Maiden VALMIN Oil and Gas Reserves Imminent for AKK’s Colorado Project

Published 07-FEB-2017 00:04 A.M.

|

8 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Major catalysts in the oil industry can be hard to come by, but Austin Exploration (ASX: AKK) is gearing up to announce its first proven oil and gas resource.

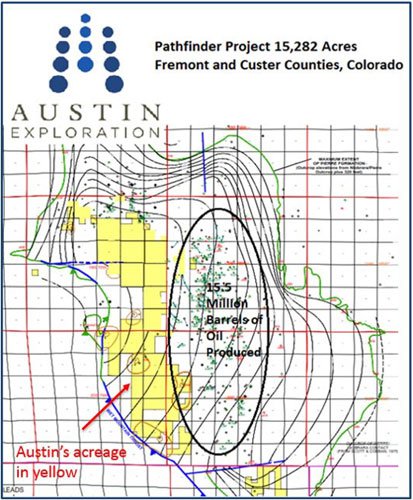

A Maiden VALMIN, independent oil and gas Reserve and Resource evaluation is anticipated within the week, in which we expect AKK to announce it has discovered a large oil and gas deposit at its Pathfinder project in South-Western Colorado.

The independent oil and gas reserves and resources evaluation is being completed by world renowned petroleum Engineering firm, Gustavson Associates.

That would be big news for the company in propelling it towards its goal to become a major onshore oil and gas producer.

Based on AKK’s impressive capital management and at the same time, smart expansion, along with the history of oil in the Colorado region, which was at one time a booming oil and gas hub, we have every reason to be confident it can succeed.

AKK’s Pathfinder Project is situated in the DJ Basin, one of America’s most prolific oil and gas basins and home to the Florence oilfield, the second oldest commercial oilfield in the US, dating back to the nineteenth century.

In December last year, AKK entered an agreement with Incremental Oil and Gas (Florence) LLC to acquire 100% of its Florence Oilfield acreage and oil production in Colorado for $2M.

Through the combination of the Florence Oilfield and AAK’s Pathfinder project, AKK will control approximately two thirds of the entire Florence field and is aiming to restore the region to its vibrant and robust oil capacity.

Additionally while Florence is a good supplement to its holding, AKK’s reserves are deeper and thicker than what was previously found and therefore has significant potential to exceed volumes of what has been previously estimated for the region.

Remember, the size of AKK”s landholding is enough to drill more than 400 wells at a scale that could be worth hundreds of millions of dollars.

Note this is a speculative value at this stage and should not be the sole focus of any investment decision related to this stock. If considering this stock for your portfolio, take into account your own personal circumstances and risk profile.

AKK has a significant opportunity to return the region to boom times and enjoy its full potential, with shareholders tagging along for the ride.

The Catalyst: Maiden Independent VALMIN Oil and Gas Reserves and Resources evaluation due in days

In a year in which 200 US oil and gas companies filed for bankruptcy due to the fallen oil price, AKK has gone from strength to strength. Not only did the Company eliminate all debt in 2016, but it somehow found a way to significantly increase its landholdings to more than 15,000 acres – of which it controls 100%.

That number, while dire for a large portion of other US small cap oil stocks, indicates the potential potency of AKK’s oil and gas project. The company has been able to withstand one of the worst oil markets in living memory, and is ready to capitalise on any future upside in oil prices.

The imminent release of a major Reserve and Resource assessment carried out by independent and highly renowned petroleum engineering firm, Gustavson Associates, is likely to put AKK onto a lot more investors’ radars.

Results confirming the field’s potential could significantly boost the value of AKK’s field, which would likely carry over to its market value and share price.

However any effect on its value and share price is speculative and investors should consider all public information as well as the information in this article and seek professional financial advice before making an investment decision.

Results are imminent – they will be published by end of this week.

AKK and its shareholders have been given every reason to expect success – but the key point here is that either way, we will get a result in the coming days.

The Pathfinder property in Florence, Colorado is located in the Florence Oil Field – the world’s second oldest oil basin. Pathfinder sits directly adjacent to Florence Field, an extension of the prolific DJ Basin in Fremont County that has produced more than 16 million barrels of oil from the Pierre formation.

