Delecta looks to expand its position in battery minerals

Published 18-SEP-2018 11:29 A.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Delecta Ltd (ASX:DLC) is in a transitioning phase as it aims to diversify its operations and capitalise on the demand for battery minerals.

With this in mind management has entered into a binding option agreement to acquire a 100% interest in the high-grade Highline Cobalt-Copper Project, located in the State of Nevada, USA.

The Highline acquisition is part of Delecta’s diversification strategy aimed at capitalising on the demand for battery minerals such as Cobalt, Lithium and Vanadium, which has seen the rapid rise in the LME price of Cobalt (from US$23,000/tonne in March 2016 to US$63,750/tonne in August 2018).

The key commercial terms of the option agreement include a cash payment of $100,000 and the issue of 10 million fully paid shares in Delecta for a 90 day exclusive option period.

Upon exercise of the option, Delecta can choose to complete the transaction by paying $150,000 in cash and issuing 50 million fully paid ordinary shares in the company with an escrow period of six months.

Complements lithium investment

It is worth noting that this acquisition complements a direct investment by Delecta in the battery minerals sector, as the company has leverage to lithium through its shareholding in European Lithium Ltd (ASX:EUR).

Highlighting Delecta’s decision to focus on the battery minerals space, managing director Malcolm Day said, “Given the Delecta’s success with its investment in European Lithium Ltd (share price up more than 200% year-on-year), the company has continued to seek and evaluate other investment opportunities in the battery minerals space.

“The increased demand for battery minerals, like lithium and cobalt, is primarily due to the rapid advancement and demand for electric vehicles.

“Given the Highline mine’s previous mining and exploration was circa 100 years ago, the company believes that the Highline Cobalt-Copper Project represents a relatively low risk opportunity in an area of known mineralisation.”

However, this is a very early stage play and investors should seek professional financial advice if considering this stock for their portfolio.

Highly prospective area

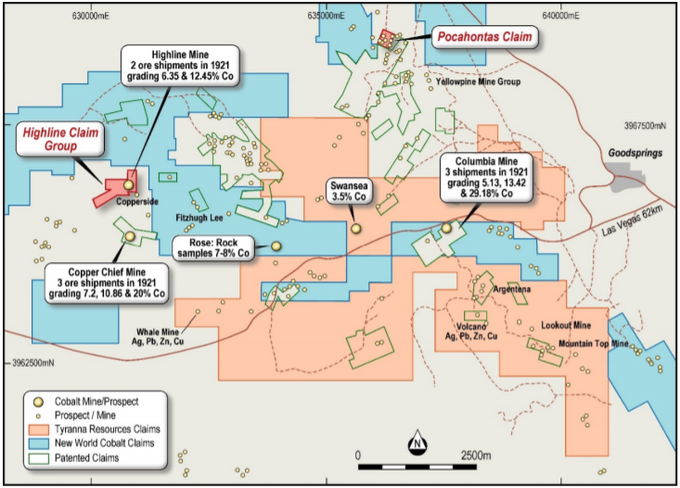

The Highline Project comprises five patented mining claims totalling 90.4 acres located within the Goodsprings mining district in southern Nevada, 48 kilometres southwest of Las Vegas and approximately 3 kilometres south-west of the town of Goodsprings, Nevada.

The claims are readily accessible via the interstate route from Las Vegas to Los Angeles.

Located in the Springs Mountains the topography is mountainous, but access is good owing to the numerous tracks in the area.

The project to be acquired is surrounded by four historical cobalt mines, and neighbours include the ASX-listed New World Cobalt (ASX:NWC) and Tyranna Resources (ASX:TYX).

Both have aggressive exploration programs planned for the next six months on their respective projects.

Less than a kilometre away is the New World Goodsprings Copper-Cobalt Project, now owned by New World Cobalt.

It also boasts a rich history which dates back nearly a century when three parcels of cobalt ore were mined and sold, with individual ore parcels grading 29.18% cobalt, 13.42% cobalt and 5.13% cobalt.

Historical records report that by the end of 1962, the Goodsprings District had yielded 109,000 tonnes of zinc, 47,000 tonnes of lead, 2,500 tonnes of copper, 90,500 ounces of gold, 2.1 million ounces of silver and 5.5 tonnes of cobalt.

The Highline claim group themselves are recorded as having been mined between 1917 and 1921, producing 132 tonnes of copper from 477 tonnes of ore at an average grade of 35%, the highest grade in the district.

Two separate lots of cobalt ore from the dump weighed in at 2,190 kilograms and 545 kilograms, returning impressive grades of 6.35% and 12.45% respectively.

Due to the lack of any modern exploration, the project area presents very attractive opportunities to deploy modern exploration techniques which Delecta is planning to commence as soon as the option agreement is executed.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.