In Pursuit of 1Moz Gold at High Grade USA Alluvial Project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Gold has broken through the US$2,000/oz level, delivering impressive gains for small cap gold investors on the way.

But there are still some opportunities flying under the radar on the ASX.

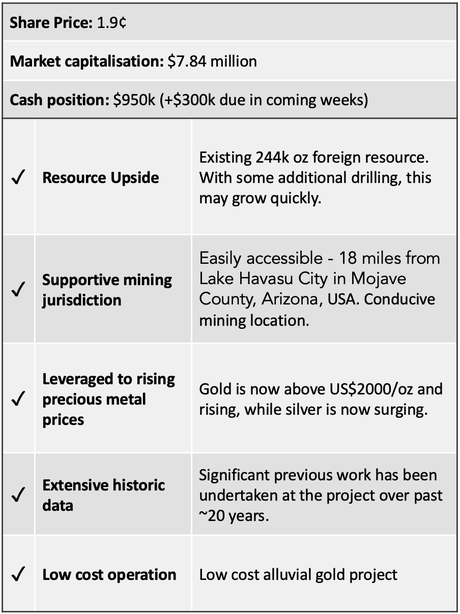

Pursuit Minerals (ASX:PUR) may be one of the few sub-$10 million gold stocks that is yet to be swept up in the recent gold rush.

The company has an exclusive option to acquire the Buck Mountain Gold Project — a gold-silver-Platinum Group Metals (PGM’s) project in Arizona, USA until 30 September.

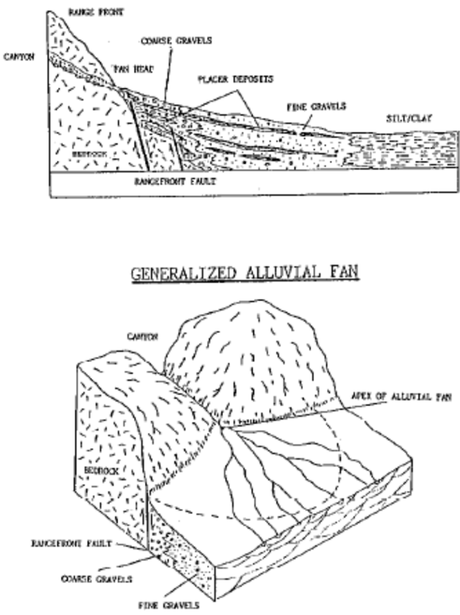

The precious metals at the project are contained within the gravels of an alluvial fan surrounding the Mohave Mountains in Arizona, shedding off Buck Mountain within the Mohave Mountain Range.

The project already has an existing high-grade gold resource — a foreign mineral resource, complying with Canada’s NI-43-101 standard, – of 1.248Mt, grading 6.1g/t gold for 244,000 ounces.

The compelling factor here is that this resource could expand very quickly.

The foreign resource estimate was based on analysis of alluvial gravels down to 15 feet. Yet previous drilling determined that gold, silver and PGM bearing alluvials extend down to at least 30 ft in the project area.

Since gold is the heavier material, it goes to reason that it would also be present at greater depths.

Additionally, the existing resource was calculated over an area of 45 acres only — just 14% of the total 320 acres (1.3km2) landholding.

With some well targeted expansion drilling both vertically and horizontally across the 320 acre package, it may not take much to grow the resource base to 1 million ounces, while at the same time converting to the resource to being JORC (2012) compliant.

Of course its early days here – time and drilling with see that plan unfold, however what we do know so far points to a significant amount of upside in resource size.

PUR is moving quickly on this, currently conducting due diligence with its option over the Buck Mountain Project to be exercised on September 30th.

We recently made an investment in PUR given the currently low entry price and this article will explain the reasons why.

Assuming DD is successful, and the option over the project is exercised, given the market for gold projects, PUR could soon be valued at multiples of its current valuation.

A significant amount of work has already been undertaken at the project in the past, such as drill programs and a number of sampling exercises, including the collection and processing of a 16.2 tonne bulk sample by the project vendors.

