Hot Chili raises $12.5 million at hot price

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

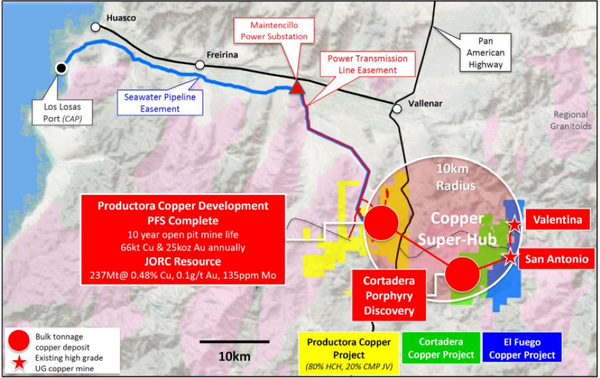

Hot Chili (ASX:HCH) has performed strongly in 2019, reaping the rewards of a considerable acquisition and exploration program that has laid the foundation for the company to establish multiple feed sources for its large-scale Productora copper development in Chile.

News released on Monday morning that it has raised over $12 million in capital at 3.6 cents per share to continue to fund its exploration and development initiatives indicates that the company is well-placed to accelerate its expansion into 2020.

Central to its success have been world-class drilling results from the Cortadera copper-gold discovery which lies only 14 kilometres from the Productora development.

Investors have realised the implied increase in valuation attributable to the group’s assets, resulting in the company’s share price increasing more than four-fold in 2019.

Just last week the company went close to matching its 12 month high of 4.3 cents, but its moving average over the last three months has mainly hovered between 3.2 cents and 3.5 cents.

Consequently, today’s news that the company has raised substantial funds at a price of 3.6 cents per share should be well received.

Funding 15,000 metres of drilling

While this provides a strong financial footing for the company, management said that it will continue to advance its longer-term strategic funding discussions with several groups, while completing its phase 2 drilling programme aimed at defining a significant initial resource at Cortadera.

Funds raised from the placement will be used for satisfaction of the remaining US$3 million part-payment for the first instalment of the Carola Option Agreement, completion of a 15,000 metre reverse circulation and diamond drilling programme at Cortadera, and general working capital.

The incorporation of diamond drilling into the exploration program will test promising mineralisation at depth that has been delineated in shallower drilling to date.

Discussing the significance of attracting prominent investors and maintaining full control of Cortadera, managing director Christian Easterday said, “We are very pleased to be attracting new high quality investors to the company who share our view that Cortadera is showing all the hallmarks of a company-maker.

‘’This funding support allows Hot Chili to maintain its ability to control 100% of Cortadera through the most value accretive stages of a major global discovery.

‘’The company will continue to advance its longer-term strategic funding discussions, while focusing our efforts to establish Cortadera’s credentials as one of the world’s top potential standalone copper-gold developments.”

Near-term catalysts

The release of results for the second diamond hole of its phase 2 drilling programme at Cortadera is imminent, and this could provide further share price momentum.

The drillhole was designed to test a potential 300 metre extension to high grade copper-gold mineralisation at Cortadera’s main porphyry where the company unexpectedly intersected a wide 440 metre zone of strong mineralisation between 340 metres and 780 metres down-hole.

Drilling of this hole was terminated at 1,133.5 metres owing to significant deviation in dip and azimuth of the hole away from the intended deeper target.

Hot Chili has now commenced its third diamond hole of the phase 2 programme, which is initially focused on defining and expanding the discovery of a high-grade core to the deposit.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.