Increasing recurring revenue shows Simble’s strength

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Speculator aims to identify stocks that tend to fly under the radar, perhaps due to the fact that they don’t suit the risk-averse investor, or simply because they are small, emerging, potentially next big thing stories where the market moving news is yet to break. FinFeed will be looking to uncover such stocks on a weekly basis.

Energy management and mobility solutions software group, Simble Solutions (ASX:SIS) has released an outstanding result for the September quarter, featuring doubling in its cash receipts quarter on quarter, the best performance since the company listed on the ASX in February.

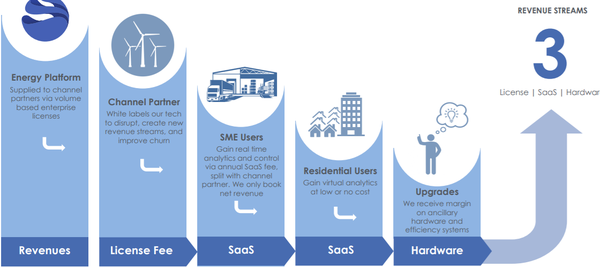

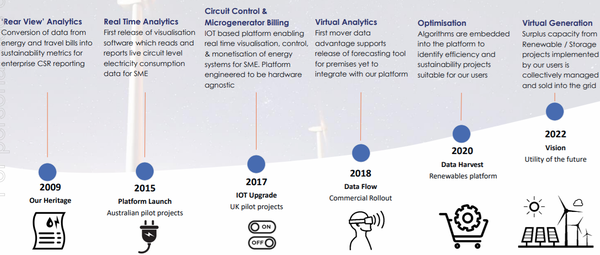

As a backdrop, the company’s Software as a Service (SaaS) platform has Internet of Things (IoT) capabilities and enables enterprises and consumers to remotely automate energy savings opportunities to reduce their energy bill.

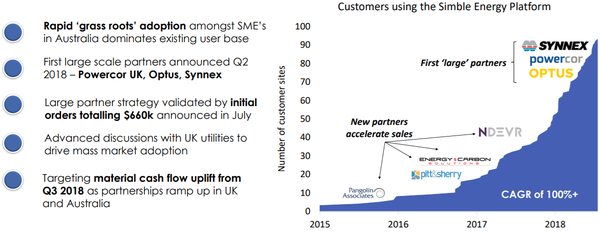

Simble operates in the small to medium enterprise (SME) SaaS market and targets the distribution of its platform through channel partners.

The company has an international presence with offices in Australia, New Zealand, the UK, Vietnam and the United Arab Emirates (Dubai).

As well as cash receipts increasing 108% to $1 million in the September quarter, the company generated the first material cash flow contribution from the Simble Energy Platform, totalling $500,000 in customer receipts.

150% increase in customer sites

Adding to the quality of its financial performance for the quarter was a 25% improvement in net outflows.

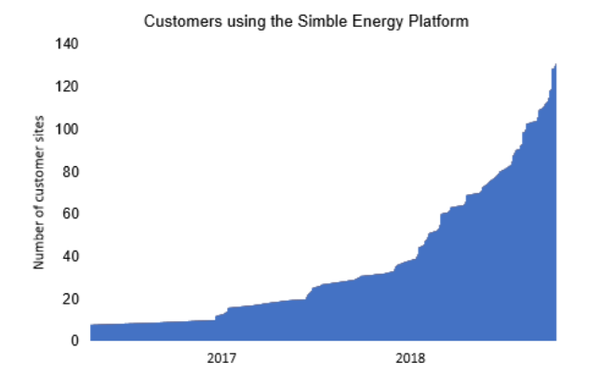

Simble is providing the foundation for ongoing growth having increased customer sites on the Simble energy platform by 150% in 2018.

Installations in the UK increased four-fold during the September quarter.

Pointing to the prospect of a strong first half performance was a substantial increase in cumulative sales across Australia and the UK subsequent to September 30.

The company’s UK expansion strategy will be accelerated by technology collaboration with Accel-KKR backed Utiligroup, targeting mass adoption in the residential market.

Caught up in the tech sell-off

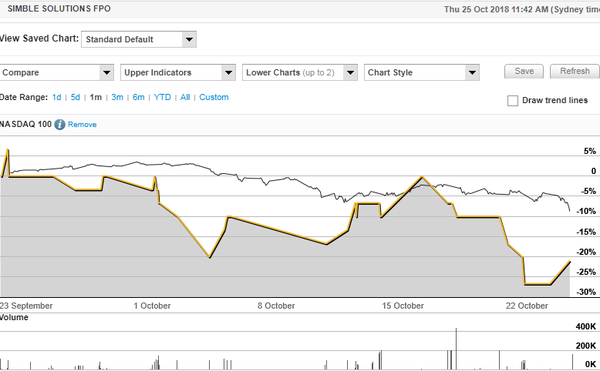

In October, the NASDAQ index fell from more almost 9% as many global blue-chip IT companies experienced a sharp sell-off.