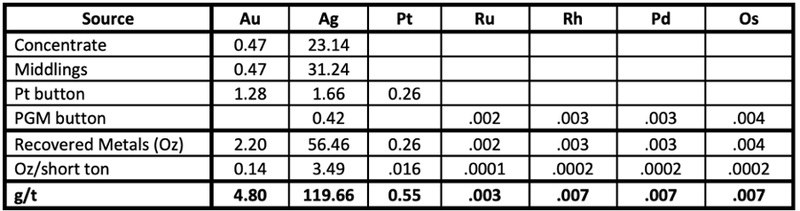

The bulk sample was processed in a similar way to how a mine would process the alluvial gravels and grades of 4.8g/t gold, 119.66g/t silver and 0.55g/t platinum, were recovered from the bulk sample.

A 2014 auger ampling program was also completed but the samples were never assayed.

PUR is now in possession of these samples and, along with samples from its own soil sampling program, that’s currently underway, will now be independently assayed with results due in early September.

These results should provide a large boost in confidence to the market and give PUR investors a clearer idea of what is really in the gravels at the Buck Mountain project.

The company is looking for further confidence in the average grade gold over the project area, to make a call on whether or not to proceed with the transaction. Having spoken at length to CEO Mark Freeman, we sense his confidence here.

The company has undertaken a $600,000 capital raise, of which the second tranche of 60.5m shares and $300k is due within the next five weeks. This should be sufficient to complete the due diligence exercise that’s anticipated to cost ~$840k, and then move forward on a small drilling program.

This is a project that has a very realistic potential to soon boast a million ounce gold resource, not to mention its silver and PGM upside.

Also attractive is the project’s low costs in alluvial gold processing, and the strength in gold and silver prices.

Now trading at just 1.9 cents per share for a $7.8 million market cap, this could be the start of big things for this PUR and its Buck Mountain project.

We have covered Pursuit Minerals (ASX:PUR) a few times over recent years across a number of projects that have not quite worked out the way shareholders would have liked.

However, this current project looks to be the right project at the right time, given the macro forces at play with the current gold price being what it is.

Just a few weeks ago, PUR announced that it had acquired an option over the Buck Mountain Gold Project on 17 July 2020, entering a binding option agreement with the vendors, Golden Buck Ventures LLC (GBV) and Moreton Gold Pty Ltd (MOR), for the right to purchase a 100% interest in the project.

PUR only had to pay small initial cash payment of US$20,000 to gain exclusivity over the Buck Mountain Gold Project until 30 September.

Following this due diligence period, PUR has the right to acquire 100% of the project with a payment of US$75,000 in cash, plus deferred payments of US$675,000 (50% cash/ 50% shares) and a 2.5% net smelter (gold) royalty.

