Due diligence proves positive for Hardey’s NT vanadium play

Published 24-AUG-2018 10:08 A.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Hardey Resources Limited (ASX:HDY) has today presented its geology team’s preliminary due diligence findings on two highly prospective vanadium projects in the Northern Territory, part of a package of six projects the company has agreed to acquire from privately owned Vanadium Mining Pty Ltd (VanMin).

HDY believes it’s in “the right vanadium neighbourhood”

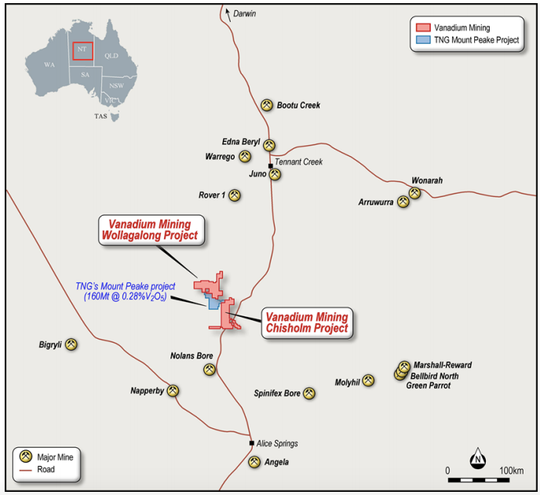

VanMin’s Northern Territory assets are located adjacent to TNG’s advanced Mt Peake VTM project. A key positive with Mt Peake is the underlying mineralisation, which comprises a high-grade form of VTM associated with ore bodies that can be selectively mined utilising open pit methods.

This means clear comparative advantages in being able to develop economically efficient mining operations. Relative to Mt Peake, which is ~190km north of Alice Springs, the Wollagalong project is 6km north while the Chisholm prospect is 13km east. Both VanMin’s projects are contiguous to the Mt Peake tenure, forming the north and east boundaries.

HDY Executive Chairman Terence Clee commented: “Undoubtedly, the two Northern Territory projects are in the right neighbourhood, given the proximity to TNG’s high-calibre Mt Peake VTM operation.

“The aeromagnetic and soil sampling evidence is quite compelling that both projects are highly prospective for vanadium mineralisation. Taking a holistic view, the Board is delighted the due diligence to date on Vanadium Mining’s six assets across Queensland and the Northern Territory is heading in the right direction,” he said.

Geological overview — Wollagalong and Chisholm

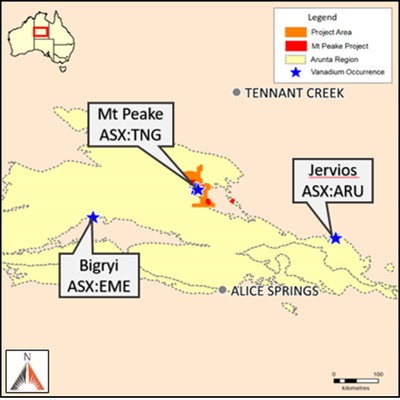

The largest vanadium resources in the Northern Territory are associated with mafic-hosted vanadium magnetite deposits in the Arunta Region’s Aileron Geological Province. These mafic-hosted VTM deposits (which is the type targeted within the Wollagalong and Chisholm projects) have only recently been identified in the Jervois area and at the Mt Peake project.

This implies that due to the Wollagalong and Chisholm projects’ proximity to Mt Peake (which has a JORC 2012 code reported total mineral resource of 160Mt at 0.28% Vanadium oxide, 5% Titanium dioxide and 22% Iron, cut-off grade 0.1% Vanadium oxide), there is clearly significant exploration upside to uncover additional vanadium mineralisation.

The probability would appear to be higher for the Wollagalong project given the surface exposures of the Anningie Formation, which underpins the VTM economic mineralisation at Mt Peake, has been mapped within its boundaries.

As an aside, the Jervois vanadium deposit forms part of a joint venture (now known as Bonya JV) between Arafura Resources Limited and Thor Mining Limited. A drill intersection, which returned 49m at 0.96% Vanadium Oxide, 8.55% Titanium Oxide and 34.5% Iron (over 0-49m depth range), further highlights the vanadium potential within the region.

The second known style of vanadium mineralisation in the NT is associated with sandstone-hosted uranium deposits. The largest known resource is at the Bigrlyi uranium prospect, which has a total mineral resource of 7.46Mt at 0.13% Triuranium octoxide and 0.12% Vanadium Oxide cut-off grade 500ppm Triuranium octoxide (reported under the JORC 2004 code).

Project aerial geophysics

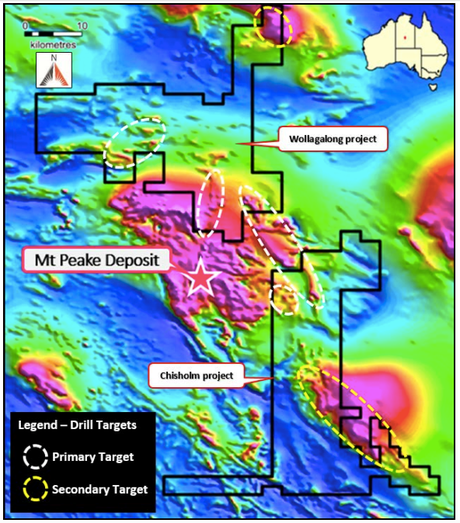

In Australia, VTM deposits are typically formed on cratons of Archean to Proterozoic age and are closely associated with large igneous provinces — hence this is a focus when undertaking exploration activities. Mafic to ultramafic complexes that host VTM deposits are generally apparent as strong, clearly defined anomalies from aeromagnetic surveys. Aeromagnetic surveys confirm that Wollagalong and Chisholm have highly magnetic anomalies within their boundaries.

Assessing the geophysics, the aeromagnetic image identifies two phases of potential mineralisation with east-west and north-south trending structures visible and intersecting within the project areas. VanMin’s projects have similar geological and magnetic features to the Mt Peake deposit. HDY’s team report that “they are highly probable to be gabbro-hosted magnetite deposits, the same as those that underlie Mt Peake’s VTM mineral resource”.

As vanadium mineralisation within these systems is relatively shallow, selecting prospective targets for further follow-up within the two projects is straightforward — which provides the opportunity to expedite and de-risk the projects materially with a high-level exploration program that aims to potentially model, estimate, and report a JORC 2012 compliant vanadium mineral resource.

Next, HDY will complete due diligence reviews for Nelly Vanadium Mine, Argentina and VanMin projects.

The Exploration Targets reported herein are not JORC compliant Mineral Resources. The potential quantity and grade of the Exploration Targets are conceptual in nature, there has been insufficient exploration to determine a Mineral Resource and there is no certainty that further exploration work will result in the determination of a Mineral Resource.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.