Preferred bidder selected for NHE farm out deal

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 4,166,307 NHE shares and 2,437,037 options, and the Company’s staff own 64,339 NHE shares and 4,000 NHE options at the time of publishing this article. The Company has been engaged by NHE to share our commentary on the progress of our Investment in NHE over time.

We have a deal... almost.

NHE is gearing up to drill two high impact helium exploration wells in Tanzania next quarter.

NHE’s drill targets have a combined 16BCF helium potential.

For context on the size of this prize - some “back of the napkin” calcs arrive at a US$7.2BN in ground value, based on 16Bcf recoverable helium multiplied by the long term helium contract price of US$450 per mcf.

Four weeks ago, we covered the news that multiple bidders were interested in paying for NHE’s upcoming drilling costs, in return for share in the project - this is known as a “farm-in”.

Given the size of the potential prize, we can understand why NHE had multiple bidders interested.

Today NHE announced a “preferred bidder” has been selected and non-binding heads of agreement has been signed.

The deal will see the preferred bidder pay for:

- The FULL COST of NHE’s TWO upcoming exploration wells, and,

- All of the past exploration costs already incurred (prorated to the yet-to-be revealed project ownership structure).

NHE expects to finalise the terms of the deal in the coming weeks.

This is when we expect to get more clarity on the dollars being paid, and importantly what % of the project the farm-in partner will be getting from NHE.

A successful farm-in deal is a material event for a small cap explorer. This is because in the market’s eyes, it reduces the likelihood of a large, discounted capital raise to fund an upcoming drill program, and the loose stock that inevitably comes with that raise.

This type of looming capital raise typically weighs down a company’s share price.

For this reason, strong farm-ins with favourable terms are coveted by small cap oil & gas explorers, and their shareholders.

Of course, while the risk of a large capital raise is removed if a farm-in deal is secured, companies can always do smaller raises in order to shore up their balance sheets in the lead up to drilling programmes.

On the timing of actually signing the deal, NHE says “We aim to conclude negotiations over the coming weeks to welcome the new joint venture partner into the project while meeting the drilling program’s funding requirements.”

The plan is for NHE’s drilling to start next quarter, likely August/September.

We are expecting a share price run in the lead up to drilling and/or the results, which will hopefully start on or around the binding farm-in deal being signed.

NHE has a certified mean unrisked prospective helium resource of 175.5Bcf (billion cubic feet).

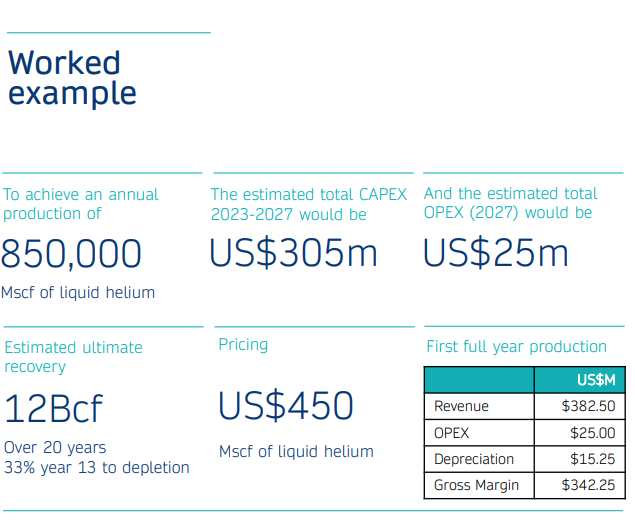

To get a sense of the size of the prize, last week NHE shared some numbers on what a successful discovery and development of a helium project could look like here.

The numbers were shared in last week's NHE investor presentation which you can view here.

Two key takeaways before we show the worked example are:

- As a gas, helium has similar exploration and production costs per Mscf as traditional oil and gas,

- However - helium projects require significantly less capital - as much smaller volumes are required for a highly profitable project.

- Discovering a 6 bcf recoverable helium resource is a “company making” result.

Here’s the worked example of a developed helium project from NHE:

This shows the first full year of production is extremely profitable with a gross margin of US$342.5M on an annual production of 850,000 Mscf of helium.

However, of course, the first big step to development is a discovery, and that's what NHE is intending to do in its two well campaign next quarter.

Helium One - NHE’s Tanzanian helium peer - also drilling next quarter

NHE is scheduled to start drilling in August/September - NHE’s neighbour, Helium One, is likely to drill in July/August.

NHE is currently capped at A$47M.

NHE’s neighbour Helium One is capped at A$110M - despite having only one drill target (with no disclosed volumetric potential) and no farm in deal.

Whilst drilling in the same region, Helium One is drilling a different play type to NHE’s - NHE’s play type has a regional success rate of 14 from 14 for oil and gas wells.

For this reason, we can see clear upside potential in NHE as it builds up to drilling over the coming months.

Our ‘Big Bet’

“NHE discovers the world’s largest helium reserve held by a single company and is strategically acquired by a major company OR a state owned enterprise to secure supply (USA, China, Qatar).”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done and many risks involved - some of which we list in our NHE Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

To monitor NHE’s progress since we first Invested and to track how the company is doing relative to our “Big Bet”, we maintain the following NHE “Progress Tracker”:

Click to see our NHE Progress Tracker here:

What’s next for NHE?

Farmout partner secured 🔄

NHE has two drill targets selected and NHE had been in discussions with potential farm out partners to de-risk the project from a funding perspective.

As of today, NHE announced a “preferred bidder” has been selected and non-binding heads of agreement has been signed.

Next we want to see the farmout deal concluded including confirmation of the terms - so that NHE is fully funded for drilling these two wells.

Rig contract executed 🔄

With the previously discussed cooperation agreement with Helium One, we’re hoping NHE that the focus for this quarter is on securing a rig.

Both companies will be keen to have this locked away.

Previously, NHE announced that it had signed a Letter of Intent (LOI) with a drilling company called Sanofi for a rig.

The rig is a Drillmec HH102 oil and gas rig which can drill to 2,500m, more than double the depth of NHE’s deepest planned well (Pegere-1) - so it's more than capable of doing the job.

NHE says the cost savings from the rig sharing agreement are “significant”, and we see this LOI as evidence that the cooperation agreement is working.

We want to see the rig contract executed here as any delay on a rig could impact the company’s timeline (see risks section).

⚠️The Big One: Drilling ⚠️ 🔄

NHE expects to be drilling two wells next quarter.

Across the two wells NHE will be targeting a ~16.5 bcf (billion cubic feet) unrisked mean recoverable helium volume.

The two targets represent <10% of NHE’s overall resource which sits at an independently certified Mean Unrisked Prospective helium resource of 175.5Bcf.

For some context on what a “good result” might look like, NHE has previously referred to a benchmark of 6Bcf recoverable helium as a “company maker”.

Closer to the drilling event, we intend to outline our bull/bear/base cases for NHE’s drilling.

Risks

Below are the two key risks we are focussed on ahead of drilling, with more detail provided as per our NHE Investment Memo:

With the current newsflow, operational milestones such as executing a rig contract could hamper NHE’s ability to deliver a drilling program in the necessary timeframe.

As an addition to the risks listed above, if a farmout partner is not secured, we would also note that funding risk could materialise or precipitate a capital raise in order to fund the two wells.

Our NHE Investment Memo

Click here for our Investment Memo for NHE, where you can find a short, high level summary of our reasons for Investing.

In our NHE Investment Memo, you’ll find:

- Key objectives for NHE

- Why we are Invested in NHE

- What the key risks to our investment thesis are

- Our investment plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.