Kairos prepares to grow Pilbara Gold Project in 2020

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

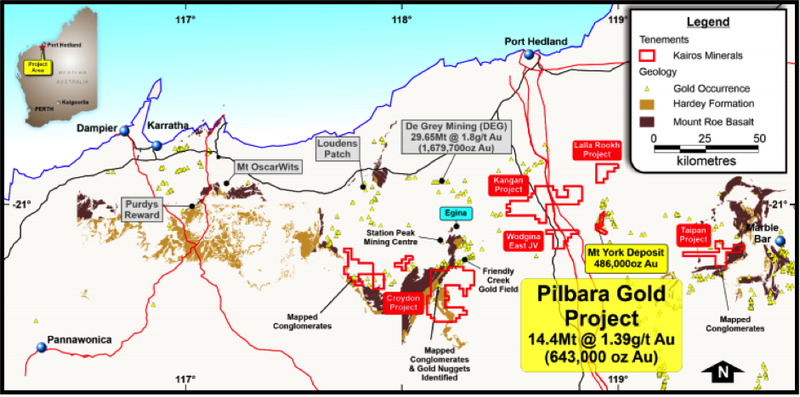

Kairos Minerals Ltd (ASX:KAI) has commenced a 1,500 metre reverse circulation (RC) drilling program, targeting extensions of the Iron Stirrup gold deposit, part of the 643,000 ounce Mt York Project within its Pilbara Gold Project in Western Australia.

Management is targeting depth and strike extensions of the existing Iron Stirrup Mineral Resource of 1.07 million tonnes at 1.94 g/t gold for 67,000 ounces.

The program is expected to take approximately two weeks to complete, with assay results expected to be reported early in the New Year, possibly providing share price impetus at the start of 2020.

This news comes on the back of a $1.35 million capital raising which will provide funding for the group’s extensive exploration campaign in 2020 with a major focus being the Pilbara Gold Project.

Funds will also be used to complete a review of the current Mineral Resource, commence mining studies and undertake initial exploration activities at the newly-identified gold target at the Croydon Project.

The location of the Pilbara Gold Project can be seen in the following map with the 486,000 ounce Mt York deposit accounting for much of the resource.

Large exploration program planned at Mt York

In providing some background on Iron Stirrup and where it sits in the company’s broader exploration strategy in 2020, Kairos executive chairman Terry Topping said, ‘’The current program will target extensions of the higher grade Iron Stirrup deposit that was last mined in the 1990s in a much lower gold price environment as part of the historical Lynas Find operation.

‘’The two-week program will target extensions of the mineralisation at depth and along strike below the historic open pit, with results expected early next year.

“The Iron Stirrup drilling program is expected to form part of a much larger exploration push at Mt York next year.

‘’The results of the current drilling will be incorporated as part of a review of the current 643,000 ounce Resource that is already underway.

‘’This will, in turn, underpin mining studies commencing in the March quarter next year.

‘’In addition to reviewing the mining potential at Mt York, we plan to return to the Croydon Project next year to test the large gold-in-soils anomaly identified recently and advance other recently identified opportunities at the Kangan Project and elsewhere.”

Will Mt York become a production hub

From a broader perspective, management will continue to review the current 643,000 ounce mineral resource in light of the substantial increase in the Australian dollar gold price since the resource was first released in May 2018.

Indeed, there is a significant difference as the Australian dollar was fetching US$0.76 at that time, and the gold price was hovering in the vicinity of US$1300 per ounce.

This implies an Australian dollar gold price of $1710, well below the current price of approximately $2150 per ounce.

The Australian dollar gold price has been well above $2000 for about the last six months, suggesting this isn’t a blip.

Most brokers are forecasting the precious metal to continue to trade around the US$1400 per ounce mark, and with global equity markets looking toppy, along with a continuation of geopolitical uncertainty it could trade north of that level.

Meanwhile, it is hard to identify any catalysts on the horizon that would trigger a significant strengthening in the Australian dollar.

Consequently, if Kairos were to crunch the numbers on a prospective production centre at Mt York, it would be safe to say that the economic returns based on the Australian dollar gold price assumptions would be far superior than was the case some 18 months ago.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.