Pilbara offtake agreement a positive development for the lithium sector

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Thursday’s announcement by emerging lithium producer, Pilbara Minerals (ASX: PLS), regarding an offtake agreement not only drove its share price up by circa 12%, but it also had a positive impact on other ASX listed early stage and emerging players.

There is no denying this as a positive development for the sector, and fairly timely given that there appeared to be some selling over recent months, perhaps triggered by profit-taking or a perception that the sector had got ahead of itself.

The latter is a fair assumption when it is evident that new supplies coming on stream from numerous sources, but there is a lack of material evidence of demand.

Even though investors are aware that the lithium theme is long-term in nature, there is always an element of anticipation and perhaps a degree of impatience regarding the emergence of concrete data in relation to the demand side of the equation.

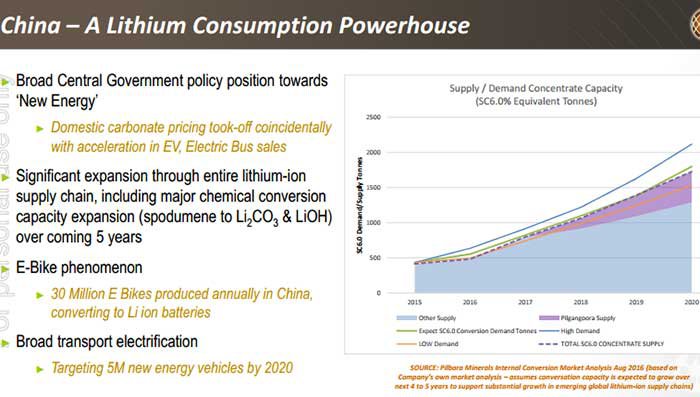

However, as demonstrated below, there are multiple sources of demand emerging from just one country.

Although investors should only use this fact as party of their investment decision and should seek professional financial advice if considering investing in lithium stocks.

PLS deal underlines compelling supply/demand dynamics

Pricing comes back to the laws of both supply and demand and on this note European Lithium’s (ASX: EUR) Chairman, Tony Sage made some interesting observations, which are not only insightful in terms of the lithium industry, but also EUR itself as it expects to release an upgraded resource next week.

It is worth noting that EUR was one of the biggest movers in the sector on Thursday with its share price gain outstripping PLS as it surged 15%.

Harking back to Sage’s comments, he said, “The announcement by PLS demonstrates the level of supply constraints in the lithium market and provides justification for market capitalisation growth of emerging producers with high grade JORC resources”.

He went on to discuss the upcoming resource upgrade with FinFeed, and while the updated numbers are yet to be released, he said, “The pending resources upgrade by EUR will be a significant milestone in the development of the Wolfsberg lithium project in Austria”.

While we will discuss individual industry players in more detail at a later stage, it is worth noting that Wolfsberg already has an established high-grade resource as outlined by FinFeed earlier this week.

Since we highlighted the potential upside in the stock its shares have spiked circa 20%. However, investors who enter the stock at current levels could still reap considerable returns given the significant discount implied by peer comparisons.

EUR only listed on the ASX in September, and it has arguably slipped under the radar as it has maintained a low profile pending the collation of exploration results in advance of a resource upgrade.

Offtake terms and what this means for emerging players

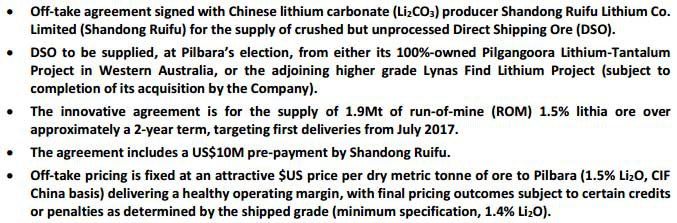

Running the ruler across the various aspects of the PLS agreement there were a number of key takeaways. Firstly, the agreement with Chinese lithium carbonate producer, Shandong Ruifu Lithium Co. is for the supply of crushed but unprocessed direct shipping ore.

The agreement is for the supply of 1.9 million tonnes of run of mine 1.5% lithia ore over approximately a two year term targeting first deliveries from July 2017.

While pricing remains confidential the agreement includes a US$10 million prepayment.

However, it was the terms of pricing that provided the most interest. PLS said that final pricing outcomes were subject to certain credits or penalties as determined by the shipped grade which was to be of a minimum specification of 1.4% lithium dioxide.

This could serve to tighten the focus on companies with higher grade resources, even if they are only early stage exploration plays. Arguably the players that stand to benefit the most of emerging producers with established resources with grades around the 1.5% mark.

