OSL’s Pancreatic Cancer Treatment Approved for Sale in Europe

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

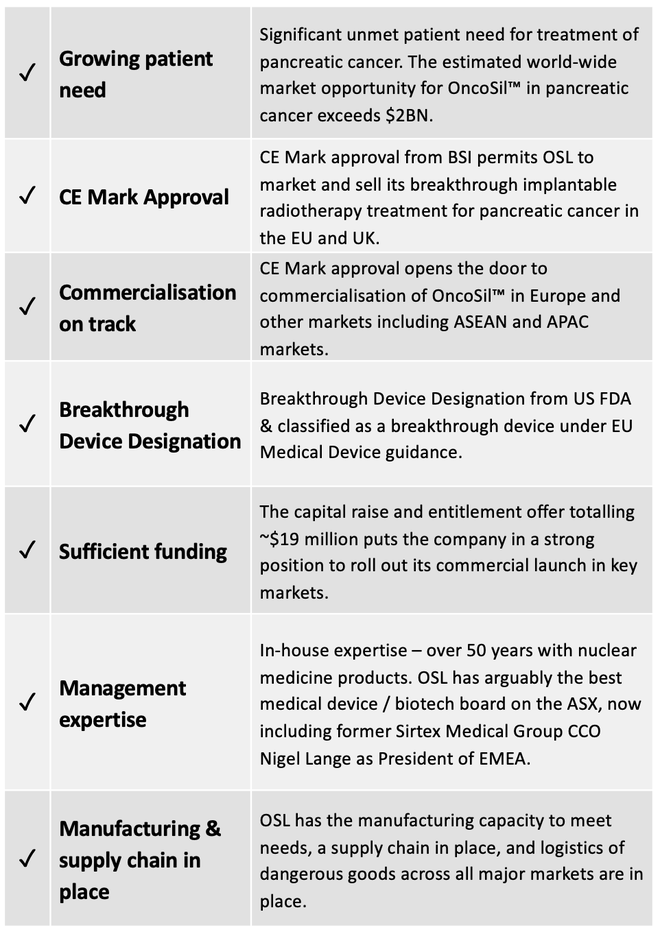

By 2030 pancreatic cancer will be the second leading cause of cancer death in Western countries.

Poor survival rates are due to severely limited treatment options for patients living with pancreatic cancer and radical surgery is the only current treatment that provides a chance for a cure.

Medical device company OncoSil Medical (ASX:OSL) is developing solutions to treat both pancreatic and liver cancer. Its lead product, the OncoSilTM device implants a pre-determined dose of beta radiation directly into cancerous tissue via an endoscopic ultrasound.

Patients treated with OncoSilTM in combination with chemotherapy (CT) have a median overall survival of 16.1 months — almost double the accepted median overall survival in patients with unresectable pancreatic cancer — as demonstrated in clinical studies.

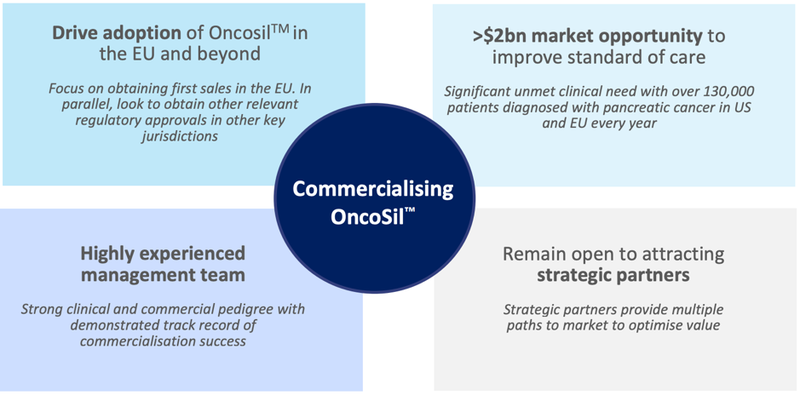

OncoSil has recently achieved a significant regulatory milestone — receiving CE Mark approval for its OncoSil device for the treatment of locally advanced pancreatic cancer (LAPC) in combination with chemotherapy from the British Standards Institute (BSI).

This European CE Marking approval permits OSL to market and sell its breakthrough implantable radiotherapy treatment for pancreatic cancer in the European Union and the United Kingdom.

