Gold plated copper rockets

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

A strong surge in the copper price between 2016 and 2018 resulted in companies exposed to the commodity coming back into favour.

During this period the red metal increased from approximately US$4400 per tonne to a high of more than US$7200 per tonne in mid-2018.

However, the sharp decline that occurred between June and August 2018 took the shine off many stocks as the copper price fell to a low of about US$5800 per tonne.

While a recovery of sorts occurred between September and December, this coincided with a meltdown in global equity markets, resulting in very scarce share price gains on the back of the commodity price recovery.

Consequently, while the copper price has increased from about US$5800 per tonne to around US$6500 per tonne in 2019, the share prices of both explorers and producers are still trying to catch up with the fallout that occurred last year.

Looking at the big picture, even if you take into account the sharp decline in copper during the global financial crisis, the commodity has generally traded in a range between US$3000 per tonne and US$9000 per tonne.

The fact that copper is hovering above the mid-point of this range is healthy in terms of companies achieving solid margins, taking into account prevailing costs of production.

Given we haven’t had a ‘rising tide lifts all boats’ response to the recent rally, Trifecta examines three stocks exposed to the commodity where there appears to be scope for share price upside.

Note that each stock is also leveraged to the resilient gold price, either through production or exploration success.

Antipa Minerals

Antipa Minerals Ltd (ASX:AZY) is the smallest of the companies with a market capitalisation just shy of $50 million.

Size doesn’t necessarily count though, particularly for companies in the exploration stage.

This is very much the case with Antipa which boasts some of the most highly prospective copper-gold territory in Australia.

Hartleys resource analyst Paul Howard is confident regarding the company’s ability to transition some of its numerous well-positioned prospects into projects, referring to their location as one of the hottest exploration destinations in Australia.

His 12 month price target of 5.9 cents implies upside of nearly 140% to the company’s current trading range. This is, of course, speculative.

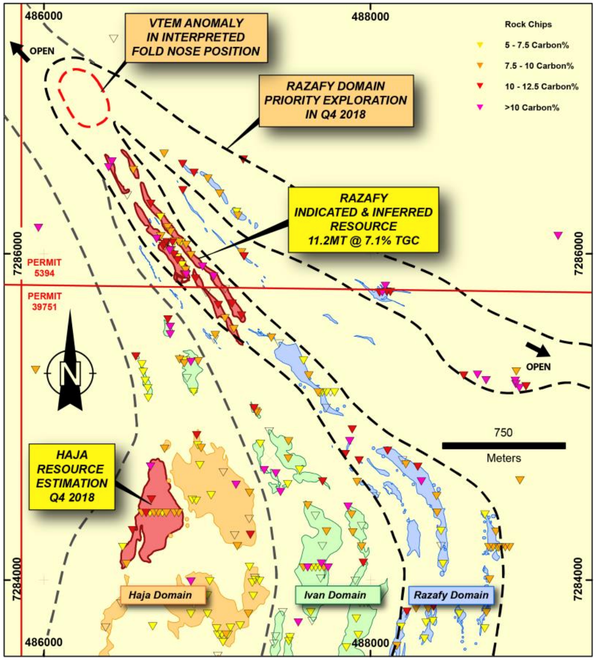

The company owns approximately 5500 square kilometres of tenements in the Paterson Province of Western Australia, including a 1330 square kilometre package of prospective granted tenements known as the Citadel Project.

The Citadel Project is located approximately 75 kilometres north of Newcrest’s Telfer Gold-Copper-Silver Mine and includes the gold-copper-silver±tungsten Mineral Resources at the Calibre and Magnum deposits and high-grade polymetallic Corker deposit.

Under the terms of a farm-in and joint-venture agreement with Rio Tinto Exploration, a wholly owned subsidiary of Rio Tinto Ltd (ASX:RIO), Rio can fund up to $60 million of exploration expenditure to earn up to a 75% interest in Antipa’s Citadel Project.

Aside from the Citadel Project, Antipa has an additional 2360 square kilometres of granted exploration licences, known as the North Telfer Project which hosts the high-grade gold-copper Minyari and WACA Mineral Resources.

As indicated below, this extends its ground holding in the Paterson Province to within 20 kilometres of the Telfer Gold-Copper-Silver Mine and 30 kilometres of the O’Callaghans tungsten and base metal deposit.

Antipa has acquired, from the Mark Creasy controlled company Kitchener Resources Pty Ltd, additional exploration licences in the Paterson Province which cover 830 square kilometres.

The company also owns a further 930 square kilometres of exploration licences (including both granted tenements and applications), which combined are known as the Paterson Project, which comes to within three kilometres of the Telfer Mine and five kilometres of the O’Callaghans deposit.

Underexplored province with world-class potential

Management has good reason to be buoyed by the group’s prospects given a number of their projects are in close proximity to neighbouring multi-million ounce gold and copper deposits.