In terms of identifying end markets, Shandong Riufu is an established supplier of lithium products and materials to the fast growing lithium battery industry in China, producing lithium carbonate products in East China with lithium hydroxide production planned in the near future.

However, there is another chapter to this story in terms of the distributor’s plans for the future.

What else is in the pipeline

PLS also informed the market that it is negotiating a separate offtake agreement for the supply of spodumene concentrate to Shandong Riufu, which is hoped to be finalised shortly, in addition to the existing offtake agreement with General Lithium Corporation for 140,000 tonnes per annum of spodumene concentrate.

The fact that there appears to be a short time frame on this announcement is also a potential near-term share price catalyst for companies in the lithium sector, as it will lead to further number crunching regarding profit margins.

It is important to note that in any industry, confidential pricing doesn’t prevent the likes of brokers and institutions making their own assumptions, and in many cases there are parties in the know that actually are aware of the finer details which invariably become public knowledge.

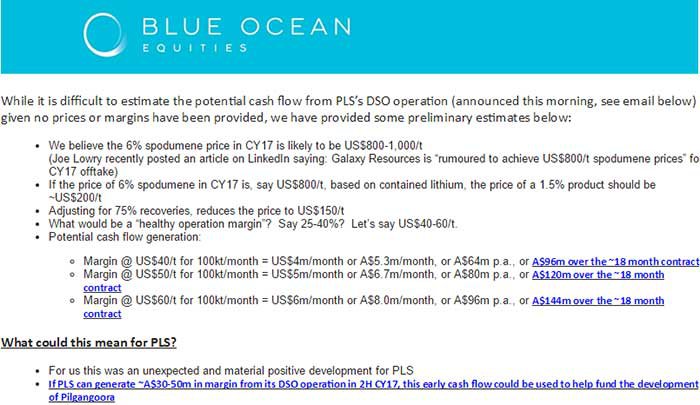

On this note, Steuart McIntyre from Blue Ocean Equities, a broker that extensively covers PLS, released a note within two hours of the announcement being released to the market.

The timing is arguably important in that analysts would need to be fairly close to the action to be comfortable in proposing potential pricing at such an early stage.

What the number crunchers are saying

McIntyre has based his projections on the 6% spodumene price in calendar year 2017 as this was the chemical grade concentrate product which was the subject of an offtake agreement with General Lithium Corporation negotiated in July.

McIntyre said, “If the price of 6% spodumene in calendar year 2017’s, say US$800 per tonne, based on contained lithium, the price of a 1.5% product should be approximately US$200 per tonne.

Fleshing that out a little bit more, McIntyre said that if an adjustment were made for 75% recoveries, this reduced the price to US$150 per tonne.

PLS maintains that the offtake agreement was struck at a “healthy operating margin”, which McIntire suggests would probably be in a range between 25% and 40%. This would imply a midpoint of US$50 per tonne.

The margin at this price for 100,000 tonnes per month equates to $80 million per annum or $120 million over an 18 month contract.

McIntire said he was surprised with this development, but sees it as particularly positive given that PLS can generate early cash flow which can be used to help fund the development of its Pilgangoora project, which requires funding of circa $250 million.

Implications for less advanced players

This is an encouraging development for early stage players, particularly from the perspective of generating income from pre-processing sales.

Yet, there is no getting around the fact that the grades need to be strong to be a price maker rather than a price taker, and on the score of margins, other issues such as the accessibility of mineralisation, proximity to essential infrastructure and from a broader perspective end markets all come into play.

Taking these issues into account Finfeed examines other industry participants at various stages from explorers to emerging producers.

At this point though it is worth noting that PLS has an established large resource which warrants a significant valuation premium to companies that are still in the process of proving up a resource or expanding an established resource.

Identifying stars of the future

While Finfeed consistently reminds potential investors to be aware that forward-looking statements and projections regarding exploration activities should not be used as a basis for an investment decision as they may not come to fruition, there are situations which in broker parlance are called ‘upside risk’.

It is easy to dismiss stocks in the early stages of exploration on the basis of results that don’t perhaps measure up with more advanced peers. However, to demonstrate how the landscape can change very quickly, the share price of Pilbara Minerals hardly deviated when it announced a maiden resource of 8.6 million tonnes grading 1.01% lithium.

What investors failed to recognise was the potential upside from future exploration where more focused and comprehensive drilling initiatives substantially resulted in the resource increasing to the current level of 135.9 million tonnes grading 1.22%.

While this has been assisted by the acquisition of other tenements, for the best part it has been the expansion of the group’s established tantalum-lithium resource that has underpinned the increase.