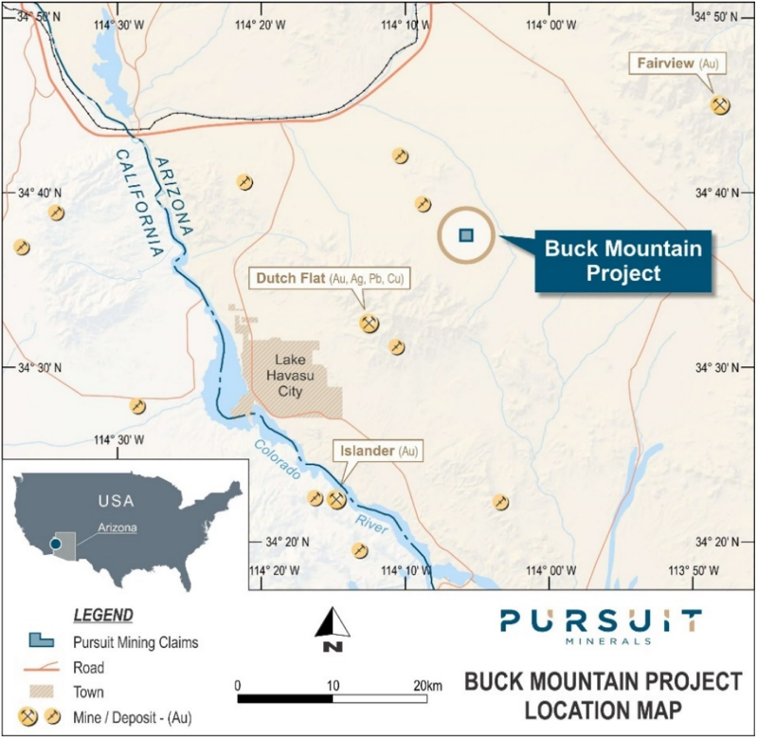

Located just 18 miles northeast from Lake Havasu City in Mojave County, Arizona, the project is easily accessible but not largely populated — conducive to a mining environment. Plus, its Arizona, USA location ensures very secure title and ownership.

The area is a very flat scrub with old river beds running through it and not much by way of hinderances.

Geological Setting and Mineralisation

As Buck Mountain is a high-grade alluvial gold project, it is essentially gold sitting in gravel that has been washed down onto the plains from the surrounding mountains. Mineralisation is widespread, although mostly in small deposits of gold, silver and tungsten.

The project claims are located on an alluvial fan surrounding the Mohave Mountains which lie within the Basin and Range province of the western USA, where eroded mountain ranges are separated by sediment-filled valleys or basins.

The Mohave Mountains have a long history of sedimentation, igneous activity, metamorphism and structural deformation. Many indications of mineralisation have been recorded, and it has a long mining history that can be traced back as far as the early Spanish settlers.

During the 1930’s depression years, the alluvial gold-silver placers supported an estimated 5,000 to 10,000 miners.

Wet processing was undertaken along the Colorado River, but on the higher levels of the alluvial fan, where there was no surface water, dry rockers recovered only coarse gold.

Due to the lack of surface water needed to process the alluvial material, the bulk of the Buck Mountain alluvial fan was never worked during the 1930’s.

However, extensive aquifers have since been located within the Buck Mountain project area.

The precious metals here — predominantly gold, silver and PGM’s — are contained within the gravels of an alluvial fan, shedding off Buck Mountain within the Mohave Mountain Range.

The true thickness of the vast alluvial fan surrounding the Mohave Mountains is unknown. Conservatively, a depth of 15 feet has been assumed for the purposes of estimating recoverable precious metals from the Buck Mountain Gold project.

Here’s CEO Mark Freeman speaking with Proactive's Andrew Scott about the Buck Mountain Project:

Buck Mountain resource and historical drilling

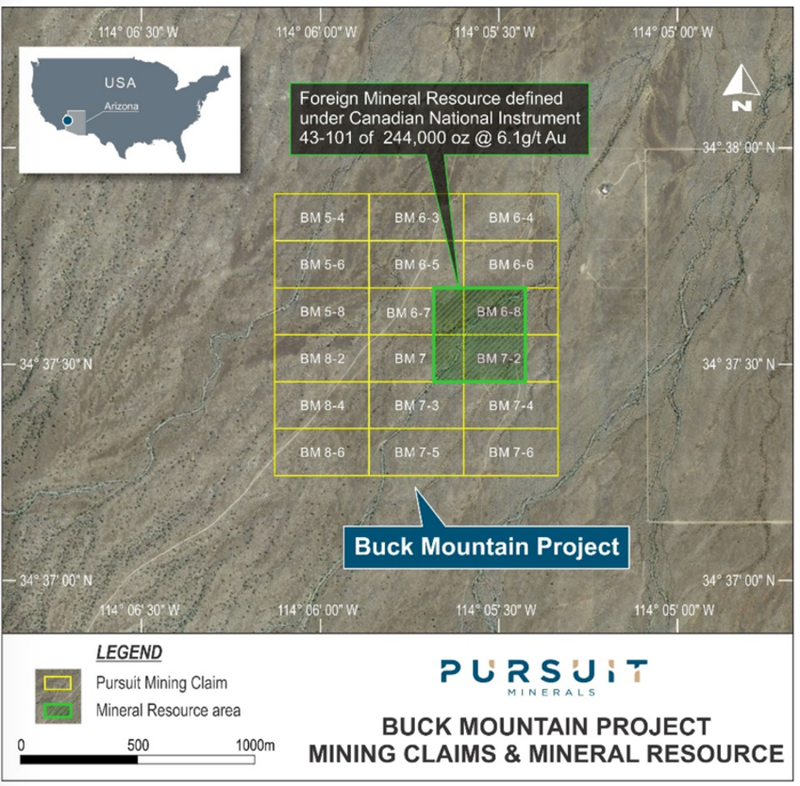

The high grade alluvial gold project covers an area of 320 acres (1.3km2) and consists of 18 placer claims and includes a foreign mineral resource estimate of 244,000 ounces gold.

