Pacifico primed for production at Sorby Hills

Published 26-MAR-2019 11:28 A.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

In what has emerged as a company defining development, Pacifico Minerals Ltd (ASX:PMY) has completed an updated prefeasibility study (PFS) for its Sorby Hills Project, demonstrating that a high quality, high margin base metals project can be established.

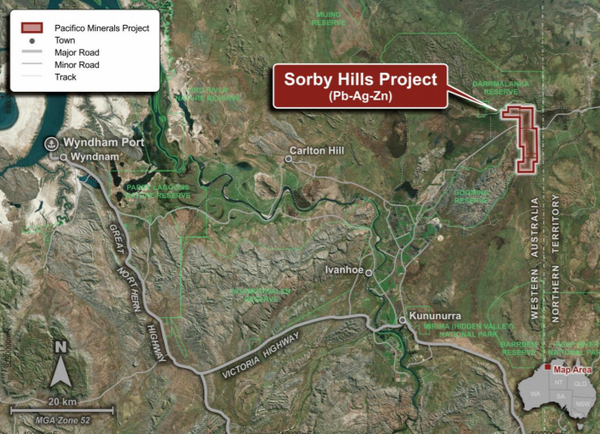

This is a significant development for the project which is strategically positioned near essential infrastructure in Western Australia, particularly given that mining leases and key permits have already been granted, placing the company in a strong position to move quickly to the development stage.

The impressive PFS combined with the company’s relatively advanced readiness no doubt contributed to the 40% share price increase that occurred on Tuesday morning.

Commenting on the PFS and upcoming initiatives, managing director Simon Noon said, “Following a substantial upgrade to the Mineral Resource Estimate in early March 2019, the economic outcomes of this study are compelling and represent an important milestone towards the development of Sorby Hills.

“Our efforts are now firmly focused on completing phase II of the planned infill and expansion drilling program and again upgrading the Mineral Resource Estimate and targeting an optimised PFS with higher throughput in the fourth quarter of this year, while also advancing the Definitive Feasibility Study (DFS) work programs that have already begun.”

Consequently, 2019 is shaping up as a watershed year for the company with multiple share price catalysts including a mineral resource upgrade, a PFS with even better commercial outcomes and a DFS that will put a finer point on the metrics and timelines surrounding the transition to production.

During this period the company will continue its exploration campaign with 6500 metres of drilling planned to start in April/May, another potential share price catalyst.

Management is already in discussions regarding project financing which could include basic debt funding from a financial institution or strategic financing, which could involve offtake agreements or an extension of its joint venture partner’s stake.

As things currently stand, Pacifico owns 75% of the project and Yuguang (Australia) Pty Ltd, a subsidiary of Henan Yuguang, owns the remaining 25%.

HYG is the largest lead smelting company and silver producer in China and has been among the Top 500 Chinese enterprises and Top 500 China manufacturing enterprises for the past five consecutive years.

Eight year mine life

The PFS proposes an open-pit operation and a 1 million tonne per annum plant that applies conventional flotation processing.

Product will be transported along an existing sealed road to the Port of Wyndham, which is located approximately 150 kilometres from the proposed mine site.

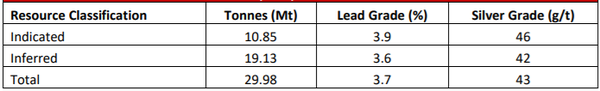

Feed to the mill for the proposed 8 year mine life is comprised of 8.6 million tonnes of Indicated Mineral Resources.

It is important to note that the tonnage volumes incorporated in the PFS don’t include Inferred Resources which currently stand at 19.1 million tonnes, indicating that their potential inclusion has the capacity to take the mine life beyond 20 years and/or be used to develop a higher throughput operation.

Crunching the numbers

As indicated below, the PFS points to steady state annual production of concentrate containing approximately 31,000 tonnes per annum of lead and 1.2 million ounces per annum of silver.

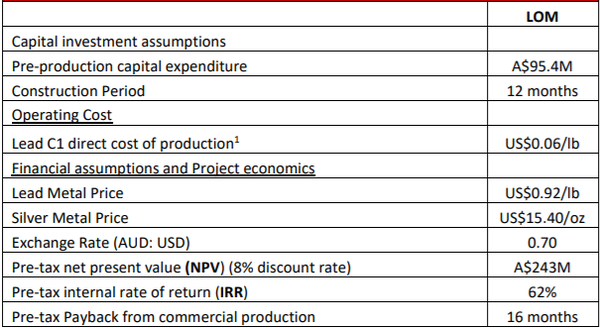

Pre-production capital expenditure is estimated to be $95.4 million and lead direct cash costs of production of US$0.06/lb, inclusive of silver by-product credits.

Using a lead price of US$0.92 per pound and a silver price of US$15.40 per ounce, together with an exchange rate of $1.00/US$0.70, results in an estimated NPV (net present value) of $243 million (at an 8% discount rate) and an IRR (pre-tax internal rate of return) of 62%.

These are compelling metrics for any project, but particularly attractive for a company with a market capitalisation of $9 million.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.