L1M discovers 4.04% lithium in unknown artisanal mine. Drilling soon.

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 7,625,696 L1M shares and 3,523,077 L1M Options at the time of publishing this article. The Company has been engaged by L1M to share our commentary on the progress of our Investment in L1M over time.

That was quick.

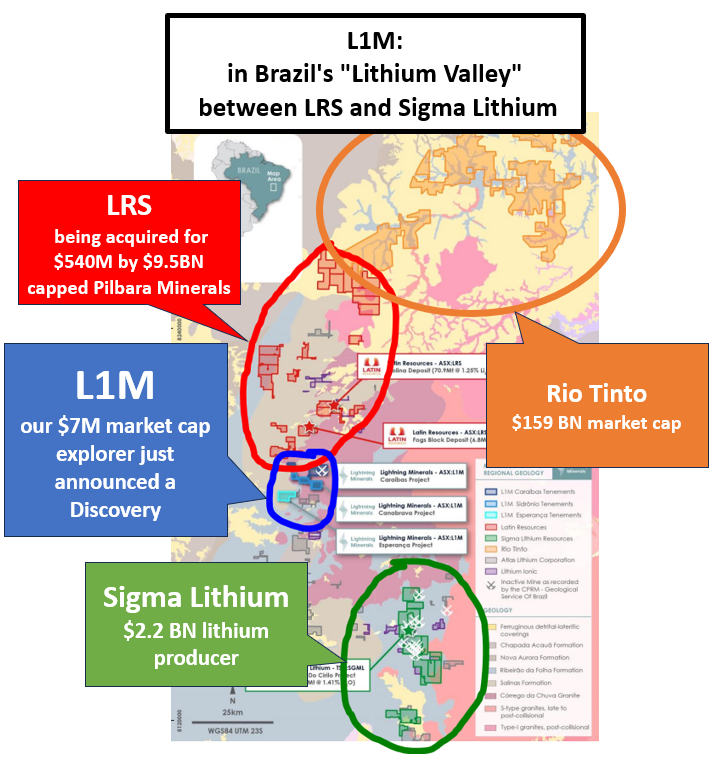

Our $7M capped exploration Investment Lightning Minerals (ASX:L1M) just discovered spodumene at its lithium project in Brazil’s Lithium Valley.

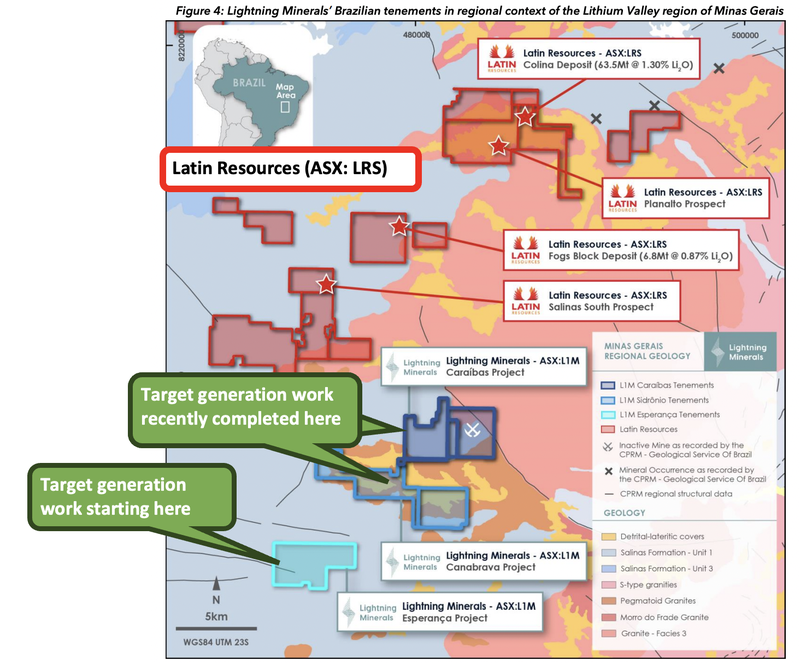

L1M has lithium exploration ground in between ~$600M LRS and ~$2.2BN Sigma Lithium in Minas Gerias, Brazil.