European CE Marking approval is a major inflection point for OSL — it de-risks the company, allowing it to market and sell its breakthrough implantable radiotherapy treatment for pancreatic cancer within the EU and the UK.

With the OncoSilTM device now approved for commercial sale in Europe, OSL has also filed for multiple registrations in key ASEAN and APAC markets that recognise CE Marking certification.

The OncoSil device has also been officially classified as a “breakthrough device” under EU Medical Device guidance. In addition, in the US it has received Breakthrough Device Designation from the US Food and Drug Administration (FDA).

The CE Mark approval was achieved based on the compelling clinical outcomes from OncoSil’s PanCO study which showed a prolonged median overall survival of 16.1 months, almost double the accepted median overall survival for patients with pancreatic cancer.

The study showed an encouraging rate of surgical resection with curative intent with nearly one-in-four patients downstaged.

To help progress OSL’s EU, UK and ASEAN commercialisation efforts, the company announced a capital raise of approximately $14 million via an institutional placement supported by existing and new investors, plus an additional raise of approximately $5 million for an entitlement offer.

The funds raised allow the company to drive commercialisation activities across UK, Europe and ASEAN regions as well as accelerate US commercialisation in bile duct cancer.

Furthermore, to help build the company’s commercial infrastructure on the ground in Europe, OSL has appointed former Sirtex Medical Chief Commercial Officer Nigel Lange as President of Europe Middle East Africa (EMEA).

The company is on a clear commercialisation path, targeting first EU sales later this year.

Share Price: $0.11

Market Capitalisation: $68.3 million

Cash position: $4.8 million (at 31 March 2020) – excludes funding from recent capital raise)

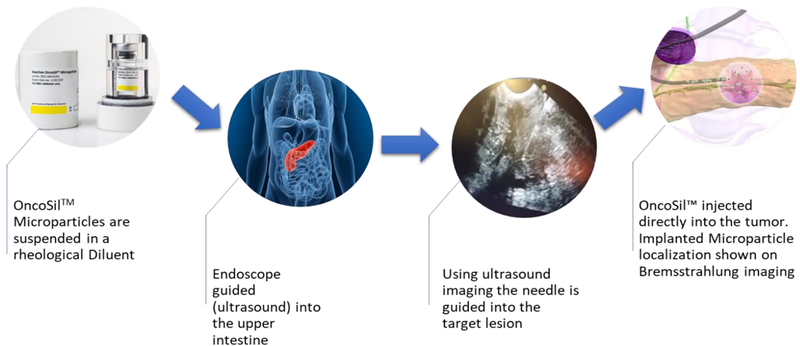

OncoSil Medical’s (ASX:OSL) lead product, OncoSilTM is a targeted radioactive isotope (Phosphorus-32), that’s implanted directly into a patient’s pancreatic tumours via an endoscopic ultrasound.

It is a single-use brachytherapy device that implants a pre-determined dose of beta radiation directly into cancerous tissue to deliver more concentrated and localised beta radiation compared to external beam radiation.

The beta particles emitted by OncoSilTM travel a short distance in the tissue causing damage to cancer cell DNA, which renders them incapable of further cell division and proliferation.

The device is used for the treatment of pancreatic cancer and is intended for locally advanced, unresectable pancreatic cancer (LAPC), in other words, patients who are unable to undergo surgery to remove their tumours due to either tumour size, or the location in the pancreas.

For further background on OncoSil read our in-depth initial article:

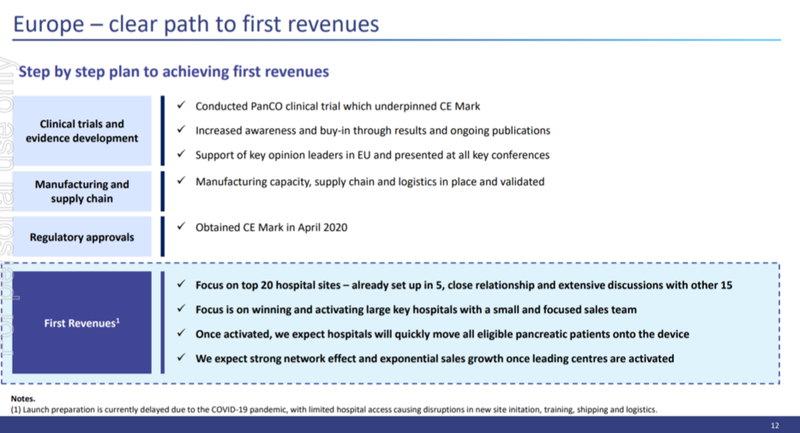

The company has a clear path to first revenues in Europe:

Healthcare veterans to move Oncosil forward

The CE Marking approval means OncoSil is now able to activate and accelerate its European commercial roadmap. To help build the company’s commercial infrastructure on the ground in Europe, former Sirtex Medical Chief Commercial Officer Nigel Lange has been appointed EMEA President for OncoSil.

