Is this Newly Listed Micro-Cap About to Put Manganese in the Spotlight?

Published 15-AUG-2017 09:37 A.M.

|

16 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

One tiny ASX listed metals explorer is in fighting shape to undertake an aggressive program of works across its diverse, clean energy-focused portfolio.

Freshly recapitalised, having raised funds to the tune of $4.5 million, the company has realigned its focus and begun trading on the ASX under a new code.

Its current market cap is just $5.4 million, attributing an Enterprise Value (EV) of just $900,000 to this company, it is clear that this stock is well funded to start adding some serious value over the coming months.

The ASX micro-cap has set its sights on a compelling string of prospects in the globally recognised Gascoyne and Pilbara mining regions in Western Australia, as well as an intriguing property in South Australia.

With an immediate view to explore these highly prospective tenements, a flood of news flow from the company is expected in coming months and into 2018.

With a strong emphasis on clean energy applications and battery technology, this company is looking for key ‘next generation’ battery metals.

Lithium is one half of the clean energy equation in its portfolio, and we hardly need to tell you about the electric vehicle-powered future of this relentlessly high-performing metal.

Another crucial piece of the battery puzzle for this forward-looking company is manganese.

That’s right. This lesser-known metal is driven by both the robust steel industry and growing demand from clean energy applications — electric vehicles, off-the-grid power systems and other energy storage applications will require significant amounts of manganese.

The estimated demand for manganese in 2022 is forecasted to reach 28.2 million metric tonnes.

Supply, however, is in decline. The US Geological Survey (USGS) estimated that the world produced 8.6% less manganese in 2016 than in 2015.

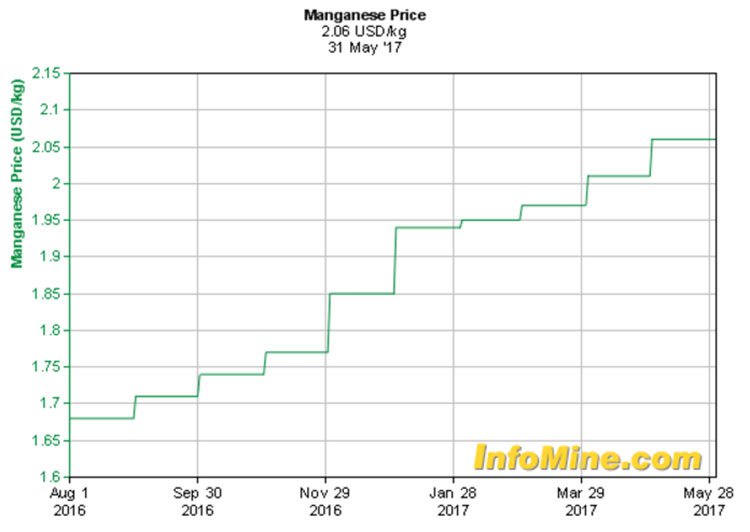

With all these macro factors at place, it is on the rise, with the price of manganese up more than 42% since the start of 2016.

However, we should point out that commodity prices can also fluctuate down, so caution should be applied to any investment decision and not be based on historical spot prices alone.

Could we see a great manganese boom unfold over the coming months to rival that of lithium and cobalt?

With the incumbent manganese industry highly concentrated and in need of a shake up by a fast moving ASX micro-cap, this company could be in the right place at the right time, having acquired 100% of the Battery Hub Manganese Project in Western Australia.

Close to $5 million has already been spent on this project to date, with high-grade manganese (of more than 40%) being delineated from reverse circulation (RC) drilling.

The company has initiated review of extensive historical exploration database from the project, with drilling expected to start in late August to early September— a matter of weeks away.

Nearby, at its Mt Boggola project, the company is targeting gold-copper mineralisation defined by previous drilling and surface sampling.

The high-grade copper mineralisation will be assessed via sampling and mapping, with a plan to drill in early 2018.

In Gascoyne, WA, the company has an 80% interest in the Morrissey Hill Project, which is prospective for lithium and tantalum mineralisation. Field work will commence here immediately, as well as at the Bordah Well Project, which is prospective for gold-copper and uranium.

Remember, this company is currently capped at a miniature $5.4 million, but with an assortment of activity anticipated very soon, exploration success at any of these projects could prove to be a considerable share price catalyst.

And considering its assets, this could well be an excellent entry-point into a promising micro-cap opportunity.

Unveiling:

Pure Minerals Limited (ASX: PM1), formerly Eagle Nickel, is an emerging junior explorer with a diverse portfolio of highly prospective copper, lithium and manganese projects in globally significant WA mining districts.

