Good news stories abound on day three of Diggers

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

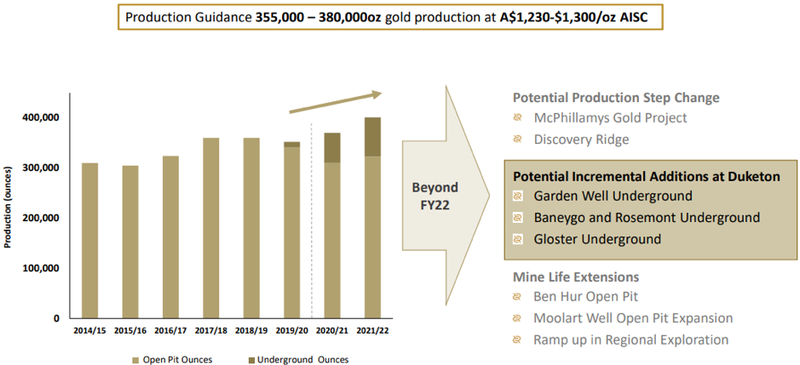

Gold producer Regis Resources Ltd (ASX:RRL) kicked off day three of Diggers and Dealers in Kalgoorlie as news of an overnight fall in the price of the precious metal came to hand.

However, Regis is a well-managed company that has an established record of achieving growth through maintaining robust production, minimising costs and conducting successful exploration.

The latter has led to mine life extensions across its Western Australian projects, but the big kicker from a production perspective promises to be the McPhillamys Gold Project in New South Wales which has a mineral resource of 2.3 million ounces and a reserve of 2 million ounces.

There is the potential to grow the mineral resource substantially through the addition of tonnage from Discovery Ridge which currently has 10.4 million tonnes at 1.2 g/t gold for 390,000 ounces.

Based on the PFS, the project should be able to deliver average annual production of nearly 200,000 ounces over a minimum nine year mine life.

The following graphic shows what to expect in the near to medium-term production wise, and the moderate AISC should be noted as it implies a margin of more than $1400 based on the current spot price.

Red 5 (ASX:RED) was next to present, a company that has two mines in Western Australia, including King of the Hills (KOTH) which has a large mineral resource of 4.1 million ounces and an ore reserve of 2.4 million ounces.

KOTH is central to the company’s growth, longevity and profitability given that its reserve life should see it transition to a mid-tier producer with production lasting for at least 16 years.

Importantly, AISC’s for KOTH will reduce substantially, and with the project expected to deliver average production of nearly 108,000 ounces per annum for the first six years it is very much central to RED 5’s success.

However the purchase of the Darlot mine is important as it transforms the company into a multi-mine producer and potentially increases annual production to about 250,000 ounces per annum from 2022.

The company’s shares doubled between June and September, but a recent retracement of about 20% could present a buying opportunity.

Breaker Resources (ASX:BRB) is another smaller company that has recently seen its share price retrace significantly.

Since Breaker’s shares increased three-fold between March and June when it hit a high of about 30 cents, it has mainly been all downhill since then and the group’s shares are now trading in the vicinity of 22 cents.

Management highlighted the three new large areas that have the potential to deliver significant resource growth.

These include depth extensions to the Bombora deposit in Western Australia which features a near surface resource of 18.4 million tonnes at 1.5 grams per tonne gold for approximately 800,000 ounces.

The company is undertaking extensive exploration to the north and south of Bombora, and reverse circulation drilling at Kopai-Crescent has returned hits of 9 metres at 4.9 g/t gold and 10 metres at 2 g/t gold.

Providing a break from precious and base metals was Salt Lake Potash Ltd (ASX: SO4), developer of the Lake Way project at Wiluna in Western Australia.

The project which is expected to deliver first sulphide of potash production in the March quarter of 2021 reached 60% completion in mid-September.

All permanent buildings are now on site and installed, including the permanent village, construction village, workshop, administration and communications infrastructure.

These projects can take lengthy periods to bring into production, indicating that SO4 has successfully met one of the key challenges.

This hasn’t been lost on investors with the company’s shares increasing 25% since announcing its excellent progress in September.