Antipa’s assets shouldn’t be described along the lines of your usual ‘along trend’/‘similar geological characteristics’ banter – they are literally in the backyard of billion-dollar producers with some of the best projects in the world.

On a pre-mining basis, Telfer has 32 million ounces of gold and 1 million tonnes of copper and Nifty (also shown on the above graphic) has a pre-mining copper resource of 2 million tonnes.

It is also worth noting that the O’Callaghans resource is home to more than 5% of the world’s tungsten resource.

An aggressive and expansive drilling campaign in 2018 focused on a number of key targets across the company’s tenements.

Importantly, management was able to prove that its territory was not only close to high grade deposits, but drilling demonstrated that some of the areas actually contained mineralisation as good as, if not better than average grades at Telfer and Nifty.

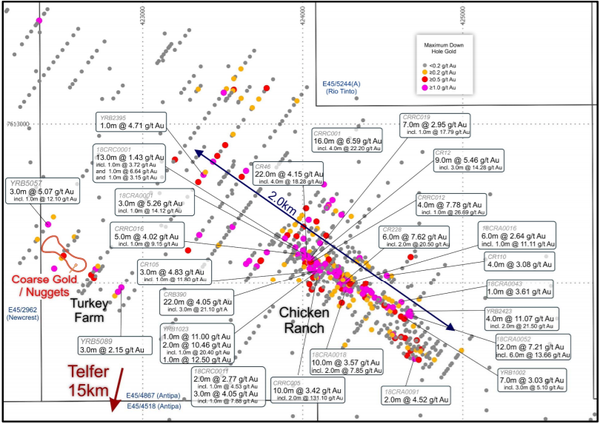

Chicken Ranch which is in close proximity to Telfer delivered some particularly promising results including 12 metres at 7.2 grams per tonne gold from a shallow 28 metres down hole, including 6 metres at 13.6 grams per tonne gold.

Shallow high grade mineralisation remains open along strike at Chicken Ranch.

Management aims to deliver a maiden resource for Chicken Ranch in the June quarter of 2019, a potential share price catalyst.

One of the key objectives is to identify sufficient resources to support a production opportunity including nearby deposits at Tim’s Dome, Chicken Ranch and Turkey Farm with the latter expected to be the subject of a maiden drilling program in the first half of 2019.

Success at Turkey Farm would be particularly significant in terms of transitioning to production given its close proximity to Chicken Ranch.

Aurelia Metals

Aurelia Metals Ltd (ASX:AMI) is an Australian gold, silver, lead, zinc and copper mining and exploration group with its operations focused on the Hera and Peak gold and base metal mines in central New South Wales.

In terms of current production, Aurelia should be considered a gold stock rather than a copper or base metal play.

However, it produced 2400 tonnes of copper in concentrate in the six months to December 31, 2018, and the company will continue to produce copper in the near to medium-term.

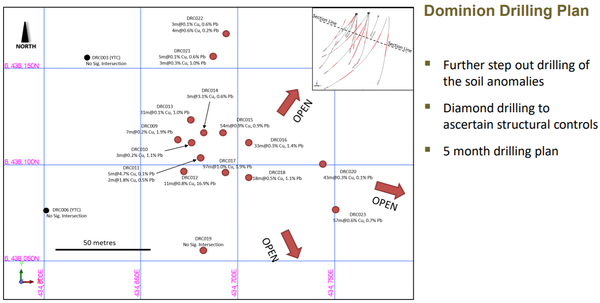

In terms of the company’s copper prospects, of greater significance was the company’s exploration success at Dominion, 11 kilometres south of the group’s Hera project which produced 30,000 ounces of gold at a particularly low cost of $600 per ounce in the first half of fiscal 2019.

The discovery of near surface copper mineralisation at Dominion prompted management to say that there would be a ‘renewed focus on exploration’, and that the group would be conducting a five-month drilling campaign, including further step out drilling.

The results were promising with initial drilling identifying multiple broad new surface mineralisation including 97 metres at 1% copper, 2.4% lead and zinc, 8 grams per tonne silver and 0.14 grams per tonne gold.

These polymetallic systems are consistent with those that define producing mines in the broader region, and the presence of what could be considered as secondary metals can potentially determine the commercial viability of a project.

For example, if copper is the predominant metal being mined, revenues from other base metals or gold and silver assist in driving down the cost of copper production, potentially adding significant value to projects.

With regard to Aurelia, investors have exposure to what may emerge as a substantial copper project while also having the comfort of being part of a profitable company with dual projects and exploration targets.

In the December half, group gold production was 71,330 ounces at all in sustaining costs (AISC) of $794 per ounce.

During this period the company achieved an average gold price of $1678 per ounce, implying a margin of nearly $900 per ounce.

As at December 31, 2018, Aurelia had cash of $108 million, up from $67 million at the end of fiscal 2018.