Shareholders who recognised the ‘upside risk’ and took advantage of a 2 cent share price only had to wait approximately 12 months to be sitting on a 10 bagger, and another 12 months later, a 40 bagger. As can be seen in the following share price chart, even in the last 12 months PLS’s share price has substantially rerated.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Investors considering the following stocks should not assume that they can emulate PLS’s astronomical gains, and as most of these are relatively early stage industry participants independent financial advice should be sought before investing.

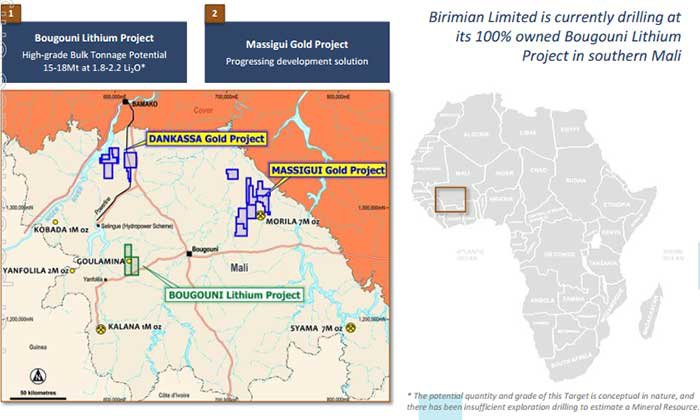

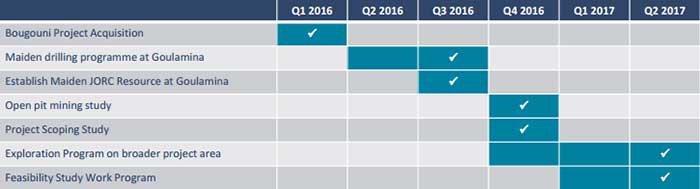

Birimian

Birimian (ASX: BGS) is shaping up as a PLS of the future, having released its maiden resource at the Goulamina deposit at the end of October. Despite being a particularly large maiden resource, as well as boasting higher grades than most of its peers, a little like PLS in the early days there was a muted share price response.

The maiden resource of 15.5 million tonnes grading 1.48% lithium dioxide represents an outstanding platform for future expansion, bringing into question why the company’s shares didn’t respond accordingly.

Perhaps this could be attributed to broader market volatility at the time of the announcement, or even expectations beyond what was delivered. It may have been the latter as Trent Barnett from Hartleys said, “The resource was slightly less than we expected, but was within the company’s exploration target of between 15 million tonnes and 18 million tonnes”.

Importantly, he sees potential for the project to grow in size over time as the deposit is open along strike and at depth, noting a general rule of thumb being a 1 million tonne increase in resource for every 50 metres. As a guide to what this could relate to in terms of resource expansion there is an tapped exploration potential within 250 km2 of the project

On this note Managing Director, Kevin Joyce, said “Birimian remains confident that over the course of subsequent drilling campaigns it will progressively increase the lithia inventory at Goulamina, confirming the significance of the deposit on a global scale”.

Providing further confidence regarding the likelihood of substantial resource expansion is the recently discovered high-grade West Zone which has a resource grade of 1.67% lithium dioxide.

Commenting on the potential upside from the West Zone, Joyce said “There remains significant potential to substantially expand this maiden resource and improve the modelled grade with additional drilling particularly at the recently discovered West zone where wide and high grade mineralisation remains open along strike near surface and at depth”.

Joyce highlighted the fact that the company is in a strong cash position with sufficient capital to fund development activities through the next round of drilling, including the completion of a scoping study.

On the score of upcoming drilling, Barnett is upbeat about the chances of success given high-grade intercepts in the West Zone pleaded 82 metres at 1.64% lithium dioxide and 51 metres at 1.93% lithium dioxide.

He has a speculative buy recommendation on the stock with a 12 month price target of 59 cents, representing a premium of nearly 100% to the company’s recent trading range.

Finfeed has been across Birimian for some time and those looking for some further background on the stock can follow this link in order to gain a comprehensive overview of BGS and the broader lithium industry.

While some of our readers benefited from entering BGS at an early stage, the recent retracement in the company’s share price arguably provides a useful entry point. However, potential investors should note that prior trading patterns are not an indication of future share price performance.

This is also still an early stage company and caution is advised if considering this stock for your portfolio.

Also, while BGS is relatively advanced in its exploration, progression to production is not assured and investors considering this stock should seek independent financial advice, particularly given the fact that its assets are situated in a region that carries sovereign risk.

