Increased working capital to drive Scout’s sales growth

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Home security provider Scout Security Ltd (ASX:SCT) has entered into an agreement providing access to a working capital facility of up to AU$1 million, available in two separate tranches.

The key terms of the agreement will see Scout receive a first tranche of $500,000 upfront, with each tranche of the facility having a term of 180 days, and a minimum term of 90 days.

In the event Scout draws down on the second $500,000 tranche (available 150 days after the first tranche is drawn down), bringing the total to $1 million, the term of the second tranche will be a further 180 days, and a minimum of 90 days.

The interest rate will be fixed on each advance at 11.25% per annum, calculated and payable every 30 days after the relevant advance is drawn.

The funds will allow Scout to continue to pursue growth opportunities across the company’s lines of business without incurring the earnings per share dilution of issuing shares in order to raise capital.

As a backdrop, Scout sells the Scout Alarm, a self-installed, wireless home security system that is making security more modern, open and affordable.

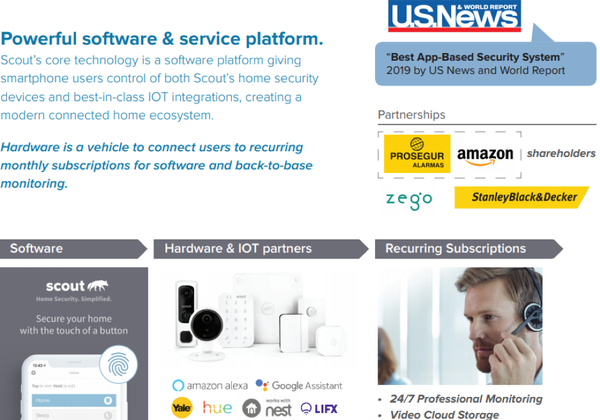

Scout was named “Best App-Based Security System” in 2019 by US News and World Report.

The company’s design-centric offering gives users complete flexibility around connected home security, allowing the system to integrate with other best-in-class IoT devices and offering flexible monitoring options.

Scout is an official partner of Amazon Alexa, Google's Assistant and Samsung SmartThings, and it is also an Amazon Alexa Fund portfolio company.

Funding to assist in growing revenues in 2020

Access to increased working capital should assist management in facilitating the strategic goals outlined in July when chief executive, Dan Roberts said, ‘’We plan to bolster our home security product suite by selectively unveiling new devices, integrations and system capabilities in the near future.

‘’We expect this to provide a steady flow of positive news, and more importantly, ensure users receive a curated home security experience from end to end.’’

In providing this forward overview, Roberts was reflecting on 2017 and 2018, a period in which the company invested heavily in new products, which placed a drag on cash flow.

Scout is now set to capitalise on its broad suite of products developed over the last few years, and the access to increased working capital announced today positions the company to deliver on its strategy, with Robert saying, “Securing this facility allows us to fund the working capital Scout needs to meet the company’s expectations to continually expand Scout Alarm deployments and grow monthly recurring revenue.

‘’As our existing white label business continues to expand and new opportunities arise, this facility gives us the flexibility to respond with additional resources to meet the demands of those programs.

“The facility will support Scout’s operational expenditures and allow the company to pursue growth opportunities in the second half of the year.

‘’This will empower us to meet customer orders faster as we continue to aggressively grow the business in the USA and abroad.

“We look forward to building Scout’s operational momentum with greater supply chain efficiency as our white-label partnerships continue to develop as planned.”

Indeed, the company’s two pronged strategy of building recurring revenues while expanding into overseas markets delivers a healthy mix of growth and stability.

On one hand, the company should achieve solid revenue growth as it builds its position in overseas markets, while increasing recurring income will provide earnings predictability.

As Scout improves its supply chain efficiencies, the company should also start to generate improved margins on the sale of its products.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.