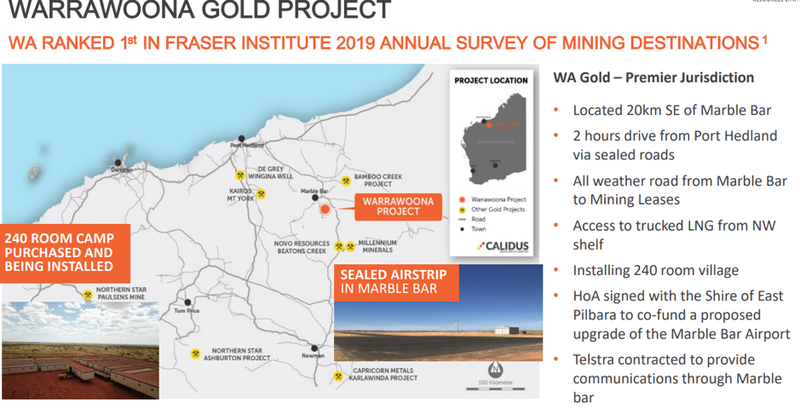

Calidus Resources Ltd (ASX: CAI) provided a comprehensive update on its Warrawoona Gold Project in Western Australia, located two hours from Port Hedland.

It has a 1.5 million ounce resource that is open at depth and along strike.

Following the completion of permitting and financing in the December quarter, management is expecting the first gold pour to occur in 2021/2022.

In parallel with construction of the plant at Warrawoona, management will be conducting further exploration with a particular focus on growing the near-mine Klondyke mineral resource.

The above map not only shows the Warrawoona project but you can also see the De Grey Mining Ltd’s (ASX:DEG) landholdings to the west.

De Grey presented shortly after Calidus, but unlike the latter it has been operating in the area for many years.

However, it could be argued that 2020 has been its best year on record, and the increase in the company’s share price from 5 cents in January to an all-time high of $1.60 in September highlights the incredible journey for both management and shareholders.

The defining point was in February when the company announced the Hemi discovery just to the west of the 357,000 ounce Wingina deposit.

Subsequent drilling throughout the year has demonstrated that there is even more to Hemi than was originally anticipated.

Not surprisingly, management is looking for other lookalike Hemis and with a consolidated land position spanning 150 kilometres of strike and more than 200 kilometres of shear zones the opportunities are numerous.

The existing shear hosted mineral resource of 2.2 million ounces at 1.8 g/t gold does not include Hemi.

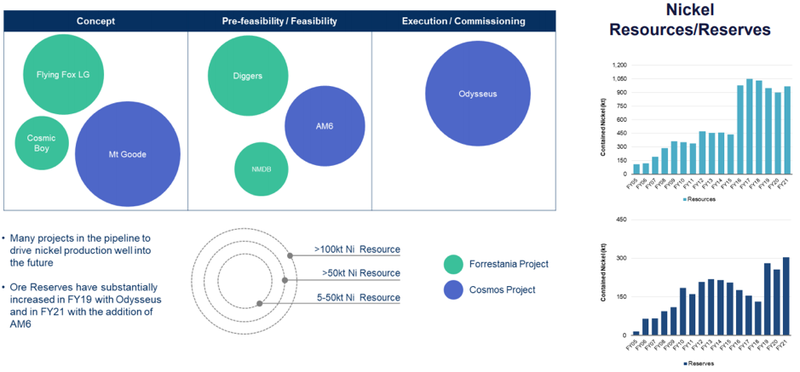

With nickel once again hitting US$7.00 per pound this week it was good to see Western Areas Ltd (ASX: WSA) present.

The company’s shares are up 10% in October, but it could be argued they were due for a boost after a sell-off in recent months.

The company has been operating in the Forrestania region south-east of Kalgoorlie in Western Australia for 20 years.

During this period Western Areas has developed both the Flying Fox and Spotted Quoll nickel mines, and in 2015 the company acquired the Cosmos Nickel Operation to the north of Leinster from Glencore.

It has a nickel mineral resource of 265,000 tonnes, and management expects to bring it into production in 2022.

As indicated below, Cosmos has been responsible for substantially increasing the group’s nickel resources and reserves over the last five years.

However, it could be argued that this hasn’t been captured in the company’s share price which is still trading broadly in line with where it was five years ago.

Consequently, while 2022 will mark a substantial uptick in income and earnings as production starts at Cosmos, the current share price may represent a useful entry point before momentum builds closer to production.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.