Prospect Resources

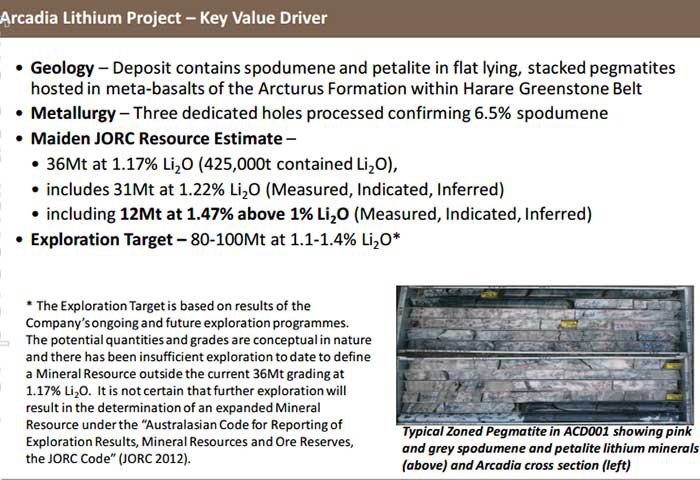

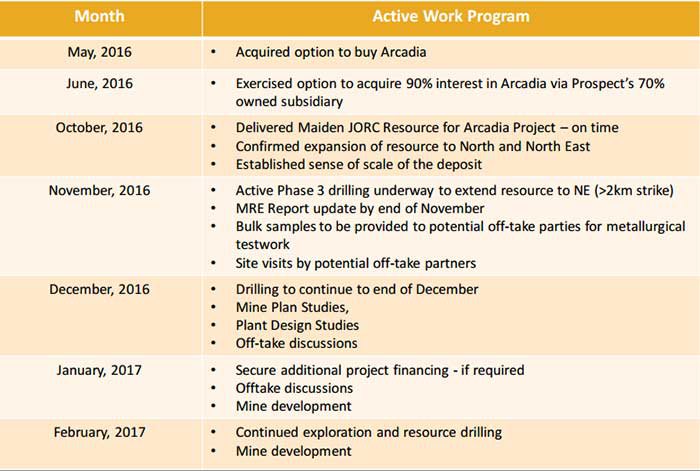

Another company that has just released its maiden JORC resource estimate is Prospect Resources (PSC).

The group’s Arcadia lithium project located in Zimbabwe has delivered the largest maiden resource estimate of any ASX listed company with 36 million tonnes grading 1.17% lithium dioxide.

It should be noted that getting mining projects up in countries such as Zimbabwe does hold a great deal of risk given its political and social climate, so caution and professional financial advice is advised when considering an investment in stocks operating in volatile areas.

While the grades aren’t up there with some of its peers, Hugh Warner reinforced previous comments by Finfeed in relation to the potential to expand both resource size and grades saying, “We have easily issued the largest maiden JORC resource of any company on the ASX with 53% of the resource in the measured and indicated categories, providing confidence that grades and tonnages will rise as further drilling is undertaken”.

As indicated below, the exploration target is between 80 million tonnes and 100 million tonnes grading between 1.1% and 1.4%. This would place it in a similar category to Neometals (NMT) which has a current resource of 77.8 million tonnes grading 1.37%.

NMT has a market capitalisation of circa $200 million, five times that of PSC which is capitalised at $40 million.

As can be seen below, PSC has already demonstrated that it can quickly and efficiently deliver on projected goals, and given the important milestones outlined in the following work program there appear to be numerous potential share price catalysts on the horizon.

With further drilling underway in November and continuing into December with the prospect of offtake discussions occurring over the next three months there is the potential for market moving news flow.

European Lithium

European Lithium (ASX: EUR) is another company with an established high-grade resource that is making progress towards substantially expanding both the volume and grade.

Interestingly, this news regarding the previously mentioned Wolfsberg project located in Austria is only a week away, perhaps accounting for the recent share price surge which has seen it increase from a low of 5.6 cents on November 7 to hit a high of 6.9 cents this week, representing an increase of 23%.

EUR has released promising drilling results over recent weeks which have featured thick high-grade lithium intersections grading up to 3.35% lithium dioxide. It is worth noting that the company already has an established resource grading 1.5%.

