Exploration underway at Amani's African Gold Projects

Published 04-FEB-2020 13:50 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

African gold explorer, Amani Gold (ASX:ANL) has provided a quarterly update for the three months to 31 December.

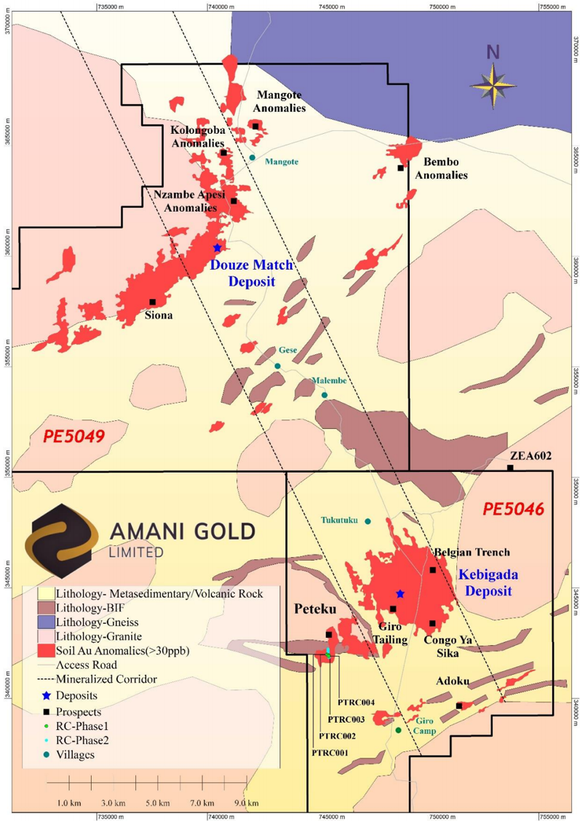

Giro Gold Project - Kebigada Deposit

On 14 October 2019, Amani announced the completion of Phase One diamond core drilling operations (drillholes GRDD034 and GRDD035) at Kebigada Gold Depoit, Giro Gold Project.

Drilling targeted deeper high-grade sulphide associated gold mineralisation within the central core of Kebigada deposit. Drillhole GRDD034 successfully targeted deeper high-grade sulphide associated gold mineralisation within the central core of Kebigada deposit and these assays are the deepest yet at Kebigada.

Phase One holes GRDD034 and GRDD035 are 240m apart and have both outlined high-grade gold mineralisation deeper than previously intersected at the Kebigada deposit.

Given that the gold assay results indicate the potential for the Kebigada deposit to substantially grow via targeted deeper and along strike drilling, additional drilling has been planned, which will comprise a further four core holes, each 500m in length.

Peteku Prospect - Giro Gold Project

At the company’s Peteku Prospect, initial Reverse Circulation (RC) drilling operations (drillholes PTRC001 – PTRC004) have been completed.

Total initial drilling was completed for 397m and targeted near surface gold mineralisation below a regional gold in soil anomaly. Holes PTRC001 - PTRC004 were completed at depths of 77m to 120m with RC rock chip samples at SGS Mwanza laboratory (Tanzania) for gold analysis.

The styles of alteration and sulphide mineralisation of mafic volcanic and quartz veins present in three of the drillholes are typically good indicators of gold mineralisation at Giro. If significant gold mineralisation has been intersected in the initial four holes, further drilling may comprise an additional 25 RC core holes, each nominally 150m in length (total 3,750m).

Assay results are pending and are expected shortly.

First Gold Shipment from Geita

Tanzania has launched its first ever international minerals trading hub in the gold rich Geita District in the North-western part of the country and will accommodate buyers, miners, government offices, banks and dealers at a one-stop centre.

The Geita District minerals trading hub is expected to attract both local and foreign gold dealers and is designed to be a model for other regional precious metals trading hubs in an effort by the government to crack down on illegal gold and precious metals trading.

Tanzania is the fourth largest producer of gold in Africa and the Geita District produces 40% of all gold produced in Tanzania.

Amani announced the securing of Gold Dealer Licences in Tanzania via a 60% equity interest in Amago Trading Limited.

Then, on 28 November, Amani announced that Amago completed its first shipment of approximately 6.77Kg gold (purity78%) from Geita mineral and gem Hub (Tanzania) to a Hong Kong refinery. The total amount of refined gold at Hong Kong was 5.08Kg gold (purity 99.9999%) on 29 November.

Amago received payment for the gold from the Hong Kong gold refinery the same day as it was processed. There are plans to increase the size and frequency of shipments from the Geita Hub to Hong Kong as soon as possible.

Corporate

On 22 October, Amani announced the completion of a placement of 833,333,330 shares at $0.003 per share to raise $2.5 million. Funds raised will be used by the company to advance the Giro Gold Project in the DRC.

On 29 January 2020, the company then announced that it has issued Convertible Notes with a face value of $2.1M to Hong Kong based investment company, Neo Gold Limited.

Amani has since announced that it has received an additional commitment from Neo Gold that will raise up to a further $3.0 million through the issue of up to 1 billion fully paid ordinary shares at an issue price of $0.003 per share.

Completion of the Placement and issue of the Placement Shares will be subject to shareholder approval at a general meeting of shareholders anticipated to be held by during March 2020.

Funds raised are to be used to advance the Giro Gold Project, including diamond core and RC drilling programs, regional exploration, resource estimate upgrade for Kebigada deposit, mining studies and for general working capital purposes. A clear strategy will be advancement to gold production.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.