With a strong balance sheet under its belt to the tune of $4 million at completion, following a successful capital raising , PM1 can now embark upon an aggressive program of works at its prime exploration prospects.

A new look

In October last year, PM1 announced sweeping changes to its board and shareholder base, with the exit of former chairman Xuefeng Mei, who, since May 2012, had controlled 51% of the shares in the company.

Since being replenished, the new board has spent considerable time on financial reporting, as well as articulating its intentions to pursue potential acquisitions with a compelling investment case, which would result in suspension of trading in its shares being lifted.

Which brings up to another pivotal development in the lead-up to the now-recapitalised PM1...

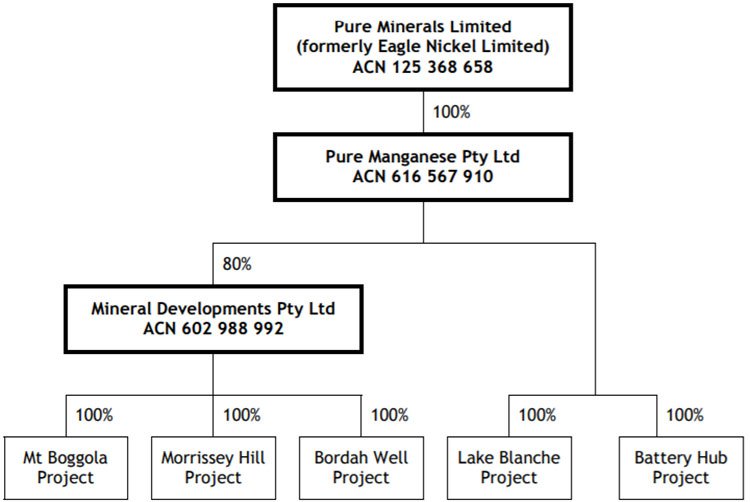

In March this year, the company announced it had agreed to acquire the entire issued capital of Pure Manganese Pty Ltd , an Australian-based proprietary company which was established in December 2016 as a special purpose vehicle to secure exploration and prospecting licences.

Pure Manganese has two exploration licence applications for highly prospective manganese projects and has, in turn, an agreement in place to acquire 80% of Mineral Developments (MDV), which holds four WA exploration licences.

Pure Manganese also has an agreement in place with a subsidiary of GB Energy Limited (ASX: GBX) to acquire an additional South Australian exploration licence (EL5391).

On completion of these acquisitions, PM1 will have a clear path on which to focus exploring and developing a diversified prospective package of tenements and tenement applications for lithium, rare earths, uranium, gold, copper and manganese projects in both WA and SA.

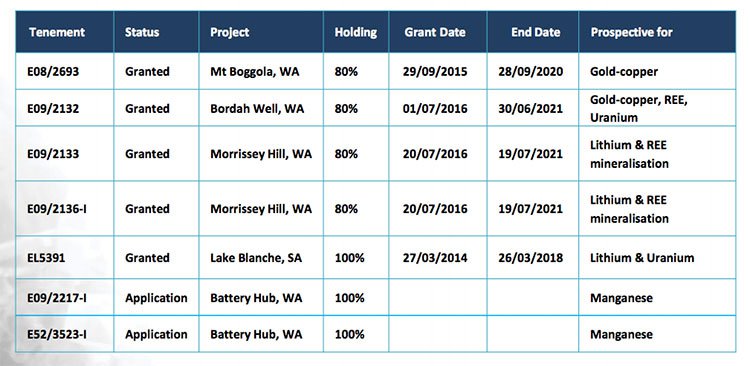

This is what PM1’s assets and proposed business makeup will look like following completion of the acquisitions:

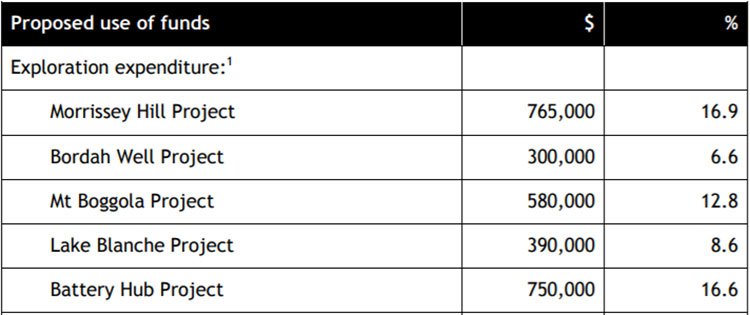

With this fairly drastic revamp comes a considerable capital revitalisation, with around $4.5 million raised. Some $2.8 million of this will be used to undertake exploration across the five projects PM1 now has in its sights, as laid out below:

PM1 now has 270 million shares on issues, of which 17.5 million will be escrowed for 12 months or more.