In such an environment it is often the case that smaller stocks are hit even harder, and this appears to be the case with ASX-listed Simble Solutions, as indicated in the following chart which illustrates its October performance (yellow line) against the NASDAQ index.

At odds with its outstanding quarterly report, the company’s shares have slid 27% from 15 cents to 11 cents during October.

The promising progress made in the September quarter, along with management’s indications of a continuation of strong trading conditions, suggests that it could be an ideal time to snap up the company at a relatively cheap price.

The strong operating performance not only had a positive impact on the September quarter, but it has promising implications going forward given that the company is building its recurring revenue, providing income visibility and predictability.

In its current configuration, the Simble Energy Platform comprises a bundled software and hardware solution, with a weighted average subscription term of three years.

As subscriptions are prepaid in advance, recent growth in orders is poised to have a material impact on Simble’s cash flow.

The first material impact on cash flow from the ‘Simble Energy’ division is anticipated during the current quarter.

Associated revenue recognition commences following installation by Simble’s partners with the end user.

Outperforming its peers

During the quarter Simble has cemented its position as the fastest growing energy SaaS company on the ASX by number of customer site installations.

Over the three-month period, the number of customer sites on Simble’s IoT platform increased 45%, taking the total user growth since the beginning of the year to over 150%.

Installations in the UK increased four-fold during the September 2018 quarter.

In the UK, Simble achieved the first breakthrough early in the quarter, as the channel partnership with Powercor Ltd delivered first material sales exceeding $180,000.

Each installation delivers recurring Software-as-a-Service (SaaS) revenue, recognised on a pro-rata basis over the contract life.

The orders also include hardware components, which are recognised upfront.

Investing in the future

While management has demonstrated its ability to do the best with what it has to work with at the moment, just as important is the fact that it has recognised the potential to develop new technologies to deliver additional revenue streams in the near term.

Simble invested $560,000 in research and development, primarily aimed at accelerating an upgrade of the Simble Energy Platform that will introduce the ‘Virtual Analytics’ module.

This version of the product is designed to support the next generation of energy management solutions made possible by the UK Government’s smart meter rollout.

The Virtual Analytics platform is developed in collaboration with Utiligroup, a UK based supplier of enterprise SaaS to utilities.

Utiligroup services over 60 energy suppliers using its industry focused customer, operational and financial management solutions.

Development of the platform is largely complete with a formal launch now scheduled for the December quarter.

Targeting the UK residential market, the new platform is delivering energy analytics to users without the requirement for additional onsite hardware installation.

It is a potential gateway to mass market penetration and is expected to generate recurring licence and SaaS revenue.

The launch of this new technology, and in particular the subsequent release of evidence that it is gaining traction with users, is a potential share price catalyst.

Clearance of share overhang should help

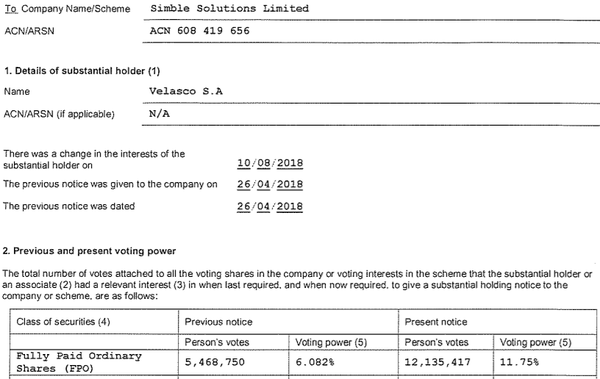

On the score of the company’s share price it is worth noting that a $2 million capital raising at 15 cents per share completed in August was heavily oversubscribed, suggesting that investors recognised the company’s prospects.

It is worth noting that approximately 23 million shares were released from escrow in August, perhaps flooding the market with sellers and driving down the share price. The potential share overhang may need to clear before sustained share price momentum can be achieved.

Interestingly though, investment group Velasco S.A took advantage of the lower share price offered in the capital raising, increasing its stake from 6.1% to 11.7% by snaring 50% of the shares on issue at the time of the placement.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.