Oil junior Melbana reports strong progress at Zapato well

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Oil explorer Melbana Energy Ltd (ASX:MAY) this morning provided an encouraging progress update.

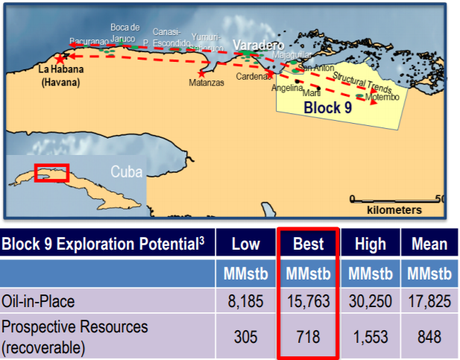

Cuban regulatory authorities have provided environmental approval for MAY's Zapato exploration well — the proposed second well in its Block 9 drilling program. This suggests that Melbana is making good progress.

Melbana and Anhui Guangda Mining Investment Co Ltd (AGMI) have exchanged binding documentation regarding the Block 9 farmout, completing another milestone as the parties target execution of the binding definitive agreement by December this year.

Under the terms of the farmout, AGMI will fully fund all costs in Block 9 for the duration of the PSC, including a minimum commitment to drill three exploration wells on MAY's preferred targets.

This includes all exploration, appraisal and development wells, and any facilities development costs.

In return, Melbana will receive 12.5% of the profit oil under the Block 9 production sharing contract.

Melbana's chief executive, Robert Zammit, said, “We are making progress with our Block 9 farminee to progress to a binding agreement and also plan for the first well to be drilled in Block 9.

“It is pleasing to obtain the environmental permit for Zapato, the proposed second well in our Block 9 drilling program.”

AGMI is a private company that reports assets in excess of US$1 billion, including 20 onshore drilling rigs and oil production of 6,000 barrels/day.

The company has diversified operations through its subsidiaries in over 13 exploration and exploitation blocks in Kyrgyzstan and in areas of the Americas, as well business relationships with major state-owned Chinese companies such as CNPC, Sinopec, and CNOOC.

AGMI brings quality infrastructure, proven expertise and financial stability to the project — a major benefit for MAY.

A drilling rig made available by a local operator is currently being considered to drill the first exploration well, Alameda, in April 2019. However, AGMI has access to its own drilling rigs which it may import into Cuba to undertake the Block 9 drilling program.

Promising survey data at Beehive

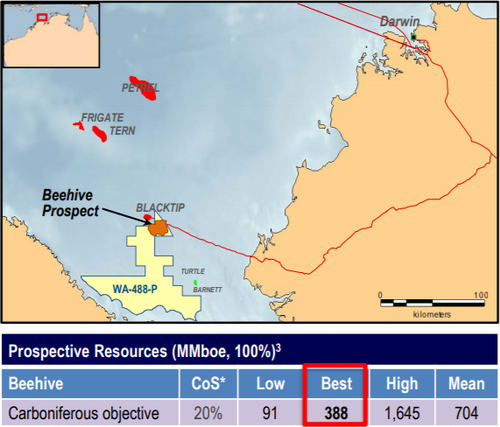

Melbana has also received promising news regarding a 3D seismic survey which was conducted at its Beehive prospect in Australia.

Located in offshore WA, it is the largest undrilled hydrocarbon prospect in Australia:

Melbana has reviewed early data products from the 3D seismic survey, which are of an excellent quality for this stage in the processing exercise.

Data processing will continue, with a final data set due to be received by early February 2019.

The processing of the survey data is being undertaken currently by CGG, a French-based geophysical services company that operates across the global oil and gas industry.

French oil and gas major Total and Australia's Santos have a farm-in agreement with MAY. Total and Santos have an option (exercisable together or individually) to acquire a direct 80% participating interest in the permit in return for continuing to fully fund the costs of all activities until completion of the first well in the WA-488-P permit.

The option is exercisable by either Total and/or Santos at any time but no later than 6 months from the receipt of final processed seismic survey data.

If the option is exercised, drilling would be expected to be no later than 2020, with Melbana estimating that the Beehive-1 exploration well cost is indicatively in a range between US$40 million and US$60.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.