The resource, compiled in compliance with Canadian National Instrument 43-101, has been estimated at 1.248Mt, grading 6.1g/t gold for 244,000 ounces. PUR intend to convert this to a JORC resource.

Being alluvial gold does make it a little harder to define a resource, but it is an incredibly easy and affordable mining and processing method. All that’s required is recovery of gold from gravel via simple gravity separation, using mobile, off the shelf technology.

The 45 acre resource area, highlighted in green on the map below, is within the 18 placer claims of the 320 acre project area (yellow):

In addition to the gold resource, the project has significant complementary silver and Platinum Group Metals (PGM’s) mineralisation.

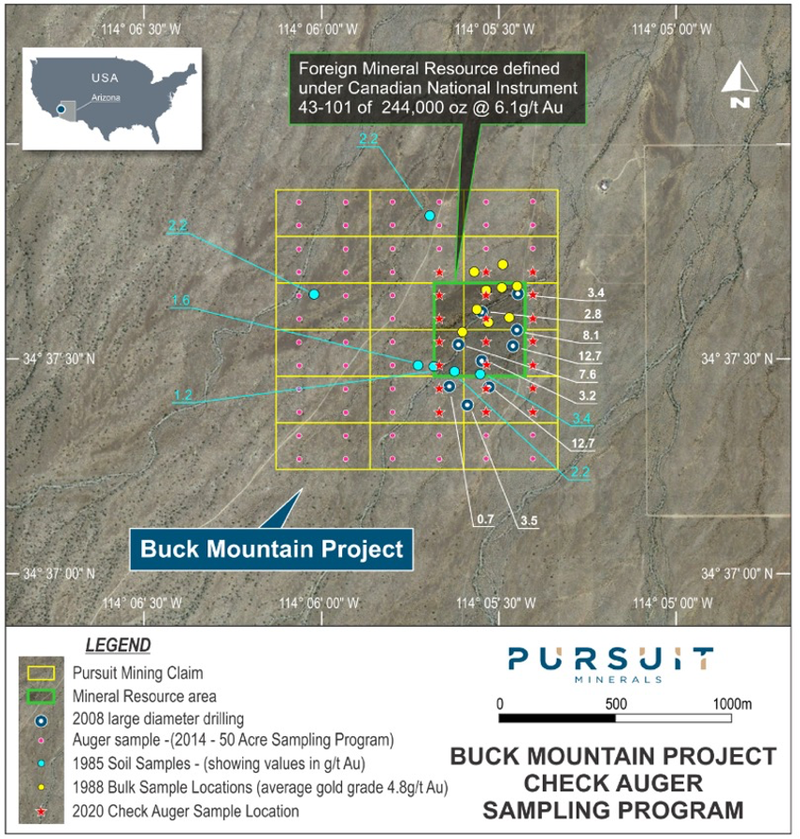

The following project map identifies the extent of the past sampling undertaken at the Buck Mountain Project area over many years by the project vendors.

Over the years processing has been undertaken by a range of different groups, and across the project area, quite varying results have been returned.

1985 soil samples

Initial testing of the project area was undertaken in 1985 (blue dots). Twenty, 1lb surface samples of soil and gravel were collected from ridges, slopes and beds of washes and showed that gold at surface was wide spread cross the project area with samples returning gold grades of 1.2 – 3.4 g/t gold.

1988 bulk samples

In 1988, a bulk sample (yellow dots) was taken, extracting a significant amount of material, at 16.2 tonnes of alluvial gravels, from 9 locations (~30 acres), down to a depth of 14 feet.

