Drilling Complete and Assays Imminent as N27 Ramps up Cobalt Exploration

Published 21-NOV-2017 09:52 A.M.

|

11 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

As one of the best performing commodities of 2017, cobalt is attracting a lot of attention from junior explorers and investors. Its rising price is supported by the rapid growth of electric vehicles, which require more and more cobalt to keep up with demand.

Yet, there are only few ASX juniors focused on cobalt alone, and fewer still that are trading at reasonable prices. Worldwide, 94% of all cobalt production comes as a by-product of nickel or copper mining, with cobalt being refined from a concentrate.

Furthermore, a bulk of the world’s cobalt supply comes from the Democratic Republic of Congo, whose mining industry is plagued by ethical and sovereign risk concerns.

With a market cap of less than $21.86 million, Northern Cobalt (ASX:N27) is one cobalt focused junior that ticks all the boxes and still remains reasonably priced. With operations in the mining friendly jurisdiction of the Northern Territory, N27 has none of the sovereign risk or ethical concerns of African-focused cobalt juniors.

Having listed on the ASX in September, N27 has already more than doubled its share price as the market responded positively to the company’s drilling updates.

In its most recent announcement, N27 alerted the market to the fact that two diamond drill holes have been completed at its 100%-owned Stanton Cobalt deposit, which is part of the Wollogorang Cobalt Project in the Northern Territory’s north-east corner.

The diamond drilling follows the completion of 57 holes at Stanton, 13 more than had been planned initially so that it could test extensions of mineralisation that are outside the previously defined JORC 2012 inferred resource. A further four diamond holes are planned to be completed in the next two weeks. Samples from the diamond drill core will be sent for metallurgical test work in December.

It seems there is a drilling frenzy going on at the moment, with six RC drill holes to be drilled this week outside the resource envelope to test for possible extensions to the resource in this area.

However, it should be noted that N27 is an early stage play and investors should seek professional financial advice if considering this stock for their portfolio.

Analysis will also begin on the last batch of geochemical samples from the resource drilling by the end of this week.

The initial program was to confirm some of the historic holes, and bring more of the resource in under JORC 2012, and possibly increase the resource.

Having completed resource drilling at Stanton, the RC drill rig moved on to the Running Creek prospect where N27 completed drilling 34 holes targeting extensions to known cobalt and copper mineralisation that had been identified in historical drilling.

N27 is pushing towards the completion of drilling ahead of the wet season with the goal of defining an indicated resource. It will be helped along by a detailed airborne aeromagnetic and radiometric survey over the main prospects at the Wollogorang Cobalt Project. The survey will cover approximately 77km 2 and will help prioritise drill targets. Results are expected by the end of the month.

With that in mind, let’s catch up with...

Northern Cobalt (ASX:N27) is focused on developing cobalt assets at its Wollogorang Cobalt Project in the Northern Territory’s north-east corner.

Having only recently listed on the ASX in September after raising $4.2 million during its IPO, N27 remains sufficiently cashed-up to continue its exploration pursuits in the near term.

The video below provides more detail on N27’s ambitions:

