Mustang confirms maiden vanadium Resource

Published 20-JUL-2018 11:48 A.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

This product is classified as ‘very high risk’ in nature due to its location and geopolitical situation of the region. Finfeed advises that extra caution should be taken when deciding whether to engage in this product, however if you are not sure whether it is suitable for you we suggest you seek independent financial advice.

Mustang Resources Ltd (ASX:MUS | FRA:GGY) today reports that it has completed a maiden JORC-compliant vanadium Mineral Resource estimate at its Caula Vanadium-Graphite Project in Mozambique.

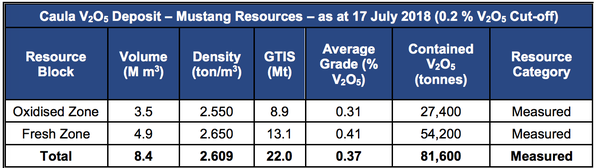

The Mineral Resource, which is all in the Measured category, is 22Mt at 0.37% vanadium pentoxide (V2O5), at a 0.2% grade cut-off, for a total of 81,600 tonnes of contained vanadium pentoxide.

This maiden vanadium Resource is another key step towards development, adding to the existing graphite Resource at Caula of 5Mt at 13% Total Graphitic Carbon (TGC).

Mustang Managing Director Dr. Bernard Olivier said the combination of the vanadium and graphite resources shows Caula is rapidly emerging as a highly valuable project.

“This is an exceptional result, with over 81,000 tonnes contained V2O5, particularly given that the entire JORC Resource is in the Measured category.

“With vanadium pentoxide prices running at more than US$40,000 per tonne (98% V2O5), the Caula resource translates to a highly valuable resource.

“Furthermore, the potential of the project is even greater as our vanadium is mica-hosted and associated with the graphite mineralisation and potentially far cheaper to extract and recover through two simple processing steps, compared with most vanadium projects, where the vanadium is located in a complex titaniferous magnetite ore body.”

Of course, as with all minerals exploration, success is not guaranteed — consider your own personal circumstances before investing, and seek professional financial advice.

As seen in the resource table (above), the Vanadium Resource is subdivided into two zones: the upper oxidised zone and the lower fresh zone.

There remains substantial scope for further expansion of the vanadium Resource through continued exploration. The deeper fresh mineralised zone is open at depth, and hence the fresh model will significantly expand with future drilling.

MUS is extremely encouraged by the results received to date from its maiden Vanadium Resource Estimate and the Caula deposit as a whole. It is now finalising an updated graphite Mineral Resource estimate.

The combination of high grade drilling results, positive initial metallurgical testwork, a large V2O5 maiden Measured Resource estimate, large-scale untested exploration targets and the project's location within a demonstrated world-class graphite-vanadium province confirm the project's potential to create significant future value for the company.

Today’s vanadium Resource announcement follows news just days ago that MUS had agreed to merge its Montepuez ruby assets with Fura Gems Inc. (TSX-V:FURA) for A$10 million in Fura shares. The deal will give MUS shareholders significant exposure to the rapidly growing ruby market via a specialist gem company with extensive experience and a diversified asset base in the coloured gemstone industry.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.