With the group being debt free, it is well-positioned to mount an aggressive exploration campaign which could quickly determine the future of the Dominion discovery.

In noting that more than 7000 metres of drilling is planned, along with a large IP survey, Hartleys resource analyst Mike Millikan said that he expects ‘strong news flow’, particularly given that mineralisation remains open in a number of directions.

The more advanced project is Nymagee with a resource of 1.4 million tonnes at 2.2% copper, 1.6% lead and 3.2% zinc.

A scoping study indicates that it could add up to 4 years mine life to the Hera project.

Consequently, the fortunes of Aurelia are linked in many ways to its success in progressing projects that incorporate copper production.

Xanadu Mines

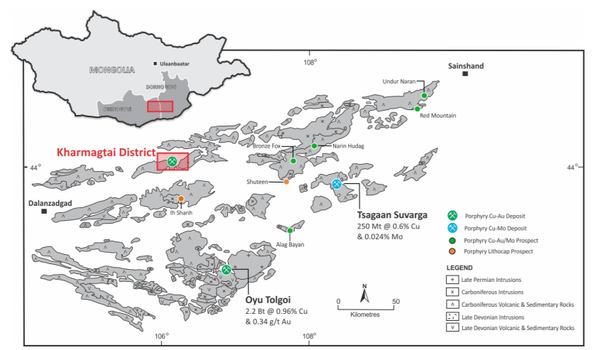

Xanadu Mines Ltd’s (ASX:XAM, TSX:XAM) release of promising assay results from its Kharmagtai copper-gold deposit in Mongolia has largely been responsible for its strong share price performance in the last month.

During this period, the company’s shares have surged from 9 cents to a high of 14.5 cents in early March.

Though they have retraced slightly to 12.5 cents, analysts are generally of the view that the group’s exploration program in 2019 will build on recent positive results, leading to significant share price upside.

Bell Potter analyst, Peter Arden, views the project as globally significant saying, “The discovery of extensive and potentially high grade bornite mineralisation in the latest drilling at Kharmagtai confirms the company is closing in on the high grade root zone.

“We continue to regard Kharmagtai as one of the world’s most attractive undeveloped copper-gold projects because of its favourable location in a mining friendly jurisdiction and ability to benefit from lower capital and operating expenditure than its peers.”

Another Oyu Tolgoi?

Mongolia has become an increasingly popular destination for both emerging miners and global giants such as Rio Tinto, with Rio being part of a joint venture developing Oyu Tolgoi, one of the world’s largest new copper-gold mines in the South Gobi region.

Based on current projections, the project should be the third largest copper producer in the world by 2025.

In attributing a value of 52 cents per share to Xanadu, Arden said, “XAM is well positioned to be significantly re-rated as it continues to expand its resource base, demonstrating Kharmagtai’s very favourable economics and considerable upside, especially as the extent of the potentially high grade bornite mineralisation is defined.”

Bornite mineralisation is often associated with high gold grades.

The recent drill hole KHDDH488 intersected a 713 metres zone of porphyry style veining, extending from a depth of 178 metres to 891 metres.

To put this in perspective, Oyu Tolgoi is characterised by multiple copper-gold porphyry centres which occur above and partially telescoped onto the underlying porphyry systems.

The high grade core of the deposit is a cylindrical shaped copper-gold porphyry 250 metres in diameter that extends vertically for over 800 metres - sound familiar?

It is early days, but management is emphasising that the latest drilling results have confirmed a transition to higher temperature sulphide mineral assemblages such as bornite in the intrusive root to the deposit, with a significant increase in the gold-to-copper ratio associated with increasing bornite.

Cutting through all the geo-speak, this means ‘we think we are getting close to the good stuff.’

Initial assay results included 352 metres at 0.4% copper and 0.6 grams per tonne gold, 102 metres at 1% copper and 1.7 grams per tonne gold and 78 metres at 1.1% copper and 2 grams per tonne gold.

Comparatively smaller widths included 10 metres at 2.2% copper and 5.3 grams per tonne gold.

Numerous catalysts in 2019

While the grades may seem underwhelming, it is important to understand the type of project Xanadu has in its sights

The presence of both gold and copper will drive down the cost of production, and should a project be undertaken it would be a large-scale operation where high volumes are the economic driver.

As an example, Oyu Tolgoi has a resource of 2.2 billion tonnes at 0.96% copper and 0.34 grams per tonne gold.

While at full tilt between 2025 and 2030 it is expected to deliver annual production of more than 550,000 tonnes of copper and over 450,000 ounces of gold.

Harking back to Xanadu, further assays from drillhole KHDDH488 will come to hand shortly, perhaps providing further share price momentum.

Potential catalysts in 2019 include results from further drilling, an increase in the size and grade of the mineral resource and possibly the commencement of economic studies.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.