EverBlu begins coverage of MRR as it closes in on securing Pilbara assets

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

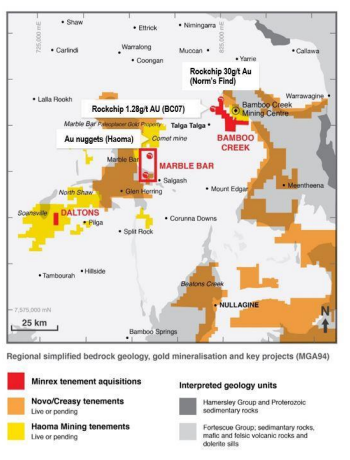

MinRex Resources Limited (ASX:MRR) has today informed the market that the final requisite conditions precedent to the settlement of its East Pilbara Tenements have been given key shareholder approval and are expected to be completed in the near future.

Rock chip samples taken from the tenements, collected prior to Christmas, have now been delivered to the lab in Perth for assaying. In anticipation of the pending settlement of the East Pilbara tenements, an initial program of works is currently being finalised by MRR — the program covers the work to be undertaken at the tenements as soon as it gets the green light.

Earlier this month, the company released an update, including news of six gold nugget discoveries (22.7 grams) and a site inspection of its to-be-acquired projects. MRR also welcomed Artemis Resources (ASX:ARV) to its shareholder register.

Source: MinRex Resources

However it is an early stage of this company’s development and if considering this stock for your portfolio you should take all public information into account and seek professional financial advice.

Another potentially significant factor MRR is closely monitoring is the tenements’ close proximity to gold occurrences on the adjacent Haoma Mining (ASX:HAO) tenements, which puts much of MRR’s exploration work along strike from HAO.

They also border licences controlled by the $475.4 million capped Novo Resources Corp (TSX-V:NVO).

In good news for Pilbara gold stocks, Novo recently gave a presentation at a Canadian mining conference which led to a 25 per cent uplift on the Canadian Stock Exchange.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Whilst Pilbara stocks have seen a slight downturn recently, the tide looks to be turning and MRR is seeking to capitalise as they look to release news around assay rock chips from 2017 due diligence field evaluation, historical data compilation, target generation, mapping, surface sampling, prospecting and drilling depending on results.

MRR a ‘speculative buy’ says EverBlu Capital

Boutique investment bank, EverBlu Capital, has published its extensive research report on junior gold explorer MinRex Resources (ASX:MRR).

The 16 page report, which provides an in-depth exploration of MRR’s growing portfolio, has rated MRR as a ‘speculative buy’ with a price target of A$0.31. EverBlu’s price target assumes successful exploration efforts and 77.1 million MRR shares on issue.

It should be noted that broker projections and price targets are only estimates and may not be met. Those considering this stock should seek independent financial advice.

The report comes on the back of significant investor interest in Western Australia’s Pilbara Region, due to several gold discoveries over the past year. Initial interest was sparked by the aforementioned Novo Resources, which found small watermelon seed-shaped gold nuggets at Artemis Resources’ (ASX:ARV) Purdy’s Reward prospect as part of an exploration joint venture.

Several explorers are now in the process of testing the two proposed geological models for the region: conglomerate-hosted gold and high grade orogenic gold.

MRR’s Pilbara progress to date

Since listing on the ASX in 2011, MRR has aggressively expanded its tenement holding.

The company acquired a 70% interest in five highly prospective licenses in the East Pilbara region last November, which are prospective for gold as well as copper, lead and nickel.

As part of the deal, MRR paid a non-refundable deposit of A$100,000 on execution of the Heads of Agreement. The company will make a further cash payment of A$650,000 and issue 14,583,334 fully paid ordinary shares at $0.12 per share to the Vendors upon settlement of the acquisition.

During the private placement held to facilitate the acquisition, Artemis Resources (ASX:ARV) secured a A$250,000 strategic stake in MRR, which ensures the company’s involvement in any developments involving the tenements moving forward.

These new licenses are located within three projects: Bamboo Creek, Marble Bar and Daltons. Of particular interest is the Bamboo Creek project, which has returned historical rock chip samples of 30g/t gold at Norm’s Find.

Source: MinRex Resources

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.