Testing incorporated all the steps intended for a full-scale alluvial mine, mill and refinery.

The 16.2 tonnes bulk sample recovered gold at a grade of 4.8g/t gold, 119.66g/t silver and 0.55g/t platinum.

To a reasonable extent, this 1988 bulk sample corroborates the grade of the foreign resource estimate, which was completed following the 2008 large diameter drilling (see below).

2008 large diameter drilling

In 2008, nine large diameter rotary drill holes (blue/white dots) were completed in the area of the 1988 bulk test. The nine holes were drilled to 25-30 feet, however only the top 15 feet of each drill hole was assayed. Several metallurgical studies were completed from the large diameter drill holes which produced an average grade of 6.1g/t gold. These results were received from 0 to 15 feet and used to calculate the project’s 244,000oz resource.

This drilling — down to 30 feet — demonstrated that the gravels continue down to at least that depth and probably beyond. The expectation is that the mineralisation of the alluvials should continue to that depth, which is beyond the 15 feet depth used in the resource calculation.

A quick estimate suggests that considering just the depth drilled, PUR could see a doubling in the resources once the drilling program gets underway.

2014 auger samples

In 2014, a large number of auger soil and gravel samples (red dots on map above) were collected from 128 sample locations on a regular grid across the entire project area.

The samples were collected from surface with gold occurring at surface, to an approximate depth of 3-4 feet. They were placed into a secure storage facility but never assayed.

Due diligence underway

PUR has now sent 24 of these large auger samples from 2014 to an independent lab to further verify the grade and distribution of gold-silver mineralisation within the alluvial gravels.

The company will also re-drill 21 of the auger samples sites from 2014 to a depth of 3-4ft.

Results are anticipated in mid-September 2020 and are aimed at getting confidence in the average grade of the resource and will support the decision to exercise the option to acquire the project.

Given that the depth of these soil and gravel samples were collected from just 3-4 feet depth, PUR view any gold grading >2 g/t as successful and is a very good indication that everything is good to go for PUR to exercise the option by the end of September.

The 1988 bulk sample was processed in a way which reflected how a full-scale processing plant would operate, demonstrating a simple processing flow sheet is appropriate.

Going forward, the majority of the gold will be recovered via gravity separation to the extent required with a small CIL plant utilised in the back end of the processing to recover some of the gold and silver which appears to have been hydrothermally deposited and is not as alluvial material. PUR envisage a combination of mobile and Modular (Gekko) off the shelf processing technology.

Resource expansion

As we highlighted in our introduction above, while the resource was estimated from drilling to 15 feet, the drilling undertaken in 2008 determined that the gold, silver and PGM bearing alluvial gravels extend to at least 30 feet, indicating significant upside potential to the existing mineral resource.

Further, as mentioned, the foreign mineral resource was estimated for an area of just 45 acres, while the Buck Mountain Gold Project covers an area of 320 acres.

PUR intend to expand the mineral resource at the project, while also converting to a JORC (2012) resource. Given the size of the project area and the limited depth drilled here, this could be significant large in a very short time.

Additionally, the existing 43-101 Resource does not include PGM or silver, which, in fact, forms a significant component of the project opportunity.

This was evidenced by the 16.2 ton bulk sample which recorded recovery grades of 119.66 g/t and platinum credits of 0.55g/t Pt.

Precious metals continue their run

There’s never been a better time to be in precious metals, with gold and silver having delivered one of their strongest months on record In July.

Gold hit record highs, eclipsing the US$2,000/oz level, while forecasters including Bank of America anticipate gold’s run to continue $3,000/oz and VanEck is confident it will reach $US3,400/oz.

Given the huge government stimulus measures, volatile equity markets, low yields, and ongoing uncertainty around the longer-term economic impacts of the COVID-19 pandemic, gold is expected to continue its rise.

