PUR - Now a $31M advanced stage lithium stock

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 25,133,333 PUR shares and 10,000,000 PUR Shares on Trilogy Class B Con Note conversion at the time of publishing. The Company has been engaged by PUR to share our commentary on the progress of our Investment in PUR over time.

We were waiting... and hoping something might happen here.

Our long held Investment Pursuit Minerals (ASX:PUR) has just announced plans to acquire an advanced lithium asset in Argentina.

This asset sits in South America’s ‘lithium triangle’, a region home to ~50% of the world's lithium production and multi-billion dollar lithium majors like SQM and Albemarle.

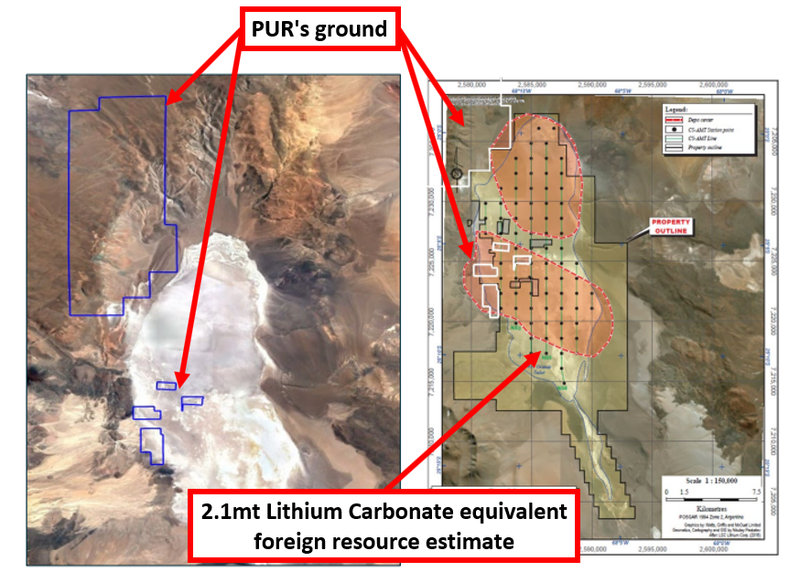

PUR’s new project sits on ground inside the boundaries of a broader, existing foreign resource estimate of 2.1mt lithium carbonate equivalent.

After the deal is completed, PUR will be capped at $31M.

Over the coming 12 months we want to see new drilling, a maiden measured JORC resource, an offtake agreement and Bankable Feasibility Study - hopefully leading to a real, producing lithium project.

Lithium has been one of the most sought after minerals over the last two years, where we have seen companies go from micro-caps to multi billion $ industry leaders.

One of our best Investments was Vulcan Energy Resources - which had a tiny market cap of ~$20m when we first Invested in it, and less than 18 months later was capped in the multi billions of $.

At its peak Vulcan’s return from our initial entry price was 8,225%.

To date, Vulcan has been the ONLY lithium Investment we have made in the Next Investors Portfolio but this doesn't mean we haven’t been looking for new lithium Investments.

Over at our earlier stage exploration portfolio, Catalyst Hunter, we have had success with lithium explorers like TYX and RAS that both had share price runs into drilling results.

LRS that made a successful discovery and is now moving into feasibility studies (highest point up 1,195% from Initial Entry Price).

The past performance of these companies does NOT mean that PUR will perform the same way. There are unique risks to every project which we cover in our PUR Investment Memo below.

With the bull market for lithium into its third year, finding an attractively priced Investment in advanced stage lithium projects has been difficult.

More specifically finding projects with 1,000%+ potential returns has become very difficult.

So we are pleased that our PUR Investment is planning to acquire an advanced-stage lithium brine project in Argentina, inside the ‘lithium triangle’ - home to ~50% of the world’s lithium supply and industry majors like Allkem (capped at $8.3BN), Albemarle (capped at $45BN), SQM (capped at $39BN) and Rio Tinto ($172BN).

Post acquisition at 1.2c, PUR will be capped at just $31M.

Aside from the major lithium heavyweights, an example PUR could look to follow is ASX listed Argentinian lithium brine developer Argosy Minerals - which is almost finished developing its project and is capped at $828M.

Today PUR has entered a due diligence period to acquire the Argentina lithium asset, expected to close in January. We participated in the $2M cap raise just completed by PUR.

We have been following the private Argentinian lithium asset being acquired by PUR since October this year, and have an interest in this company as well after participating in a pre-listing capital raise, which will convert to PUR shares post transaction.

So after a failed foray into Julimar PGE drilling, we are happy to see PUR move into the lithium space with an advanced project.