With an experienced board and management boasting extensive project delivery expertise and deep capital markets networks, the new look PM1 is impeccably placed to embark on a focused exploration program.

Underpinning PM1’s exploration strategy is its exposure to highly favourable battery tech metals, especially manganese and electrolytic manganese (we’ll look at this emerging manganese market in more depth in a bit).

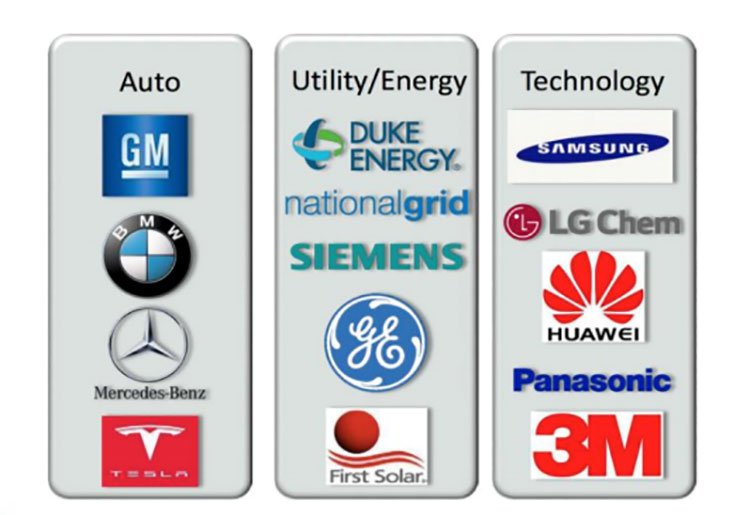

PM1 has also identified a movement towards the utilisation of cheaper input materials in lithium battery manufacture and energy storage technology. End users in electric vehicles, utilities and technology sectors have been actively developing ‘next generation’ batteries containing manganese as a key ingredient.

Companies like these, for instance...

Subsequently, PM1’s exploration properties are highly prospective for metals that it believes will be key components of the next generation of rechargeable batteries.

Its immediate course of direction?

To undertake surface exploration programs at its Morrissey Hill and Mt Boggola projects, before shifting its focus to drilling at its Battery Hub prospect in late August once the tenement has been granted.

Once granted, the plan is to start drilling at the project with a view to advancing it to a maiden resource estimate. Metallurgical testing will soon follow thereafter.

In short: PM1 has a very full dance card for the second half of 2017.

Let’s take a closer look at these assets.

PM1’s diverse portfolio

Setting the scene for busy coming months, the map below shows you the full expanse of the PM1’s projects.

To give you an idea of exactly what is being targeted and where, this is what PM1’s overall tenement portfolio looks like:

Battery Hub Manganese Project

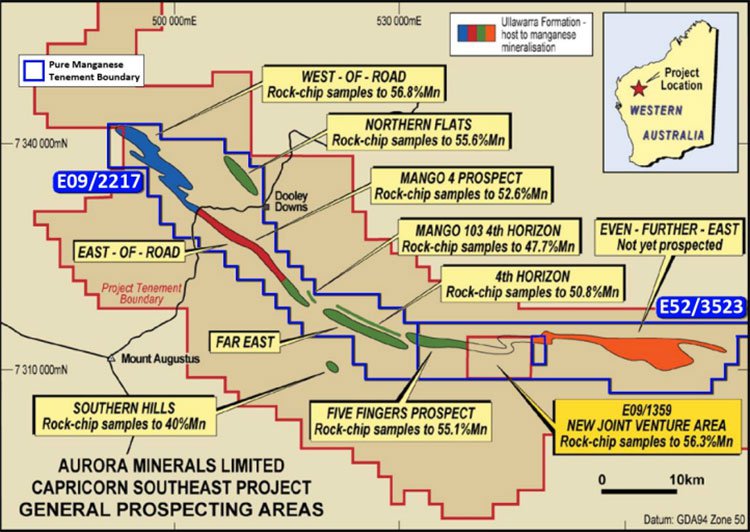

PM1’s 100% owned Battery Hub Project comprises a 50 kilometre mineralised trend of 68 near-surface manganese prospects.

Importantly, nearly $5 million has already been spent by Aurora Minerals on the project to date.

Surface samples and RC drilling have reported grades of significant mineralisation of over 40% manganese. Advantageously, all of the mineralisation is near the surface.