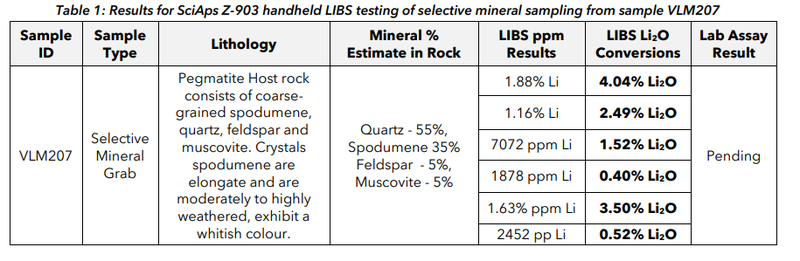

L1M says on-site analysis results up to 4.04% Li2O.

This is very high grade.

(on site analysis is NOT as accurate as a lab assay result, assay results are pending)

And the spodumene crystals they found measure up to 50cm in length.

L1M got very lucky here...

This discovery was made while the L1M team was walking the ground to identify potential drill targets for their Q1 2025 initial drill campaign.

They literally stumbled onto a small scale "artisanal mine” that some locals had been digging.

(We visited the site earlier in the year and no one knew this mine existed - until now)

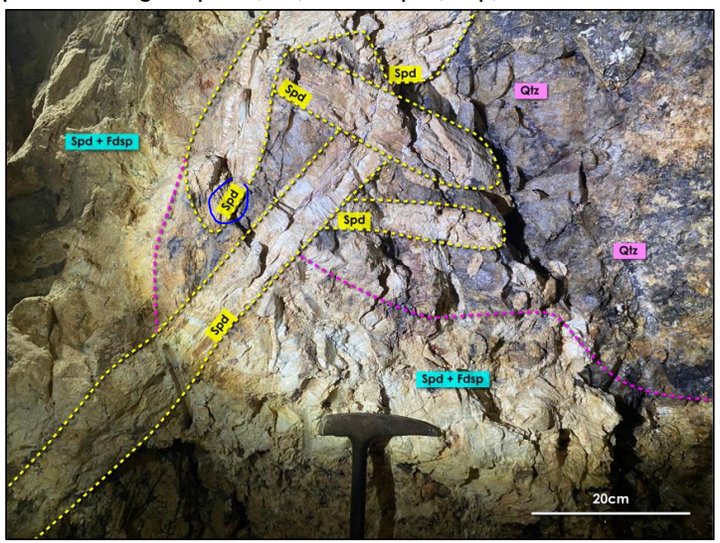

Inside they found “large, elongated spodumene crystals up to 50cm in length” in the walls:

Here’s another section showing a “spodumene rich portion of the zoned pegmatite”:

(Hows that “custom made wooden ladder” used by the local artisanal miners)

Based on what L1M has found in these artisanal workings - they now have a high priority drill target for their initial drill campaign commencing in Q1 2025.

They know there is lithium bearing pegmatites with spodumene there, now they need to drill test it to find out how deep and thick it goes.

L1M has suddenly and expectedly moved to a position where the chances of making a discovery are materially higher.

And we will find out the result when they drill it in the Jan-March quarter in 2025.

L1M is the only greenfield exploration Investment we have made in the last 12 months.

We Invested in L1M based on:

- our success with Investing in LRS,

- the success of producer Sigma Lithium,

- the proximity of L1M’s land package to LRS and Sigma,

- and that the Minas Gerais state government is pushing to make itself the world's next major lithium province.

The exploration game is a lot about luck - and today the exploration gods are smiling on L1M.

Finding spodumene is big when it comes to lithium exploration.

(Most of the world’s lithium is produced from spodumene bearing pegmatites)

Today’s news means L1M is suddenly three steps of the way through the tried and tested playbook that has led to the discovery of some of the world's biggest lithium deposits.

Most of which were company makers creating hundreds of millions of dollars (and sometimes billions) of value.

(WA’s biggest discoveries are all spodumene hosted deposits - a recent example is the $4.2BN discovery made by Azure Minerals).

The lithium exploration process playbook for a company is broadly as follows:

1. Map outcropping pegmatite structures which are likely to host lithium mineralisation ✅

L1M has mapped pegmatites across its project. It still has soil sampling/mapping results to come in the next few weeks

2. Sample these outcrops to confirm if there is lithium mineralisation ✅

L1M has shown its pegmatites have lithium... today’s announcement had grades up to 4.04%.

3. Confirms if spodumene hosted mineralisation ✅

Spodumene is the source rock for the majority of the world’s lithium supply. Today, L1M confirmed that its pegmatites contain spodumene.

4. Drill into the outcropping pegmatites to determine if a large lithium bearing structure 🔃

The only thing left to do is drill to see if these pegmatites are part of a bigger lithium system. L1M’s guidance is for drilling to start next quarter

Latin Resources was the most recent company to hit all four of those steps with its Brazilian lithium project.