Wollogorang Cobalt Project – Investor Video – Northern Cobalt

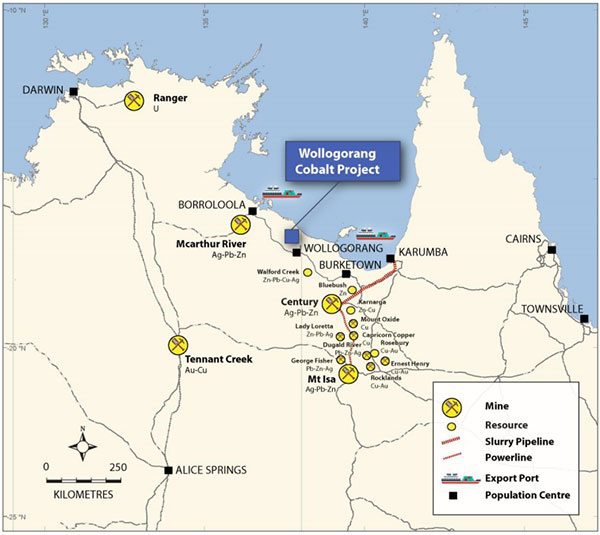

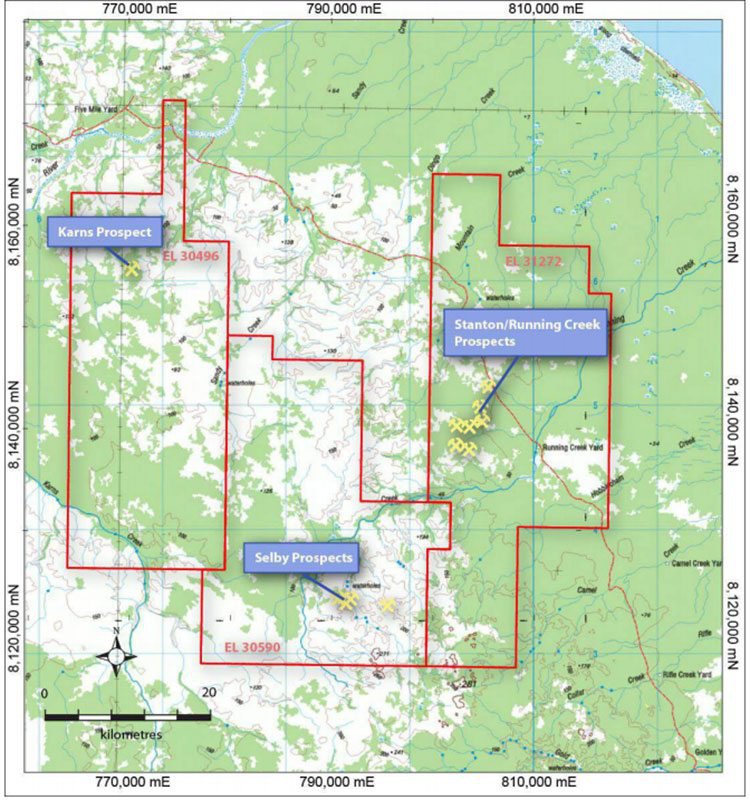

The Wollogorang Cobalt Project covers 1,131 square kilometres of pastoral land, wholly within the NT pastoral lease of Wollogorang Station. The project area is located 180 kilometres to the south-east of Borroloola, and the prolific McArthur River mining region is 150 kilometres west-north-west.

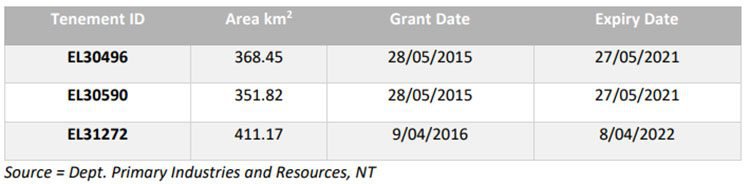

The Wollogorang Project’s portfolio of tenements is made up of three exploration licences: Stanton Prospect/Running Creek (EL 31272), Selby Prospect (EL 30950), and Karns (EL 30496).

These tenements are outlined on the map below:

N27 off to an impressive start

Since listing on the ASX on September 22, N27 is up over 100%. Much of this gain came in late October when N27’s share price rallied after the company released a drilling progress report in regards to its Stanton deposit at the Wollogorang Cobalt Project.

Following the update to the market, N27’s share price gained 67% on the previous day’s closing price to reach as high as to 38.5 cents. It is now at 47 cents, having gained well over 100%.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Much of the focus of N27’s movement has been due to events at its Stanton Cobalt Deposit.

Stanton Cobalt Deposit

Since we introduced you to N27 in September , the company has progressed its clear strategy of developing cobalt assets at its Wollogorang Cobalt Project in the Northern Territory’s north-east corner.

N27’s recent focus has been its drill programmes at the Stanton Cobalt-Copper Deposit and the Running Creek Prospect.

