Large Buddy smart light order exceeds 40% of total 2019 sales

Published 01-APR-2020 09:53 A.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

After the market closed on Tuesday, Buddy Technologies Limited (ASX: BUD), announced that it had received its largest set of smart light orders to date, totalling approximately A$3.8 million.

With many people across the world confined to home, this could be the start of a busy period for the company given that it develops and distributes products that are used indoors.

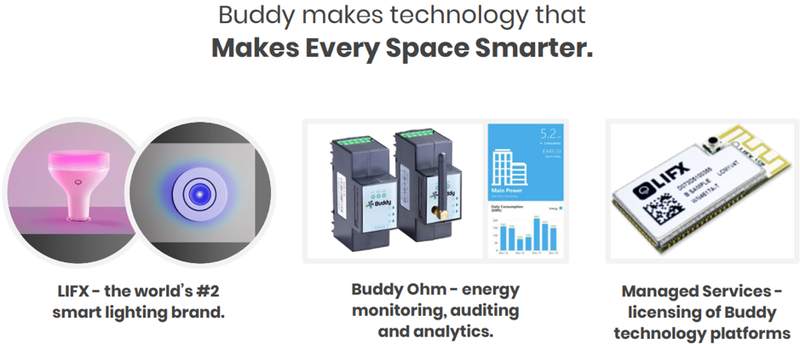

Buddy is an IoT and cloud-based solutions group that services both the commercial and consumer sectors.

Its two core businesses are Buddy Ohm and Buddy Managed Services with the former providing the commercial and industrial sector with monitoring and analytics solutions for energy monitoring, reporting and auditing.

Buddy Managed Services licenses Buddy’s technology platforms to customers for integration into their own products.

Buddy’s Consumer Business trades under the LIFX brand and has established a leading market position as a provider of smart lighting solutions.

The company’s suite of Wi-Fi enabled lights are currently used in nearly one million homes, viewed as second only to lighting giant, Philips Hue.

LIFX products are sold in over 100 countries worldwide, directly and via distribution and sales partnerships with leading retailers and ecommerce platforms including Amazon, Google, Apple, JB Hi-Fi, Bunnings, Officeworks, MediaMarkt, Saturn and Best Buy (in both the US and Canada).

Largest order the company has received

The orders for LIFX White low-cost smart lights, which will reach retailers in time for the northern summer, demonstrates that while the impact of the COVID-19 virus is dominating the news, retailers continue to plan for significant sales of smart lighting products in the second half of the year.

It is worth noting that these first orders for LIFX White smart lights are initial stocking orders destined for the North American online and offline retail markets in North and South America, and comprise only a portion of the initial projected manufacturing run for the product, which will be sold globally.

The company anticipates further orders for other regions of the world (as with all other LIFX products), which are re-ordered by retailers to replenish stock on a regular basis.

Commenting on this development, Chief Executive David McLauchlan said, “Such a large first set of orders marks an important milestone for us.”

“The affordability and ease of installation of LIFX White will help bring smart lighting into the homes of countless new customers around the world who are now spending more time at home.

‘’In unit volume of lights, this single order exceeds 40% of our total sales volume in 2019.’’

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.