South of the infrastructure is also the richly mineralised Pilbara region.

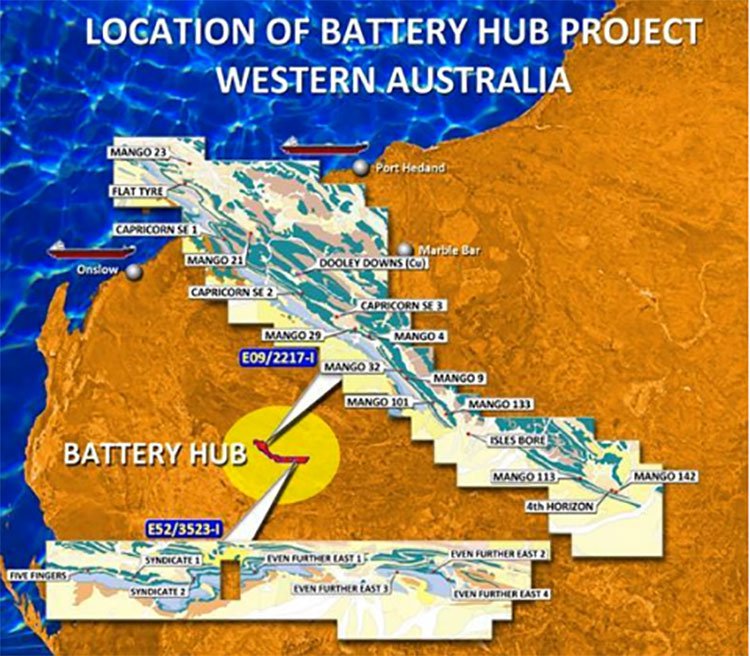

The project’s location is shown in the map below:

And here’s PM1’s Battery Hub tenements (E09/2217 and E52/3523):

These Battery Hub tenements, which cover an expanse of some 724 square kilometres, are expected to be granted at the end of August and in early October.

Prior to that, the company will undertake a detailed review of the extensive historic drilling, mapping and surface sampling data. From this, it will generate high-priority drill targets and develop a detailed drilling plan.

Part of PM1’s immediate plans with this high priority Battery Hub project is also resource delineating, as well as a scoping study to ascertain the viability of the project.

Nearby...

Morrissey Hill & Bordah Well

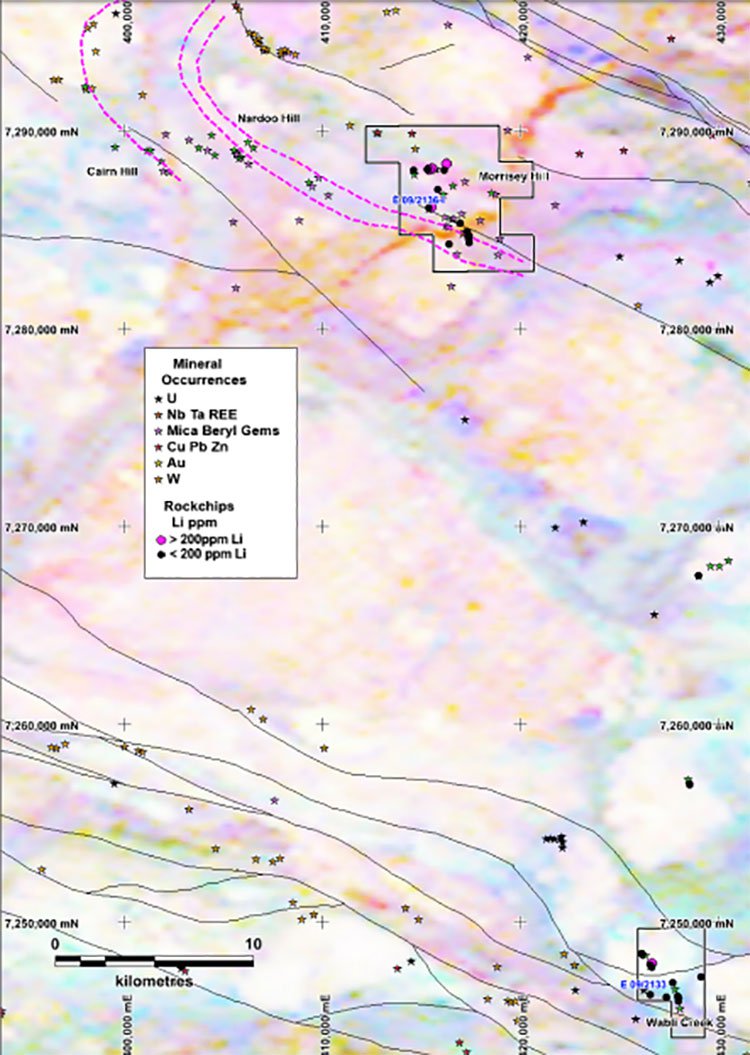

PM1 will immediately mobilise an exploration team to its 80% owned Morrissey Hill Project, which is located some 200 kilometres east of Carnarvon and 51 kilometres east of the Gascoyne Junction.

