Hartleys sees 50% upside in Navarre

Published 02-DEC-2019 11:46 A.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Hartleys resource analyst John Macdonald has initiated coverage of Navarre Minerals (ASX:NML) with a speculative buy recommendation and a 12 month share price target of 15 cents, representing a 50% premium to the company’s share price.

This would build on an already strong share price performance by the company which has surged nearly 100% in the last six months.

The company hit a six-year high in October on the back of impressive exploration results, but there could be more to come, and Macdonald believes this will happen sooner rather than later.

He has a high opinion of the company, particularly in terms of his belief that there is a strong likelihood of imminent exploration success in saying, “Navarre holds our attention because we feel the company is one or two good holes away from a major discovery in the Stawell Corridor.

‘’The share price has appreciated, partly due to recognition that mineral exploration in Victoria is yielding phenomenal returns at Fosterville (Kirkland Lake) and Thursday’s Gossan (Stavely Minerals).

‘’Navarre has the management and portfolio to continue to provide this sectoral exposure.’’

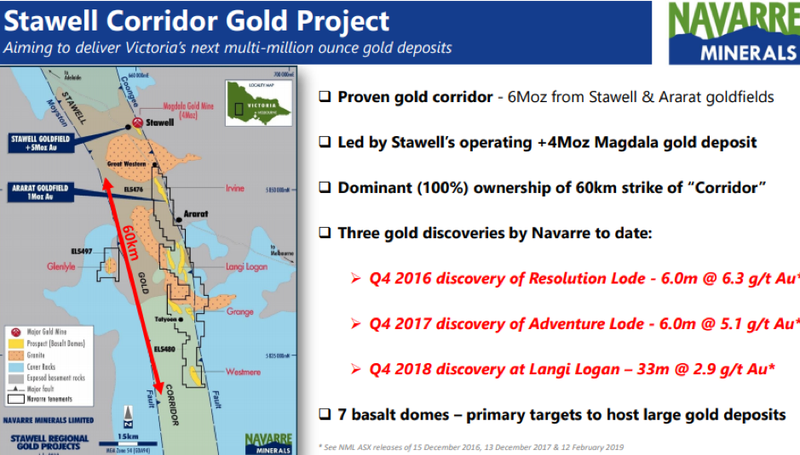

Expanding on the exploration theme, Macdonald pointed out that since 2014 Navarre’s geologists have been piecing together the case for potential repeats of the 4 million ounce Magdala gold system, in 60 kilometres of strike to the south of Magdala (Stawell).

The following graphic shows the area Macdonald is referring to and three of Navarre’s gold discoveries to date.

Targeting Thursday’s Gossan type mineralisation

Navarre is targeting large VMS, porphyry copper-gold and epithermal deposits similar to Thursdays Gossan.

Discussing Navarre’s broader exploration program over the next 12 months, managing director Geoff McDermott spoke specifically about an imminent drilling campaign at the group’s WVC (Western Victorian copper) project in saying, “In the December quarter, Navarre will recommence exploration activities at the Western Victoria Copper Project following the recent outstanding copper-gold discovery by JV partner, Stavely Minerals at its Thursdays Gossan prospect.’’

The 100%-owned Glenlyle Project is located 25 kilometres north of Stavely Minerals’ Thursdays Gossan prospect, providing the group with full exposure to a prospective discovery.

The Glenlyle Project occurs in the Stavely Arc where regional geophysics indicate a possible circular intrusive at depth with potential for porphyry, epithermal and VMS mineralisation as indicated by other prospects in the Stavely Arc.

Shallow air core (AC) drilling to date at Glenlyle has identified a silver-gold anomaly at least 150 metres wide with grades of silver up to 390 g/t silver, gold up to 4.0 g/t gold, zinc up to 0.7% and lead up to 0.3%.

The anomalous zone remains open to the north, south and at depth.

Macdonald noted that in the next the next 6 to 9 months Navarre plans to test the size, continuity and tenor of gold mineralisation outlined near surface at two Irvine prospects (Resolution and Adventure lodes), down to about 300 metres depth from surface.

At the same time similar targets at Langi Logan will be matured with aircore drilling.

The combined prospective contact under historic alluvial/deep lead workings at Irvine and Langi Logan is about 42 kilometres.

Having discussed management’s approach to potential development, Macdonald said that the company is searching for ore systems in the Stawell Corridor that will justify stand-alone development.

He believes a low capex (capital expenditure) start-up may also eventuate if necessary, and if access to the third party, 1 million tonnes per annum plant operating within 40 kilometres of the prospects, is negotiated.

Other irons in the fire

Macdonald also highlighted the prospects of the Tandarra Gold Project (NML 49%, Catalyst Metals 51%) which lies 40 kilometres north of Bendigo and 50 kilometres north-west from Kirkland Lake Gold’s Fosterville Gold Mine.

It is an advanced Bendigo analog exploration project under shallow cover with high gold grades associated with several quartz reef structures.

Assays up to 131 g/t gold have been returned from recent drill programs covering a 1.1 kilometre strike length.

With drilling to follow up a successful six diamond hole program due to start in December 2019, this represents another opportunity for Navarre to benefit from its aggressive exploration campaign.

Macdonald noted that Navarre was well funded to finance upcoming exploration, being debt free with $10 million in cash.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.