PUR granted exploration licences for Warrior Project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

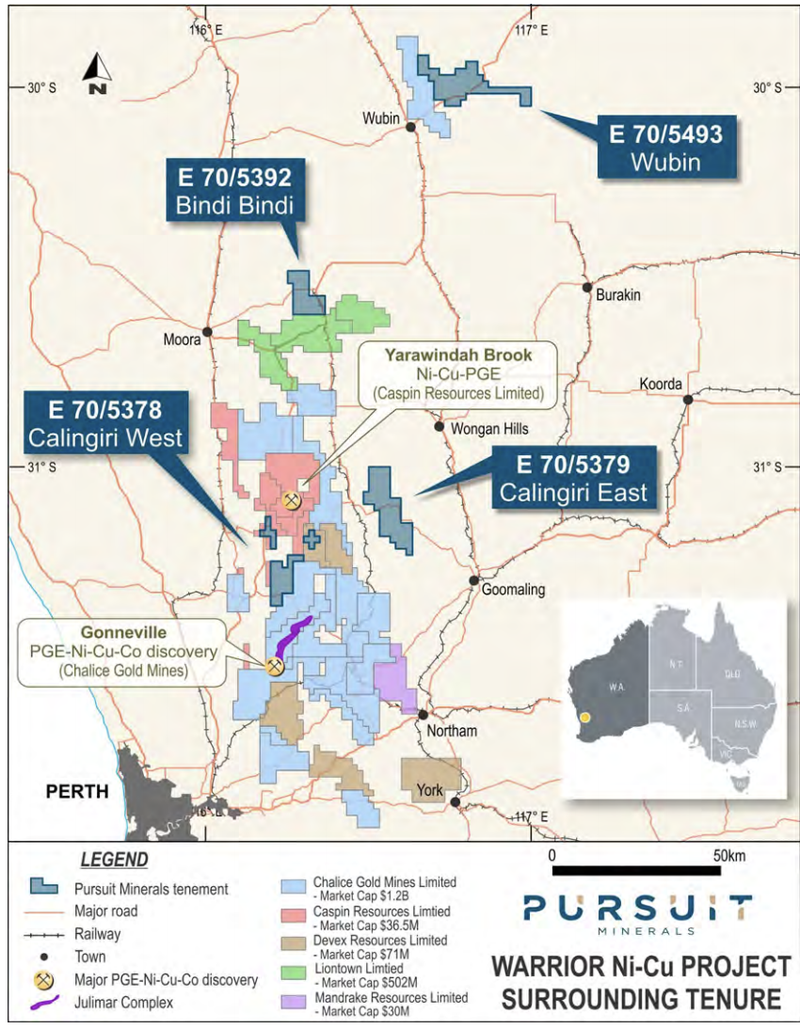

Yesterday, Finfeed alerted readers to Pursuit Mineral’s (ASX:PUR) acquisition of four highly prospective land positions totalling 593 square kilometres in an emerging nickel-copper-platinum group elements (PGE) region of Western Australia.

The tenements are collectively known as the Warrior Project.

Read: Pursuit set to acquires ELA’s close to Chalice’s Julimar Project

Today, the company has announced that Exploration Licences for Calingiri East (E70/5379) and Bindi Bindi (E70/5392) have been granted effective 2 December 2020.

The tenements are located between 20 kilometres and 170 kilometres to the north of Chalice Gold Mines Ltd’s (ASX:CHN | OTCQB:CGMLF) Gonneville Julimar discovery.

This discovery was a groundbreaking one for Chalice, which is up over 1,600% since January, and is currently capped at $1.2BN - one of the top performing companies on the ASX this year.

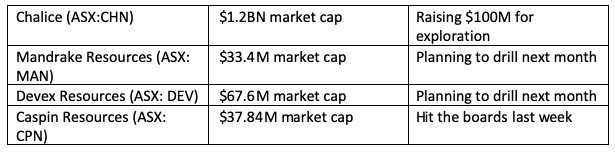

Following, the Chalice discovery a raft of companies entered the region:

PUR is now the latest company to join the Julimar ranks.

Since the announcement yesterday, PUR’s shares have risen 30% and its market cap has moved from $11M to $15.58.

Given its proximity to Chalice and pending newsflow, we could see further upside.

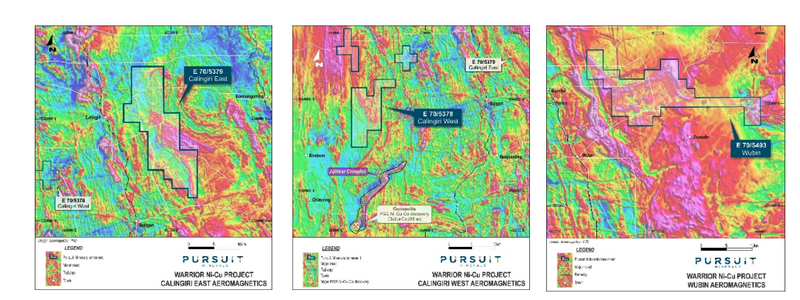

You can see its location below:

The Company is now working to finalise Heritage Agreements, securing Ministerial consent and moving ahead with the transfer of the tenements for Calingiri East (E70/5379), Bindi Bindi (E70/5392) and Wubin (E70/5493).

PUR will also commence fieldwork on the Warrior Project during the January-March quarter 2021.

Work at Warrior will consist of prospect scale geological mapping, rock chip and soil geochemistry, along with planning for electromagnetic surveys, to be followed by an initial drill program.

Preparatory work on the project has commenced and it has focused on the interpretation of aeromagnetic data covering the four tenements in order to identify magnetic anomalies which are potentially due to mafic and ultramafic intrusions.

PUR plans to expediate the granting of the one remaining tenement application and is progressing discussions with various landowners, native title groups and government agencies.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.