At the Stanton Deposit the company has a cobalt dominant JORC 2012-compliant Inferred Mineral Resource of 500,000t at 0.17% cobalt, along with 0.09% nickel, and 0.11% copper. Mineralisation at the deposit is cobalt dominant, at surface, and open in a number of directions.

All out drilling at Stanton Cobalt Deposit

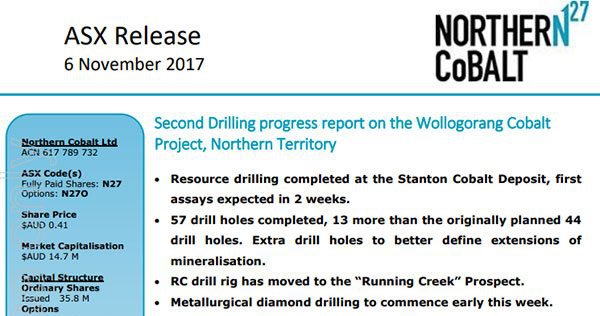

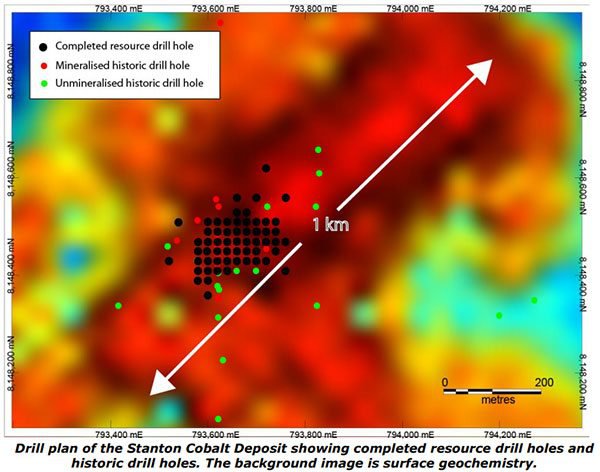

On November 6, N27 announced that it has completed its initial round of drilling at the Stanton Cobalt deposit, which was focused on upgrading the current JORC 2012 resource.

A total of 57 RC drill holes were completed near the current resource, that’s 13 more than were originally planned for the site. These extra 13 drill holes were drilled to test extensions of mineralisation located outside of the previously defined JORC 2012 inferred resource.

A second drill rig was brought to the site to assist in completing the drill holes by the year’s end and before the onset of the wet season.

The final batch of geochemical samples from resource drilling will be despatched from site for analysis by the end of the week. Assays for the first half of the resource drilling are expected to be received by the end of November, just days from now.

Sample preparation and analysis are close to completion and quality analysis and control will commence before results are in at the end of the month.

Here’s a look at what was happening on site in mid-November as Managing Director Mike Schwarz inspects drill chips from the Stanton Cobalt Resource.

The company rallied again following the November announcement and if previous updates are anything to go by, further re-ratings aren’t out of the question when the assay results begin arriving.

This is speculative on our part and investors should take all publicly available information into account and a cautious approach to any investment decision with regard to this stock.

There is clearly an upward trend with regard to N27 as reported by Finfeed.com ( a related entity of S3 Consortium Pty Ltd as defined in Section 9 of the Corporations Act 2001) on November 1:

Shares in the stock surged after the drilling update above under the second-highest volumes since the company listed on the ASX.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