We are now Invested in PUR to see it achieve our “Big Bet” for the company which is as follows:

Our “Big Bet”

“PUR increases the size and scale of its lithium project to a level that warrants putting it into production. We are hoping this re-rates the company to a market cap of >$1bn (similar to what peer company Argosy achieved)”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our PUR Investment memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

Today, we will be launching our 2023 PUR Investment Memo, where you can find:

- Why we like the new PUR project

- Our long term bet

- The key objectives we want to see PUR achieve over the next 12 months

- The key risks to our Investment thesis

- Our Investment Plan

Today PUR announced its plan to acquire a lithium brine project inside the “lithium triangle” in Argentina - a region home to over 50% of the world's lithium reserves.

With most of the world's lithium brine projects being operated out of this region by majors including Allkem and Albermarle, for the global lithium market to be able to increase production, the lithium triangle needs to boost output.

The Argentinian government recognises this and has already committed US$4.2BN in funding for the domestic industry with a view of doubling production over a three-year period.

Private capital has also flowed into the region with Rio Tinto’s US$825M acquisition of the Rincon project in Argentina being a notable deal completed recently.

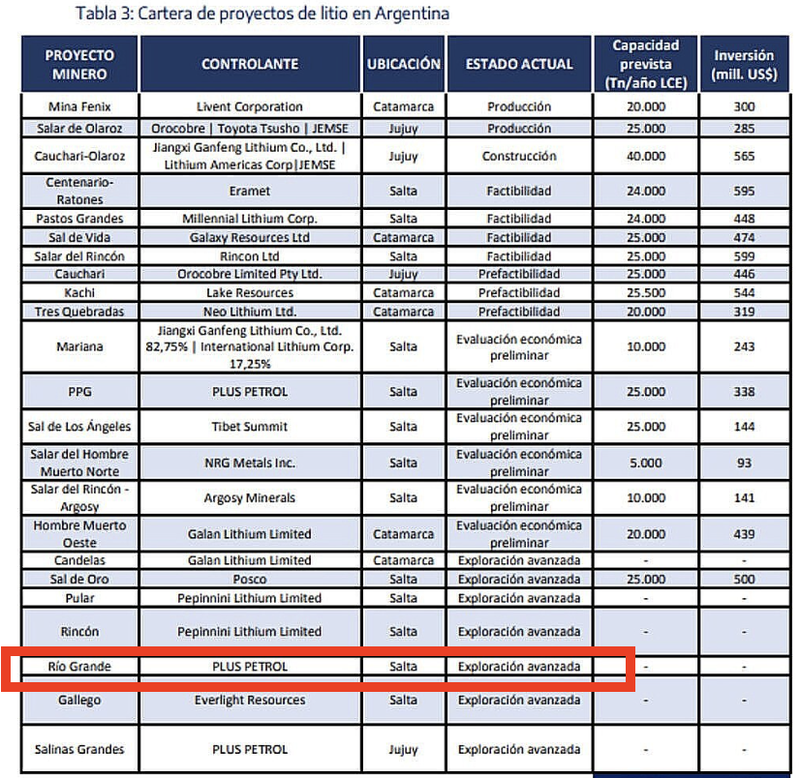

The region PUR’s project sits in is one of ~23 project areas listed in a recent lithium report by the Argentinian productive development ministry.

The project PUR is acquiring sits on ~9,260 hectares of ground inside the Rio Grande salar (salt lake) in Argentina (27,500 hectares) which has a foreign resource estimate of 2.1mt of lithium carbonate equivalent.

We are hoping that with a well planned drilling program PUR is able to convert some of this into its own maiden JORC measured resource estimate.

Here is a link to the foreign resource estimate put out by LSC Lithium in 2018: Report here.

For some context, Argosy Minerals (capped at $828M) has an indicated JORC of 245kt lithium carbonate at 325mg/lithium. While there’s no guarantees, we think PUR’s project has the potential to host a resource on par with or even larger than Argosy’s.

We also note that the resource put together by LSC Lithium was completed with drilling data down to depths of just ~100m. However lithium mineralisation in this part of Argentina is interpreted to extend down to depths of ~500m.

Given this, we like the exploration upside PUR’s project offers, especially considering it is de-risked by the foreign resource it sits around.

Argosy trades with a market cap of $828M, whereas PUR’s current market cap (at 1.2c where the deal was done) is just $31M.

The management team has been there and done it all before - it is more likely they know what to do to get the most out of this project.

On this front, the team PUR is acquiring along with the assets includes:

- Tom Eadie who was the founding chairman of $1.7BN Syrah Resources - a graphite (battery material) producer.

- Aaron Revelle who had previously run and then sold a lithium explorer in Argentina to Canadian listed Arena minerals which is now capped at ~$230M.