Lange has over 30 years’ experience in the medical devices industry and a demonstrated track record of success in commercial leadership roles and will help position OncoSil as a major player in the pancreatic cancer treatment space..

Furthermore, on 31 March, Karl Pechmann was appointed as Chief Financial Officer and Company Secretary. Pechmann was previously CFO and Company Secretary of a regulatory technology company, Kyckr Limited (ASX: KYK). Other prior roles include Finance Director with ASX listed biotech company, Immutep Limited (ASX: IMM) and he has held senior finance roles at both ASX-listed and multinational organisations.

CE Mark Approval

As mentioned, on 1 April, OSL announced that it received CE Mark approval from BSI for its device for the treatment of locally advanced pancreatic cancer in combination with chemotherapy.

This first approval is a major milestone for OncoSil and allows for the OncoSilTM device to now be marketed and sold within the European Union and the United Kingdom.

This is puts the company’s commercialisation strategy in full swing, as outlined below:

The CE Marking approval was achieved based on the compelling clinical outcomes from the PanCo study.

The international multi-institutional PanCo study was conducted across 12 sites in Australia, UK and Belgium to further investigate the safety, efficacy, feasibility and performance of the OncoSilTM device when implanted intratumorally in patients with non-resectable locally advanced pancreatic cancer (LAPC).

The key data from PanCo was presented at American Society of Clinical Oncology (ASCO) in June 2019.

The OncoSilTM device was shown to provide a valuable treatment option in an area of high unmet medical need with an acceptable safety and tolerability profile.

Treatment with the device was associated with a reduction in both the size and the fibrosis of tumours along blood vessels — a finding not seen in study participants undergoing chemo-only regimens.

The highlights were:

- Interim median survival of 16 months in the per protocol group vs approximately nine months in the standard of care.

- One-year survival of 64% vs 50% on standard of care.

- Improved resection rates which lead to potentially curative surgery.

- There were no serious safety concerns.

In addition to CE Marking approval, the OncoSilTM device has now been officially classified as a “breakthrough device” as defined under EU Medical Device guidance.

In the EU, a “breakthrough device” is defined as one that delivers clinical benefit to patients for unmet medical needs which are life threatening and for which current medical alternatives are insufficient or carry significant risks.

The OncoSilTM device is now officially designated as a breakthrough device in both the EU, and the UK as well as the US.

FDA breakthrough device designation

In the USA, an early path to market has opened.

Also, on 18 March, the US Food and Drug Administration (FDA) granted Breakthrough Device Designation to OncoSilTM device for the treatment of unresectable, locally advanced pancreatic cancer in combination with systemic chemotherapy.

The granting of this designation is infrequent for new drugs and devices and will likely materially accelerate OSL’s path to US revenues.

In 2019, just 26 drugs were given Breakthrough Designation and of these, 12 were supplements for new indications of already approved drugs. Of the 14 new drugs, nine were for oncology indications.

While Breakthrough Designation is not common, the benefits however, are significant.

OSL will have priority access to FDA consultants during the design of the clinical trial as well as expedited meetings with the FDA and a range of concession in order to fast track the approval process.

The company will still be required to conduct a clinical trial in the US, but there is now potential for an accelerated approval based on a review of interim data.

The US is a huge addressable market for OSL and of the approximately 48,000 new cases annually of pancreatic cancer, an estimated ~42% are unresectable, locally advanced and may be suitable for the OncoSil device, once approved.

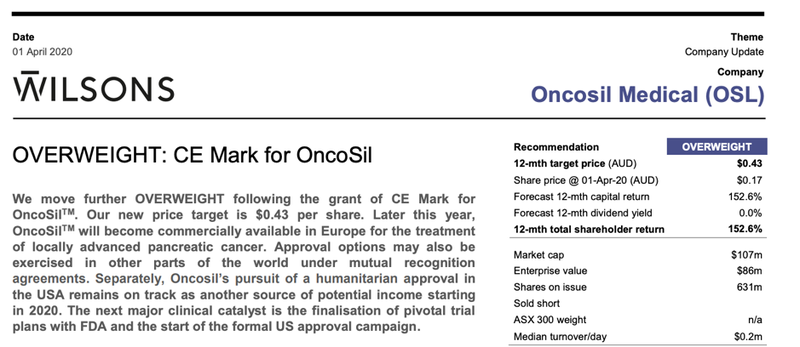

Wilsons: “Overweight”

Following the 1 April CE marking announcement Wilsons released a research report on OSL.