The team will soon begin a program of detailed geological mapping, soil sampling and rock-chip sampling in a pegmatite terrane prospective for lithium and tantalum. Multiple pegmatites have been identified on site, including the former Beryl Mine.

The Morrissey Hill Project is located directly next to Segue Resources’ (ASX: SEG) Reid Well lithium-tantalum discovery. Recent surface exploration at Segue’s property returned values of 3.77% lithium oxide, 2.22% lithium oxide, and 1.89% lithium oxide.

Below is the plan of the Morrissey Hill Project, showing rockchip samples taken by MDV, mineral occurrences, prospects, tenements and interpreted pegmatites over GSWA radiometric data.

In the case of both Morrissey Hill and Mt Boggola (which we’ll look at in a moment), the plan is to identify drill targets that can be tested in late 2017.

Due to its considerable history of mining and well-documented geology, the Morrissey Hill region in the Yinnietharra area was often explored when ‘rare’ or ‘exotic’ minerals were in demand. However, most exploration programs (which largely occurred during the 1970s) have solely comprised mapping and surface sampling of some description.

The immediate plan for Morrissey Hill over the coming months includes detailed field mapping and sampling, characterisation of pegmatite phases to determine prospectivity for rare metals, and drilling to test identified targets for rare metal mineralisation.

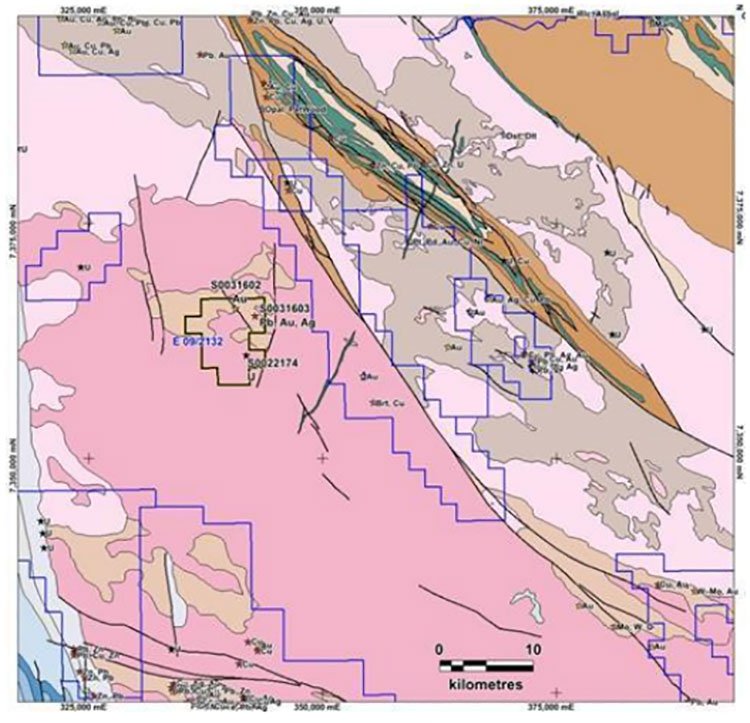

Meanwhile, PM1’s Bordah Well tenement (E09/2132) spans 57 square kilometres, and is prospective for gold-copper, uranium and REE mineralisation associated with pegmatites and other intrusive rocks. Here multiple pegmatitic rocks have been identified.

Bedrock geology, showing mineral occurrences and prospects, is mapped out below:

Mt Boggola Copper Project

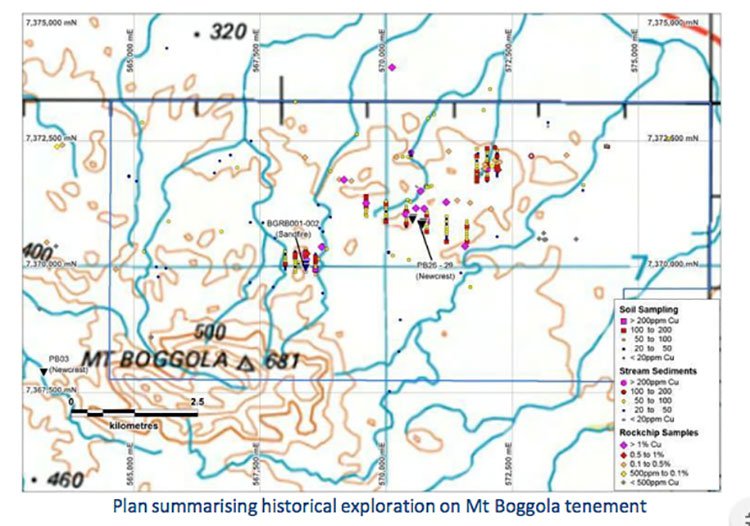

PM1’s Mt Boggola Project is situated approximately 60 kilometres south of Paraburdoo. The map below shows historical exploration on the tenement:

PM1’s tenement (E08/2693) spans some 62 square kilometres, and is prospective for gold-copper mineralisation, which has been defined by previous drilling and surface sampling, with the previous tenement holder, Newcrest Mining Limited, having most recently identified mineralisation on site.

The PM1 team will undertake mapping and surface sampling at the Mount Boggola Project, which contains a gossan outcrop that has returned historic surface sampling grades of greater than 20% copper.

Its exploration plan will also consist of field mapping and reconnaissance sampling to confirm location of the gossans identified by historical explorers and drilling. PM1 will then drill to test extensions to mineralisation identified by Newcrest.

Lake Blanche Project

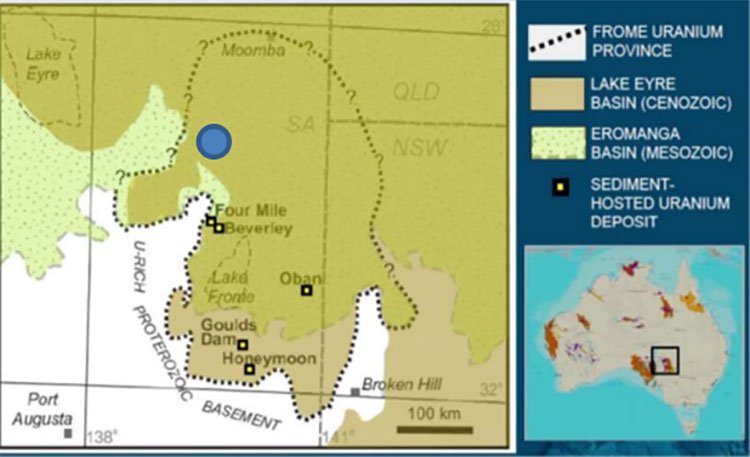

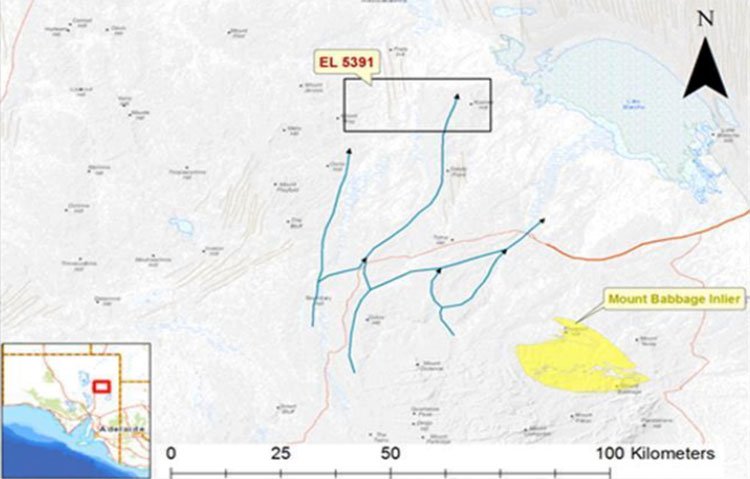

Finally, PM1 is targeting sediment-hosted lithium and uranium, as well as lithium brines, at its 100% owned Lake Blanche Project.

The project is located in the remote north-eastern part of South Australia, approximately 120 kilometres north-east of Marree. Access to the general area is via the Strzelecki Track east of Lyndhurst and then via station tracks.

PM1’s tenement is situated within the Frome Uranium Province:

This region is highly prospective for sedimentary uranium in Cenozoic sediments and contains a large number of existing uranium deposits. Mineralisation in the Froome Uranium Province is theorised to result from the leaching of uranium from granitic and metamorphic rocks in the Mt Painter Inlier approximately 100 kilometres south of the Lake Blanche Project.

The same source rocks for the uranium mineralisation are also known to have high concentrations of lithium and rare earth elements.