- Kyle Stevenson who was the founder of Millennial Lithium which was eventually sold for CAD$491M.

With a history of building companies from the ground up in the battery materials space and seeing them through to either development, production, or a takeover offer, we are backing the team behind PUR’s new projects to deliver success for PUR holders.

While the market seems to be re-rating other less advanced explorers to market caps in the hundreds of millions we have been patient and avoided Investing in those highly valued exploration opportunities.

As we noted above, post deal completion, PUR’s market cap will be just $31M.

This is a fraction of where most lithium players with far less advanced assets trade, and given this entry point, it means PUR has higher potential to re-rate on successful achievement of key milestones.

We think that in the latter stages of a bull market it is important to focus on valuation when making Investments in hot macro themes, hence why we like this project.

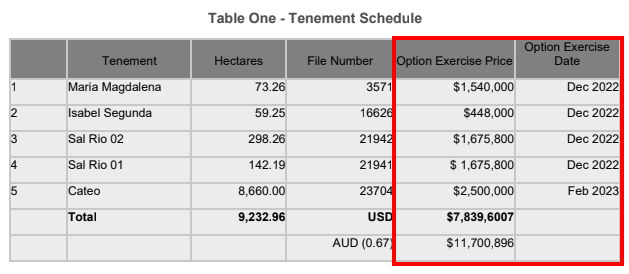

What is PUR paying for the project?

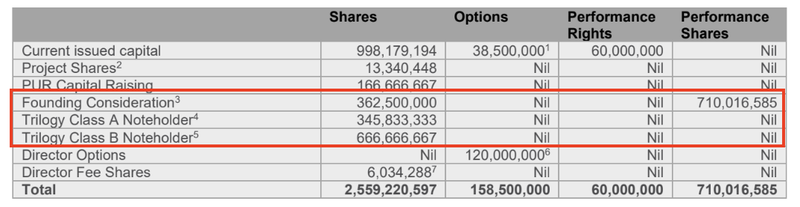

As part of the deal, PUR is issuing the vendors of the project ~1.375 billion PUR shares and ~710 million in performance options.

The reason for the ~1.375 billion in shares is because there is an $8M capital raise being done by the vendor (Trilogy) to settle the project acquisition costs. Trilogy shares and con notes will then be converted to PUR shares at 1.2c per PUR share.

As part of the deal PUR is also raising $2M at 1.2c which will see another ~167 million shares come to market at this price.

Combined with the ~$5.6M in cash PUR held in the bank at 30 September 2022, the company should have in excess of the option exercise price for all of the ground which totals ~$11.7M.

Of the shares being issued, ~362.5 million will be under a 12 month escrow and the ~710 million in performance shares only vest if the share price of PUR reaches 3c, 5c and 7c per share.

After the deal is completed, PUR will have ~2.56 billion shares on issue, not including options and performance rights/shares.

It’s important to note that post deal completion (expected in January), there will be new PUR shares coming on to the market. These may require some time to digest if there are any short term or stale holders looking to exit.

What next for PUR?

Given the project is a new acquisition, PUR needs to run through the usual process of due diligence and having the transaction approved by existing shareholders. There are also a number of conditions precedent on the deal which are typical of a deal of this nature.

PUR expects this process to be completed by the 30th of January, after which the shares will be issued to the vendors of the project.

We have been holding a position in PUR for over 2 years now, and after a failed attempt at drilling in the Julimar province we are happy with this new advanced lithium acquisition (pending DD and shareholder approval expected in January 2023).

We are Invested in PUR to see it take this project from where it is now to a JORC resource multiples of its current size, through feasibility studies and hopefully one day into production.

We plan to follow the same Investment Strategy that we do for most of our Investments (more detail on this in our Investment Memo).

It’s very early in PUR’s new project, but as always we may look to de-risk ~20% in the next 12 months in line with our trading policy, if the price materially re-rates on key milestones.

Given PUR is acquiring a new asset in a new country, we have put together an updated PUR Investment Memo, where you can find:

- Why we Invested in PUR

- Our long term bet - what we think the upside Investment case for PUR is.

- The key objectives we want to see PUR achieve over the next 12 months

- The key risks to our Investment thesis

- Our Investment Plan

Click the button here or just keep reading to see our full PUR Investment Memo on this new asset:

Why we Invested in PUR:

Below are the five key reasons why we like PUR’s proposed acquisition:

- Project sits inside an already giant resource - PUR’s project sits inside an already established foreign resource estimate of 2.1mt lithium carbonate equivalent. PUR’s ground covers ~9,260 hectares inside and on the perimeter of the larger Rio Grande salar (salt lake) in Argentina which measures ~27,500 hectares.