LRS is one of our most successful Investments ever.

Our Initial Entry Price into LRS was 1.8c - at its peak it was up ~24x from that price.

At its peak (post discovery), Latin was capped at ~$1BN, and its neighbour Sigma Lithium was capped at more than $6BN.

Now, Latin is being taken over by one of the world’s biggest lithium producers - the $9.5BN Pilbara Minerals.

L1M has prospective lithium ground sitting on the same type of rocks and in the same region as Latin Resources (and the $2.2BN capped producer Sigma Lithium).

L1M is tiny - it has a market cap of ~$7M and cash of $2.6M at 30 September 2024.

In addition to Sigma and Latin Resources, the world’s biggest miner, Rio Tinto, has pegged a huge swathe of ground in the same region as L1M has a position.

So Rio, Pilbara, and at some points even Tesla was rumoured to be interested in discoveries in this part of Brazil.

(Source)

The giant Chinese EV maker also was in ‘talks’ about potentially acquiring Sigma Lithium.

Clearly there is corporate interest from majors in Brazilian lithium assets, especially in Minas Gerais.

Partially because if the discovery is strong enough (like LRS or Sigma’s) these projects can have low operating costs compared to other hard rock lithium projects.

AND partially because of the supportive government - Minas Gerais is a pro mining state and is welcoming of foreign capital to grow its local lithium industry.

Below is L1M’s managing director Alex Biggs signing an MOU to fast-track its projects with Invest Minas:

Invest Minas is the Minas Gerais State Government’s Investment Promotion Agency.

A few weeks ago, we saw the Invest Minas team present in Sydney - the message was pretty clear that Minas Gerais is open for business.

You can read more of that here: Insights from Industry Leaders at IMARC

We are substantial holders in L1M as we think it has a good chance of making the next big lithium discovery in Brazil’s Lithium Valley.

Given our material shareholding in the company, we had one of our team members go on a site visit a few months back while in Brazil with the L1M team.

At the time, the historic artisanal mine that yielded the high grade lithium bearing pegmatite was not known.

Check out the write up from our Brazil site visit here

At the same time as our L1M site visit, we attended the “Brazil Lithium Summit” in Belo Horizonte, the capital of Minas Gerais, Brazil.

You can also read that note here:

Of course, it’s still early days for L1M - it still needs to drill test its target - similar to LRS back in 2019 before it made its discovery...

Here is a quick overview of the 11 reasons we first Invested in L1M back in April this year:

- We have had success Investing in Brazilian lithium before - One of our best Investments was Latin Resources, which made a hard rock lithium discovery and was re-rated to a high of ~42c per share — 2,332% above our Initial Entry Price. L1M is following the same exploration playbook, 20km away.

- Two of Brazil’s biggest lithium projects are near L1M - L1M’s ground sits between $545M Latin Resources (20km away) and $2.3BN Sigma Lithium (60km away), both of which are the big pioneers of the lithium industry in Brazil.

- Minas Gerais is Brazil’s “Lithium Valley” - The state aims to be the biggest lithium province in Brazil. The “Lithium Valley” concept was launched in the State of Minas Gerais to promote foreign investment in Brazilian lithium projects.

- Rio Tinto moving into Minas Gerais in a big way - Rio Tinto has started pegging ground to the north of LRS and Sigma. Could Rio Tinto be setting up for a play on the region as a whole? Rio is already active in Argentina so South American assets are definitely not out of their remit.

- L1M’s project sits on similar geology to LRS and Sigma - L1M’s ground sits on top of similar geology to where Latin Resources made its discovery (the Salinas Formation). The projects also sit within similar proximity of the granites in the region & has similar aeromagnetic data running through the ground.

- Exploration “roll of the dice” - Our other Investment SLM was trying to find lithium in Brazil, and it ran from ~13c to ~$1.34 per share. Unfortunately it didn’t deliver a discovery (yet, we still hold). We are betting on L1M as another early stage “the next LRS” exploration bet to hold in our Portfolio.

- Bear market pick up - L1M is picking up ground in a lithium bear market, which means the likelihood of finding higher-quality, well-priced projects is higher.

- There is an existing playbook for success in Brazil - Companies like Sigma have gone from <$100M market cap explorer to a peak market cap >$4BN. Latin Resources has gone from <$20M market cap to a peak of ~$1BN. There is a proven valuation re-rate for companies that manage to make hard rock lithium discoveries in the region.

