The next Ripple? Crypto solution ivyKoin set to disrupt payments systems

Published 30-JAN-2018 15:00 P.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

With the rise of Bitcoin and the sustained momentum of last year’s initial coin offering (ICO) trend, even mainstream financial institutions like Goldman Sachs are beginning to realise the potential of the cryptocurrency and blockchain boom. However, cryptocurrency anonymity is incompatible with the current international payment framework and has slowed down mainstream adoption.

One company, ivyKoinTM, looks to have a highly disruptive solution to this problem. ivyKoin is building a blockchain-based cryptocurrency for business transactions: particularly those which exceed US$10,000 and therefore require extensive verification in the international monetary system.

Backed by a number of industry heavyweights, including the former regional and business heads of the likes of PayPal, Westpac and Dexia, in combination with talent from some of the world’s leading tech companies including Microsoft, Intel Capital and MySpace, ivyKoin has assembled a formidable team to conduct a rapid product rollout within the international banking and financial system.

That rollout is boosted by the strategic investment of ASX-listed US-based Change Financial (ASX:CCA | OTCQX:CNGFF), which provides a demonstrated track record of opening traditional banking channels to new technology via its popular Chimp Change smart wallet banking app.

ivyKoin is being specifically designed based on direct feedback from the banks so that ivyKoin users can voluntarily de-anonymise transaction data to provide Know Your Customer (KYC) and Know Your Transaction (KYT) information in accordance with Anti-Money Laundering (AML) laws, and serve as a bridge between cryptocurrencies and the international payment system.

ivyKoin has the potential to disrupt the global financial transaction market worth US$9 trillion per day. For instance, an existing secure transaction system used worldwide called SWIFT, processes some US$5 trillion per day — or US$1.25 quadrillion per year.

It has to be noted here, that ivyKoin is an early stage tech play operating in the high risk cryptocurrency investment environment. Investors in any cryptocurrency should seek professional financial advice before making their investment decision.

ivyKoin’s belief that it offers considerable technological and architectural improvements to incumbent payment networks, and over the global leading altcoin, Ripple — its closest peer with a current market capitalisation of US$52 billion — means that success in its stated vision could lead to a substantial re-rate. On completion of its pre-sale, ivyKoin expects to have a market cap of US$84 million, equivalent to approximately 0.16 per cent of Ripple.

As a decentralised system of transaction validation, the ivyKoin network offers a range of considerable advantages over traditional incumbent and competing payment networks. It’s quicker, more accessible and cheaper, with no delays and more expansive data. The network is also fully trackable and non-forgeable, providing greater security.

In contrast to Ripple, according to ivyKoin it allows for more than 74 KYC and 120 KYT data points and customer files per transaction. In fact, it’s designed specifically to break down the KYC/KYT/AML barriers between cryptocurrency and the existing financial system, with Chief Technology Officer Michael Beck commenting, “Whilst Ripple is centralised and offers few transaction data points, ivyKoin is being purpose built across a decentralised network, with a far richer set of information to allow better integration with the current financial system”.

How the platform works

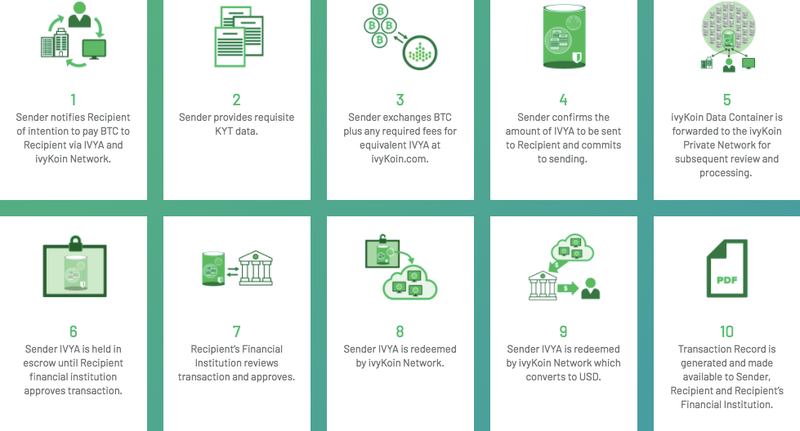

All ivyKoin transactions will use ivyKoin tokens for settlements, with significant KYC and Anti-Money Laundering (AML) data to be embedded into the cryptocurrency itself.

The following diagram gives an overview of how it works:

Source: ivyKoin

Token Pre-sale offer

ivyKoin is currently conducting a token pre-sale offer for the purchase of ivyKoin tokens for US$0.10 each.

The Token Pre-Sale Offer closes at 5pm (AWST) on 9 February and comes ahead of the company’s Planned Token Generation Event and listing, on track to occur within the first quarter of this year.

ASX Change Financial’s Managing Director and CEO Ash Shilkin said: “From having made our initial investment into ivyKoin in October last year with an intention to leverage our technical capability and banking relationships into the platform, I am excited to see the pace of progress since and the Company’s current potential as ivyKoin engages with prospective banking customers and moves towards a token listing.”

NB: For more information about ivyKoin and its Token Pre-Sale offer, you can find the company’s WhitePaper on its website at https://www.ivykoin.com

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.