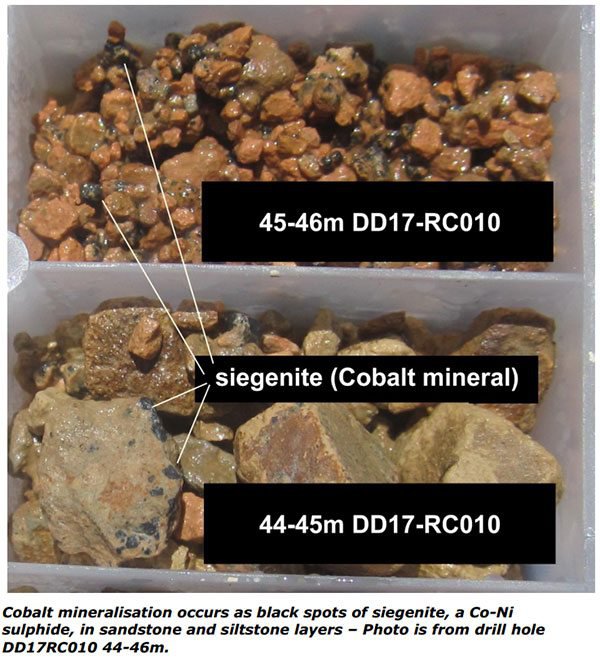

N27 highlighted the presence of cobalt mineralisation in different geological forms as indicated below:

Cobalt mineralisation at the Stanton Cobalt deposit is observed as fine grained black disseminations primarily in sandstone and siltstone layers. Historical petrology and metallurgy has confirmed the main cobalt mineral as siegenite, a cobalt-nickel sulphide, below the main zone of weathering and as cobalt oxide within the weathering zone.

In addition to cobalt mineralisation, copper mineralisation was observed as malachite (copper-oxide) within the weathered zone and chalcopyrite (copper sulphide) in fresh rock. The following image shows the main significant chalcopyrite intersection in drill hole DDRC011 from 73-75m. The abundance is estimated at around 5-10% chalcopyrite:

Several drill holes ended in cobalt mineralisation, so the lower depth of the mineralised sequence hasn’t been defined. This included the Stanton drill hole RC22 which terminated in 0.3% cobalt at 65m at the bottom of a 22m intersection from 43m.

This means that there’s opportunity in the area to further extend the mineralised system which could lead to conversion into additional resources. This led to more holes being drilling than as initially planned.

Metallurgical diamond drilling at the Stanton Cobalt Deposit

Having completed its resource drilling at Stanton Cobalt Deposit, N27 was quick to move into diamond drilling and has already completed two diamond drill holes in the central part of the Stanton deposit. A further four are planned for the coming two weeks before being sent for metallurgical test work in December.

The diamond drill core will be used to obtain representative samples of cobalt-copper-nickel mineralisation. These samples will be submitted for metallurgical test work to establish a process to produce a concentrate. The information will also enable N27 to define an indicated resource, and will help with marketing to potential customers.

Here is Mike Schwarz again, this time inspecting the first drill core.

Drilling at the Stanton deposit was just the first of a series of drilling programmes for N27. The rigs will move on to test a further 21 nearby prospects, 11 of which have historic mineralised drill intersections.

The first of these is the Running Creek Prospect...

Drilling to begin at the Running Creek target.

A RC drill rig began drilling at the Running Creek cobalt-copper target after the diamond drill rig was moved to the target after drilling at the Stanton Cobalt deposit was completed.

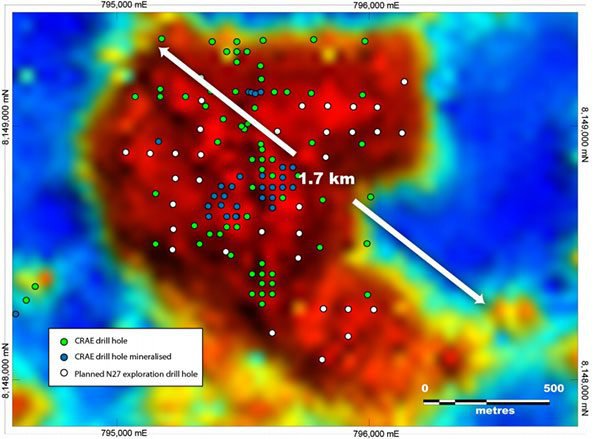

Drilling at Running Creek is now complete, with N27 drilling 34 holes targeting extensions to known cobalt and copper mineralisation identified by historic drilling undertaken by CRA Exploration in the 1990s.

