Extended mineralised vein at Hardey’s Nelly Vanadium Mine

Published 15-AUG-2018 09:56 A.M.

|

5 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

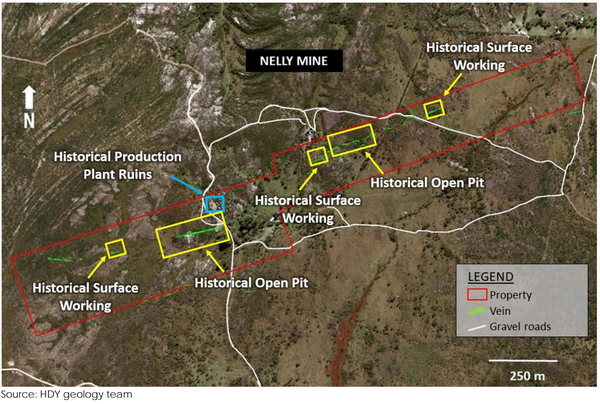

Hardey Resources Limited’s (ASX:HDY) today reported that a second field trip to the Nelly Vanadium Mine (NVM) in Argentina’s San Luis Province has confirmed its vanadium exploration upside.

HDY received the second field trip update report from the SRK Consulting and Condor Prospecting teams, which focuses on the north-east part of the tenure. The report provides incremental evidence there is significant exploration upside at the mine. As such, HDY has decided to proceed with exercising the option to acquire NVM.

Notably, an old open pit, surface historical workings and mineralised veins, were discovered — none of which have been previously identified. Evidence of a mineralised vein outcropping was found 100m before and 250m after the second open pit (65m long, 2.5m wide, 3m deep) that aligns with the main open pit south-west of the historic processing plant.

Collectively, these observations confirm the mineralised vein running through tenure is at least 50% larger than the 0.9-1 kilometres originally envisaged.

Significantly, other than the known open pits and small historic workings, much of the mineralised vein appears untouched and exposed at surface

Mineralisation observed in the north-east section — hematite, pyrite, copper and vanadate minerals — was consistent with the geology in the main open pit south-west of the processing plant.

The clear visible extension of the mineralised vein at surface to the north-east across tenure up to 1.5 kilometres long highlighted the degree of exploration upside across NVM. These new discoveries have been measured and evaluated, with the thickest observations outlined the updated tenure map below.

Of course, as with all minerals exploration, success is not guaranteed — consider your own personal circumstances before investing, and seek professional financial advice.

Highlights from the second day

Around 400m north-east from historic processing plant ruins there is a mineralised vein outcropping adjacent to a small legacy working area 2m by 2m and 1.5m deep. The vein’s general mineralisation trend is a south-west to north-east strike, with outcropping in portions over 6-10m distance. Notably, numerous mineralised clasts are surrounding the vein and working area.

A further 100m along from the small historic working area, in the same north-east direction, is the newly discovered open pit, which is in the same orientation as the pit in the south-west section of the tenure. This new pit strikes south-west to north-east and is 65m long, 2.5m wide and 3m deep.

Interestingly, a portion of the vein remains untouched while the mineralisation is identical to other historic working areas. In addition, there is another stockpile which brings the total across the tenure to ten in total.

The type of mineralisation observed in the north-west open pit is hematite, pyrite, copper minerals, green and yellow vanadate and black minerals.

A further 250m to the north-east of the open pit another mineralised vein outcropping – over a 5m distance – was observed. Adjacent to the outcrop was a surface workings area 4m by 5m and 1.5m deep, with a small residual rock pile. Visual observations of the rocks within the pile showed hematite and veining which confirm the extension of mineralisation into this area. Specifically, the veining and minerals can be seen on within the outcrop.

The fact the north-east vein and historic surface workings are an aligned extension from the main open pit south-west of processing plant ruins (implying at least a 1.5km mineralised vein system), illustrates the huge exploration potential still apparent within the NVN tenure.

The image below is the open pit north-east of the historic processing plant. On the left side it shows part of the vein left untouched, while the host rock is on the right side. This open pit has the same orientation as the main pit located in the south west section.

This is a significant discovery as further work must be carried out to determine the design of the mineralisation in place and vein dimensions. This includes detailed surface mapping and an inaugural drilling program.

Final stages of due diligence underway: option to acquire Nelly Vanadium Mine

Although SRK’s final site visit report remains outstanding, the Board is satisfied due diligence is complete and have decided to exercise the option to acquire NVM

As such, HDY should soon be in a position to advise the vendors of Nelly Vanadium Pty Ltd that it is exercising the option to acquire NVM with immediate effect.

The other key factor swaying the HDY’s decision is the favourable outlook for vanadium demand and the opportunity for new supply chains from Argentina and Australia to be evolved. In particular, Nelly Vanadium Mine may meet this objective, given it can be re-opened relatively quickly and the legacy stockpiles potentially monetised as a direct shipping ore vanadium product.

HDY Executive Chairman, Terence Clee commented: “The new discoveries in the north-east part of the tenure which confirm the likelihood of an extended mineralised vein that is largely untapped is exciting news. Taking into account the geology team’s findings and prevailing global demand outlook for vanadium, the Board has decided to proceed with exercising the option to acquire Nelly Vanadium Mine.”

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.