Fluence leading the way in growing niche market

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

In a world where there is an increasing focus on establishing a reliable supply of healthy water, Fluence Corporation Ltd (ASX:FLC) is having outstanding success.

Fluence has a strong stable of proprietary products which are used in the treatment of decentralised water, wastewater and reusable water.

The company’s products and services are well sought after, and as recently as yesterday the group was awarded a sizeable contract by the federal government of Ivory Coast for the supply of a 150,000 cubic metre per day surface water treatment plant.

This project valued at €165 million will provide potable water to Abidjan, the country’s largest city with a population of 4.7 million.

The scope of work under the contract includes water intake, water treatment, bulk water piping, water towers and infrastructure.

The plant will include cutting-edge integration of proven technologies, including smart intake, various separation and membrane systems, advanced oxidation, biological filtration and sludge treatment.

The advanced multiple barrier design (ensuring water quality according to World Health Organisation standards) is an environmentally sound water treatment process that allows the flexibility to optimise operating costs in various feed qualities.

The design combines Fluence’s suite of water treatment technologies and demonstrates the company’s expertise in areas of water biology, chemistry and its range of treatment processes.

Such is the adaptability of Fluence’s technology that the end-product will be produced by treating water from Lagune Aghien, Ivory Coast’s largest freshwater reserve near Abidjan, which is dense with algae and other contaminants.

In relative terms, the size of this contract (US$187 million) is an extremely important development for the group considering the company’s full-year revenues for the 12 months to December 31, 2018 were US$105.6 million.

The contract is expected to generate revenues of US$20 million in 2019 and US$80 million in revenue in 2020, with the remainder in 2021.

Recurring revenues provide earnings predictability

Fluence has been focused on building recurring revenues by incorporating facility management into contracts.

The company has started to build a meaningful recurring revenue base, with secured average annual recurring revenue of US$14.7 million at 31 December 2018.

Importantly, Fluence has been invited by the Ivory Coast government to bid for an operating and maintenance contract, which could provide further recurring revenue.

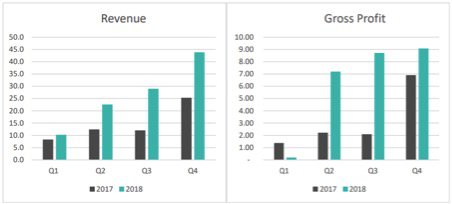

With the company continually expanding its global presence, its revenue and profit growth momentum as illustrated below looks set to continue.

Management recently reaffirmed its underlying earnings guidance for 2019, projecting that the company will move to profitability by the December quarter.

Expansion into China

The expansion of Fluence into China, both through sales and manufacturing facilities, strongly positions the company to participate in the planned improvement in China’s rural wastewater treatment quality.

The Chinese Government’s current five-year plan is targeting, and provides finance for, an increase in rural wastewater treatment to reach Class 1A effluent discharge.

With approximately 10% of rural wastewater currently treated and the five-year plan’s target to reach 70% treatment of wastewater in China, Fluence’s Smart Packaged AspiralTM system featuring MABR technology is the lowest cost treatment alternative available in the decentralised market, and simultaneously guarantees to consistently reach Class 1A effluent discharge standards.

A successful demonstration plant with Chinese partner Hubei ITEST, enabled the execution of an exclusivity agreement in October with anticipated AspiralTM sales estimated at a minimum of US$45 million over the next three years.

The first two contracts under this partnership were booked in December with a total of 35 AspiralTM units to be deployed.

In November 2018, Fluence announced a new partnership with environmental EPC firm Zhongzi Huaze and executed a multi-unit AspiralTM order.

Six AspiralTM units were delivered in December 2018 and commissioned in January 2019 - the first for Fluence in Jilin Province.

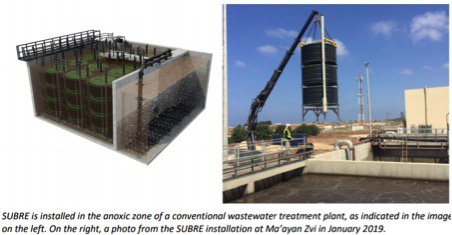

Fluence is actively quoting SUBRE (submerged MABR) projects for potential clients in China and in other key markets and the group continues to focus on the full commercialisation of the product in the first half of 2019.

An example of SUBRE is shown below.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.