The Running Creek target appears to be more copper rich than Stanton, with historical drill intersections estimates that include:

- 4m at 1.2% copper from 25.5m in DD94RC63

- 0m at 0.38% copper from 25m in DD94RC125

Below is the drill plan of the Running Creek Target showing historic drill holes. The background image is surface geochemistry.

Rising Cobalt Price

The rising price of cobalt is supportive of N27 as it works towards defining a resource and moves towards establishing a commercial operation.

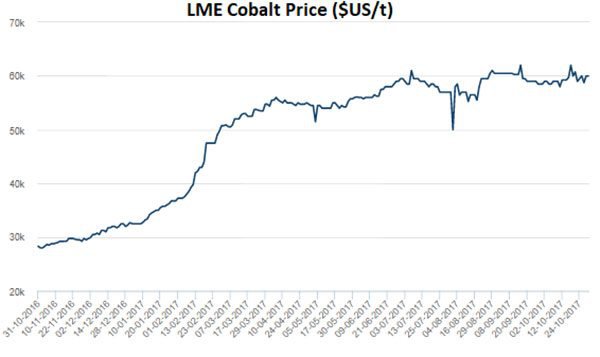

Rising demand coupled with supply issues is reflected in the sharp jump in the cobalt price over the past year. In fact, cobalt was 2016’s standout commodity, rallying from US$25,000/t in 2016 to US$62,500/t in September 2017. Yet, this remains at only half the 2008 high price of US$115,000/t suggesting that high prices could be on the horizon.

The chart below outlines how the price of cobalt has more than doubled over the past year:

Importantly, this price rise is backed by solid fundamentals which are only going to continue.

Of course it should be noted that commodity prices do fluctuate and caution should be applied to any investment decision here and not be based on spot prices alone. Seek professional financial advice before choosing to invest.

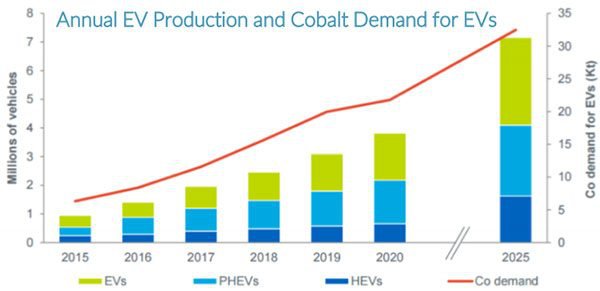

Cobalt is a critical component in the manufacture of rechargeable lithium-ion batteries, which is where half of the world’s cobalt production is used. And that demand is increasingly backed by the massive growth that’s ahead for renewable technologies and electric vehicles (EV) in particular.

By 2020, it is estimated that the number of EVs will reach 7 million units, compared to some 800,000 in 2015.

But investors shouldn’t be tempted by just any junior cobalt explorer — they are not all the same. In fact, with the hype surrounding the growing demand for cobalt is making it increasingly difficult to identify junior cobalt explorers still trading at reasonable prices.

Yet, N27 has been picked as a standout.

On November 1, Livewire Markets published an article from Wentworth Securities, which highlighted N27 as a stand out when compared to other junior cobalt explorers.

In summary, Wentworth Securities highlighted that the problem with investing in lithium and cobalt companies is that their share prices have often run ahead of drilling or are too pricey given many have only limited exploration results.

Yet they conclude that if N27 can successfully confirm historical holes and perhaps extend the resource, it looks very cheap when compared to other junior explorers.

Of course, broker projections and price targets are only estimates and may not be met.

Wentworth notes N27’s low market cap, combined with its operations in Australia’s mining friendly jurisdiction, plus its existing JORC-2012 compliant inferred mineral resource.

It also compares N27 with a number of peers in the Wentworth Report Overnight Market Update .

Upcoming newsflow

Having now completed its planned resource drilling at the Stanton Cobalt deposit, N27 expects the first assays to arrive very shortly, while metallurgical diamond drilling is also set to begin.

Immediate potential catalysts include the results from the first batch of geochemical samples which have been submitted for analysis and should arrive soon and will be the best guide as to what may lie ahead.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.