AKK believes the majority of its oil and gas reserves, which were previously held by coal and gold mining companies, remain in virgin, previously unexplored, yet high potential territory.

In September we told you that AKK was gearing up to deliver a multi-well program at Pathfinder in three phases.

Following this in November, AKK announced that its Magellan #1 well successfully flowed oil to surface, at an initial production rate of 98 barrels per day, plus it had very encouraging gas flows. Sales agreements for the crude oil collected from this drilling campaign were signed for haulage and refining with Suncor Energy, a nearby refiner, the revenues of which are now being received.

Magellan #1 commencing oil production

Later in November, AKK then reported strong gas flows at its Marco Polo and Columbus wells. The natural gas emanating from these wells is a strong indication that oil is present at these locations too.

Gas flared from the Marco Polo well ahead of flow tests for oil

It has already been confirmed that the Pierre formation definitely has hydrocarbons present, which we saw when AKK’s first well, Magellan #1, struck oil and the first commercial oil production commenced.

To keep margins as high as possible, management is on location everyday doing the drilling themselves, meaning it is being as done as cheap as anyone can. This fits into AKK’s goal of becoming one of the lowest cost drillers in America, along with reducing overheads and staff numbers, and streamlining production.

These flow rates at Magellan #1 confirmed that Pathfinder was highly economical even when the oil price was at just US$40 per barrel.

Such is AKK’s belief in the regions’ potential that it has now focused 100% of its efforts on Colorado.

AKK is confident that expanding its holdings in the prolific region, plus the promising maiden VALMIN Reserves and Resources Evaluation report will propel AKK towards establishing itself in the eyes of oil investors.

Much less substantial announcements from the company have caused significant run ups in its share price. And while there are no guarantees, a confirmed VALMIN resources would surely be well received by shareholders.

However, like all speculative oil companies, there is no guarantee the company will continue in its current manner, as it depends on a range of assumptions that may not eventuate – consult a professional financial advisor if considering an investment here.

These results, if as expected, will be a major catalyst for AKK in coming days.

In December, AKK announced it had significantly expanded its asset base in Colorado by upping its holding in the DJ Basin. For $2 million AKK will acquire 100% of Incremental Oil and Gas’ 2,436 acre Florence Oilfield and oil production operations.

The acquisition of a neighboring parcel of land set to be finalised in March, brings it closer to controlling 100% of the entire Florence Oil Field.

The completion of the acquisition is another catalyst to look for in just a couple months’ time.

The move brings AKK’s total holdings in the prolific oil and gas producing region to 18,208, and ever so close to controlling the entire region. Although it does already control 100% of the operations underway.

The transaction includes extensive oil production equipment and inventory, including 22 producing oil and gas wells.

These wells are profitable with minimal operating costs, no leasing fees and have long term haulage contracts in place. They were drilled from 2008 – 2011, meaning that the initial high decline production rates across the majority of the wells have already occurred, leaving AKK with around 52 barrels of oil per day. This brings immediate and high margin monthly revenue streams.

The acquisition also includes an extensive amount of scientific data, and geophysical and engineering analysis of approximately 50% of the Florence field.

On completion of the acquisition, AKK will still be debt free, as it was funded by a $3.2M capital raising at $0.006 per share.

On top of the cash flow benefits, the acquisition is highly complementary to AKK’s existing Colorado assets, and results in AKK having access to over 450 future low cost drilling locations, in the Pierre formation alone.

Don’t forget, the Pierre formation lies on top of the Niobrara Shale formation, which is one of the most prolific oil and gas producing formations in North America. The Company has said it will aggressively pursue this formation when oil prices recover to above $60 per barrel – not that far away when oil prices are in the mid $50s.

Plus, there remains scope to unlock even further value from field as six development infill Pierre well locations are ready and defined by 3D seismic.

The move reinforces AKK’s commitment to its shareholders, as one of just a handful of exploration companies that are taking advantage of the low oil price environment and actively expanding its holdings.

That’s in addition to its focus on low cost development and pursuing opportunities that offer the highest level of sustainable, long term growth.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.