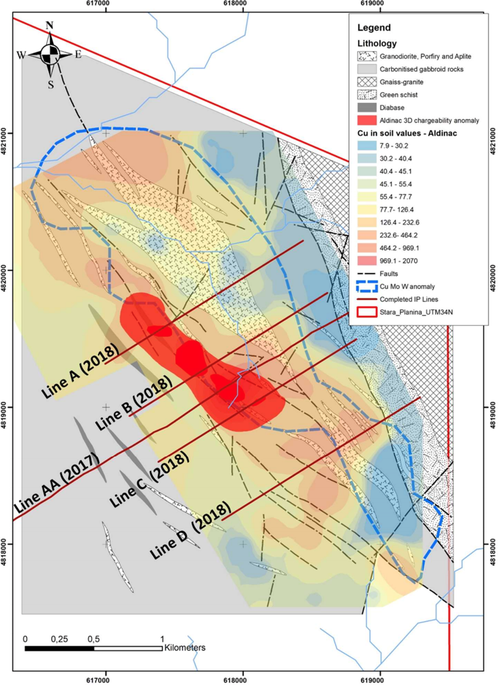

RDN engaged German based geophysical service provider, Terratec, to follow up on the IP anomaly which was defined in the 2017 IP survey. A total of four, approximately 1800m long lines were completed to determine the strike extent of the Aldinac target. The data from the 2017 survey was incorporated into the 2018 survey data set and used to generate a unified model.

Of course, as with all minerals exploration, success is not guaranteed — consider your own personal circumstances before investing, and seek professional financial advice.

The latest interpretation indicates that the anomaly extends from the surface to the maximum survey depths (approx. 450m) and possibly remains open at depth. Preliminary interpretations have defined a large and very intense chargeability anomaly which extends over a strike length of almost one kilometre.

Below is the location of IP lines executed on the Aldinac anomaly. IP lines B, C and AA are centred over the highest copper-gold-molybdenum values of the soil survey. Lines C and B are parallel to the 2017 survey line (AA) and spaced 200 meters either side. Line A is approximately 400m north west of line B and line D is approximately 600m south east of line C.

In parallel with the IP survey, RDN has been conducting reconnaissance mapping and rock chip sampling of the target area and have located several highly encouraging outcrops.

The presence of these mineralised outcrops provides further encouragement ahead of the planned drill program. The outcrops are located in the vicinity of the interpreted IP anomalies and provide support that the anomalies may be related to massive and disseminated mineralisation.

RDN continues to advance its exploration activities on the Aldinac and Gradiste targets and continues to take all steps required to commence drill testing of the targets defined at Aldinac as soon as possible. At this point drill testing is scheduled to commence in the third quarter of 2018.

Mapping and rock chip sampling of the Aldinac and Gradiste target areas is ongoing, while processing and interpretation of the Induced Polarisation data from the recently completed Gradiste survey will soon commence.

Negotiations with private and state landholders are ongoing to obtain access rights for the drilling program, as are negotiations with the drilling service provider to finalise the drilling contract. RDN is also engaging with contractors to commence with the construction of access roads and drill pads.

Dusko Ljubojevic, Managing Director of Raiden, commented: "We are very encouraged by the IP results at Aldinac which highlights the potential of a significant mineralisation system. The survey has defined a very large and robust IP anomaly which not only confirmed the 2017 IP survey results but has extended the target along strike and it remains open at depth and along strike.

“The Company has commenced with procedures to create drill pads and access in anticipation of the upcoming drill program.”

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.