- Exploration upside - Most of the drilling in the Rio Grande salar (salt lake) has been down to depths of ~100m. Lithium mineralisation is interpreted to extend down to depths of ~500m in depth leaving plenty of exploration upside for PUR to chase.

- Strong management team - Team includes the founding chairman of $1.7BN Syrah Resources - Tom Eadie, and Kyle Stevenson was also the founder of Millennial Lithium which was eventually sold for CAD$491M.

- Located inside Argentina’s “lithium triangle” - PUR’s project sits in a region home to ~50% of global lithium supply, dubbed the “lithium triangle” of Argentina. The region also hosts majors like Allkem (capped at $8.3BN), Albemarle (capped at $45BN), SQM (capped at $39BN) and Rio Tinto ($172BN) hold lithium projects. This brings with it potential future consolidation opportunities.

- Low market cap relative to advanced peers - post acquisition PUR will have a fully diluted market cap of ~$31M, which is low compared to other lithium brine players Argosy Minerals ($828M).

Our long term bet:

“PUR increases the size and scale of its lithium project to a level that warrants putting it into production. We are hoping this re-rates the company to a market cap of >$1bn (similar to what peer company Argosy achieved)”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our PUR Investment memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

What we want to see from PUR achieve over the coming 12 months:

Objective #1: Drilling program to establish maiden JORC resource estimate.

- We want to see PUR drill to depths of ~500m where mineralisation is interpreted to extend to.

- The ultimate aim of the drilling program will be to establish a maiden JORC resource estimate for its project.

Milestones:

🔲 Drilling program commencement

🔲 Drilling program results

🔲 Maiden JORC resource estimate

Our bull/base/bear case expectations for the maiden JORC resource is as follows:

Bull case = >100kt lithium carbonate equivalent.

Base case = 50-100kt lithium carbonate equivalent.

Bear case = <50kt lithium carbonate equivalent.

Objective #2: Pilot plant construction to show recovery potential.

- We want to see the company build and operate a pilot plant to show that it can produce lithium carbonate from its project efficiently.

Milestones:

🔲 Pilot plant construction commenced

🔲 Pilot plant construction completed

🔲 Pilot plant operating results

Objective #3: Complete either a definitive feasibility or bankable feasibility study (DFS/BFS).

- We want to see the company advance the feasibility studies for its project from where it is now (scoping study) to either a Definitive Feasibility or Bankable Feasibility study level.

Milestones:

🔲 Feasibility study commencement

🔲 Feasibility study completion

What are the risks?

Commercialisation risk - Lithium brine projects are highly dependent on different variables like weather, flow rates to surface and the variability of grades in the brines. There is always a risk that PUR’s project doesn't meet the levels required for its project to be operated commercially.

Resource risk - PUR’s ground sits inside an area where another company has already defined a foreign resource of 2.1mt lithium carbonate equivalent. This does not mean PUR will be able to define a resource of its own, there is always a chance that the ground PUR holds is considered uneconomic and no resource estimate is produced.

Market risk - there is always a risk that market sentiment impacts PUR’s ability to raise capital. Given the company is yet to commence producing any cashflows the need to raise capital may weigh on the company’s share price.

Commodity price risk - Lithium is currently trading at all time-highs. There is always a risk that the market interest for lithium decreases and in turn appetite to invest in companies like PUR decreases.

What is our Investment Plan?

We have been holding a position in PUR for over 2 years now, and after a failed attempt at drilling in the Julimar province we are happy with this new advanced lithium acquisition (pending DD and shareholder approval expected in January 2023).

We participated in the $2M PUR cap raise (December 2022). We have also been following the private Argentinian lithium asset being acquired by PUR since October this year, and also have an interest in this company after participating in a pre-listing capital raise, which will convert to PUR shares post transaction.

It’s very early in PUR’s new project, but as always we may look to de-risk ~20% in the next 12 months in line with our trading policy, if the price materially re-rates on key milestones.

Our PUR Progress Tracker

We recently began launching “Progress Tracker” slide decks for our Portfolio companies.

Below is the PUR Progress Tracker document.

We will use this internally to keep up to tabs on the company's progress. It shows how the project was brought into PUR, and the progress made up to today, along with what we want to see the company achieve next.

Click here to check out our PUR Progress Tracker

If you want to follow the progress of our Investment in PUR over the next 3 years make sure you are subscribed to our Next Investors mailing list or read our weekend newsletter.

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 25,133,333 PUR shares and 10,000,000 PUR Shares on Trilogy Class B Con Note conversion at the time of publishing. The Company has been engaged by PUR to share our commentary on the progress of our Investment in PUR over time.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.