Dateline Resources materially increases head grades at Gold Links Gold Mine

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Dateline Resources Limited (ASX:DTR) has announced the second phase of ore sorting results for the Gold Links Gold Mine in Colorado, USA, whereby gold grade per tonne has increased by 41.6% from 15.34 to 21.71g/t Au.

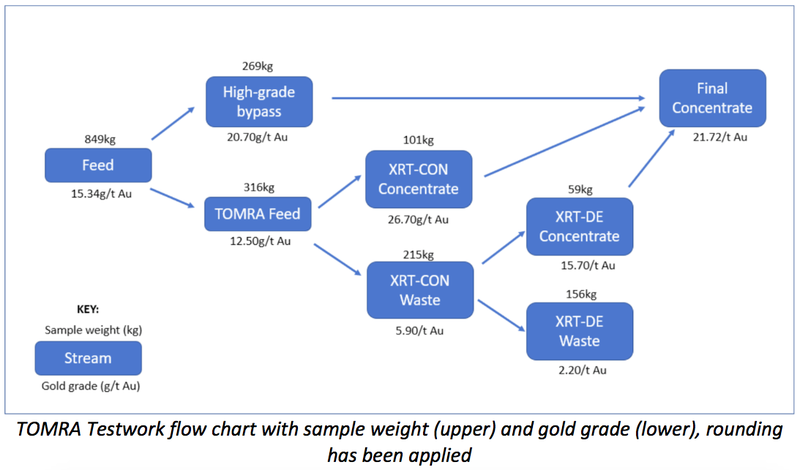

A total of 849kg of material was transported to the TOMRA ore sorting facilities in Sydney. Two tests were conducted using both laser and XRT sorting technology with the XRT technology proving to be a better fit for the Gold Links project.

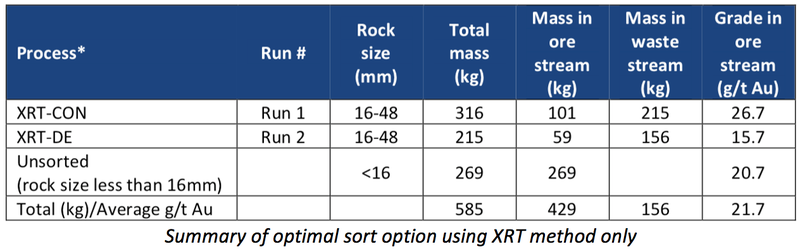

The below table is a summary of the optimal test results received from the XRT sorter:

Commenting on the results, Managing Director, Stephen Baghdadi, said, “The ore sorting results are in line with our expectations and have confirmed that the Gold Links ore is perfectly suited for this technology.

"The sample head grade was increased by 41.6% to 21.7g/t Au. Approximately a third of the material was sorted to waste. The amount of gold that was left in the waste was 2.2g/t, which equates to less than 0.7g/t per mined tonne.

"By upgrading high-grade material from the veins to an even higher grade significantly enhances the potential of Gold Links by reducing processing costs and increasing the returns per tonne.

The company intends to conduct an additional test to determine if the results can be further improved by using an ore sorter that is capable of both XRT and Laser in a single run”

Ore Sorting Test Work

DTR completed the ore sorting program with TOMRA in order to assess the potential of upgrading the ore prior to further processing through the Lucky Strike mill.

These results are considered to be “proof-of-concept” tests by TOMRA and were conducted on a representative sample of mineralised material collected from Gold Links.

A total of 849kg of mineralised material was collected from Gold Links, with an aggregate grade of 15.34g/t Au.

49% of the sorted material was reported as waste and contained less than 0.7g/t Au per mined tonne.

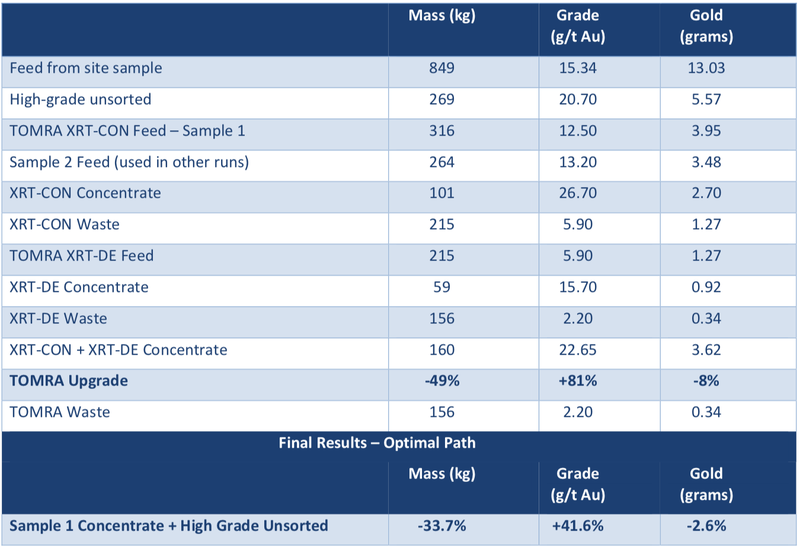

The upgrade factor, which includes the TOMRA concentrate stream as well as the high-grade bypass material, resulted in a gold upgrade of 41.6%, a decrease in sample mass of 33.7%, and a 2.6% loss in contained gold.

The analytical results of the 2021 Gold Links ore sorting trial (optimal route) are presented below:

In addition to the optimal path presented in the above, additional testing was undertaken whereby the XRT- DE waste stream was subjected to ore sorting using the Laser technology.

Implications and next steps

Dateline’s 100%-owned Lucky Strike processing facility is located 50km via road from the Gold Links Gold Mine. The plant includes a primary circuit for the extraction of nuggety or free gold from the veins. A secondary flotation circuit allows for the production of a gold-silver-lead concentrate.

By implementing x-ray ore sorting technology after primary crushing, the tonnage going into the primary and secondary circuits may be materially increased by ~33%. For DTR, this translates into the ability to mine and transport up to 45,000tpa to Lucky Strike for processing through the 33,000tpa plant.

Subject to further analysis and modelling, there is the potential to increase future gold production by 40% compared to not installing ore sorting technology.

Following the test program, Dateline has commenced discussions with various suppliers of ore sorting equipment with regards to purchase/lease options. Further test work will also be undertaken with alternative units that includes XRT and Laser in a single unit to improve recovery.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.