Maiden JORC imminent for Tando’s SPD Vanadium Project

Published 25-OCT-2018 12:12 P.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Tando Resources (ASX:TNO) this morning revealed more high-quality assay results from its SPD Vanadium Project in South Africa.

These results come from the recently completed Phase 1 drilling program, which targeted the established SPD deposit, where there is currently a resource of 513 million tonnes at a grade of 0.78% vanadium pentoxide, defined under the SAMREC code. This resource is a “foreign resource”, which is ‘foreign Resource’ (as defined in the ASX Listing Rules).

These latest results will form part of a maiden JORC Resource, which is expected to be published next month.

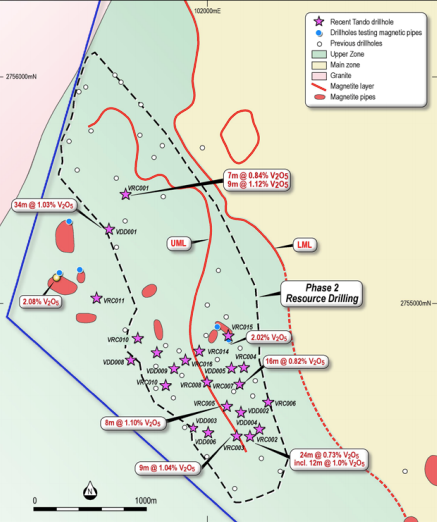

The latest assays, which are quoted as whole-rock, or pre-concentrate, grades, include:

- 34m at 1.03% vanadium pentoxide (V2O5) from 22m (VDD001, Upper Layer)

- 8m at 1.02% V2O5 from 108.6m (VDD001, Lower Layer)

- 24m at 0.73% V2O5 from 0m / surface (VRC002, Lower Layer)

- including 12m at 1.00% V2O5 from 12m

- including 2m at 1.72% V2O5 from 22m

- 1m at 1.31% V2O5 from 0m / surface (VRC007)

- 16m at 0.82% V2O5 from 10m (VRC007, Lower Layer)

- including 2m at 1.54% V2O5 from 24m

- 37m at 0.65% V2O5 from 13m (VRC005, Lower Layer)

- including 8m at 1.10% V2O5 from 42m

- including 2m at 1.56% V2O5 from 48m

- 35m at 0.65% V2O5 from 23m (VRC003, Lower Layer)

- including 9m at 1.04% V2O5 from 49m

Historical drilling at SPD returned magnetic concentrate grades above 2.2% vanadium pentoxide. TNO has now submitted samples from VRC001 – VRC003 for magnetic separation by Davis Tube and analysis of the magnetic concentrate.

Phase 1 drilling was aimed to define a maiden JORC-compliant Mineral Resource. As TNO announced last week, Phase 1 is now completed and all outstanding assays are expected to be received during the next month.

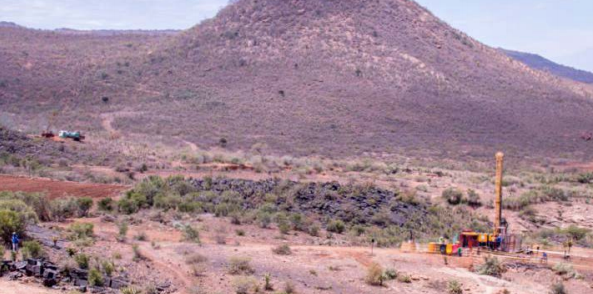

A Phase 2 drilling program is now underway with two rigs operating. Phase 2 aims to upgrade the maiden JORC Resource to an Indicated category (provided results are as anticipated), with 58 holes for 5,550 metres currently planned.

Drilling is also underway to test the potential of the surrounding high-grade vanadium pipes at SPD (as shown in the image below), which have the potential to complement a low-cost DSO operation at the project.

Tando managing director, Bill Oliver, said: "These results are further evidence of the high-grade, near-surface vanadium mineralisation at SPD. Results such as these will underpin the impending maiden JORC Resource.

"While we await assays to finalise the resource estimation, the phase two drilling program is continuing along with drilling of the shallow vanadium pipes nearby. This multi-pronged strategy will give us strong newsflow for several months as we push to unlock the value of this outstanding asset."

As part of drilling activities, the drilling contractor has recruited employees from the local communities, assisted by TNO — this expected to be the first of many opportunities for the project to provide benefits such as employment and training for these communities.

The cost to complete the entire Phase 1 and Phase 2 drilling program and the subsequent Resource estimations is estimated at A$1.4 million. TNO is fully funded for the drilling program, as well as the corresponding metallurgical and mining studies.

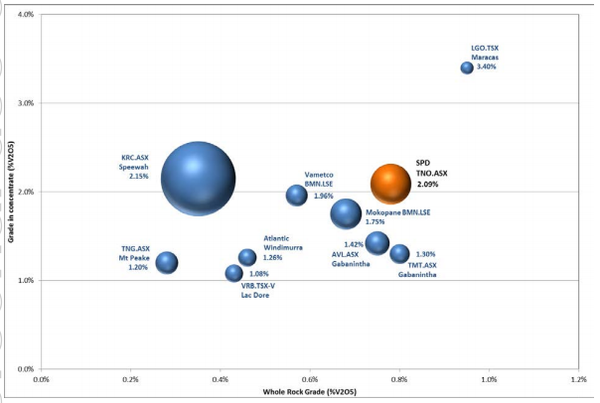

Currently, 85% of the world’s vanadium is produced in China, Russia and South Africa. TNO’s SPD Vanadium Project is located in one of these regions and has the potential to be of global significance, based on the tonnage and grade in concentrate (as shown below).

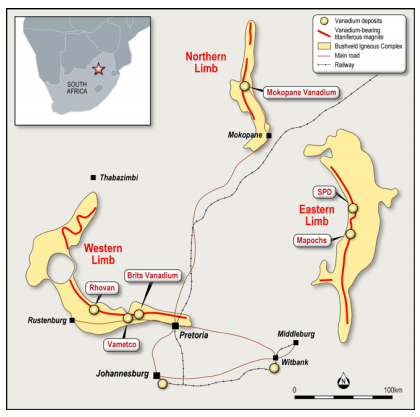

The SPD Vanadium Project is located in a similar geological setting to the mining operations of Rhovan (Glencore), Vametco (Bushveld Minerals) and Mapochs (International Resources Ltd) in the Gauteng and Limpopo provinces of South Africa.

Of these, both Rhovan and Vametco processing plants feature refining to generate products used in the global steel industry, with an aim to develop downstream processing to produce materials used in the battery market.

The SPD Vanadium Project is located only 30km from the currently dormant Mapochs mine, which has a processing plant and railway infrastructure.

TNO has targeted vanadium as a commodity of interest due to its usage in energy storage — specifically vanadium redox flow batteries (VRFB). It is anticipated that forecast increase in battery usage for large scale energy storage will lead to a significant increase in the demand for vanadium.

The price for >98% vanadium pentoxide, a more commonly traded intermediate product, has increased from US$3.50/lb at the start of 2017 and approximately US$10/lb at the start of 2018, to current prices at and above US$30/lb — a 300% increase this year.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.