Elsewhere in the world, leaching of such rocks leads to the formation of groundwater highly enriched in lithium, potash, and rare earth elements. Should these groundwaters be contained in closed lake environments from which evaporation can occur, lithium rich brines could form.

Recent work in the region by Geoscience Australia and the South Australian Department of State Development means that a substantial dataset of magnetic, radiometric and EM data is available.

You can see the location of Lake Blanche in the map below, which shows interpreted palaeochannels in blue arrows:

The plan with this project? To review and reprocess the geophysical data, and to sample the lake sediments and brines for lithium.

Of course, as with all minerals exploration, success is no guarantee. Consider your own personal circumstances before investing, and seek professional financial advice.

Manganese: the next generation battery metal you may not have heard of

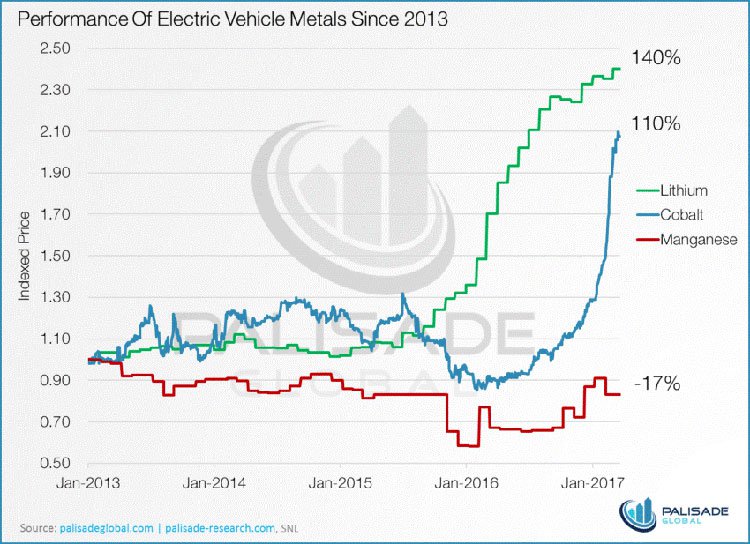

Lithium and cobalt have for some time been situated as the darlings of the battery metals market, riding the Tesla wave and that of the broader electric revolution.

But there’s another metal that’s used widely as a battery component that has received less market attention and media coverage: manganese.

Manganese could be the next metal to embark on a long rally in the same vein as lithium and cobalt over the past few years.

It’s received a bit of attention, and some are asking whether it’s poised to become the next lithium. For instance, this Palisade Research article back in March ...

...And on Finfeed.com in June :

Manganese is a critical and irreplaceable element used in steel production.

According to the International Manganese Institute, the global steel industry is expected to grow 2% annually from now until 2020. This will provide a steady source for manganese demand, some 80-90% of it.

But significant additional upside will come from clean energy applications.

An upgraded form of the commodity, electrolytic manganese dioxide, has emerged as a key material in rechargeable battery technology developed for electric vehicles and off-grid energy storage.

Particularly interesting is the growing use of nickel-metal hydride (NiMH) electric vehicle batteries and lithium-ion (Li-ion) batteries — major catalysts for manganese demand. NiMH batteries are predominantly used in hybrid vehicles, like the Toyota Prius.

The newest emerging technology to utilise manganese is the lithiated manganese dioxide (LMD) battery. A typical LMD battery uses 61% of manganese in its mix and only 4% lithium.

LMDs have a range of benefits, including providing higher power output, thermal stability, and improved safety when compared to regular lithium-ion batteries.

These are already in production, and are currently used in electric cars such as the Chevy Volt and Nissan Leaf. These less expensive electric cars, as opposed to the narrower luxury-segment in which Tesla operates – is predicted to be a significant part of the burgeoning clean energy revolution.

Another highly significant manganese application is off-the-grid power. Tesla and its Powerwall batteries are breaking ground here, and the market is only going to get bigger.

A fertile market – a question of supply and demand

The price of manganese has increased by more than 42% since the start of 2016, but with clean energy applications driving demand and no major supply response foreseeable, further price improvements are likely to be on their way.

The increasing gap between supply and demand translates into price increases, especially for electrolytic manganese.

Again, commodity prices do fluctuate and this is an early stage speculative stock so caution should be applied to any investment decision here and not be based on spot prices alone.

Vertically integrated companies will be the primary drivers of forward momentum in the manganese industry, which at this point is highly concentrated and in need of disruption.