- Tight capital structure - After acquiring the Brazilian assets, L1M will have ~99M shares, which means there aren't many shares on issue. The top 20 hold ~47%, and the board and management hold ~8.7% of the company’s shares on issue.

UPDATE: We think the L1M capital structure is now in even better shape. L1M’s top 20 hold ~56.11% of the company now, and we have seen on market buying from the company’s biggest shareholders. - Low market cap leveraged for a re-rate on a discovery - Post acquisition at 7c per share, L1M has a market cap of ~$6.5M leaving plenty of room to re-rate off the back of a discovery, especially given the peer valuations in the region like Sigma and Latin Resources.

UPDATE: L1M’s current market cap is ~$7M. L1M had ~$2.6M cash in the bank at 30 September 2024 which gives the company an enterprise value of ~$4.4M. - Good deal terms tied to success on the project - Bulk of the consideration being paid for the assets are tied to milestone payments related to defining a JORC resource, NOT the usual “lithium bearing drill intercepts” we see on project acquisitions.

We are hoping that the above reasons (and a bit of exploration luck) contribute to L1M achieving our Big Bet which is as follows:

Our L1M Big Bet:

“L1M returns 1,000%+ by making a discovery significant enough to move into development studies, or attract a takeover offer.”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our L1M Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true

Why we think L1M could be LRS 2.0 for our Portfolio

As mentioned earlier in our note, we are Invested in L1M to hopefully see it replicate Latin Resources’ success and become “LRS 2.0”.

L1M has been doing what LRS did for years before its discovery.

L1M has been using the cyclical low in the lithium market to its advantage, picking up new ground cheaply and doing all the lower cost groundwork to prove up drill targets.

This is at a time when most other ASX small caps have moved on to focus on other regions and other commodities...

This was the approach LRS took back in 2017-2018 when the lithium market turned negative in late 2018. LRS’s Managing Director Chris Gale sent his geologists out to Brazil to look for “the best ground”.

Over the next 4 years (while the lithium bear market played out), LRS did all the groundwork, finding ground and then identifying drill targets.

Then, in March 2022, LRS finally drilled one of those targets and made a discovery.

We covered the early days of LRS’ exciting discovery pretty extensively in these notes:

- 17th Feb 2022 - Spodumene alert: Has LRS just made a new lithium discovery?

- 17th March 2022 - Large fresh green crystals everywhere - is this a new lithium discovery?

The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

We think L1M is doing a lot of the same groundwork that was foundational to LRS’s discovery.

L1M has been picking up its ground at the depths of a lithium bear market where many aren't paying attention yet...

L1M also does low-cost field work to define targets worthy of drilling.

(Today’s announcement is from one of the areas we want to see L1M drill).

AND hopefully when the lithium market turns, L1M will drill these targets (and fingers crossed) make a discovery of its own.

What’s next for L1M?

Exploration program across Brazilian lithium projects 🔄

L1M has three projects in the Minas Gerais region of Brazil.

For the past few months L1M was working on its Caraíbas and Canabrava projects. The most recent work was on Esperança (where today’s announcement relates to).

Across these projects, L1M still has plenty of soil sampling/mapping results to come.

Ultimately, these different datapoints will form the basis for L1M’s future drill programs.

It's still relatively early days for L1M’s projects and we expect to see a lot more newsflow from the company as it finalises the plans for its first drill program.

We don't mind the patient approach from L1M. Instead of rushing to drill a half baked drill target, L1M is making sure to rank the best on its ground and drill the ones it thinks will have the highest chance of making a discovery.

During a lithium bear market, rushing to spend a relatively decent amount of money drilling wouldn't make much sense.

Over the next ~3-6 months we are hoping to see L1M rank a few of its highest priority targets.

Objective #1: Find high priority drill targets

We want to see L1M conduct geochemical and geophysical surveys and determine the best drilling spots at its Brazilian lithium project.

Milestones

🔄 Geological mapping

🔄 Rock chip sampling

🔄 Soil sampling

🔄 Define high-priority drill targets

Source: “What do we expect L1M to deliver” section - L1M Investment Memo 2 May 2024

Our L1M Investment Memo

Our Investment Memo provides a short, high-level summary of our reasons for Investing. We use this memo to track the progress of all our Investments over time.

Below is our L1M Investment Memo, where you can find the following:

- What does L1M do?

- The macro theme for L1M

- Our L1M Big Bet

- What we want to see L1M achieve

- Why we are Invested in L1M

- The key risks to our Investment Thesis

- Our Investment Plan

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.