Pacifico drilling results to feed into PFS

Published 24-OCT-2018 11:50 A.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

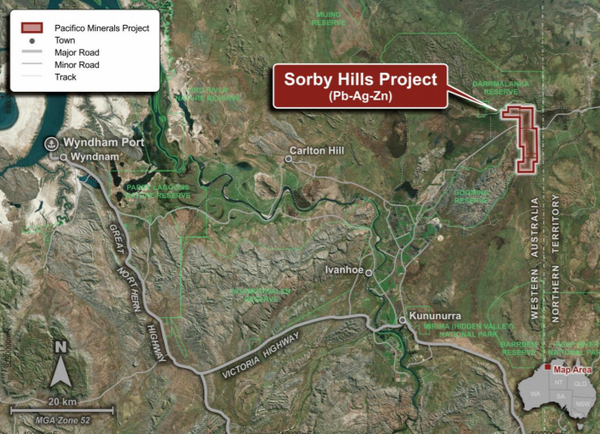

Pacifico Minerals Ltd ASX:PMY) has commenced a major drilling campaign at its Sorby Hills Lead-Silver-Zinc Project near Kununurra, Western Australia.

As part of a 12,000 metre drilling program, the initial 6000 metre infill and expansion drilling will focus on the high-grade and shallow portions of the current 16.5 million tonne lead-silver-zinc resource stop

As a backdrop, the company completed the acquisition of a 75% interest in the Sorby Hills Project only a fortnight ago and management has moved quickly to mobilise a drill rig to the area.

Immediate commencement of drilling augurs well for investors who see significant future value being realised given the strong grades and extensive mineralisation already recorded.

Pacifico is looking to extend the existing mineral resource estimate of 16.5 million tonnes at 4.7% lead, 0.7% zinc and 54 g/t silver.

The existing resource extends over two of the five granted mining leases, and the majority of the resource lies within one mining lease, ML80/197 which was granted in 1988.

Pacifico has concluded that drilling within the existing Inferred Mineral Resource or zones immediately adjacent provide the best option to incorporate an updated resource estimate from this drilling into a prefeasibility study (PFS) to be completed in 2019.

Valuable support from global smelting giant

Pacifico’s joint venture partner in the Sorby Hills Project is Henan Yuguang Gold and Lead Co Ltd (Henan Yuguang), who has maintained a 25% interest in the project since acquiring its interest on September 2010.

Henan Yuguang is the largest lead smelting company in China with headquarters in Jiyuan in Henan Province, China.

Henan Yuguang general manager, Mr Li, reaffirmed his support for the project in saying, “We are delighted that Pacifico Minerals has completed the acquisition of a 75% interest of the Sorby Hills project.

“Yuguang is committed to the Sorby Hills Project and will actively support future plans with its resources with a view to moving the project into production as soon as possible.”

Working towards PFS

Pacifico will now work with Henan Yuguang to update previous technical studies to increase the confidence in the resource estimate and undertake metallurgical testing to optimise the design of the processing plant in order to produce a simple and clean concentrate.

This will ensure that the end product complies with all regulatory requirements to complete a PFS which envisages mining, processing and exporting base metal concentrate from the Port of Wyndham, a road distance of approximately 140 kilometres from the Sorby Hills.

Summing up near-term developments, Pacifico managing director Simon Noon said, “This drill program represents a significant investment by Pacifico and Henan Yuguang in building the tonnage and gaining an understanding of the resources at Sorby Hills.

“The planned drilling is focused on expanding the mineral resource in a manner that is expected to immediately add to the project’s Indicated Resources and assist in preparing for Phase 2 of the drilling campaign to move a portion of the resource to an Ore Reserve, enabling planning for a future mining operation.”

Exploration potential

Beyond the initial high-priority infill drilling, Pacifico has highlighted exploration potential outside of the existing estimated resource, where a number of orebodies remain open along strike and warrant follow up drilling.

Expanding the resource would add further value to the project as it would provide scale to increase production off a relatively fixed cost base.

Over the years, the project has seen the development of the Kimberley region with a number of operating mines in the East Kimberley producing diamonds, iron ore, nickel, lead and zinc and more recently the development of a rare-earth mine.

The expansion of the Ord Irrigation Scheme has required significant involvement from government authorities and this has assisted the project in receiving a comprehensive environmental review by the West Australian Environmental Protection Authority.

The area is also well served in terms of export infrastructure with access to the port of Wyndham.

However, Noon, sees the scope for further development saying, “Pacifico believes that it can incorporate improvements in infrastructure, including a sealed highway from the mining lease to the port already in place, better handling of base metal concentrate using sealed containers, and a desire from customers seeking a clean lead-silver concentrate free from deleterious elements to offset the closure of a number of lead mines in China.”

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.