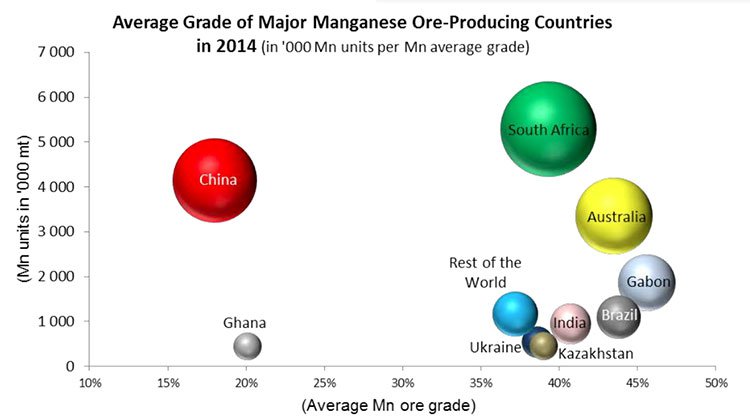

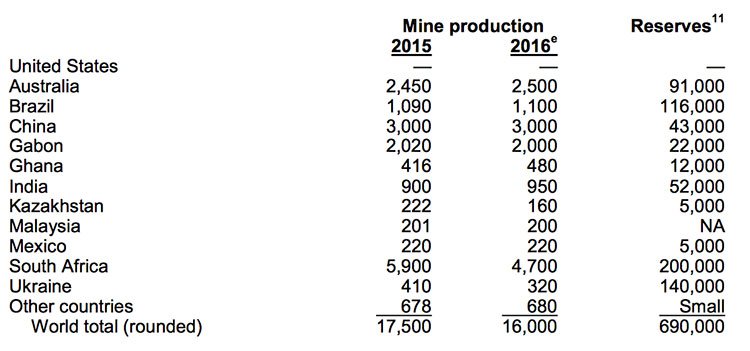

The world’s manganese is produced by just a few countries, some of which are risky jurisdictions.

70% of global resources are in South Africa, where infrastructure and policy place constraints on supply growth. 97% of global electrolytic manganese metal production is in China, but tends to be high-cost and low-grade.

According to the USGS’s Mineral Resources Program, the US is entirely dependent on manganese imports, with no production facilities of its own. It needs around 500,000 tons (1.1 billion pounds) of manganese per year, the majority of which is consumed by the steel industry.

The USGS has therefore deemed manganese a ‘critical mineral,’ one defined as being essential to the economy, as well as being at significant risk of incurring supply interruptions. It’s also been singled out by the USGS because of its significantly increasing use in emerging technologies.

Manganese supply is declining. In 2016, the USGS estimated that the world produced 8.6% less manganese than in 2015.

This supply-demand dynamic bodes well for PM1, which is looking for manganese on highly prospective ground, alongside a range of other upwardly swinging commodities that are geared towards clean energy and battery technology.

Also in PM1’s favour is the fact that Australia features what is noted as extremely high grade manganese deposits:

In fact, Australia is the second-largest provider of manganese to the US, with 21% of the total.

With the widening gap between manganese supply and demand likely to lead to a price increase over the next few years, PM1 is optimally positioned to take advantage.

Should it manage to reach production, it would have potential to disrupt the current market.

What next?

A hub of activity planned across its projects in the coming weeks and months and well into 2018, meaning that PM1 expects to generate regular, consistent news flow.

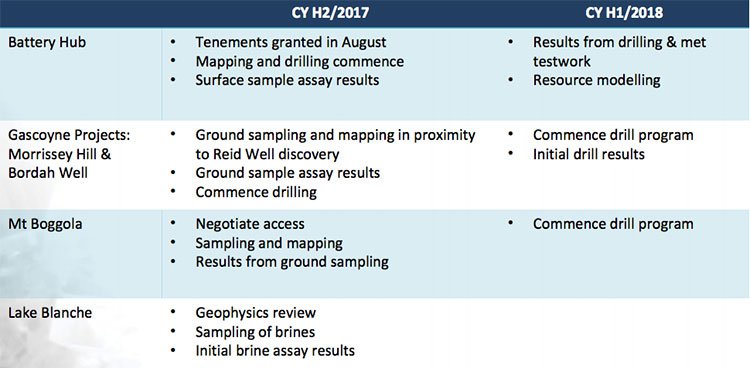

Here’s a snapshot of what it has in store:

Clearly, the newly cashed up and ASX-reinstated PM1 is set to get busy as it throws itself head-first into an aggressive exploration program.

With its exposure to a diverse range of metals in highly prospective areas and its focused exploration strategy, PM1’s micro-cap days might soon be far behind.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.