The broker stated that “Wilsons move further OVERWEIGHT following the grant of CE Mark for OncoSilTM with a new price target of $0.43 per share”.

This was a significant premium to the share price at the time of 17 cents, implying a 152% 12-month return.

This price target was lifted by 43% to $0.43/share as Wilsons ‘de-risked’ the granting of CE Mark in its valuation. It sees further upside available this year as US market access under HDE and as the company’s pivotal clinical trial plans are confirmed.

The report stated: “The clinical data that supports OncoSilTM has continued to improve in terms of patient survival, and changes to the European medical device approval process has been a systemic challenge for developers over the last 12-18 months.“

It added: “This [CE Marking] is the product’s first major market approval and serves as strong validation of the therapeutic concept.”

Wilsons maintains its long-term launch outlook, “in spite of near-term disruption from COVID19”, while recognising that the anticipated international approvals provide additional growth opportunity.

Wilsons identifies the next major clinical catalyst as “the finalisation of pivotal trial plans with FDA and the start of the formal US approval campaign.”

The full report from Wilsons is available HERE.

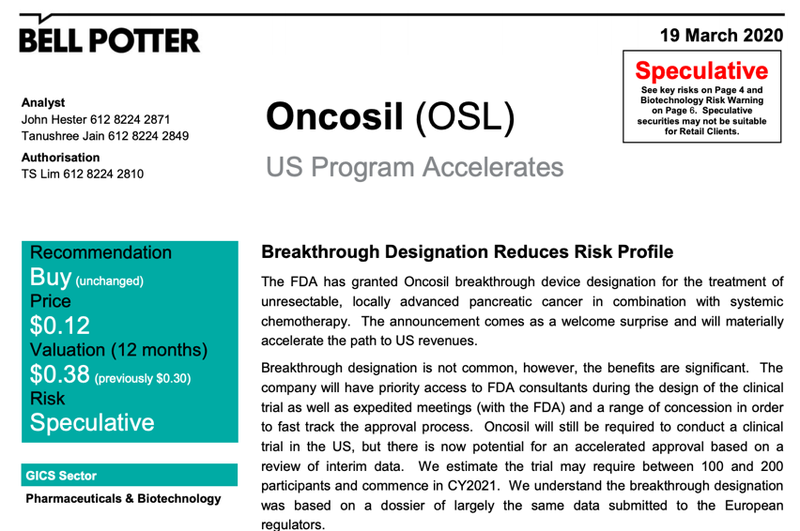

Bell Potter – ‘Speculative Buy’

Prior to the above Wilson’s report, in mid-March, Bell Potter released a report following OncoSil’s Breakthrough Device designation in the US.

Bells retained its Speculative Buy recommendation and raised its valuation to $0.38 from $0.30 — even before CE Marking had been granted. This was a significant premium to OSL’s share price at the time of $0.12.

The broker said: “In our view the awarding of breakthrough designation together with the clinical data from PanCo significantly increases the likelihood of a US approval. For these reasons we have lowered the risk rating attached to future US revenues.

“Accordingly, the valuation which is based on a DCF is increased to $0.38 from $0.30 and we maintain our Buy (Speculative) recommendation. There are modest changes to earnings associated with a delay to the product launch in Europe and incorporation of expected clinical trial costs.

The full report is available HERE.

What’s ahead for OncoSil?

The recent CE Mark approval for the OSL’s OncoSilTM device and the recent capital raise helps de-risk the company and puts the company’s commercialisation strategy into full swing.

Later this year OncoSilTM will become commercially available in Europe for the treatment of locally advanced pancreatic cancer

The company’s strengthened capital position and clear path to revenue generation means this may be a beneficial time for new investors to look into OncoSil. While the share price did initially spike on the CE Marking approval, it has since pulled back reflecting the uncertainty around timing due to COVID-19, so could now provide a good long-term entry price given the company’s clear path to first revenues.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.