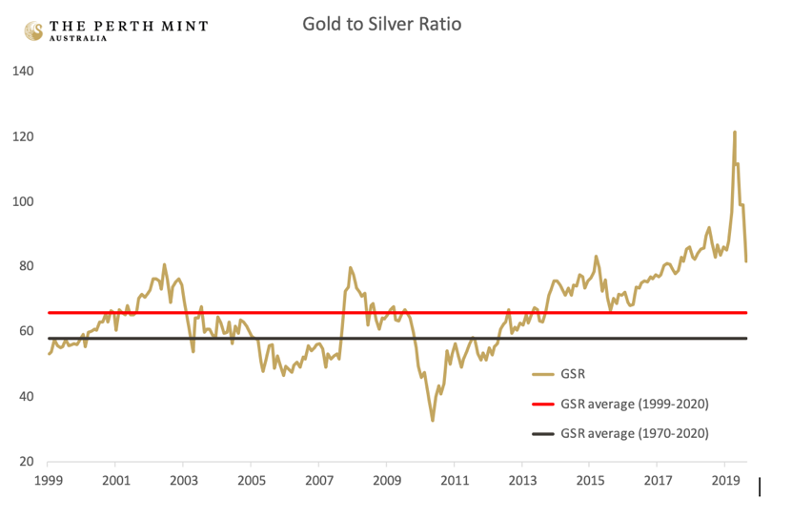

Gold’s rise has been well publicised, possibly overshadowing the recent rise in silver prices.

Like gold, silver was outstanding in July, rising 35% for the month and continuing its strength into August. The month also saw silver ETF’s record some of their biggest inflows in more than five years as investors increased their exposure to the metal.

Still, relative to historical levels, it remains cheap compared to gold. It is due for a catch up and may well outperform it. A look at the ratio of gold to silver prices going back 20 years supports this view:

One of the problems with the silver sector is that there are so few vehicles in which to invest. Another is that silver is mostly a co-product with metals such as lead, zinc and yes, gold.

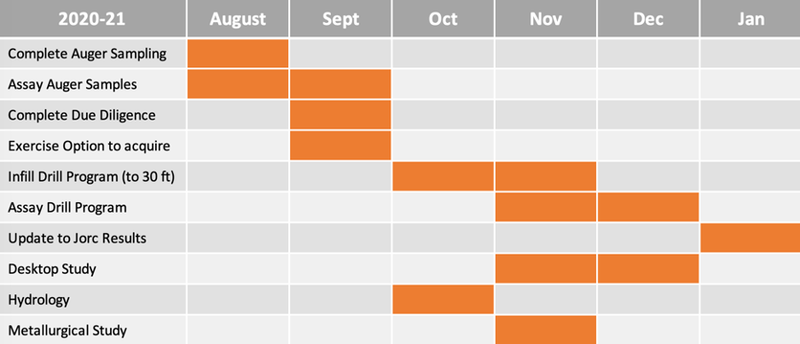

What’s next for PUR?

Currently in the due diligence phase though to the end of September, PUR is independently verifying auger samples to verify grade and distribution.

It is also re-drilling 21 of the auger samples sites from 2014. PUR will drill shallow holes of ~3-4 feet and says that results of greater than 2g/t gold would be extremely economic. The earlier average grade of 6.1g/t gold was recorded from up to 15 feet deep.

Results are due mid-September.

If due diligence is successfully completed, PUR will exercise its option, to acquire the project, then look to complete a follow up drilling program prior to the end of 2020.

The size and grade of the foreign resource estimate was a key factor for in PUR considering the acquisition of the Buck Mountain Project. Consequently, its ability to verify the resource and reclassify under JORC (2012) is an important step forward.

The results from the due diligence program will also allow PUR to assess reliability of the foreign resource estimate with much greater confidence.

The company has a very busy nine months ahead, with a focus on due diligence and auger sampling in September before exercising its option. From there, infill drilling and assay drilling programs will be conducted to gain confidence and a clearer understanding of the gold resource, before drilling an update to a JORC resource.

For a sub-$10 million company, there is significant potential to quickly and cheaply prove up and expand the existing resource, which could soon be a million ounce gold resource, with additional silver and PGM credits.

Now trading at just 1.9 cents per share for a $7.8 million market cap, this could be the start of big things for this PUR and its Buck Mountain project, particularly given the strength in gold and silver prices.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.