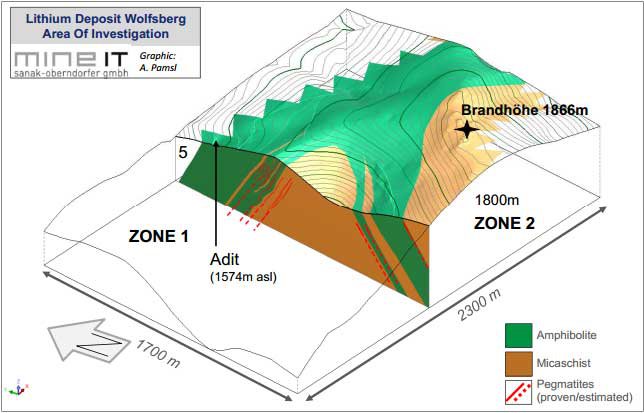

As recently highlighted by Finfeed, from an overall perspective it is encouraging that recent drilling results have confirmed strong mineralisation in previously drilled areas. However, significant upside is expected to lie in the second phase of the group’s exploration program which will investigate the anticipated extension of current mineralisation into a second zone as outlined below.

This exploration target has demonstrated to be the southern limb of an anticline of which the northern limb (Zone 1) has been the focus of all exploration to date.

Consequently, EUR is shaping up as one of those early stage maiden resource stories which could slip under the radar, providing investors with the opportunity to consider what should be a high grade lithium play situated in a region which rather than carrying sovereign risk provides close proximity to markets where lithium demand is strong and growing.

For a comprehensive overview on EUR follow this link.

Latin Resources

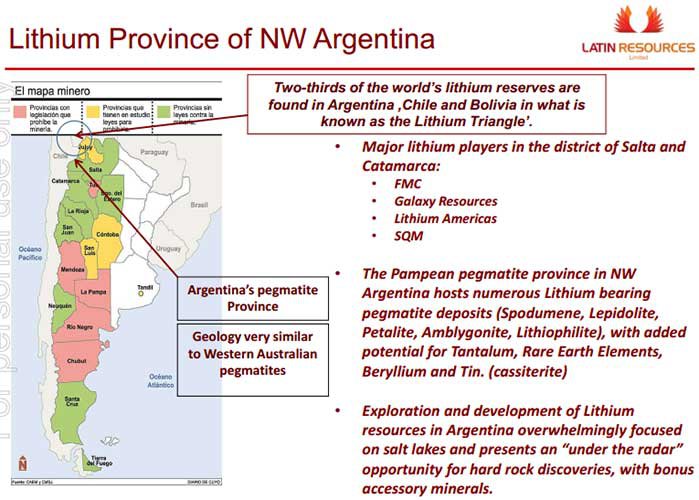

Latin Resources (ASX: LRS) is a mineral exploration company focused on the Latin American region where it has been active in acquiring new lithium projects and as recently as early November the group lodged claim applications over approximately 25,000 hectares in six exploration concessions and one vacant lithium mining concession in Central Argentina.

Some other key factors that are worth bearing in mind in relation to LRS include the fact that it also has exposure to copper in Peru, and with the base metal appearing to come back into favour last week amid commentary that we may have seen the bottom of the cycle, this could provide share price momentum looking towards 2017.

LRS is no newcomer to the region which is important in terms of operating in foreign jurisdictions. The company has more than seven years of experience in South America, having invested $20 million to date on exploration work.

The company has also attracted the interest of high profile joint-venture partners, in particular the establishment of an important alliance with First Quantum.

The group has funded geophysics survey and partial extraction geochemistry on the Pachamancha project in Peru and the target has now developed into a joint venture with First Quantum to complete drilling as agreed.

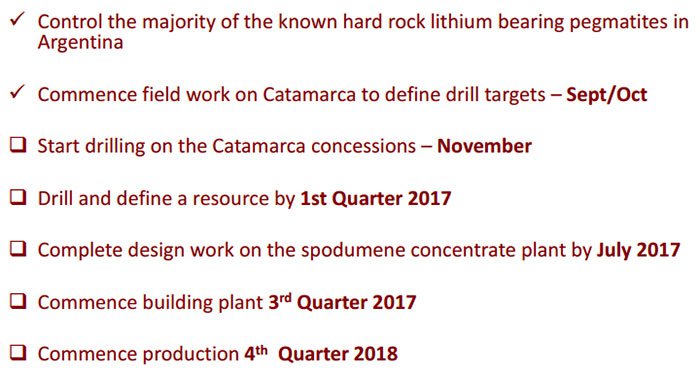

As can be seen below the company has already hit some of its milestones in recent months, but drilling at the important Catamarca concession (November), as well as the resource definition which is targeted for the first quarter of 2017 are significant developments that could provide share price momentum.

Should the necessary boxes be ticked, LRS believes that there is the potential to be in production by the fourth quarter of 2018.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.