New deals could see Dateline regain its mojo

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The June quarter was an active one for Dateline Resources Ltd (ASX:DTR) with the company digitising all available historical data on the Gold Links Mine, as well as completing planning and rehabilitation works.

The company is in the final stages of planning an exploration program to test the down dip extension of the Sacramento zone, part of the Gold Links mine in Colorado.

The Sacramento zone is only a few hundred metres away from the 2150 Gold Links vein.

Commissioning started at Lucky Strike

The Lucky Strike mine is located less than 50 kilometres away from the Gold Links mine and consists of several old mines that were last worked in the early 1980s.

During the June quarter Dateline progressed the commissioning of the Lucky Strike Mill using low-grade development ore.

The head grade feeding the mill ranged between 1.5-2.5 grams per tonne.

The company has successfully produced two batches of a gold/lead/silver concentrate.

Assay results from the concentrate show 8.65 ounces to the tonne gold from the first batch and 24.68 ounces of gold from the second batch.

Both batches have been sold to a smelter and did not incur any penalties.

Proceeds from the sale will fall into the fiscal 2019 period.

Dateline remains in discussions regarding the potential to toll treat ore from local smaller operations.

However, these are just discussions at this stage and investors should take all publicly available information into account and seek professional financial advice for further information before making an investment decision.

Prospect of a joint venture in Fiji

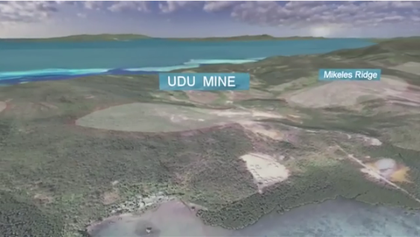

The company is also reviewing its interests in Fiji with a view to identifying a joint venture partner that would enter a farm-in-agreement in potentially developing its Fijian assets, notably the Udu Mine.

Dateline is awaiting the results of metallurgical test-work being carried out on core samples which were collected from site in December 2017.

Management expects the test work to establish if the Udu ore is amenable to separation and floatation, and if it is the company would actively seek a joint venture partner that is interested in completing a prefeasibility study for a 500,000 tonnes per annum mining operation.

The Udu deposit was discovered in 1957 and was developed in the late 1960s.

The mine operated for one year with recorded production totalling 32,435 tonnes of selectively mined material assaying 5.9% copper and 6.7% zinc.

Records indicate treatment on site yielded 5,524 tonnes of concentrates, assaying 18.3% copper, 1.65 g/t gold and 192 g/t silver.

The mineralisation consists of a cluster of VMS (Volcanogenic Massive Sulphide) lenses with an overprint of epithermal base metal mineralisation.

Subsequent phases of historical exploration within the Udu Project area largely focused on the immediate Udu Mine area.

JORC Compliant Inferred Resource

Historical regional exploration was limited and drilling hadn’t been conducted away from the mine area until Dateline commenced exploration drilling on regional targets in 2012.

Drilling in 2008 culminated in a JORC Compliant Inferred Resource estimate of 4.53 million tonnes averaging 3.9% zinc, 1.2% copper, 0.14% lead, 0.26g/t gold, 29g/t silver using a 0.5% zinc cut-off.

Regional exploration has defined a number of targets with strong geochemical and geophysical signatures.

These range from VMS/epithermal targets with affinities to the Udu Mine to deeper Porphyry Copper targets.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.